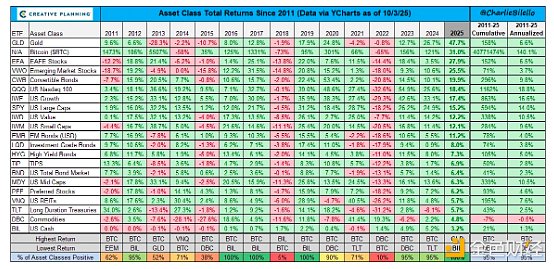

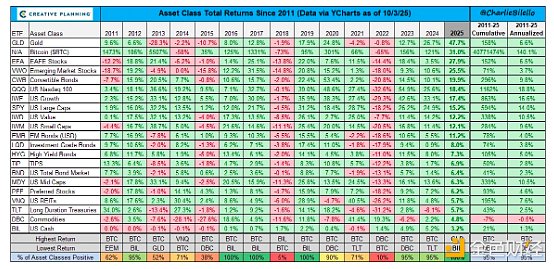

Charlie Bilello of Creative Planning highlighted that “Gold (+48%) and Bitcoin (+31%) are the best performing major assets so far in 2025. We have never seen these two assets ranked first and second in any single year.”

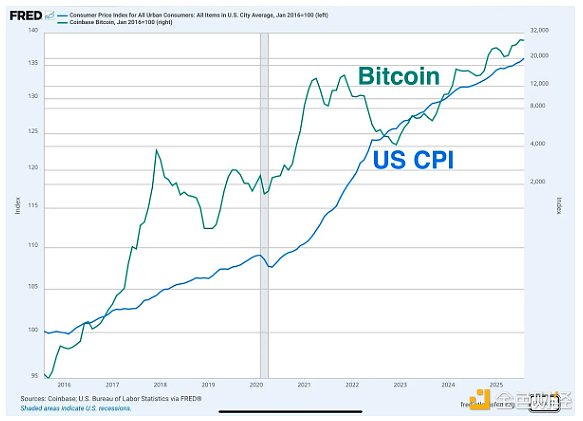

Many would argue that past performance is no indicator of future performance. While this is true, global structural trends suggest that both Bitcoin and gold will rise.

Felix Jauvin of Forward Guidance writes:

“Every country is turning ‘overheating.’ We will run as many deficits as possible in an attempt to escape debt. Central banks are abandoning inflation control, and fiscal dominance is coming. Nominal assets will do well, and devaluation hedges will do even better. The world of 2010-2020 is gone. Reset your priors. Let’s go.”

If you’ve been following the web for the past decade, none of this is new. Bitcoin holders, and their gold predecessors, have been vocal about currency debasement for years. But the difference today is that major financial institutions have lent credibility to the argument.

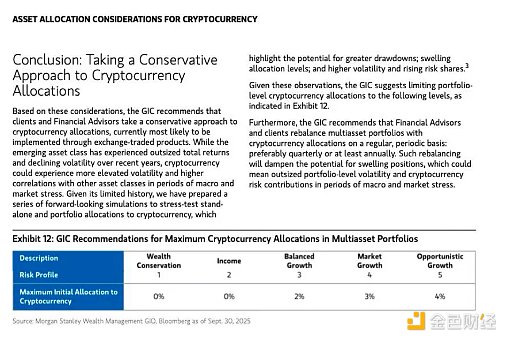

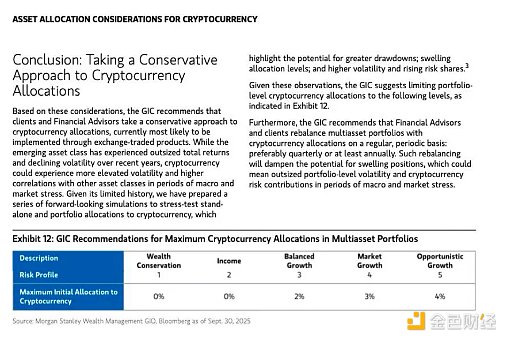

Using Morgan Stanley as an example, Ash Crypto writes:

“Morgan Stanley’s $1.3 trillion global investment committee recommends allocating 2-4% of client portfolios to cryptocurrencies, saying Bitcoin is a scarce asset comparable to digital gold.”

BTC Archive also notes that “Morgan Stanley said it would ‘support’ its 16,000 financial advisors, who manage $2 trillion, if they wanted to invest in Bitcoin and cryptocurrencies.”

The two closest siblings in the family of global financial assets (gold and BTC) are now sending the same message: global currency debasement has reached the point of no return."

The two closest siblings in the family of global financial assets (gold and BTC) are now sending the same message: global currency debasement has reached the point of no return."

Old World Investing Theory

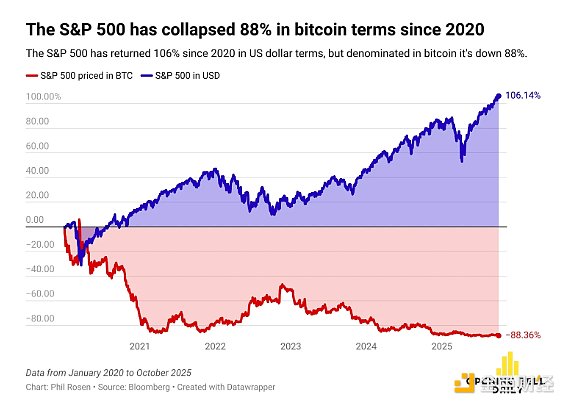

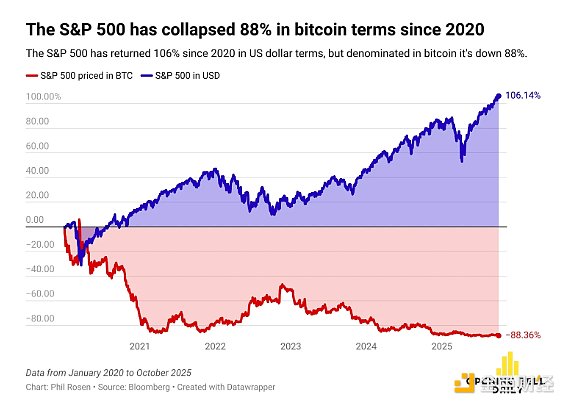

No return. This may sound hyperbolic to some of you, but I don't think it's entirely wrong. An entire generation of investors has realized that a significant portion of the market's financial returns are simply currency debasement. If that's the primary driver of returns, then all your old-world investing philosophies are questionable.

Opening Bell's Phil Rosen is a prime example of this by valuing the S&P 500 in Bitcoin instead of dollars.

If you can't beat it, you have to buy it

So, as I've been saying lately, Bitcoin is the minimum yield. If you can't beat it, you have to buy it. I think the next 12 weeks are going to be very interesting for Bitcoin holders.

Interest rates are falling. Currency debasement is accelerating. Institutional investors are embracing debasement trades. Bitcoin ETFs are seeing record inflows. Retail sentiment is rising as investors buy into the "Q4 is good for Bitcoin" narrative. The M2 money supply is expanding rapidly.

Gold is up over 50% this year. Now it's Bitcoin's turn. Hold on to your Bitcoin, because the market is about to go crazy.

Weatherly

Weatherly