Written by: 1912212.eth, Foresight News

After 4 years, the Federal Reserve finally announced its first interest rate cut of 50 basis points at this morning's meeting. After the long-dull crypto market interest rate resolution was announced, it once again ushered in a significant amplitude. Bitcoin surged from $59,000 to above $62,000, Ethereum rose from $2,200 to $2,400, and altcoins also benefited from the boost of the market and achieved good gains. SEI soared 22%, breaking through $0.34, and BLUR soared 17%, breaking through $0.2.

According to coingrass data, the entire network had a liquidation of $199 million in the past 24 hours, of which short orders had a liquidation of $123 million.

From the history of the last cycle, in September 2019, when the Federal Reserve announced its first interest rate cut after many years, BTC was not affected by the good news in the short term. Instead, the monthly chart ended with a drop of 13.54%, from above $10,000 to around $8,300. After this rate cut, will the crypto market repeat history again, or will it usher in a rising market after improved liquidity?

The Federal Reserve will continue to cut interest rates in the next few months

This rate cut far exceeds the market's general estimate of 25 basis points, directly cutting interest rates by 50 basis points. Powell emphasized at the press conference that he did not think that a sharp interest rate cut indicated that the US economic recession was approaching, nor that the job market was on the verge of collapse. The interest rate cut was more of a preventive action aimed at maintaining the "robust" status quo of the economy and the labor market.

After the dust settled, the market generally expected that interest rates would continue to be cut in November and December. It is expected that there will be another 70 basis points of interest rate cuts this year. The published dot plot suggests that there will be another 50 basis points of interest rate cuts this year.

The possibility of a recession in the US economy, which the market generally worries about, has become smaller, and the possibility of a soft landing is increasing.

The interest rate cut will have a lasting positive effect on risky assets. Although it may not be effective immediately, as time goes by and the interest rate cut continues, the liquidity of the market begins to flow out of bonds, banks, etc. and into stocks, cryptocurrencies and other markets.

In addition, in early November this year, the upcoming US presidential election will also bring short-term shocks to the crypto market. After the results are officially announced, the OTC funds that are lingering on the sidelines may begin to be continuously injected into the crypto market.

The current spot market trading volume is still in a downturn, and the overall fluctuations remain around 60 billion US dollars. Apart from the short-term sudden fluctuations caused by special macro events, the liquidity of the market is still mediocre.

Bitcoin has increasingly become a macro asset that reflects the overall economic trend. As liquidity continues to be injected into the market, the crypto market may sweep away the past haze.

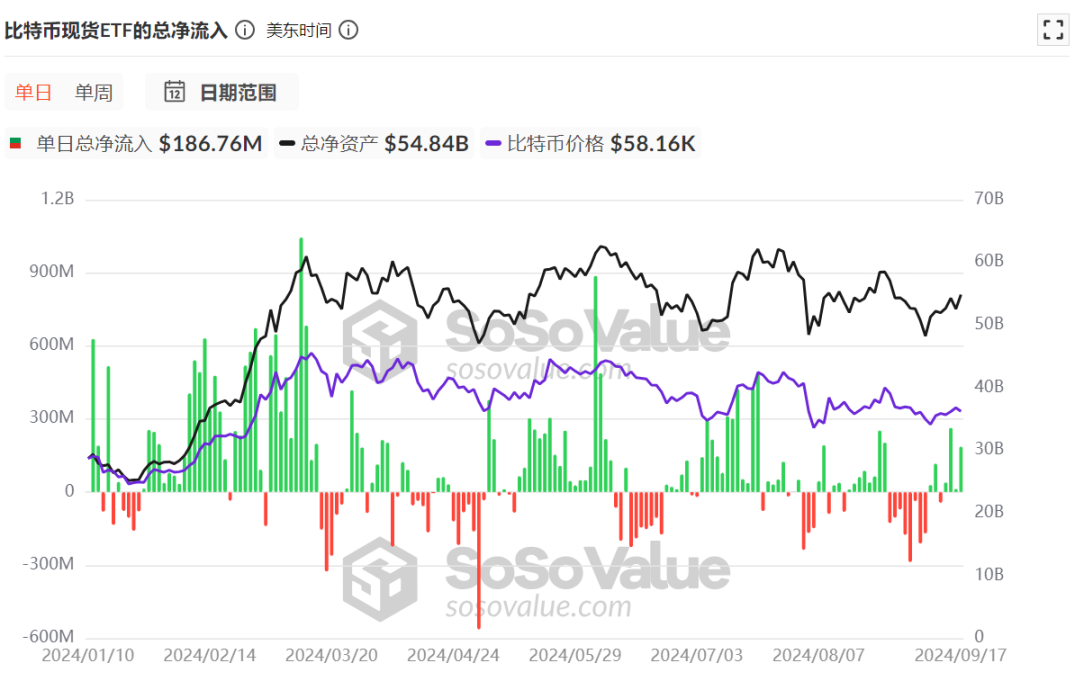

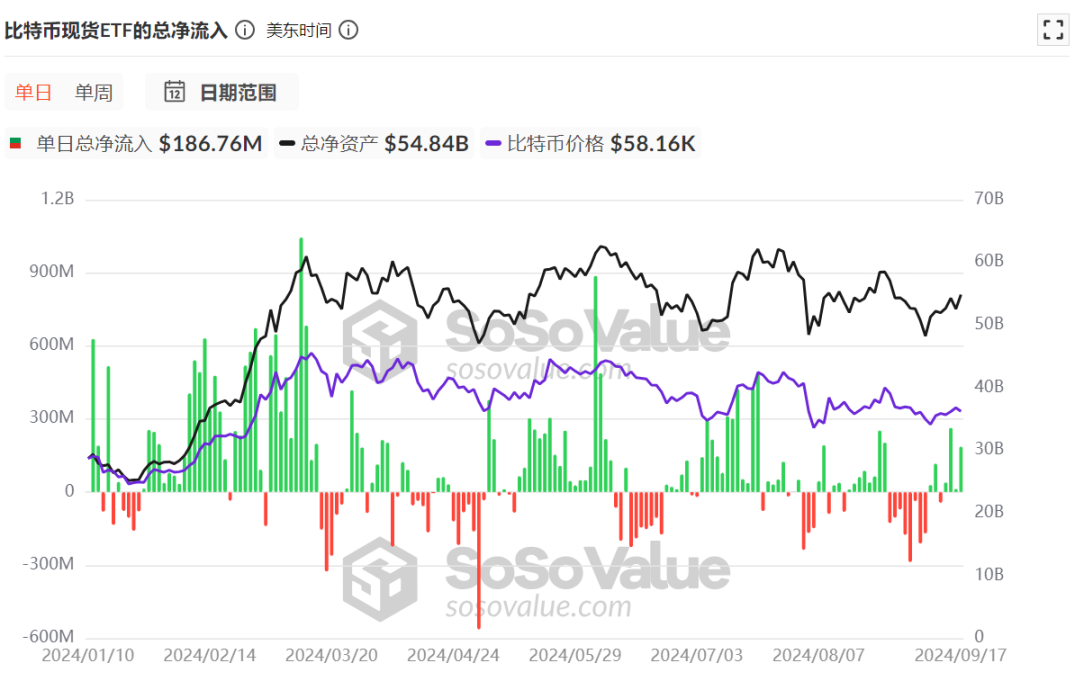

BTC spot ETF is still in net inflow

As of September 17, the total net inflow of Bitcoin spot ETFs has reached 17.5 billion US dollars. The 8-day net outflow from the end of August to the beginning of September ended. Starting from September 12, the Bitcoin spot ETF achieved 4 consecutive days of net inflow.

When BTC spot ETF continues to have net inflows, the price of Bitcoin tends to be stable and rise. Once there is a continuous large outflow, it often causes the price of the currency to fall.

At present, after experiencing a long-term downward fluctuation in the price of the currency, the confidence of OTC funds has gradually recovered and they are still buying.

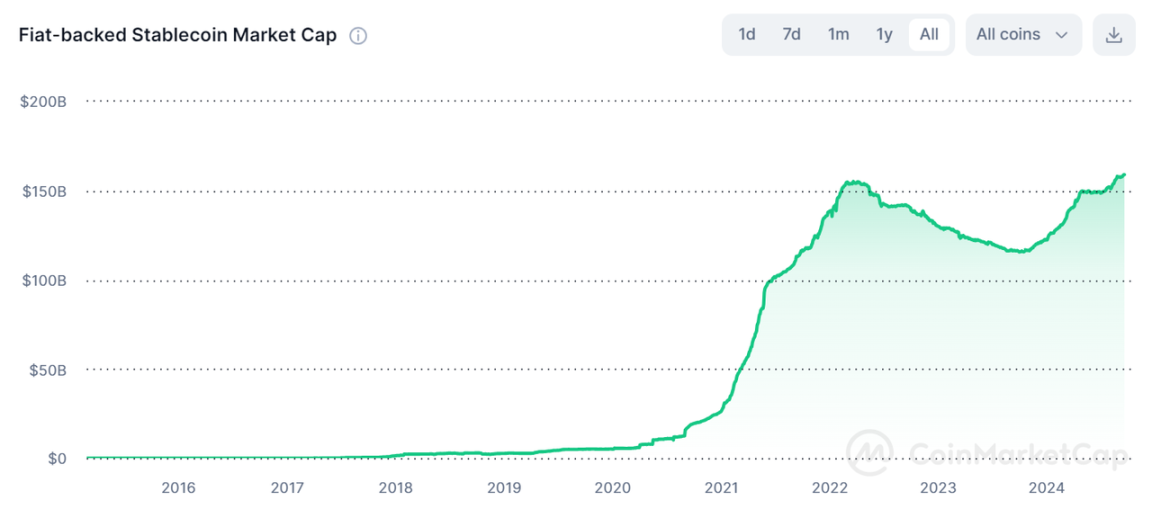

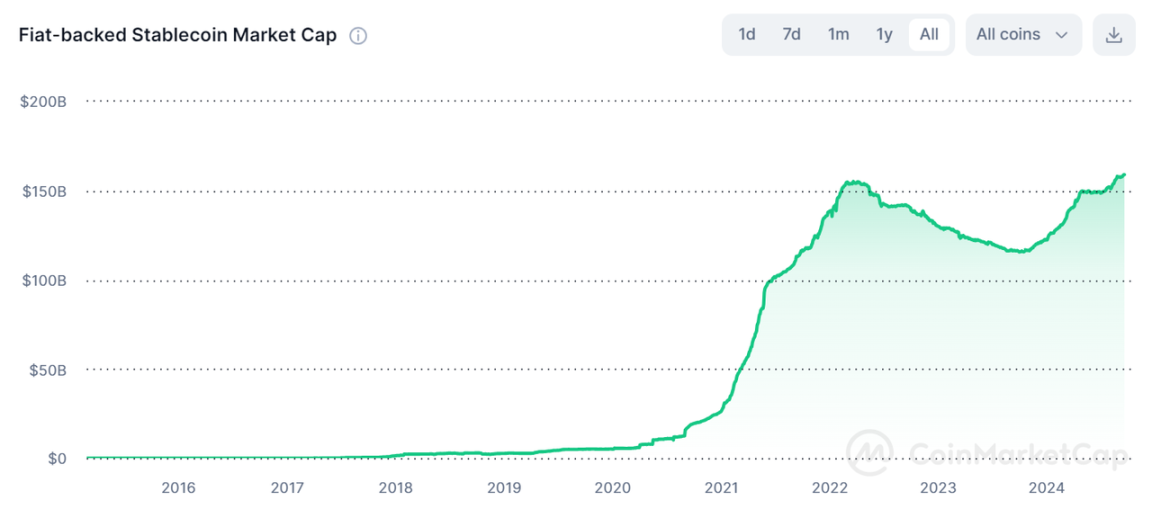

The market value of stablecoins is still rising

The total market value of USDT has risen from US$117 billion to US$118.7 billion in the past month, with an inflow of nearly US$1.7 billion. If calculated from the total market value of US$104.7 billion in April this year, the market value of USDT has still increased strongly, with an inflow of US$14 billion during the overall consolidation and decline of the crypto market.

The market value of another major stablecoin, USDC, has risen from US$34.4 billion at the end of August to US$35.5 billion, with an inflow of US$1.1 billion in less than a month.

The total market capitalization of fiat-backed stablecoins has also hit an all-time high and is still climbing.

October is historically a strong month

The interesting thing about crypto markets is that, similar to some stocks, there are seasonal trends. For example, the market generally performs poorly in the summer, and then performs well at the end and beginning of the year. Bitcoin has achieved strong positive returns in the past 9 years, except for October 2018 due to the bear market, from 2015 to 2023.

In the second half of 2023, Bitcoin has been rising since October, coupled with the expectation of approval of the Bitcoin spot ETF, thus starting a bull market.

Market Views

Crypto KOL Lark Davis: 2025 will be the high point of this cycle, and you should sell it in time

Youtube crypto KOL Lark Davis, who has 500,000 followers, said in his latest video released on September 9 that 2025 will be the high point of this cycle, and you should sell it and leave. In response to this argument, he gave the following reasons: The global liquidity cycle is expected to peak in 2025 and then begin to decline. China's credit cycle is about four years per cycle, and 2025 may be the peak of China's credit. Currently, short-term bonds have higher yields than long-term bonds, but the yield curve is gradually returning to normal, which may indicate a shift in the economic cycle. Therefore, he believes that there may be huge market dislocations in 2025, followed by a bear market.

Glassnode: The Bitcoin market is in a period of stagnation, with both supply and demand showing signs of inactivity

Glassnode, a market data research organization, said in a statement that the Bitcoin market is currently experiencing a period of stagnation, with both supply and demand showing signs of inactivity. In the past two months, the actual market value of Bitcoin has peaked and stabilized at $622 billion. This shows that most of the tokens being traded are close to their original acquisition price. Since the all-time high in March, the absolute realized gains and losses have fallen sharply, which means that the overall buyer pressure has eased in the current price range.

Hyblock Capital: Bitcoin market depth is exhausted, which may indicate a bullish Bitcoin price

Hyblock Capital co-founder and CEO Shubh Verma said in an earlier interview with CoinDesk: "By analyzing the comprehensive spot order book, especially the order book with a spot order book depth of 0%-1% and 1%-5%, we found that low order book liquidity usually coincides with market bottoming. These low order book levels may be an early indicator of price reversal, usually preceding a bullish trend.

Pr0phetMoggy

Pr0phetMoggy