Jessy, Golden Finance

According to the latest announcement from Huobi Exchange, the Heco chain will be officially closed on January 20, 2025. After January 20, deposits and withdrawals on the Heco chain will no longer be accepted.

Previously in November 2023, the cross-chain bridge of the Heco chain was stolen, and virtual currency with a total value of US$8,540 was lost. Since then, the Heco chain has been in a state of suspension for a long time.

In 2024, Huobi gradually opened up the deposit and withdrawal of some mainstream coins on the Heco chain, but the corresponding deposit and withdrawal time of each coin has certain restrictions. Huobi Exchange will regularly stop the deposit and withdrawal of some tokens. If this time window is missed, there will be no channel for the official website to handle assets.

At present, only Huobi Exchange still supports the deposit and withdrawal services of the Heco chain, and even on Huobi, only the Heco chain assets of USDT and HT tokens can be recharged to Huobi normally.

With the change of ownership of Huobi, the Heco chain has long been scattered, and it was not until the theft of the Heco cross-chain bridge that the death knell of the Heco chain was truly sounded.

And on January 20, 2025, the Heco chain officially came to an end.

Heco and HT, which had long been abandoned by Justin Sun

The Heco chain was born in 2020. At that time, DeFi emerged and Huobi decided to build its own public chain. During the bull market in 2021, relying on Huobi, the world's largest exchange, the Heco chain also developed rapidly, and the TVL volume increased significantly. Huobi also launched related ecological funds to support various excellent projects on the Heco chain. At that time, popular ecological projects continued to emerge, attracting many users and developers, and once became one of the popular public chains.

According to DeFiLlama data, at its peak, the TVL of the Heco chain reached 2.8 billion US dollars in 2021. At present, the TVL on the Heco chain is only 1.18 million US dollars.

In 2022, Li Lin sold Huobi to Justin Sun. In 2023, the Heco chain also had a series of scandals and problems, such as the price of its oracle iHash Bridge Oracle (HBO) plummeted, its insurance project Book Finance (BOOK) was involved in an additional issuance scandal, the TokenLink oracle project’s audit report was falsified, and Gainswap’s running away incident, etc. These incidents seriously damaged the reputation and ecology of the HECO chain. By the end of 2023, the cross-chain bridge of the HECO chain was theft, and then it fell into a long-term shutdown. In 2024, the liquidity dilemma of the currencies on its chain was highlighted, the transaction depth was insufficient, and the assets in the hands of investors were difficult to realize.

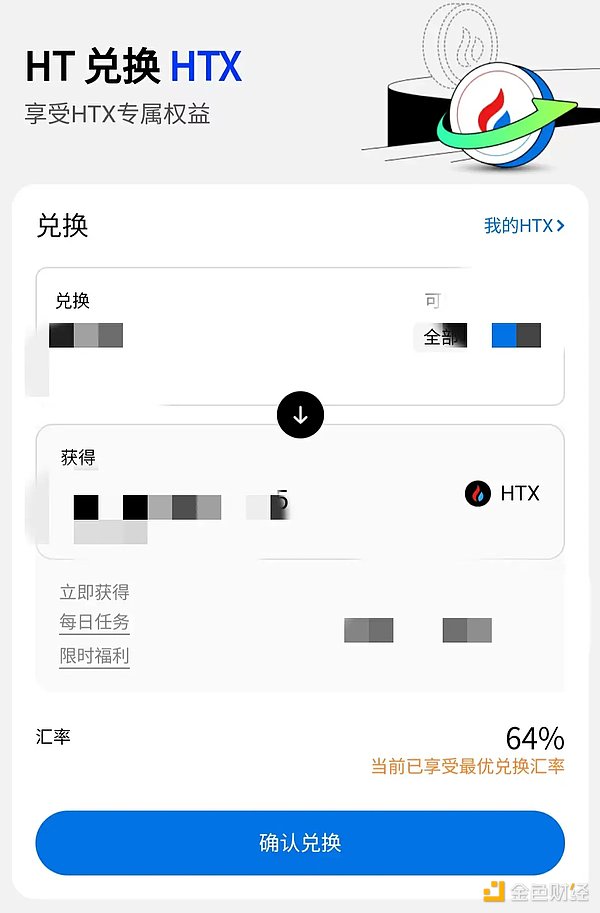

Although Huobi briefly provided charging and withdrawal services for some mainstream tokens on the Heco chain in 2024, the time was short and many users missed it. Huobi’s current boss, Justin Sun, has completely abandoned the Heco chain, and its original platform coin HT has also been abandoned. The new platform coin HTX will be launched in early 2024, and HT users can choose to exchange HT for HTX.

At present, the price of HT has already fallen by more than 90% from the price in the last bull market. For users, it is definitely a wise choice to continue holding assets on the Heco chain.

Except HT and USDT, other Heco chain assets have been invalidated

At present, if there is still HT deposited on the Heco chain, it can be directly withdrawn to the Huobi exchange. Although there is no HT trading pair in the exchange, users can exchange HT for HTX, and the conversion rate is currently 0.64.

Or, after transferring HT to Huobi Exchange, it can be transferred to Gate and other exchanges that have HT trading pairs through the ETH chain for trading. As of press time, the price of HT on Gate Exchange is about 1.3U.

USDT on the Heco chain can still be withdrawn to Huobi Exchange, but if users have other deposited assets, there seems to be no way out.

At present, in various communities, group members can often be seen posting messages related to "recycling Heco chain assets". The Golden Finance reporter randomly contacted a group member who sent the corresponding message.

He told the Golden Finance reporter that he recycled HT at a price of 1U each, and other assets on the Heco chain were also recycled, but the price was much lower than the market price. For example, Huobi no longer accepts Mana assets on the Heco chain. He can only recycle the token at about one-tenth of the price of the token.

At present, HT tokens have no fundamentals and are of no use, but they still have a market value of 200 million US dollars.

The reporter asked the group member who was doing the business of recycling assets on the chain why he wanted to recycle these tokens. His answer was that some people had faith in these coins.

But there is no gain without pain. For a businessman, there is more possibility of profitability. If he recycled HT with 1U, even if he took it to exchanges such as Gate and sold it, according to the current price of 1.3U per unit on its platform, he could earn about 30% profit.

The reporter did not try to trade with him, so there is no way to judge whether this is a scam. There is a possibility of fraud in which the coin is transferred to him but he does not transfer the money. Readers are requested to identify it by themselves.

For users, a more reliable way to handle assets on the Heco chain is through the official website of Huobi. At present, if there are still deposited USDT and HT on the Heco chain, they can be withdrawn to the exchange and then further processed. As for other assets, there is no official processing channel at present, and there is a higher risk of being deceived if you ask a third party to handle it.

Alex

Alex

Alex

Alex Hui Xin

Hui Xin Brian

Brian YouQuan

YouQuan Joy

Joy Brian

Brian YouQuan

YouQuan Hui Xin

Hui Xin YouQuan

YouQuan Joy

Joy