Author: Alvis; Source: Mars Finance

After four years of waiting, the U.S. Federal Reserve announced its first interest rate cut of 50 basis points in today's morning meeting. The announcement of this decision has injected new vitality into the long-sluggish cryptocurrency market.

According to Binance data, Bitcoin has surged from $58,000 to above $62,000, of which the premium of Bitcoin delivery contracts at the end of the year is nearly $1,600, which fully shows a strong bullish signal!

The public chain sector generally rose:

SEI is currently quoted at 0.3305 US dollars, with a 24-hour increase of 20.5%

SUI is currently quoted at 1.39 US dollars, with a 24-hour increase of 17.2%

TAIKO is currently quoted at 1.89 US dollars, with a 24-hour increase of 31.9%

ZETA is currently quoted at 0.7186 US dollars, with a 24-hour increase of 38.1%

SAGA is currently quoted at 2.46 US dollars, with a 24-hour increase of 25.1%

MEME sector:

According to statistics, the last time the Fed cut interest rates by 50 basis points was in March 2020, when it cut interest rates by 1 percentage point to 0-0.25% in response to the COVID-19 pandemic. Since March 2022, the Fed has launched an almost unprecedented round of aggressive interest rate hikes, and has maintained the policy rate at a high of 5.25%-5.5% since July 2023.

After the interest rate cut in 2020, Bitcoin started to rise from the price range of US$4,000-6,000 after "3.12", and reached the high of the last bull market of US$69,040 in November 2021, with the maximum increase of more than 10 times. During the same period, gold prices rose from the $1,450 to $1,700 range in March, peaking ahead of Bitcoin, reaching a high of $2,075 in August 2020 before falling back, and starting a new round of increases after reaching a bottom of $1,616 in November 2022.

After this rate cut, will the crypto market repeat history again?

The rate cuts are likely to continue in the coming months

The rate cut exceeded the market's expectations of 25 basis points, reaching 50 basis points. At the press conference, Powell made it clear that a substantial rate cut does not mean that the U.S. economy is about to fall into recession, nor does it indicate that the job market is about to collapse. On the contrary, the rate cut is a precautionary measure aimed at maintaining economic and labor market stability.

The market generally expects that interest rates will continue to fall in the coming November and December. It is expected that there will be another 70 basis points of interest rate cuts this year. The published dot plot shows that there may be another 50 basis points of interest rate cuts this year.

Related reading: Understand the key points of the Q&A of Powell's heavy hawkish press conference in one article (Chinese and English comparison)

The interest rate cut is a long-term positive for the risk asset market. Although the effect may not be immediately apparent in the short term, as time goes by and the interest rate cut policy continues to be implemented, market liquidity will gradually shift from traditional channels such as bonds and banks to emerging markets such as stocks and cryptocurrencies.

In addition, the upcoming US presidential election in early November may also cause short-term fluctuations in the cryptocurrency market. After the election results are announced, funds that were originally on the sidelines may begin to flow into the cryptocurrency market.

BTC Spot ETF

As of September 18, the total net inflow of Bitcoin spot ETFs has reached 300,000 BTC.

When Bitcoin spot exchange-traded funds (ETFs) continue to receive inflows, the price of Bitcoin usually remains stable and shows an upward trend. On the contrary, if there is a large outflow of funds, the price of Bitcoin tends to continue to fall.

Currently, after a period of price fluctuations and declines, market confidence is gradually recovering, and investors continue to actively buy Bitcoin.

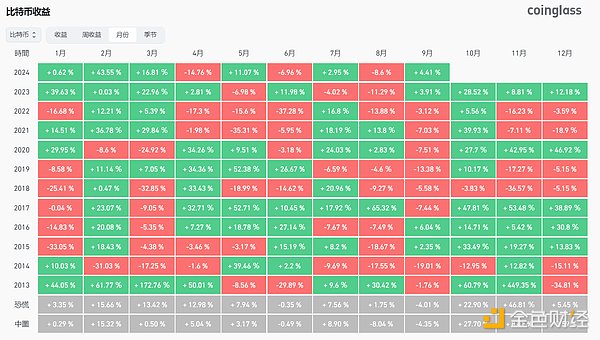

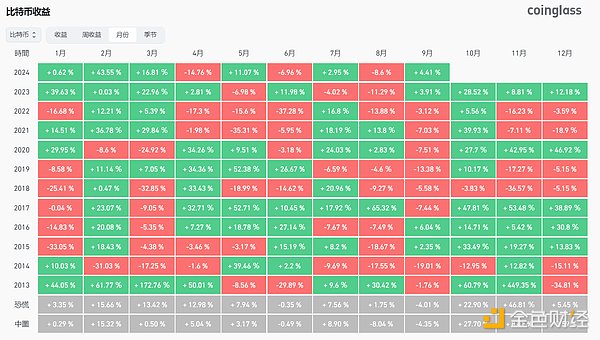

October usually rises

According to Coinglass data, the cryptocurrency market shows obvious seasonal fluctuations. For example, summer often witnesses sluggish market performance, while the end and beginning of the year usually usher in market recovery and growth. Historical data shows that Bitcoin has achieved significant positive returns in the past nine years from 2015 to 2023, except for the decline in October 2018 due to the bear market.

In the second half of 2023, the price of Bitcoin has been rising steadily since October. This trend, combined with the expectation of the approval of the Bitcoin spot exchange-traded fund (ETF), may herald the start of a new round of bull market.

Market Views

HashKey Jeffrey: The darkness before dawn has passed, and the starting point of a new round of tidal market has arrived.

HashKey Group Chief Analyst Jeffrey Ding said: The Fed's 50 basis point rate cut this time indicates that it has obvious concerns about the current economic environment and needs to start a rate cut cycle with a larger scale. The global economy has recently faced liquidity challenges, and this rate cut decision has released new vitality for the global financial market. Bitcoin, as the "digital gold" of the new era, has performed strongly against this background, breaking through the short-term rise of $62,000. However, it is not only Bitcoin that benefits this time, and the entire crypto market is expected to usher in a new round of market in the loose monetary policy. It should be noted here that, unlike traditional markets, Bitcoin's performance is more affected by the liquidity of the US dollar rather than changes in the US economic outlook. This means that in the future loose monetary environment, Bitcoin may continue to be the preferred asset for investors to fight inflation and seek safe havens. As the interest rate cut cycle continues, the crypto market may enter a longer upward channel. Market volatility still exists, but this round of cryptocurrency market may drive more funds and innovation into the field, pushing the entire crypto ecosystem into a new stage of development.

Hyblock Capital: Bitcoin market is deeply exhausted, which may indicate a bullish Bitcoin price

Shubh Verma, co-founder and CEO of Hyblock Capital, said in an interview with CoinDesk earlier: "By analyzing the comprehensive spot order book, especially the order book with a spot order book depth of 0%-1% and 1%-5%, we found that low order book liquidity usually coincides with the market bottom. These low order book levels may be an early indicator of price reversal, usually preceding a bullish trend.

Glassnode: The Bitcoin market is in a period of stagnation, and both supply and demand sides show signs of inactivity

Crypto market data research organization Glassnode issued a statement saying that the Bitcoin market is currently experiencing a period of stagnation, and both supply and demand sides show signs of inactivity. In the past two months, the actual market value of Bitcoin has peaked and stabilized at 6220 This suggests that most tokens being traded are close to their original acquisition price. Absolute realized gains and losses have fallen significantly since the all-time high in March, which means that overall buyer pressure has eased in the current price range.

Disclaimer: This article does not constitute investment advice, and users should consider whether any opinions, views or conclusions in this article are suitable for their specific circumstances and comply with the relevant laws and regulations of their countries and regions.

Catherine

Catherine