With the intervention of institutional capital, the crypto market has moved from independent market conditions to sector linkage, and its closeness to the macroeconomic cycle has been increasing. Since the beginning of this year, mainstream currencies such as Bitcoin have taken turns to stage roller coaster dramas, repeatedly following the global market shocks. It is for this reason that macro indicators have become the focus of attention in the crypto market. The U.S. federal funds rate, which has the greatest impact, has also been upgraded to an absolute industry weather vane.

Looking back at the role of this weather vane, from March 2022 to July 23, the Federal Reserve raised interest rates 11 times in a row, with a cumulative increase of 525 basis points, setting a record for the largest rate hike in the Federal Reserve's interest rate regulation in nearly half a century. In this historic rate hike, banking institutions have experienced a liquidity crisis, and many institutions such as Silicon Valley Bank and First Republic Bank of the United States have inevitably been sounded the death knell of the times. The crypto market also suffered a heavy blow. A typical case is the collapse of FTX. Although it is undeniable that FTX is full of internal sores, the key to piercing it is also the liquidity that was constantly tightened due to macro tightening at that time.

Time has come to this year. Although the success of ETFs has allowed cryptocurrencies to take a breather, the gradually weakening liquidity has also caused local deep bears to still shroud the market. And just recently, with the upcoming September FOMC meeting, after maintaining high interest rates for nearly a year, the macro market seems to have finally ushered in the dawn of dawn.

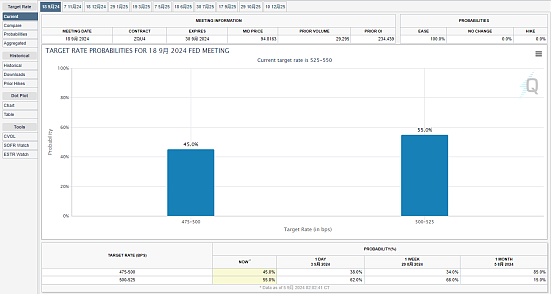

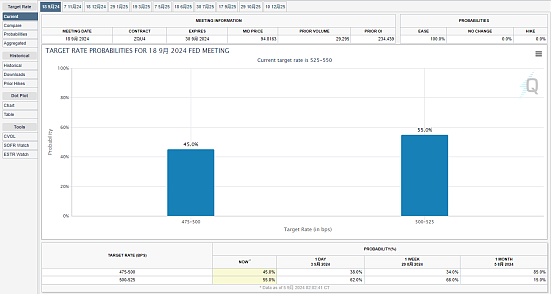

On September 5, according to CME's "Federal Reserve Watch" data, the probability of the Federal Reserve cutting interest rates by 25 basis points in September is 55%, and the probability of cutting interest rates by 50 basis points is 45%, while the probability of the Federal Reserve cutting interest rates by 50 basis points in September a day ago was only 38%. It can be seen that interest rate cuts have become a basic consensus in the market, but the magnitude remains to be considered.

Rate cuts mean the release of liquidity, which is usually a big boon for risky assets, and crypto assets are no exception. However, judging from historical data, rate cuts are often accompanied by a sharp drop in stock prices, and the crypto market, which is highly correlated with US technology stocks, may not perform as well as expected.

How will the upcoming rate cut affect the market? Whether it is a rain after a long drought or the calm before the storm, there are still different opinions, but the speeches of many industry analysts a few days ago show that the rate cut attribute determined by the US economic situation is the key, and the volatility risk is also increasing as the rate cut approaches.

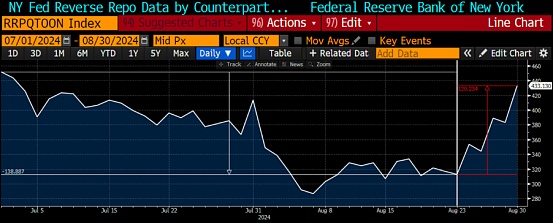

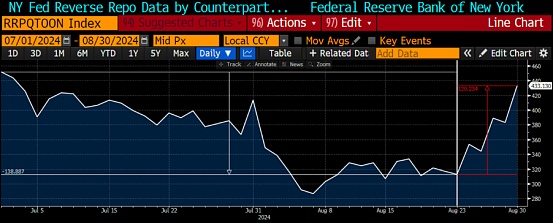

BitMEX co-founder Arthur Hayes recently wrote that interest rate cuts will not bring short-term benefits to Bitcoin. He emphasized the regulatory role of reverse repurchase agreements (RRP) in this dynamic.

RRP is an overnight tool for large banks and fund managers. Compared with other safe investments, banking institutions can obtain higher returns and achieve broader benefits. The agreement sells securities to counterparties and agrees to repurchase them at a higher price on a future date. The current RRP interest rate is 5.3%, which is higher than the 4.38% Treasury yield. Hayes believes that the interest rate difference will cause large money market funds to transfer capital from Treasury bonds to RRP, thereby reducing the amount of funds available for riskier investments such as cryptocurrencies.

Against this backdrop, contrary to expectations, Hayes said that market liquidity could be more restricted in the next two weeks before the actual rate cut. "Bitcoin will fluctuate around current levels in the best case, and slowly fall to $50,000 in the worst case as funds are being withdrawn from Treasury bills and flowed back into the reverse repo program".

Interestingly, even with a short-term bearish outlook, Hayes still said he would not sell any cryptocurrencies.

Bitfinex analysts analyzed the upcoming rate cut from historical data and expressed a more negative and aggressive view. He believes that due to the sluggish price trend for months, cryptocurrency investors had expected the Fed's September rate cut to boost the bull market, but escalating recession concerns may bring a deeper correction. "If the easing cycle coincides with a recession, Bitcoin may fall 15%-20% after the September rate cut. Assuming that the price of BTC is around $60,000 before the rate cut, the potential bottom will be between $50,000 and $40,000."

"Typically, rate cuts are seen as a positive catalyst for risk assets. A 25 basis point rate cut could mark the start of a standard rate cut cycle, which could lead to a long-term rise in Bitcoin prices as recession fears ease. Such a move would demonstrate the Fed's confidence in the resilience of the economy, thereby reducing the likelihood of a severe recession. On the other hand, a larger 50 basis point rate cut could cause BTC to rise by 5%-8% briefly, but then the gains would be wiped out as asset prices suffered a bigger blow due to growing concerns about an impending recession. Similar to past situations: large rate cuts initially pushed up asset prices, but economic uncertainty curbed the gains."

In addition, seasonal effects are also unfavorable to Bitcoin. Historical data shows that since 2013, Bitcoin has only achieved positive returns in September three times in the past decade. In September, Bitcoin's average monthly return was -4.78%, and the probability of closing in the red was 72.7%, making it one of the worst performing months for the asset.

Markus Thielen, founder of 10x Research, agrees with this view. "If the Fed cuts interest rates in September 2024 simply because of the inflation crisis, it will be a short-term positive for Bitcoin. However, if the recession leads to a rate cut, whether in September or later, Bitcoin will face huge selling pressure."

Historically, Bitcoin has risen the most when the Fed pauses its rate hike cycle, and the first rate cut usually causes a tepid response. "During the period when the Fed paused its rate hikes until July 2019, Bitcoin experienced explosive growth, with a return of 169%. After a seven-month pause in 2019, the Fed cut interest rates, starting a sharp rate cut cycle. Bitcoin responded positively, rising 19% in the week after the rate cut on July 31, 2019. However, two weeks later, Bitcoin returned to a flat state," Thielen added, adding that the rate cuts in the second half of 2019 were due to increased economic uncertainty, which had an impact on the price of BTC. CoinDesk data shows that BTC prices fell 33% in the second half of the year.

It can be seen that the analysts' views are all centered on whether the US economy will have a soft landing. Although the data is not clear for the time being, the market also has its own inclinations on this issue.

The EMC Labs article pointed out that the market as a whole tends to believe that the US economy will achieve a soft landing, so it did not price the overall downward expectation of the US stock market under the expectation of a hard landing. Based on the assumption of a soft landing, some funds chose to withdraw from the "Big Seven" that had already risen sharply, and entered other blue-chip stocks with smaller gains, pushing the Dow Jones Index to a record high.

Therefore, if the 25 basis point interest rate cut in September is finalized, and there are no major economic and employment data indicating that the economy does not meet the characteristics of a "soft landing", the US stock market will run steadily. If the Big Seven repairs upward, then BTC ETF will most likely resume positive inflows, pushing BTC upward and hitting the psychological barrier of $70,000 again and even challenging new highs. If there are major economic and employment data indicating that the economy does not meet the characteristics of a "soft landing", the US stock market will most likely be corrected downward, especially the Big Seven. Correspondingly, the BTC ETF channel funds will most likely not be optimistic, and BTC may go down and challenge the lower edge of the "new high repair period" of $54,000 again.

Zach Pandel, head of Grayscale Research, also tends to believe that this rate cut is defensive in nature. He said that usually, the Fed cuts interest rates because of economic recession. But this time is different. The Fed cuts interest rates because the protracted war against inflation has achieved a phased victory.

"Rate cuts in the context of a soft landing are an environment that is unfavorable to the US dollar and favorable to assets such as Bitcoin. This is my core view. I think the crypto market will retest its historical highs in the coming months.The main risk now is the health of the US economy. The positive view is based on a soft landing and the avoidance of a recession, which is also the view of most economists at present. Therefore, it is necessary to pay close attention to US labor market data.

If the unemployment rate continues to rise, we see signs of layoffs, and a period of economic weakness appears, Bitcoin and many other assets such as technology stocks or credit spreads will also weaken in a typical cyclical manner. But my view is that in a recession, it is an excellent time to accumulate Bitcoin. We will see loose monetary policy and loose fiscal policy to help the economy out of the recession, and the price will rebound accordingly. But if the US labor market continues to deteriorate and falls into a short recession, the downside risk of prices will become prominent, which is also the main risk we will see in the next 6 to 12 months."

Looking at the analysis of industry insiders, a soft landing of the US economy is the prerequisite for the crypto market to revitalize. If it is a soft landing, the interest rate cut will be a defensive interest rate cut, but if not, the interest rate cut will be a recessionary interest rate cut. After the US enters a recession, the crypto market, which is closely related to the macro cycle, will instead usher in a decline. From the current data, the data reflecting the recession are differentiated. The US labor market is weak, but the volume and price of the consumer market are still supported, and it is difficult to directly establish the trend. For ordinary users, it may be safer to pay attention to US macro data and wait for the direction after the interest rate cut before operating.

JinseFinance

JinseFinance