Article author: Kaiko

Article compilation: Block unicorn< /strong>

Last week, the U.S. Federal Reserve System (Fed) kicked off the easing cycle with an unexpected large-scale interest rate cut of 50 basis points. The Fed also signaled it will cut interest rates two more times this year. The move revived hopes for a soft landing for the U.S. economy, in which growth slows without triggering a recession. In response, both U.S. stocks and Bitcoin (Bitcoin) recorded significant gains after the Federal Open Market Committee (FOMC) meeting, with the price of Bitcoin rising 5.2% within 24 hours after the announcement.

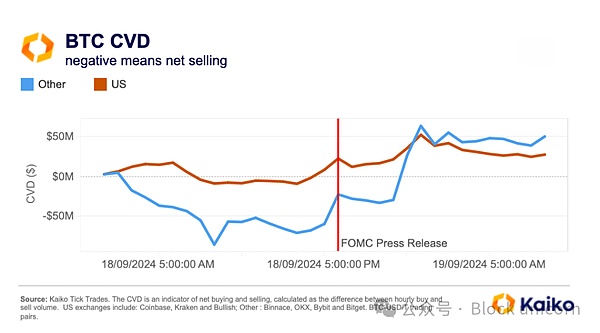

Bitcoin's CVD (cumulative volume difference) - a measure of net buying and selling pressure in the spot market - was announced by the Federal Reserve at 9 UTC It surged immediately after the press release was released at 18:00 on March 18th. Buying pressure on offshore exchanges intensified further as Asian markets opened around 23:00 UTC.

The derivatives market has seen moderate capital inflows. Between September 16 and 19, Bitcoin’s open interest rose by approximately 12% on platforms such as Bybit, OKX, and Binance, reaching $12 billion.

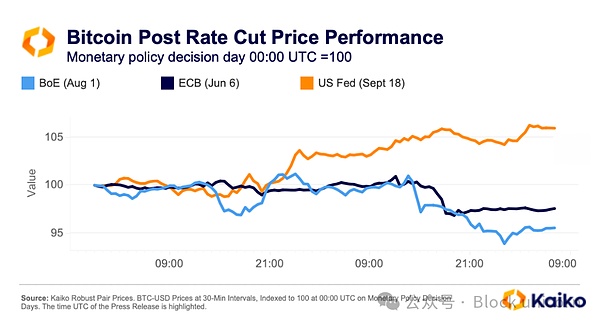

The U.S. central bank is not the first major central bank to cut interest rates this year. The European Central Bank (ECB) and the Bank of England (BoE) already cut interest rates earlier this summer. However, the market impact of these rate cuts has been relatively mild, with Bitcoin prices actually falling in the days following the ECB and BoE announcements.

So why did the market react so strongly to the Fed's decision?

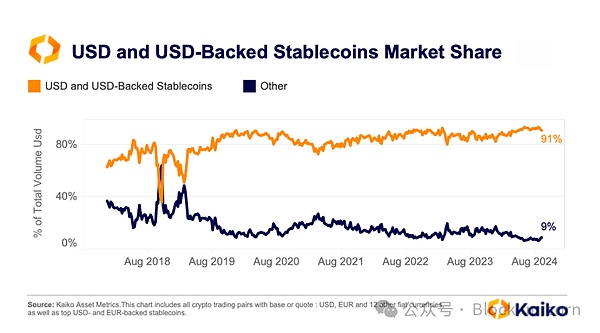

Lower U.S. interest rates typically lead to a weaker dollar. Since the U.S. dollar is the primary quoted asset for Bitcoin (BTC), a weaker U.S. dollar typically pushes Bitcoin’s price in U.S. dollars higher. The share of USD and USD-backed stablecoins’ trading volume among all fiat currencies and stablecoins has been steadily increasing over the past few years, reaching an all-time high of 93% last month.

In addition, the Federal Reserve's loose monetary policy will also increase U.S. dollar liquidity in global markets, prompting investors to look for higher-yielding alternative assets, such as Bitcoin.

It’s worth noting that the historically negative correlation between the U.S. dollar and Bitcoin has weakened over the past month, with both Bitcoin and the U.S. Dollar Index (DXY) falling in August, suggesting other factors are also affecting this Price movements of both assets. One such factor is the upcoming US election, with former President Donald Trump, for example, currently considered a positive candidate for both the US dollar and Bitcoin.

Data Highlights:

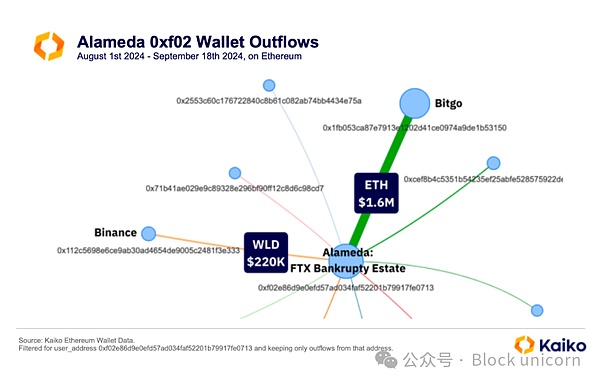

Wallets related to Alameda Research Assets are being consolidated.

Crypto wallets linked to FTX affiliate Alameda Research are rumored to have been actively moving funds over the past month, raising concerns that the FTX bankruptcy estate may be consolidating assets to Preparing to repay creditors is a guesswork. Earlier this year, FTX announced that it had recovered enough tokens to fully repay most creditors based on the value of its assets at the time of the bankruptcy filing. The exchange is expected to begin repayments following final approval of the liquidation plan in early October.

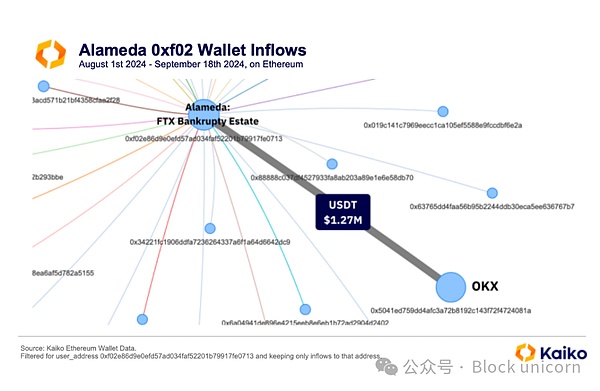

Using Kaiko’s encrypted wallet data solution, we investigated the flow of funds from the wallet at address 0xf02e86d9e0efd57ad034faf52201b79917fe0713. In the past month, the wallet has transferred $1.6 million worth of ETH to crypto custody platform BitGo and $220,000 of World Coin (WLD) to Binance.

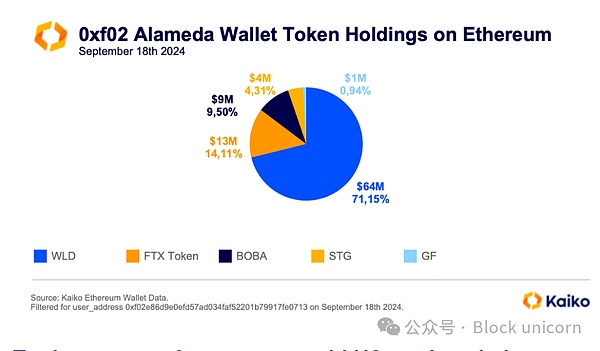

Moving assets to an exchange is often seen as a bearish signal, as traders typically move assets to an exchange with the intention of selling. Alameda Research is an early investor in Worldcoin and holds 75 million WLD tokens (valued at $118 million). The tokens have been gradually unlocked since July by Worldcoin’s developer Tools for Humanity (TFH).

In-depth analysis of the wallet's inflows shows that it consolidates assets through multiple small wallets, most likely owned by Alameda Research, the largest of which One of the inflows was $1.27 million USDT from OKX.

As of September 18, Alameda’s wallet still held $64 million worth of WLD tokens. If these tokens are sold off, it could have a significant impact on the price, especially since the tokens were unlocked on July 24 and have fallen by 30%. Other major holdings include several smaller, less liquid tokens such as FTX’s FTT (valued at $13 million) and Bona Network’s BOBA (valued at $9 million) tokens, both of which have a market depth of only 700,000 per day Dollar.

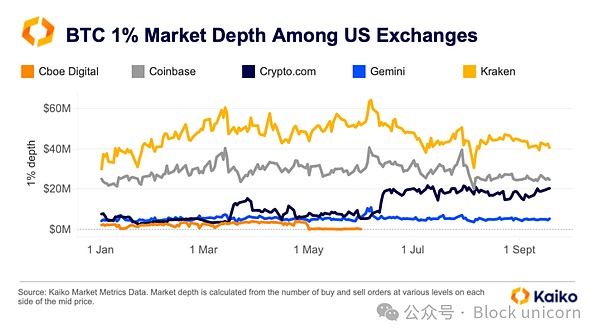

Traders turn to Crypto.com amid turmoil in US markets. This year, the cryptocurrency exchange landscape in the United States has changed due to regulatory changes and market structure developments. Cboe Digital shut down its digital asset spot trading business in June to focus on derivatives, although it had announced such plans back in April.

Crypto.com has seen significant growth in trading volume and market share since June, suggesting it may benefit from the closure of Cboe Digital. Trading volumes surged and liquidity increased. The exchange’s Bitcoin 1% market depth surged over the summer, surpassing Gemini and posing a challenge to Coinbase’s liquidity. Coinbase even lost market share in the third quarter.

In addition, Crypto.com’s competitive fee structure may also have promoted trading activity on the platform. The exchange is currently waiving market maker fees for VIP-level customers and has launched other promotions. In addition, Crypto.com’s fees are generally competitive compared to other U.S. exchanges.

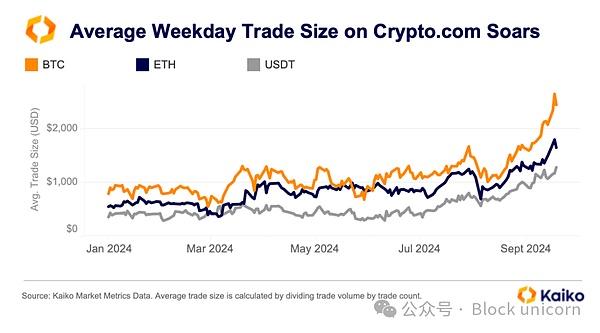

The simultaneous increase in liquidity and trading volume indicates that market makers are also becoming more active on Crypto.com. The exchange's increase in average trade size is another sign that it may have received more trading volume from Cboe's shutdown.

If we look at weekday trading for BTC, ETH and USDT, trading volumes have increased steadily since March, with a noticeable increase during the summer. Since Cboe is an institutional trading platform, its average transaction size is much higher than most retail platforms. The rise in transaction sizes on Crypto.com indicates increased institutional activity.

Why is altcoin liquidity increasingly concentrated?

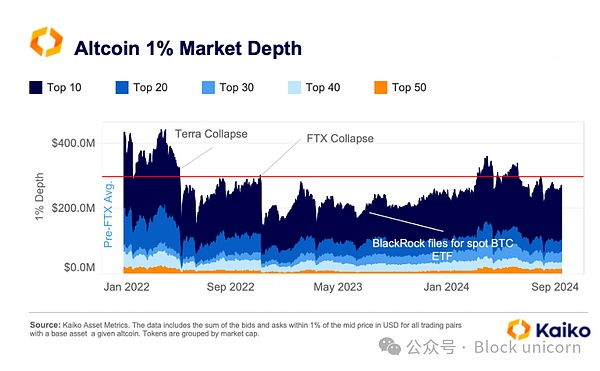

Despite the high volatility of the past few months, altcoins’ 1% market depth remained relatively stable in Q3, maintaining at $270 million, indicating that market makers are still providing liquidity despite continued volatility.

Altcoin liquidity was significantly affected by the collapse of FTX and Terra, with liquidity falling by more than 60% between April and December 2022. Over the past year, however, liquidity has gradually improved, exceeding pre-FTX crash average levels in the first quarter of 2024, only to fall back in the third quarter.

However, the recovery in this trend has been uneven by asset class. Altcoin liquidity is becoming increasingly concentrated, with large coins outperforming smaller assets.

As of early September, the top ten altcoins by market capitalization accounted for 60% of total market depth, compared with approximately 50% at the beginning of 2022. In comparison, the market share of the top 20 altcoins dropped significantly during the same period, from 27% to 14%.

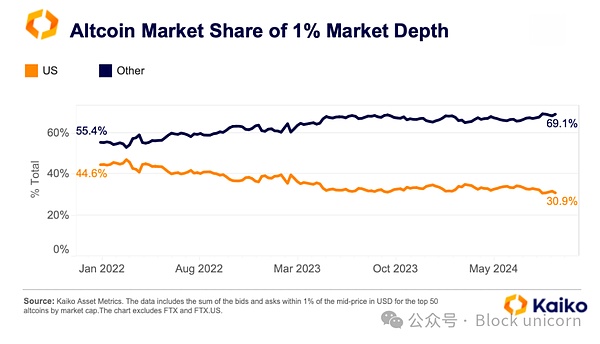

In addition, altcoin liquidity is increasingly concentrated on offshore exchanges. These exchanges’ share of total altcoin depth has risen to 69% from 55% at the beginning of 2022, a trend primarily driven by large and mid-cap altcoins.

We observe an opposite trend in Bitcoin liquidity, with U.S. exchanges increasing their share relative to the offshore market. This suggests that some market makers may have de-risked their portfolios or switched to Bitcoin.

Exchange listings to cool down in 2024

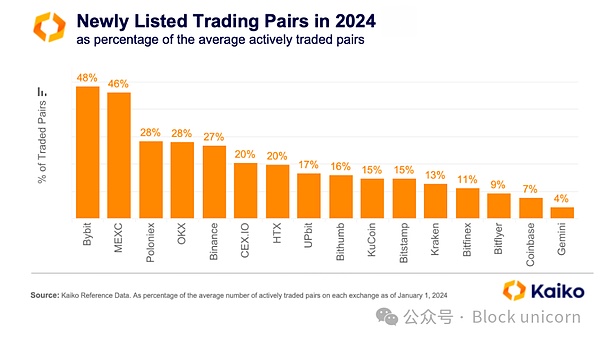

Global regulatory review The intensification of the epidemic has significantly changed the listing strategies of cryptocurrency exchanges, causing the number of new listings to slow down significantly compared to the 2021 bull market.

However, focusing solely on the notional number of new listings does not fully capture how exchanges are expanding their product lines. To provide a clearer perspective, we compared the number of new listings as a proportion of the total number of active trading pairs on each exchange.

In 2024, Binance added more than 300 new trading pairs, ranking second after MEXC. However, these new trading pairs account for only 27% of its total products, lagging behind Bybit, Poloniex and OKX in terms of listing expansion.

U.S.-based exchanges are more conservative, with newly listed trading pairs accounting for only 4% to 15% of their existing products. For example, Coinbase launched only 29 new trading pairs in 2024, a tenfold decrease compared to 2021.

Overall, newly listed trading pairs on major exchanges this year account for only about 20% of existing trading pairs, compared with an average of 50% at the peak in 2021 dropped significantly compared to the level.

U.S. presidential election triggers crypto market volatility

Digital assets It has become an increasingly prominent issue among the two leading U.S. presidential candidates. Former President Trump pledged his support for Bitcoin and its related sectors months ago and plans to launch his own cryptocurrency project in the coming weeks. Many market participants view the Republican candidate’s support for Bitcoin as a positive.

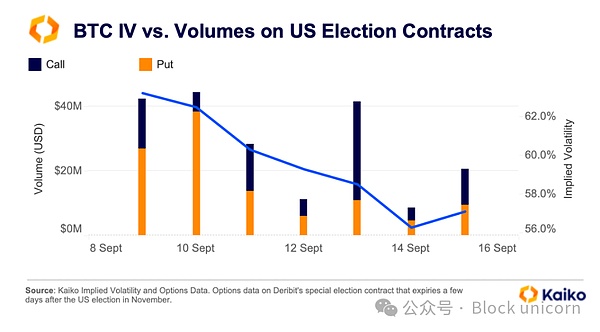

However, this can also be a double-edged sword, as recent debates have shown. Bitcoin prices fell during the debate, with the market reacting poorly to Trump’s performance against Harris.

Ahead of the debate, implied volatility surged in Deribit’s November 8 Bitcoin options contracts, which expire just 3 days after the U.S. vote. During the debate, trading volume in the special election contract surged to over $40 million, with traders primarily buying put options, which profit when Bitcoin prices fall.

The U.S. election is likely to continue to be a source of heightened market volatility in the coming weeks as we enter the final stages of the election cycle. Although Bitcoin and digital assets were not in the spotlight during the 2020 campaign, they are growing in importance this time around. Former President Donald Trump took an early stance, pledging support for U.S. digital assets and speaking at the Bitcoin Conference in August. While Kamala Harris has been less vocal about her support for digital assets, the current vice president said at a fundraiser on Sunday that she would support digital asset innovation.

If you think the article looks good, you can mark the Block unicorn with a star and add it to your desktop.

The information provided in this article is for general guidance and information purposes only; the content of this article is In no event should it be construed as investment, business, legal or tax advice. We are not responsible for any personal decisions made based on this article and we strongly recommend that you conduct your own research before taking any action. While every effort is made to ensure that all information provided here is accurate and up-to-date, omissions or errors may occur.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Beincrypto

Beincrypto Coinlive

Coinlive  Crypto Potato

Crypto Potato Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist