Source: Vernacular Blockchain

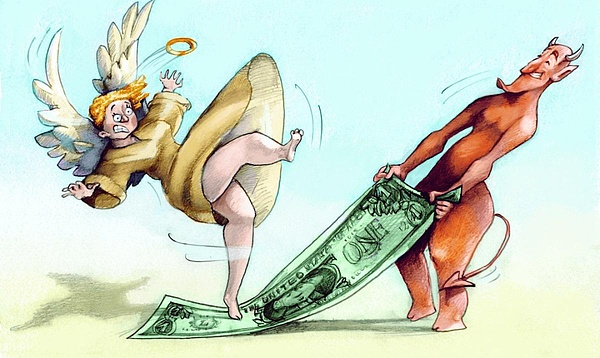

In the past year, have you encountered a Rug Pull project? Have you encountered a "buy-in peak" due to the advocacy of a KOL who called out orders? Or suffered losses caused by increasingly rampant phishing attacks? Or have you bought a newly launched token on a top platform and it has been falling all the way?

It is estimated that many users feel the same way and have been hit by at least one of these scenarios. It can be said that this should be a reflection of the investment experience and true state of mind of most ordinary investors in the past period of time:

Whether it is an on-chain security issue or an asset shrinkage issue, it is hard for users to guard against it. Many pitfalls that were commonplace before have even begun to be industrialized. To put it bluntly, even the "leek roots" have been uprooted.

This article will review the increasingly various pitfalls in the crypto world recently, and whether there are still opportunities for ordinary users to make money in the crypto industry?

01 Ordinary users’ “fancy ways to lose money”

1) Rug Pull’s industrialization trend

First of all, the setup of Rug Pull’s money-sucking is getting more and more high-end, and the most outrageous one is the ZKasino incident:

On April 20, a community user found out through a comparison of the Wayback Machine historical pages that ZKasino deleted the sentence “Ethereum will be returned and can be bridged back at this point.” from the Bridge funds on its official website’s Bridge interface.

At the same time, community users were unable to withdraw funds, the official ZKasino Telegram was banned by the administrator, and social media also stopped updating. The total amount of money embezzled was more than 20 million US dollars.

But what's interesting is that just a month ago in March, ZKasino just announced that it had completed its A round of financing with a valuation of 350 million US dollars. The specific amount was not disclosed, but there were many trading platforms and VCs participating in the investment...

In addition, zkSync, which is nicknamed "Rug Chain", not only has frequent ecological project security incidents, but also has an increasingly obvious industrial trend of taking advantage of hot spots and quickly completing harvesting, just like the zkSync ecological DEX Merlin, which has the same name as Merlin, had a Rug Pull not long ago, affecting millions of US dollars in funds.

I can only emphasize again that the current zkSync ecosystem projects are indeed uneven. Everyone should remain vigilant while participating in the zkSync ecosystem and guard against risks at all levels.

2) Increasingly rampant hacker/phishing attacks

The most eye-catching case in the field of on-chain security recently is undoubtedly the "phishing attack with the same first and last numbers" that everyone seems to have become accustomed to:

A giant whale address was phished by an address with the same first and last numbers, and lost 1,155 WBTC, as much as 400 million yuan! Although the hacker chose to return the funds due to various factors, it still revealed the extremely high risk-return ratio of this phishing behavior of "not opening for three years, and eating for a lifetime after opening".

Moreover, similar phishing attacks have been industrialized in the past six months. Hackers often generate a large number of on-chain addresses with different first and last numbers as a reserve seed library. Once a certain address transfers funds with the outside world, they will immediately find an address with the same first and last numbers in the seed library, and then call the contract to make a related transfer, casting a wide net and waiting for the harvest.

Because some users sometimes directly copy the target address in the transaction record and only check the first and last few digits, they will be caught. According to Yu Xian, the founder of SlowMist, for phishing attacks on the first and last numbers, "hackers play a net attack, and those who are willing to take the bait are probability games."

This is just a microcosm of the increasingly rampant hacker attacks. For ordinary users, in the colorful on-chain world, tangible and intangible risks are almost exponentially increasing, and personal risk prevention awareness is difficult to keep up.

In general, there are endless attacks on chains, wallets, DeFi, and even social engineering attacks are popular, making DeFi security risks like an asymmetric one-way hunt: for technical geniuses, it is undoubtedly an inexhaustible free ATM, but for most ordinary users, it is more like a sword of Damocles that may fall at any time. In addition to being vigilant and not participating in authorization casually, it is also more about luck.

And so far, C-end risks such as phishing and social engineering attacks are the most common ways for ordinary users to lose money in Web3, and the problem is getting worse due to the additional risk points of smart contracts.

Behind every successful scam, there will be a user who stops using Web3, and the Web3 ecosystem will have nowhere to go without any new users, which is also one of the biggest damages to the crypto industry.

3) KOL’s fancy calls

For most ordinary users, following the social media calls of various crypto KOLs is an important source of Alpha passwords.

This also gave rise to the so-called “KOL Round” -As a role with greater influence on secondary market investors, KOLs can even obtain a shorter unlocking period and a lower valuation discount than institutional VCs:

For example, Monad Labs recently completed a new round of financing with a large valuation of US$3 billion,and people familiar with the matter said that some KOLs in the industry were allowed to invest at an upper limit of one-fifth of Paradigm’s valuation.

So can following KOL’s calls really guarantee a steady profit? According to a study conducted by Harvard University and other researchers on the performance of crypto-assets mentioned in about 36,000 tweets from 180 of the most famous crypto social media influencers (KOLs), covering more than 1,600 tokens, the following conclusions are not satisfactory:

The average one-day (two-day) return rate of a KOL tweeting a certain token is 1.83% (1.57%), and the return rate of crypto projects outside the top 100 in market value is 3.86% after one day of shouting. The earliest return began to decline sharply was five days after the tweet was posted, with an average return of -1.02% from the second to the fifth day, which indicates that more than half of the initial gains were eliminated within five trading days.

4) VC Token has been falling since its launch

Which one would you choose, a VC Token with high FDV (fully diluted valuation) and low circulation, or a completely "dog" Memecoin that is responsible for its own profits and losses?

The market has been changing recently, with the Meme trend emerging as a new force, boosting the extreme prosperity of Solana and Base chain transactions, just like PEPE, which has secured its position as the leader of the new Memecoin, has hit a record high. In fact, in today's market environment, in addition to short-term speculation, the general public's call for fairness represented by Meme has gradually become a trend, and funds are voting with their feet.

Corresponding to this is the VC with extremely high FDV and falling trend after a series of recent listings on the top platforms. Typical representatives include AEVO, REZ, and even BN Megadrop's first project BounceBit's Token BB, which have ended with a negative line almost every day since listing, and all users who entered the market have been deeply trapped.

By contrast, the discussion and questioning about Memecoin and VC will inevitably become the mainstream of the community again. Meme at least has user flow to bring continuous incremental funds and attention, while the new projects with valuations of billions of dollars are all old concept products with grand narratives or old gameplay, which will inevitably be disliked by the community. This also sounded the alarm for VCs and project parties who are accustomed to path dependence.

02 Where should ordinary players go?

"We don't love "Flowers", but the era of opportunities everywhere",

I believe that many friends in the encryption industry have thought about it. If we have the opportunity to go back to 10 years ago, how should we participate in this wave of the times?

Hold BTC? Be a miner? Found another Bitmain? Or become an early employee of BN? The best choices seem to be countless. The past ten years of the crypto world are really a golden age that breaks through the limits of imagination, and has also given birth to waves of industry legends and bigwigs.

In any case, the question of whether to make money or not is an eternal topic in the Web3 world and the lifeline of Web3 development.

When trading platforms, market makers, VCs, project parties, and KOLs all start to make money, but only most ordinary users continue to lose money, it means that the deep-seated structural problems of the entire market have been deformed to a certain extent and are destined not to last long.

Again, behind every "fancy way of losing money", there may be a group of users who stop using Web3 products, stay away from VC Tokens, and choose to embrace Memecoins, which are more fair and grassroots. This is itself a kind of resistance of funds voting with their feet.

Before some Web3 ecological applications can truly run through the closed loop of value, ordinary users will have "nowhere to go". Of course, this may be the "twists and turns" that are necessary for the development of Web3, and the encryption industry is still moving forward by trial and error.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Xu Lin

Xu Lin Alex

Alex Brian

Brian Coindesk

Coindesk Catherine

Catherine Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph 链向资讯

链向资讯