Author: Climber, Golden Finance

On April 20, Beijing time, Bitcoin, the only true god of cryptocurrency, will usher in the fourth halving in history. Looking back at the previous halvings, the maximum increase of BTC in the first halving was 2300%, the maximum in the second halving was 4158%, and the maximum in the third halving was 741%. The block reward for this halving has also been reduced from 6.25 bitcoins to 3.125 bitcoins, and the most direct impact is the reduction of miners' income.

From the above cycle, after the halving, the price of BTC has risen sharply and repeatedly hit a record high. This rule also makes the crypto market look forward to BTC to create another glory. However, for this halving, the market views are divided, both long and short. In addition, the price of BTC has retreated to varying degrees after the previous halvings, up to 40%.

As for how the future market of Bitcoin will develop, and whether it will reach $100,000 as predicted by institutions? Coincidentally, Goldman Sachs, Glassnode, Coinbase, etc. all said that the approval of the US Bitcoin spot ETF has made this round of halving different, so it is necessary to pay close attention to the trend of ETFs. Recently, the news that Hong Kong Bitcoin and Ethereum spot ETFs will be approved at the end of April is also continuing to ferment.

1. Bullish and bearish, each sticking to his own opinion

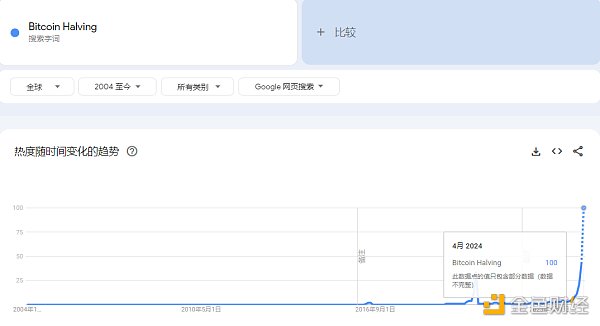

The fourth halving is also the most popular one in history. According to Google Trends data, the search popularity of the keyword "Bitcoin Halving" is constantly setting new historical highs on Google searches.

Due to the approval of the US Bitcoin spot ETF, the types, scope and levels of BTC investors are more complex and diverse than before. With the halving of Bitcoin, investors are most concerned about what the market trend will be in the future.

Multiple parties:

Long before the halving, many institutions gave BTC price predictions. Crypto research institutions PlanB and Glassnode both predict that the price of BTC will rise and exceed $100,000 in 2024. Pantera Capital more specifically predicts that after the entire bull market cycle is over, the price of BTC will reach about $149,000 in 2025.

Other institutional or personal views include:

CZ: Based on the experience of the previous three halving events, the price will not double overnight after the halving. However, within a year after the halving, the price of BTC will hit a record high many times.

Bernstein analyst: Bitcoin's bullish trajectory will resume after the halving and will rise to $150,000 by the end of 2025.

Zhu Su: From a structural point of view, April is bullish, and we are still in the early stages.

Coinbase: Bitcoin halving may have a positive impact on prices, but there is still some speculation.

Anthony Scaramucci, founder of Skybridge Capital: Based on historical data, the price of Bitcoin is expected to reach $170,000 after the halving. Anthony Scaramucci also predicted that in the long run, the price of Bitcoin may reach $400,000, with a possible 10-fold increase in market value and close to half of the market value of gold.

Based on his experience and analysis, the peak of Bitcoin prices will occur about 18 months after the halving event in April. He predicts that the "cycle top" of Bitcoin prices may be equivalent to four times its price at the time of halving.

David Bailey, chief marketing officer of Azteco: Halving is essentially a change in the remuneration of people who handle Bitcoin transactions, reminding people that Bitcoin supply is limited and increased demand may drive its value up.

On the whole, many parties generally predict that the high point of Bitcoin will appear next year, and the highest may reach around $150,000.

Short side:

JP Morgan Chase analyst: BTC is currently in an overbought stage, and the price may not rise after the Bitcoin halving. At the same time, analysts believe that the lack of venture capital funds in the encryption field will also lead to a decline in the value of Bitcoin.

On March 20, the bank issued a report saying that Bitcoin may fall to $42,000 after the halving.

Crypto.com CEO: There may be a significant sell-off during the Bitcoin halving, but in the long run, this event will support the price of BTC.

10x Research: In the past few months, miners have continued to accumulate BTC inventory, which has led to an imbalance between supply and demand and has driven up the price of Bitcoin. However, after the Bitcoin halving, miners may sell $5 billion in BTC. During the period when Bitcoin's trend is in a downturn, the altcoin market may be the first to bear the brunt and face greater downside risks.

CryptoQuant: The effect of Bitcoin halving may not be as expected, because the number of newly issued Bitcoins is less and less than the number of Bitcoins sold by long-term holders, and the growth of investor demand is the key driving force.

From the perspective of the short side, JPMorgan Chase is obviously the biggest judge of the downward trend of Bitcoin halving, and the bank has issued similar bearish views many times.

Holding Square:

Most of these institutions believe that this halving is not enough to cause fluctuations in the Bitcoin market, but there are also views that it will have a significant impact, but they have not clearly expressed their views on the rise and fall.

Deutsche Bank: Bitcoin halving has been partially priced in, and it is unlikely to rebound sharply in the future.

CryptoQuant: The effect of Bitcoin halving may not be as expected. Rather than the impact of halving, it is better to say that the increase in demand from BTC investors who hold a large amount of Bitcoin is the key driver of BTC prices. The current gap between supply and demand is greater than ever before, indicating that even with a halving, the impact on Bitcoin prices may not be as significant as in the past.

DWF Lianchuang: The total market value of the crypto market is rising, but the spot trading volume has dropped significantly. The halving of Bitcoin may bring huge fluctuations to the market.

Bitwise CEO: The Bitcoin halving in April this year may be the most influential in history.

Marathon CEO: The passage of the ETF has promoted the Bitcoin "halving market" in advance, and this halving has little impact on the currency price.

Bitwise: Judging from historical data, the market tends to underestimate the long-term impact of Bitcoin halving.

Second, direct impact of halving: miners

Bitwise: Judging from historical data, the market tends to underestimate the long-term impact of Bitcoin halving.

Second, direct impact of halving: miners

Bitwise: Judging from historical data, the market tends to underestimate the long-term impact of Bitcoin halving.

Core Scientific CEO: Bitcoin "halving" will put some mining companies in trouble and unable to bear some existing orders, so the company may acquire these mining machines.

Bloomberg: This Bitcoin halving will reduce the number of Bitcoins that miners can earn by verifying transactions by half every day, which will have an impact of about 10 billion US dollars on cryptocurrency miners. In addition, the increasing competition for preferential electricity rates among artificial intelligence companies will also lead to a decline in the income of Bitcoin mining companies after the cost surge.

Hut 8 CEO: The halving will have a "different scale" impact on the crypto mining industry, and large mining companies must become low-cost operators to survive after the Bitcoin halving.

hashrateindex.com report: After the Bitcoin halving, old mining machines may be retired, and the estimated computing power will be reduced by 100 EH/s.

Fidelity: Bitcoin halving is coming, and miners need to be prepared. While Bitcoin holders generally expect the four-year reward halving to push up prices, miners must actively develop strategies to plan for the upcoming event to prevent bankruptcy. The report emphasizes that if miners want to make a profit, they must be proactive, not just maintain their position in the network.

Analyst Daniel Gray said that miners must maintain current computing power, energy consumption and infrastructure, and face continued competition from the entire network, all of which are striving to maintain profitability in the same challenges. Gray emphasized that miners must constantly strive to improve computing power efficiency, obtain lower-cost energy from more economical sources, and expand infrastructure to accommodate new machines. However, given the competitive landscape, every miner is competing for the same resources.

Cantor Fitzgerald Report: The upcoming Bitcoin halving event will bring major challenges to the Bitcoin mining industry. BitDeer has the lowest mining cost in the industry, or it may be the biggest beneficiary of Bitcoin halving.

CoinShares: Bitcoin price needs to remain above $40,000 after halving to make most miners profitable.

The 2023 mining report released by CoinShares shows that Bitcoin mining computing power has increased by 104%, raising questions about its environmental sustainability and profitability, especially the efficiency and energy costs of the network; the average production cost of each Bitcoin is expected to be 37,856 US dollars after halving.

Most miners will face the challenge of selling and administrative expenses and need to reduce costs to remain profitable. Unless the price of Bitcoin remains above $40,000, only Bitfarms, Iris, CleanSpark, TeraWulf and Cormint will continue to be profitable.

Market analysts: Bitcoin halving will trigger a battle between mining companies for computing power expansion and mergers. To prepare for this event, large companies are buying newer, more efficient mining machines. But they may also consider swallowing up smaller miners as they look for ways to benefit from the halving while ensuring their survival.

However, there are also reports that the top five Bitcoin miners are not selling Bitcoin in response to the halving. According to a Bitwise report on April 10, the total amount of Bitcoin sold by the top five mining companies fell to about 2,000 in the first quarter of 2024, reaching the lowest level in two years.

Global Bitcoin miners currently hold more than 700,000 Bitcoins, accounting for 3.4% of the total Bitcoin supply. The last time the top five mining companies sold less than 2,000 Bitcoins was in the first quarter of 2022. In contrast, in the fourth quarter of 2023, the top five mining companies sold more than 7,000 Bitcoins.

Among the top five mining companies, Marathon Digital has the most Bitcoin production, with a cost price of $22,249 per coin. It produced more than 2,500 Bitcoins in the first quarter of 2024, but this figure is lower than the more than 4,000 Bitcoins in the fourth quarter of 2023.

JPMorgan Chase: The reduction in halving rewards will have a negative impact on miners' profitability and lead to higher Bitcoin production costs. Analysts further stated that the Bitcoin mining industry may further consolidate, and larger miners will survive.

Summary

Based on the current views of both long and short parties, the mainstream voice in the crypto market is still bullish. From the market news, mining companies have not chosen to sell a large number of Bitcoins due to the halving. The price of BTC has also remained in the range of about 59,600-73,800 US dollars, and there has been no exaggerated correction. However, the altcoins have fallen sharply.

As for the biggest factor affecting the future market of Bitcoin, many institutions including Goldman Sachs, Glassnode, and Coinbase believe that the US Bitcoin spot ETF has changed the supply and demand comparison of BTC. For this reason, investors should focus on the important dynamics of ETFs. The rumor that the Hong Kong Bitcoin spot ETF will be approved at the end of April will be a big positive for BTC.

As for the positive sectors of this halving, some institutions said that the halving will be conducive to the adoption of the second layer such as the Lightning Network; DWF Venture said that the halving may cause the Ordinals transaction volume to grow exponentially, and it may also create a wealth effect for the Runes ecosystem. And the new CEO of Binance also said that in order to welcome the halving, Binance has adjusted the inscription market series of related products and services.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Huang Bo

Huang Bo dailyhodl

dailyhodl Coindesk

Coindesk Nell

Nell Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph