On Thursday, the cryptocurrency market ushered in the most important IPO event of the year.

Circle Internet Group, the issuer of the $60 billion USDC stablecoin, will be listed on the New York Stock Exchange. The company will issue 32 million Class A shares at a price range of $27-28, and is expected to raise up to $896 million. The stock code is CRCL. The company will complete the pricing on Wednesday evening and start trading the next day.

The IPO was enthusiastically received by Wall Street. Circle's target valuation has been raised from the previous $5.65 billion to $7.2 billion. BlackRock led the investment with a 10% stake, and Ark Investment also expressed an investment interest of up to $150 million.

But under the glamorous appearance of Wall Street giants rushing to enter the market, Circle also faces structural challenges.

The seemingly "perfect" money printing machine model

Stablecoins have quietly become the mainstay of the cryptocurrency market and are increasingly closely related to traditional finance. In 2024, the transaction volume of stablecoins reached 27.6 trillion US dollars, nearly 8% higher than the total transaction volume of Visa and Mastercard.

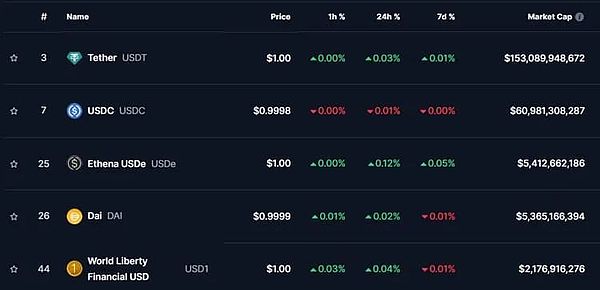

Currently, the total market value of stablecoins has reached 248 billion US dollars.Circle's USDC accounts for 25% of the market share, second only to Tether's USDT's 61%, with a total market value of 60 billion US dollars.Circle's EURC ranks first among euro-backed stablecoins with a market value of 224 million US dollars.

Circle's advantage lies in its regulatory compliance.

In the United States, USDC positions itself as a compliant bridge between the cryptocurrency ecosystem and traditional finance. In the European Union,

the implementation of MiCA—and the resulting delisting of non-compliant stablecoins such as USDT from major regulated exchanges—paved the way for USDC to become the region's leading stablecoin.

Circle's business model is simple and attractive: the company issues USDC stablecoins that are pegged 1:1 to the US dollar, and invests the $60 billion deposited by users in short-term US Treasury bonds to earn risk-free returns.

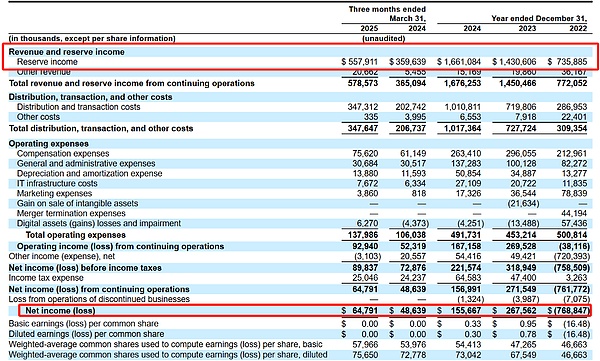

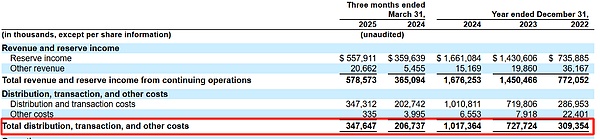

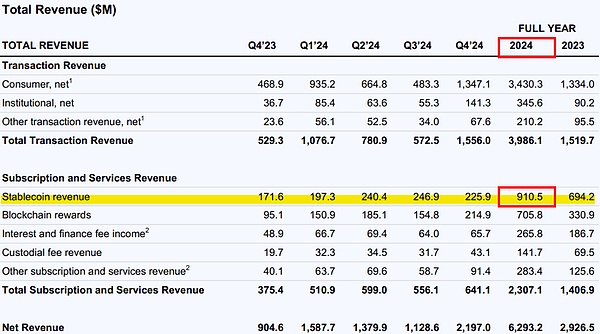

The company invests primarily in U.S. Treasuries (85% managed by BlackRock's CircleReserveFund) and cash (10-20% held in global systemically important banks). This model is highly profitable, generating approximately $1.6 billion in interest income ("reserve income") in 2024, which accounts for 99% of Circle's total revenue. Coinbase “sucks blood” Coinbase “sucks blood” But behind the seemingly “perfect” money printing model, Circle’s financial data presents a dual appearance of growth and pressure: In 2024, Circle’s total revenue and reserve income will reach US$1.676 billion, a year-on-year increase of 16%, which is a steady increase from US$1.450 billion in 2023. However, net profit fell from US$268 million to US$156 million, a drop of 42%.

Behind the contradictory financial data, "distribution, transaction and other costs" have surged, and Circle's profit sharing agreement with Coinbase is the main influencing factor.

The cooperation between Coinbase and Circle began in 2018: the two parties established Centre Consortium in 2018 to create USDC. In 2023, after the alliance was dissolved, Coinbase acquired Circle's equity, and Circle took full control of the USDC ecosystem.

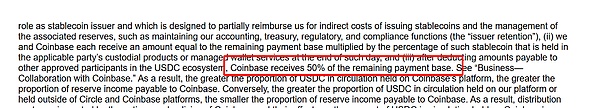

But the split did not end the distribution of cash flows between the two parties, and the two companies still divided the interest income of the reserves supporting USDC. According to Circle's S-1 filing, Circle and Coinbase have the following revenue sharing agreement:

USDC on the Coinbase platform: Coinbase receives 100% of the reserve income.

USDC on non-Coinbase platforms: Coinbase and Circle each receive 50% of the reserve revenue.

As of the first quarter of 2025,USDC on the Coinbase platform accounts for approximately 23% of the total circulation. This proportion shows Coinbase's important position in the USDC ecosystem and reflects its role as a major custodian platform.

According to data disclosed by Coinbase, in 2024, Coinbase will earn $908 million from USDC-related businesses, accounting for approximately 14.5% of its net income.

Coinbase also has the right to decide on Circle's business partners. If Circle wants to sign a new revenue sharing or distribution agreement with a third party, it needs to obtain Coinbase's approval.

Some analysts believe that the "close" cooperation terms between the two parties may lay the foundation for Coinbase to acquire Circle in the future.

Hidden "Fatal" Flaws

In addition to the high "distribution" costs, Circle's seemingly "money printing machine" business model has serious flaws.

First, Circle's revenue is very dependent on the performance of interest rates. Based on a 4.75% return rate, $60 billion in USDC can yield about $2.85 billion, which is about what Circle can earn without taking any risk.

But when interest rates fall, problems arise. The cost (in terms of risk) of maintaining these returns will be higher. Taking excessive risk may be very tempting. There is also pressure from competitors who may be willing to sacrifice a large part of their reserve income in exchange for market share.

At the same time, Circle's performance is closely related to the volatile broader crypto market.

Due to the collapse of the Terra and FTX platforms, Circle lost $768.8 million in 2022; in 2023, after the bankruptcy of Circle partner Silicon Valley Bank, USDC selling pressure increased, directly leading to a halving of USDC's market value (the time when the agreement with Coinbase was signed).

External competitive pressure has increased sharply

Ordinary stablecoins backed by the US dollar do not have any entry barriers. Providers need to be more creative than their competitors to make their stablecoins become industry standards.

ARK believes that by 2030, the size of stablecoins will increase from about $250 billion today to $1.4 trillion. This may depend on how much "floating income" the stablecoin issuers agree to share in the form of "incentives" to win or seize market share.

As the regulatory environment becomes clearer, Circle may face more intense competition. Tech giants such as Amazon and Google may launch their own stablecoins, while banks such as Bank of America, Citigroup and JPMorgan Chase are also exploring the joint issuance of stablecoins.

PayPal has already launched its own stablecoin and plans to return most of its reserve earnings to users. This trend of "competing to give benefits" may compress the profit margins of the entire industry.

IPO timing couldn’t be better

Despite all the problems both internally and externally, Circle’s IPO timing can be described as “perfectly timed”

supporters believe thatstablecoins are becoming the de facto digital dollar—especially as the U.S. becomes increasingly hostile to central bank digital currencies (CBDCs). Potential markets for stablecoins range from global remittances, institutional payments, and DeFi integration. Circle’s infrastructure and regulatory positioning could give it an early lead.

As Benjamin Billarant, founder of Balthazar Capital, an asset manager with significant investments in cryptocurrency-related stocks, commented,

Circle’s IPO couldn’t have come at a better time. We have reached a critical inflection point for stablecoins to achieve mainstream adoption.

The GENIUS Act, if passed, will provide the regulatory clarity needed to unlock its full potential — and Circle, with its compliance-first mindset, is uniquely positioned to capitalize on this opportunity.

In fact, the most comprehensive stablecoin bill in the United States to date, the bipartisan GENIUS Act, was passed by the Senate on May 21 and is currently being reviewed by the House of Representatives. This is undoubtedly a great time for Circle's IPO.

The high valuation of $7.2 billion is also telling a similar "story" (Circle's PE valuation has exceeded that of credit card giant Visa): USDC is just the beginning of tokenization.

Although Circle currently relies on the demand of the cryptocurrency market, in the future stablecoins will sweep the world as a smoother and more efficient payment method than currently offered.

Beyond ordering pizza at home or buying goods from abroad, there is the potential to build new applications and financial products on the same track. As the Trump administration pushes stablecoins into the mainstream,this will all expand demand for USDC and generate more fee income.

Is the $7.2 billion valuation justified? The market will eventually give the answer. But one thing is certain:Whether Circle can make the timely transition from "easy" interest-driven earnings to more challenging product-driven revenues will determine its long-term fate.

Major shareholders sell, Wall Street buys

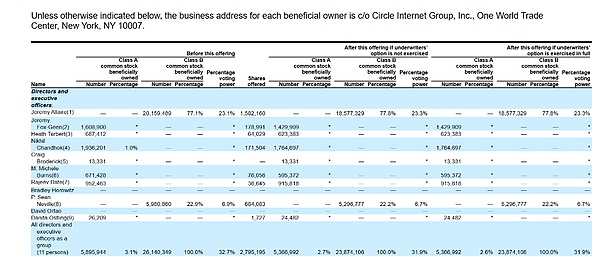

It is interesting to note that Circle's existing shareholders are using this IPO to cash out on a large scale.

According to the prospectus,Circle's existing shareholders are selling 60% of the total offering, which is much higher than typical technology IPOs.

According to the company's prospectus, Circle CEO Jeremy Allaire will sell 8% of his shares, and several well-known venture capital firms also plan to reduce their holdings by about 10%. While inside shareholders still retain a significant stake, large-scale cashing out could send mixed signals to the market.

It is extremely rare for issuance from existing shareholders to exceed company issuance in tech IPOs.

Meta is one of the few exceptions. The social network raised a then-record $16 billion in its massive 2012 IPO, with 57% of its shares sold by existing shareholders.

Alex

Alex

Alex

Alex Joy

Joy Joy

Joy Alex

Alex Kikyo

Kikyo Hui Xin

Hui Xin Brian

Brian Joy

Joy Alex

Alex Hui Xin

Hui Xin