On May 12, 2025, China and the United States concluded a two-day economic and trade talks in Geneva and issued a joint statement announcing a substantial reduction in previously imposed tariffs, marking an unexpected turn in the tariff war that has lasted for many years. For the first time, the United States referred to China as a "trading partner" and promised to revise its tariff policy on Chinese goods. Does this achievement mean that the Sino-US tariff war has come to an end? This article will combine the latest tariff adjustment data to deeply analyze the true significance of this event from four aspects: negotiation background, impact of results, potential risks and future prospects, and take you to see the opportunities and challenges of easing the tariff war.

Tariff War Background: From High-Intensity Confrontation to the Negotiation Table

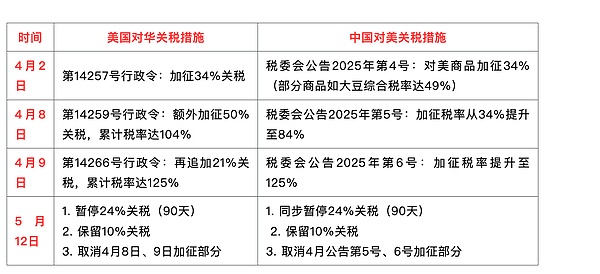

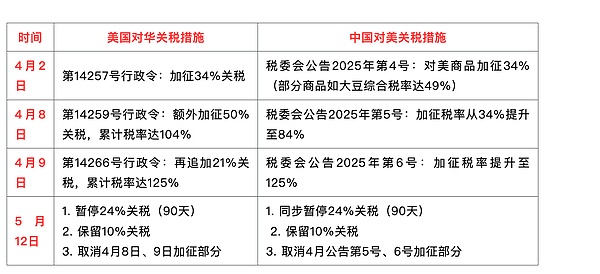

Since the Trump administration provoked the tariff war, Sino-US trade relations have experienced twists and turns. In April 2025, the Trump administration issued a series of executive orders to impose tariffs of up to 125% on Chinese goods. China quickly retaliated and also raised the tariff rate to 125%. The following is a comparison table of specific tariff adjustments:

China-US tariff adjustment comparison table (April 2 to May 12, 2025)

The high tariff rates in the tariff war have led to tight global supply chains, intensified inflation in the United States, rising consumer prices, and Chinese exporters facing a decline in orders. There were differences within the US side. Treasury Secretary Scott Bessent advocated easing the situation through negotiations, while hardliners such as Commerce Secretary Howard Lutnick preferred to maintain a high-pressure policy. China, on the other hand, accelerated the diversification of trade, deepened cooperation with Brazil, ASEAN and other countries, and reduced its dependence on the US. On May 6, the two sides announced that they would hold talks in Geneva, with the Chinese representative being Vice Premier He Lifeng and the US representative being Bessent and Trade Representative Jamison Greer.

Negotiation results: cooling down of the tariff war and new signals from "trading partners"

The joint statement on May 12 pressed the "pause button" for the tariff war. According to the statement, the two sides will revise their tariff policies before May 14: the United States will suspend the 24% additional tariff, retain the 10% base tariff, and cancel the additional tariffs imposed on April 8 and 9; China will simultaneously suspend the 24% tariff, retain the 10% tariff, and cancel the additional tariffs imposed in Announcements No. 5 and 6. The two sides also agreed to establish an economic and trade consultation mechanism to continue discussing trade issues.

This achievement exceeded market expectations. After the statement was released, the Hong Kong Hang Seng Index rose 2.98%, US stock futures soared, and the stock prices of US companies such as Nvidia and Tesla rose, reflecting the market's optimism about the easing of the tariff war. For Chinese consumers, the cooling of the tariff war means that the prices of US mobile phones, cars and other commodities are expected to fall, and exporters will also restore trade stability.

The change in the US attitude is particularly eye-catching. Greer called China a "trading partner" and said the agreement would bring "positive changes" to the United States. Bessant emphasized the "substantial progress" in the negotiations, and Trump also called it "significant progress" on the Truth Social platform. The change in wording from "opponent" to "trading partner" is seen as a signal that the United States has adjusted its tariff war strategy. However, the 90-day "observation period" stipulates that the 24% additional tariff is only suspended. If subsequent negotiations fail, the tariff war may be reignited.

The impact of the easing of the tariff war: opportunities and concerns coexist

China: Export recovery and strategic initiative

For China, the easing of the tariff war is a tactical victory. The reduction of tariffs to 10% has restored trade stability, eased the pressure on exporters, and promoted the domestic market's consumption of US goods. China adhered to its core interests in the negotiations and did not cancel the export control of rare earths, which posed a challenge to the supply chain of US military enterprises and highlighted China's initiative in the global industrial chain.

However, the long-term impact of the tariff war remains. For example, the export of US soybeans was interrupted due to the tariff war, and Brazil seized the Chinese market and occupied more than 20 million tons of trade share. Even if the tariff war ends, it may be difficult for US agriculture to regain the market. The 90-day observation period also adds uncertainty to subsequent negotiations, and companies need to be wary of repeated US policies.

United States: Short-term boost and long-term problems

For the United States, the easing of the tariff war has boosted market confidence and eased inflationary pressure in the short term. However, the core goal of the Trump administration - reducing the trade deficit - has not been achieved. Economists point out that the tariff war has failed to change the structural disadvantages of the United States in trade with China, but has pushed up domestic prices. The impact of rare earth control on US military-industrial enterprises continues to ferment, highlighting the vulnerability of their supply chains.

The divisions within the White House cast a shadow on the subsequent direction of the tariff war. The moderates represented by Bessant are dominant, but hardliners may push for policy reversals. Trump's "changing orders every day" style has added to the uncertainty.

Global impact: chain reaction of tariff war easing

The easing of the tariff war has injected confidence into the global economy. The UK and the US have previously reached a 10% tariff agreement, and the China-US talks have further stabilized multilateral trade expectations. However, scholars warn that the systemic competition between China and the US is difficult to eliminate, and the US may turn to non-tariff measures such as technological blockades to put pressure on China.

The deeper meaning of the tariff war: easing rather than ending

The success of this meeting stems from the dual effects of China's strategic resilience and US economic pressure. China has forced the US to reassess the cost of the tariff war through diversified trade and rare earth control. Domestic inflation and international isolation risks in the United States have prompted the Trump administration to compromise.

However, it is too early to say that the tariff war is over. The 90-day observation period means the fragility of the agreement, and Trump's policy changes may reignite the war at any time. The title of "trading partner" is more of a signal released by the United States to the market and allies, rather than a fundamental change in its China strategy. The essence of the tariff war is a contest of global industrial chains and geopolitical dominance, and short-term easing cannot cover up long-term competition.

Future Outlook: Cautiously Deal with the New Pattern of Tariff War

The Geneva talks on May 12, 2025 put a "pause" on the tariff war, bringing a respite to Chinese and American companies and the global market. For China, maintaining strategic focus, deepening diversified layout, and enhancing the resilience of domestic demand are the keys to coping with the uncertainty of the tariff war. For the United States, the easing of the tariff war has won it room to adjust its policies, but the trade deficit and supply chain challenges still need to be resolved.

In the future, whether the Sino-US economic and trade consultation mechanism can be transformed into long-term stability depends on the sincerity and wisdom of both sides. The easing of the tariff war is a ray of hope in the chaos, but a truly peaceful trade order still requires time and effort.

Conclusion:

The easing of the tariff war has opened a new window for Sino-US relations, but uncertainties remain. Enterprises and investors need to pay close attention to the subsequent negotiation dynamics, seize opportunities, and avoid risks.

YouQuan

YouQuan