Tencent News "Periscope", author: Ji Zhenyu

On September 18, US time, the Federal Reserve announced a 50 basis point interest rate cut at the highly anticipated September interest rate meeting, lowering the target range of the federal funds rate from 5.25% to 5.5% to 4.75% to 5%.

Federal Reserve Chairman Powell said at the press conference that day that this was the beginning of a series of interest rate cuts. His statement clearly announced to the outside world that the Federal Reserve has officially ended a round of monetary tightening cycle that began in 2021 and entered a new loose monetary policy cycle.

This magnitude clearly exceeded market expectations and increased market uncertainty about future economic trends. Stephen Guilfoyle, a former trader at the New York Stock Exchange and current individual investor, told Tencent News’ Qianwang that the Fed’s decision to cut interest rates by 50 basis points and Powell’s subsequent description of the current economic situation were somewhat “inconsistent”. “He said in his speech that there was nothing to worry about in the economy, but he cut interest rates by 50 basis points at one time. This inconsistency cannot convince me.”

Before announcing the decision to cut interest rates, the Fed faced a complex US economic environment: on the one hand, inflation was significantly suppressed, but it still did not reach the Fed’s long-term inflation target of 2%. On the other hand, the job market began to show signs of weakness and the unemployment rate rose. The Fed was in a dilemma and struggled to find a policy balance point.

It was under such doubts that the market formed different interpretations of the 50 basis point interest rate cut, which brought about sharp fluctuations in US stocks in the short term. Some people believe that if this is a panic-driven rate cut to avoid a rapid economic downturn, then it is a reason to short sell; but if this is the Fed's attempt to make up for the mistake of not cutting interest rates in the last meeting, then it can be considered a smooth transition of monetary policy from "tight to loose", and there is no need to worry too much.

The Fed does not have much historical experience to draw on. In the past, the 50 basis point rate cuts were emergency actions taken by the Fed when there were obvious pessimistic signals in the economy and financial markets. For example, in early 2001 and September 2007, the United States experienced a significant economic recession.

This time, the US economy has performed relatively steadily. Wang Yi, a professor at the Department of Economics at Virginia Tech, previously told Tencent News "Qianwang" that the probability of the Fed being able to achieve a "soft landing" of the economy at this stage is still very high.

First rate cut in 4 years

The Federal Reserve announced its latest monetary policy decision on September 18, US time, lowering the benchmark interest rate by 50 basis points to 4.75-5%. This is also the first time the Federal Reserve has announced a rate cut in 4 years.

In its statement on the same day, the Federal Reserve emphasized that the substantial rate cut was due to "slowing employment growth", and although inflation remained high to a certain extent, it had made greater progress in the expected direction.

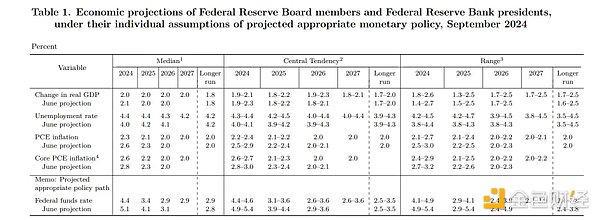

The latest quarterly economic outlook data released by the Federal Reserve at the same time showed that it believed that the inflation index would fall to 2.3% in 2024, and further fall to 2.1% by 2025, and reach the long-term goal of 2% in 2026.

For the unemployment rate, the Fed's forecast is even more pessimistic: the US unemployment rate will rise to 4.4% this year, remain at 4.4% in 2025, and gradually decline to 4.3% and 4.2% in 2026 and 2027, and the long-term unemployment level will remain at 4.2%.

Based on the judgment of inflation prospects and changes in unemployment rates, the Fed believes that the federal reserve fund rate should be 4.4% this year, 3.4% in 2025, 2.9% in 2026, and 2.9% in the long term.

In comparison, in the forecast of the previous quarter, the Fed believed that the benchmark interest rate level would be 5.1% this year, 4.1% next year, 3.1% in 2026, and 2.8% in the long term. The Fed has further significantly lowered the reasonable benchmark interest rate, but has raised the long-term interest rate by 0.1 percentage point, which reflects the Fed's concerns about the short-term economic outlook and the need to use lower interest rates to maintain economic growth.

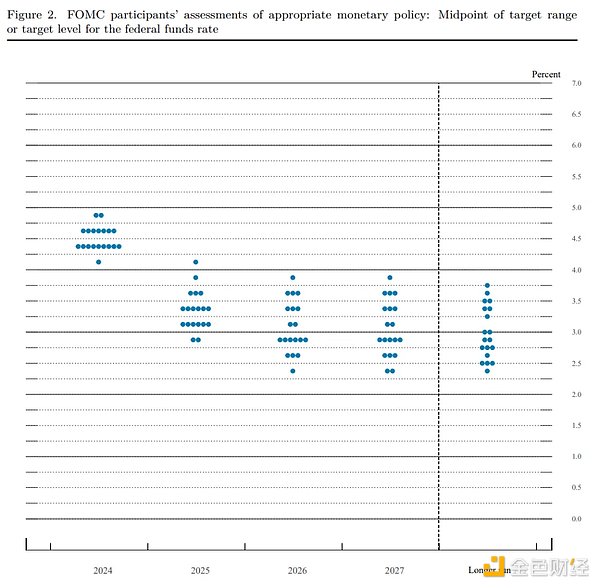

In addition, the dot plot, which has attracted much attention from the outside world, also reflects that there are still huge differences within the Fed on the future interest rate level. Regarding the interest rate level in 2024, 10 Fed officials believe that the benchmark interest rate should be below 4.5%, and 9 believe that it should be above 4.5%. Regarding the interest rate expectations for subsequent years, the views of Fed officials appear to be more scattered. The most "hawkish" and the most "dovish" opinions have a difference of more than 1 percentage point in their judgments on the interest rate level. For example, for the long-term interest rate level, one of the most "hawkish" believes that it should be maintained at 3.75%, while the most "dovish" believes that it should be maintained at 2.25%.

The most controversial monetary policy meeting

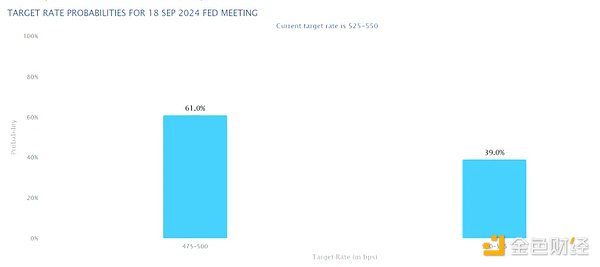

Until the Fed announced its monetary policy decision, the market had not reached a consensus on the extent of the interest rate cut.

This is rare in recent years. Usually before the Fed meeting, the market will basically form a consensus expectation about the Fed's monetary policy actions, and eventually it will be consistent with the results announced by the Fed. However, according to CME's Fed monitoring tool, before this meeting, the market expected the Fed to cut interest rates by 50 basis points with a probability of 61%, and the probability of cutting interest rates by 25 basis points was 39%.

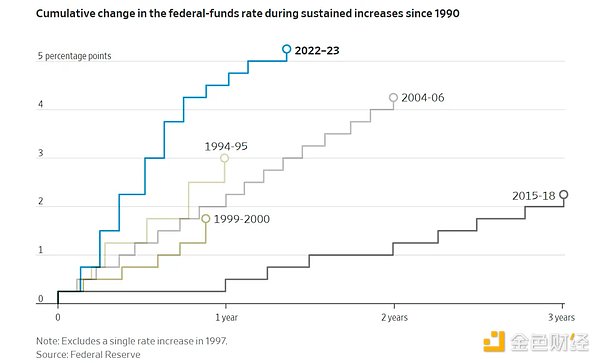

To cope with inflation, the Federal Reserve has raised its benchmark interest rate 11 times since it started tightening monetary policy in early 2022, raising the benchmark interest rate from a low of near zero to the current level of about 5.4% in more than two years. Such a speed and intensity of monetary policy adjustment are rare in history.

The high interest rate environment has a significant inhibitory effect on inflation, and victory in the fight against inflation seems to be just around the corner. A year ago, the US Consumer Price Index, which measures overall inflation, stood at 3.2%. In August, the index has returned to 2.5%. Excluding the core inflation level of categories with large fluctuations such as food and energy, it has dropped from 4.2% a year ago to 2.5%.

Although there is still some distance from the long-term inflation target of 2% set by the Federal Reserve, some economists point out that the gap is largely affected by the delayed response of high housing prices, automobiles and other commodity prices in the past few years.

Statistics from the Intercontinental Exchange show that the pricing of inflation-linked bonds and other derivatives reflects investors' expectations that the US CPI will hit 1.8% next year and average 2.2% in the next five years. This reflects that investors are relatively optimistic about future inflation expectations and gives the Federal Reserve confidence to further relax monetary policy.

On the other hand, the inhibitory effect of high interest rates on the economy has also begun to emerge. The US unemployment rate rose from 3.5% in July last year to 4.3% in July this year. Usually, a significant increase in the unemployment rate within a year will be accompanied by an economic recession. However, the current US consumer data remains strong, the number of people applying for unemployment benefits has not increased significantly, and the stock market continues to hit new highs.

These data have added new complexity to the Fed's monetary policy formulation. The Fed has repeatedly publicly emphasized that any monetary policy decision is based on economic data, but economic data often lags, which means that the Fed's monetary policy will always lag.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Alex

Alex JinseFinance

JinseFinance

Bitcoinist

Bitcoinist