Author: WolfDAO

Foreword

According to CoinMarketCap real-time data, Zcash surged from $156.21 to $533.92 between October 8th and November 7th, 2025, a 30-day increase of 241% (3.41 times), and a 67% increase from its previous high of $319 in May 2021, successfully achieving a technical breakthrough.

In-depth Analysis of Driving Factors

1. The Prince Group Incident (Core Catalyst)

On October 14, 2025, the US Department of Justice seized 127,271 BTC (worth $15 billion) from Chen Zhi, the founder of Cambodia's Prince Group. This event demonstrated the fatal flaw of Bitcoin's transparent ledger at the sovereign level—governments can easily track, freeze, and confiscate on-chain assets. High-net-worth users have a rigid demand for privacy protection, and the narrative that "Zcash is insurance against Bitcoin" has gained empirical support. The privacy coin sector collectively surged: ZEC rose 217%, XMR rose 9.1%, and DASH rose 12.5%. 2. Crypto Narrative Dryness (Market Seeks New Hot Topics) The current crypto market is in a narrative vacuum: Meme coins are causing aesthetic fatigue, new public chains lack innovation, and DeFi lacks new stories. The market urgently needs new concepts to maintain its momentum and liquidity. The return of the "privacy narrative" is timely—supported by real-world examples of government BTC seizures, endorsed by influential figures like Naval, and able to capitalize on nostalgia for the "return of old mining coins." ZEC, as one of the leaders in the privacy sector, has become a target for speculative investment. This is a typical example of "theme rotation": when mainstream concepts have run out of hype, funds will dig into niche sectors to create new hot topics.

3. Celebrity Endorsements by Hayes and Others (Igniting FOMO)

Silicon Valley investor Naval endorsed ZEC (at $68 at the time) on October 1st, stating that "Zcash is insurance against Bitcoin," and the price rose to $150 within a week. BitMEX founder Hayes has recently been frequently endorsing ZEC, igniting FOMO sentiment among retail investors. Crypto KOL Ansem placed ZEC on par with BTC. The dense endorsements from top KOLs created a "FOMO" market atmosphere, but also sowed the seeds of "endorsement-driven selling."

Fundamental Verification and Risk Warning

This surge is more driven by speculation than by fundamental growth. The core basis is the limited growth in the number of blocked transactions. Despite a nearly tenfold increase in price, the utilization rate of the blocking pool has not increased. If there were a genuine surge in privacy demand, the proportion of the blocking pool should have skyrocketed, but actual data shows almost no change.

Fundamental Verification and Risk Warning

This surge is more driven by speculation than by fundamental growth. The core basis is the limited growth in the number of blocked transactions. Despite a nearly tenfold increase in price, the utilization rate of the blocking pool has not increased. If there were a genuine surge in privacy demand, the proportion of the blocking pool should have surged, but actual data shows almost no change.

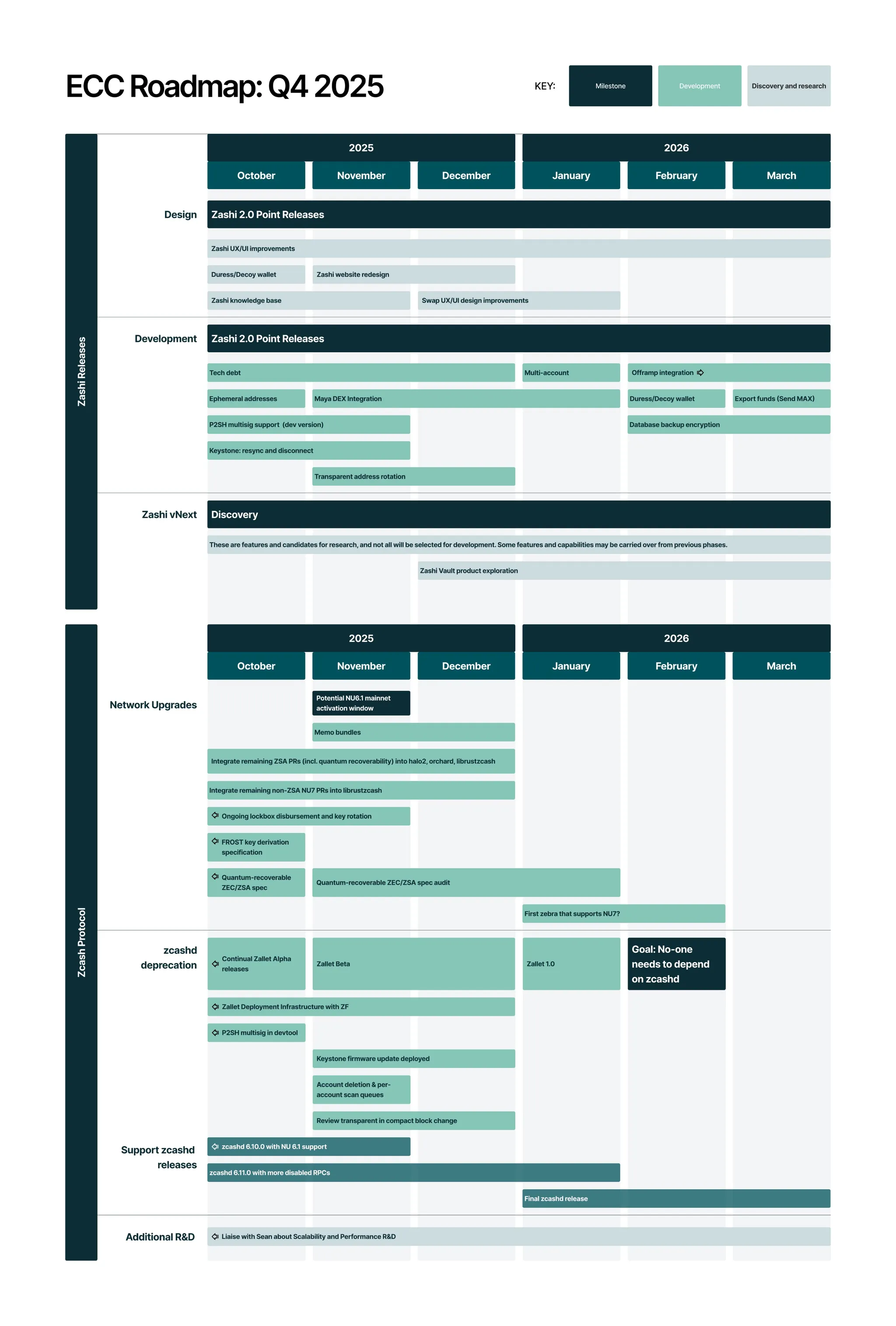

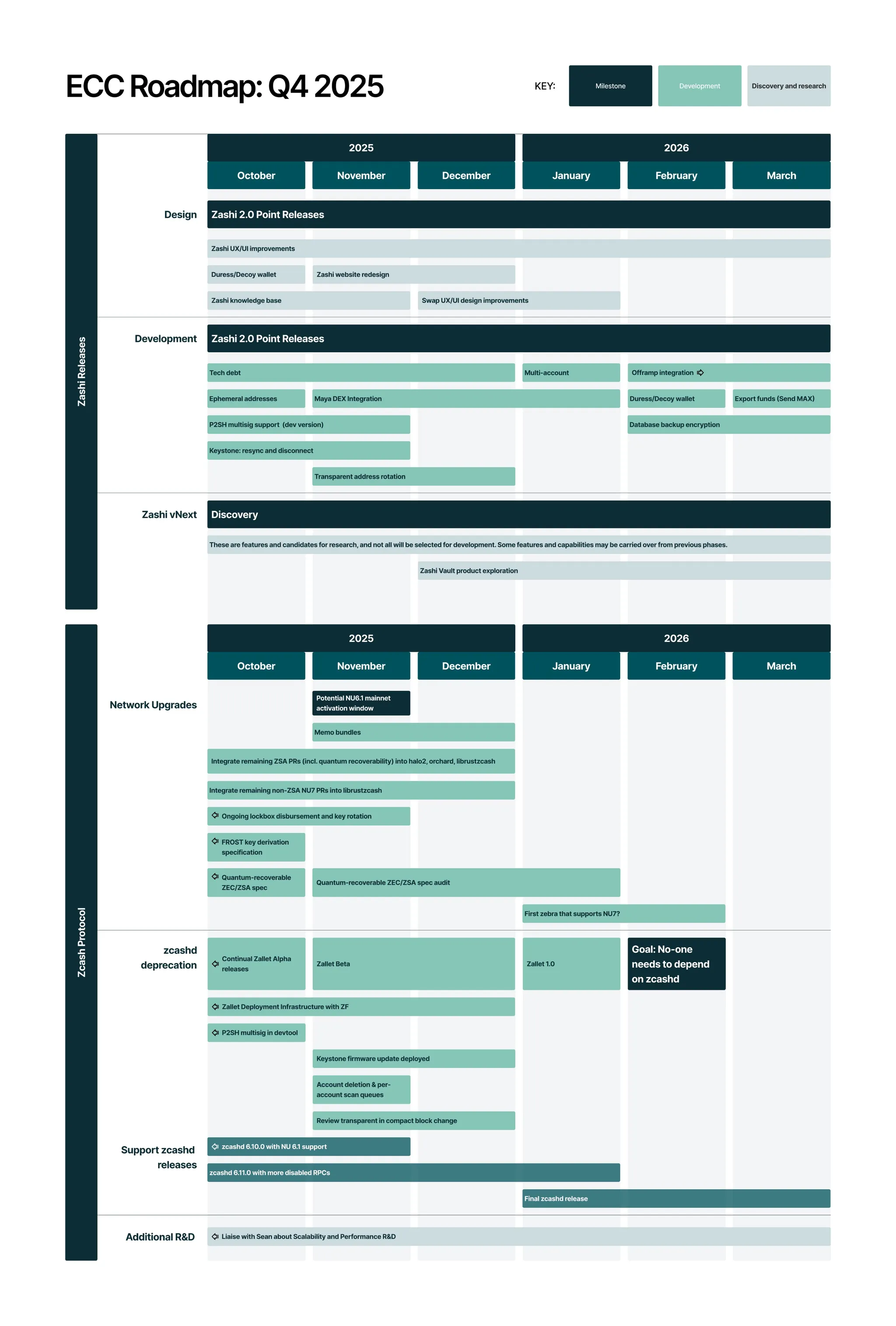

The Orchard protocol upgrade and the ECC Q4 2025 roadmap do show that ZEC is not an empty project. But the key issue is: the technological upgrade has not translated into shielding transaction growth; 70% of transactions remain transparent. Leading zk-SNARKs technology ≠ market adoption. ZEC's challenge is not technological capability, but achieving real user growth under regulatory pressure.

The Orchard protocol upgrade and the ECC Q4 2025 roadmap do show that ZEC is not an empty project. But the key issue is: the technological upgrade has not translated into shielding transaction growth; 70% of transactions remain transparent.

Final Conclusion

The technical picture has reached an extremely dangerous level: the price surged from $50 to $550, a tenfold increase in 40 days, exhibiting a typical parabolic surge. Trading volume shrank when reaching new highs, forming a textbook example of price-volume divergence. This technical pattern has led to a 30-50% violent pullback in 90% of cryptocurrency history.

The fundamentals completely do not support the current valuation: On-chain data provides irrefutable evidence: the shielded ZEC pool is 4.98M, accounting for 30.4%, showing no significant change from before the price surge. The price increased by 232%, but the shielded pool usage showed zero growth, proving BuyUCoin CEO's judgment—"more driven by speculation than fundamental growth." 70% of ZEC transactions remain transparent, fundamentally contradicting the "privacy coin" positioning.

The driving factors are unsustainable: The Prince Group incident was a one-off catalyst and will not continue; the rotation of themes due to the depletion of crypto narratives is essentially short-term speculation; KOL-driven trading carries the risk of "selling on recommendations"; the double-edged sword of liquidity depletion means that rapid rises will also lead to rapid falls. Regulatory risk is a sword hanging over our heads: Privacy coins face not the question of "whether they will be regulated" but "when they will be regulated." The US and EU are increasingly stringent in their attitudes towards privacy coins, with Monero and Dash already delisted in multiple regions. Once Coinbase announces the delisting of ZEC, the price could plummet by more than 70% in a single day, plunging investors into ruin. A Warning from the Doomsday Chariot: Privacy Coin Surges Often foreshadow Bear Markets

Historical data shows that ZEC surged 14 times from $50 to $703.75 in January 2018 before plummeting 93%, and then surged 6.8 times from $57 to $386 in May 2021 before plummeting 92%.

Weatherly

Weatherly