Author: BTC_Chopsticks

A few hours ago, Binance Labs announced its investment in $USUAL, a decentralized stablecoin platform. This is not just an ordinary investment, but a major innovation in the field of stablecoins. Usual, with its unique design, may redefine the future of the stablecoin market.

A new benchmark for decentralized stablecoins

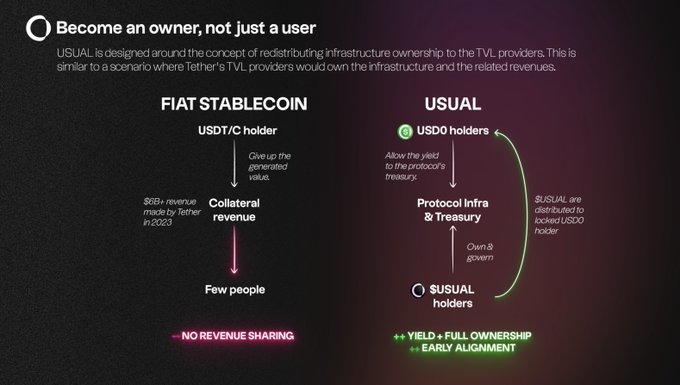

@usualmoney is a decentralized stablecoin issuance platform, whose core product is stablecoin $USD0, pegged to real-world assets (RWA). Compared with traditional stablecoins, the innovation of $USUAL is: 1. User-led governance: Usual gives users more ownership and control through the governance token $USUAL, distributes 90% of the benefits to the community, and promotes fairness and decentralization. 2. De-banking risks: Traditional stablecoins such as USDT and USDC Relying on bank deposits, there is a risk of bank failure similar to SVB. Usual provides guarantees for $USD0 through short-term government bonds to avoid the uncertainty of the traditional banking system. How does $USUAL solve the three major pain points of stablecoins?

1. Users failed to share profits

Tether and Circle in 2023 The $USUAL model returns 90% of revenue to the community through the governance token $USUAL, while providing governance rights and liquidity incentives.

2. RWA growth is out of touch with DeFi

The real world asset (RWA) market is expanding rapidly, but DeFi There are less than 5,000 mainnet holders in the field. $USUAL integrates RWA into its stablecoin ecosystem to enhance user participation and promote the integration of DeFi and RWA.

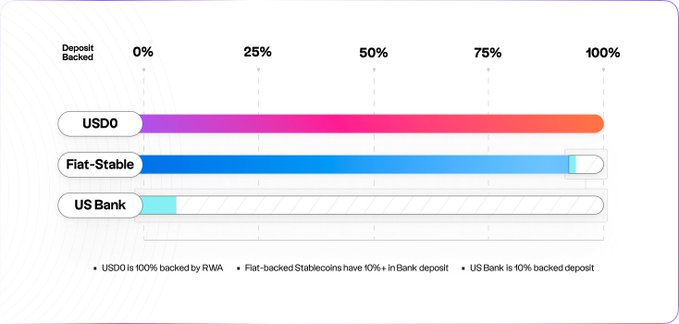

3. Bank risk and stability issues

Fiat-backed stablecoins rely on the bank's partial reserve model and are vulnerable to fluctuations in the banking system. $USUAL's $USD0 stablecoin is fully collateralized by short-term treasury bonds and has a strict risk policy and insurance fund, providing greater stability and security.

$USD0 is a US dollar-pegged stablecoin launched by $USUAL, designed for payments, transactions, and collateral, suitable for retail users and DeFi communities.

Key features of $USD0

Transparency: Reserve assets visible in real time.

Security: Fully backed by U.S. Treasuries, no bank risk.

Composability: Permissionless liquidity integration, suitable for seamless integration with DeFi.

Efficiency: Full collateralization to ensure stability.

The Holy Trinity of Stablecoins: $USUAL’s Revolutionary Model

$USUAL’s decentralized model combines liquidity, yield, and composability to inject new vitality into the stablecoin ecosystem. Binance's investment is not only a recognition of the $USUAL model, but also marks a major turning point in the stablecoin space.

Conclusion:

As the demand for stablecoins continues to grow, $USUAL's innovative model has injected new possibilities into the market. By introducing decentralized governance, short-term treasury bond collateral, and revenue sharing, $USUAL is redefining the future of stablecoins. For users who are looking for security, transparency, and sustainable development in the stablecoin space, $USUAL is undoubtedly a project worth paying attention to.

Alex

Alex