Author: Jack Inabinet, Bankless; Compiler: Tao Zhu, Golden Finance

Disturbing U.S. economic data suggests the Fed has lost control. What do the numbers say? How does the market react?

The U.S. gross domestic product (GDP), an important indicator of economic growth that measures the value of goods and services produced, grew at an annualized rate of 1.6% in the first quarter of 2024, driven primarily by non-discretionary fixed investment and government spending, well below the consensus estimate of 2.4%.

Meanwhile, the personal consumption expenditures (PCE) price index, a key inflation variable, was 3.4% annualized in the first quarter, beating expectations of 3.4% and surging from 2.0% in the previous quarter.

Risk assets have surged from their October 2022 bear market lows on the belief that central banks can keep inflation in check while maintaining relatively high employment levels and some economic growth, but that optimistic outlook has become decidedly less likely.

We were led to believe that by carefully manipulating near-term interest rates, the Federal Reserve could at least ensure a “soft landing” for the U.S. economy, characterized by below-trend (but not recessionary) growth and returns—achieving its 2% inflation target.

Unfortunately, the misalignment between economic growth and inflation suggests that the Fed has lost control of the situation…

While the impact of interest rate manipulation is questionable, as shown by the multiple Fed rate cuts that have coincided with recessions in recent history, markets are holding out hope that easing rates will stimulate the economy; rising inflation makes such cuts untenable.

Risk assets sold off this morning as market participants were forced to further push back expectations of rate cuts, with the yield curve rising about 1.4% to its highest level since 2024.

If economic growth continues to decline, inflation could fall sharply as demand falls. However, there is no guarantee that adopting lower interest rates will be enough to stabilize a global economy heading for recession.

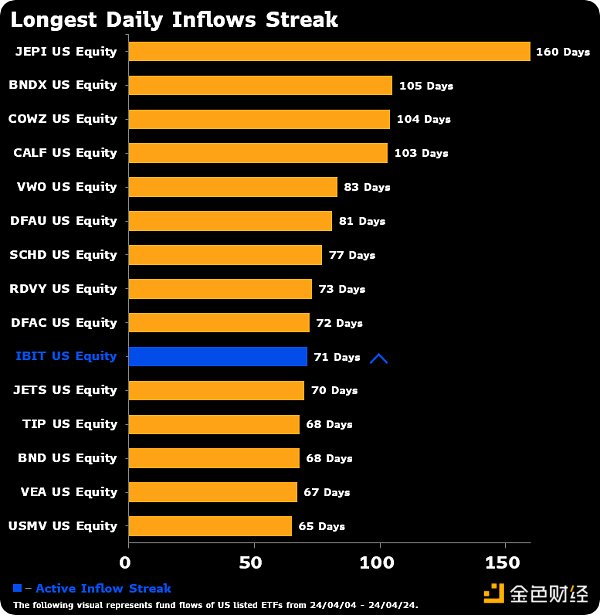

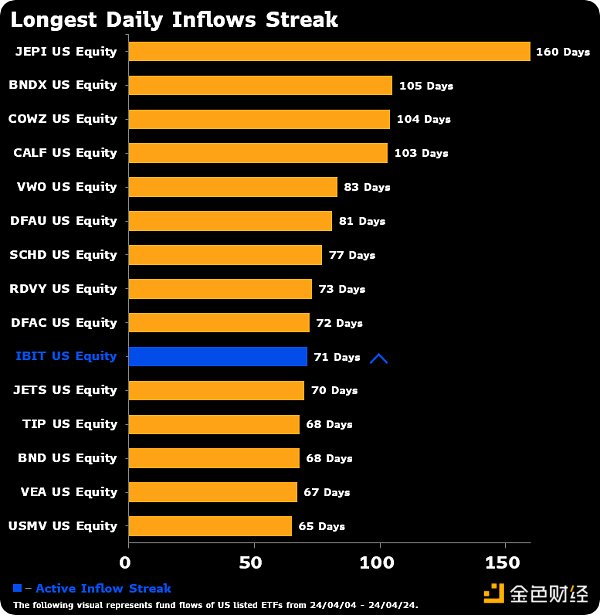

Cryptocurrencies have provided investors with huge returns, with Bitcoin being the best performing asset of the past decade, but the asset class is known to exhibit huge volatility and is not present during prolonged economic downturns. Yesterday, BlackRock’s IBIT spot BTC ETF snapped a 71-day streak of inflows, and while inflows into these instruments have been a key narrative in promoting the excitement surrounding BTC, the risk of these instruments turning to outflows is high as the economic downturn continues.

Alex

Alex