Author: Liu Jiaolian

《The Fed Slows Down QT》 text="">For the principal payments of Treasury bonds held by the Federal Reserve that mature in March, if they exceed the monthly cap of US$25 billion, they will be rolled over at auction. Starting from April 1, for the principal payments of Treasury bonds held by the Federal Reserve that mature each month, if they exceed the monthly cap of US$5 billion, they will be rolled over at auction. Redeem Treasury coupon securities until the monthly cap is reached. If the coupon principal payment is lower than the cap, redeem the Treasury notes. 」

Translating the Fed's nitpicking statement into plain words means that in the past, it had to sell US$25 billion worth of US bonds to the market every month, that is, it had to net recover US$25 billion of liquidity from the US bond market. Now this selling pressure has been directly reduced to US$5 billion, that is, it has withdrawn US$20 billion of liquidity.

The pumping mechanism is smaller, and it has been closed down a lot, by three quarters.

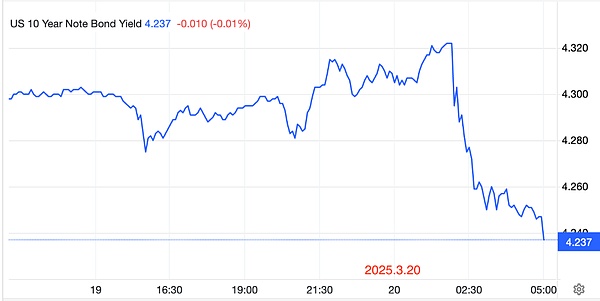

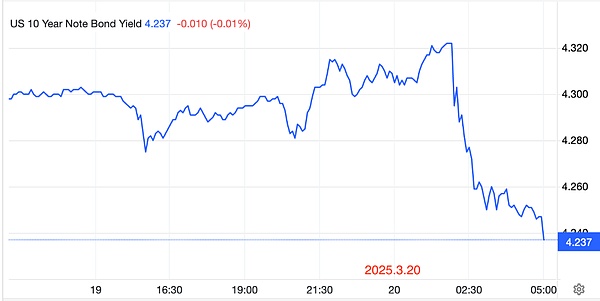

The effect was immediate. U.S. bond yields fell, breaking through the 4.3 mark, and fell all the way from 4.32 to around 4.23.

The Fed reduced the net selling pressure of U.S. bonds, which reduced the suppression of U.S. bond rises. The yield will naturally fall.

Although the Fed will not start implementing this policy until April 1, the market will inevitably start to act in advance when it hears the signal.

In this way, the Fed has achieved, on the one hand, the benchmark interest rate remains unchanged, and on the other hand, the US Treasury yield has fallen.

And Jiaolian has already written in the article "Interest Rate Cut Trap" on March 19, 2025 yesterday that the US federal government, which is in urgent need of debt refinancing this year, is more concerned about whether the US Treasury yield can be reduced.

Powell gave the answer.

The Fed finally ate this half-cooked meal.

However, Powell's meal is for the country, not for the risk speculative market.

The interest rate has not been reduced, and the leverage ratio continues to be suppressed. MBS selling has not been reduced, and the withdrawal continues. The liquidity support for the risk market is carefully controlled to the minimum.

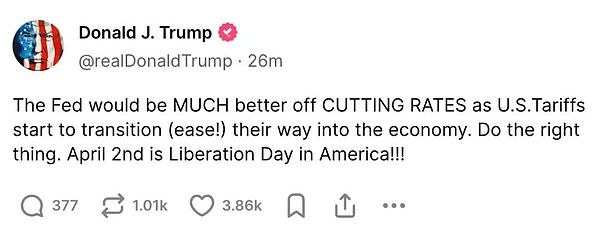

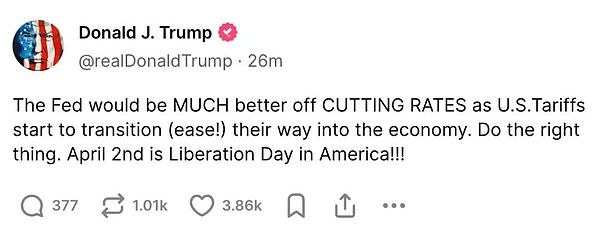

On the other hand, the president continues to post encouragement: The Federal Reserve had better lower interest rates!

The game continues...

Weatherly

Weatherly