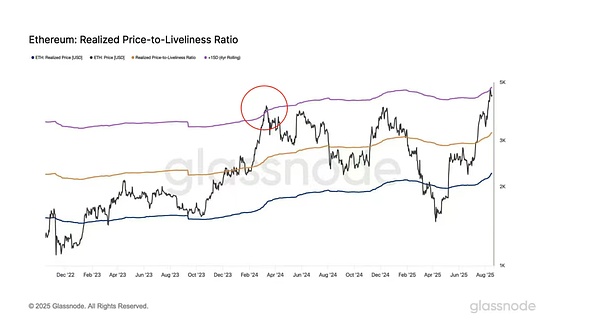

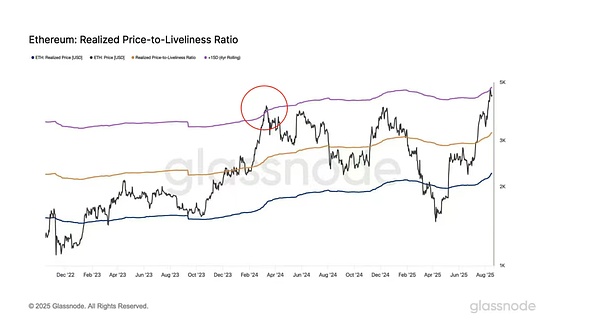

On August 14th, after several unsuccessful attempts to reach its all-time high of $4,870, Ethereum reversed course, initiating its first correction since breaking through $4,000. By August 20th, its price had fallen from its peak of $4,790 to $4,060, a cumulative drop of 15.2%, triggering $1.6 billion in long position liquidations. This unexpected market blow resulted in heavy losses for many optimistic long positions betting on a historic breakout. Many investors lamented that four years ago, long positions on Ethereum were trapped at $4,800, only to be repeated four years later. However, so far, this round of Ethereum's correction is primarily driven by profit-taking. Glassnode data shows that after breaking through $4,700, ETH's price has reached the critical threshold of +1SD active realized price, indicating that the continued rise has significantly deviated from the market's average cost (realized price). Notably, the indicator last hit this level in March 2024, following a significant sell-off in Ethereum. Market profit-taking pressure is particularly evident in the staking data: during the rally from August 3rd ($3,350) to August 14th ($4,790), the number of Ethereum unstaked tokens surged from 410,000 to 916,000. The average cost of these tokens (the staking cost) was only $2,800, indicating that a large number of early low-stake holders were cashing out at the high point.

Note: Realized price: The weighted average of the last transfer price of Ethereum. +1SD Active Realized Price: The four-year rolling average of the ratio of realized price to activity plus one standard deviation. Although Ethereum is facing significant profit-taking pressure in the short term, its upward trend has yet to show any signs of reversal. Firstly, historical experience shows that the end of a strong run in any asset is often accompanied by capital diversion and the spread of hot spots. However, Ethereum's exchange rate against major currencies remains strong—for example, ETH/BTC remains firmly above its 5-day moving average, and its contracts' dominance in the market is further strengthening. As of August 22nd, the proportion of Ethereum contract transactions had climbed to 67%, demonstrating that Ethereum remains a key battleground for capital. Secondly, in the global capital market, core asset valuations are generally showing signs of a bubble, with premiums for high-growth assets continuing to climb. For example, the S&P 500's current price-to-earnings ratio has risen to 29.51, placing it in the upper 89th percentile of the past decade. Its price-to-book ratio is a staggering 5.3, even exceeding the peak reached during the dot-com bubble in 2000. Meanwhile, the average price-to-earnings ratio of the "AI Seven" (AI7), considered to possess high growth potential, has reached 37, significantly higher than the overall valuation of the S&P 500, reflecting the market's strong appetite for scarce growth. More notably, the STAR Market 50 Index, currently experiencing a bull market, has seen its overall price-to-earnings ratio soar to 164 times, reflecting highly optimistic market expectations for the future growth of emerging tech companies. In the blockchain sector, Ethereum's systemic importance rivals that of the "Big Seven" in AI, and its growth path is even more certain. Driven by the compliance benefits of the GENIUS Act and the innovative "Project Crypto" initiative, Ethereum has entered a phase of high growth driven by strong expectations. Its valuation is expected to evolve in line with the premium expansion logic of growth assets, driven by both policy and ecosystem factors, leading to further revaluation. In short, after a brief correction, Ethereum still has the potential to reach new all-time highs. With demand for convertible bonds and preferred stock gradually waning, MicroStrategy (MSTR) was forced to abandon its previous commitment not to issue additional common stock unless its market capitalization is less than 2.5 times its Bitcoin net asset value (NAV). This move led to a sharp decline in its stock price and sparked widespread market concerns about the sustainability of the Digital Asset Treasury (DAT) business model. While MSTR's recent decline is undoubtedly closely related to its deteriorating capital structure, increased leverage is not the root cause. Almost all Bitcoin treasury companies face a common challenge: their cash flow relies overwhelmingly on external financing rather than operating income. More importantly, their core asset, Bitcoin, does not generate cash flow itself and is therefore considered a non-productive asset. Once the financing environment tightens and fundraising activities are hindered, companies will be forced to sell Bitcoin to maintain operations and pay debt interest, thus entering a negative cycle of asset sales, declining net worth, and weakening confidence. In other words, if Bitcoin Treasury companies are unable to secure new external financing, their net asset value per Bitcoin (NAV) will gradually decline, and so will their stock price. In contrast, Ethereum Treasury companies' business models are more sustainable. Currently, Ethereum PoS staking offers an annualized return of approximately 4%, while some lending protocols (such as AAVE) offer yields of 5%-7%, and some major stablecoin protocols (such as Ethena) even offer yields exceeding 10%. Therefore, even with the most conservative asset allocation strategy—such as directly staking Ethereum—treasuries can achieve a return close to the benchmark of 30-year US Treasury bonds, providing endogenous cash flow support for operations without relying on ongoing financing. Historically, the S&P 500's annualized corporate earnings return over the past 100 years (1923-2023) has been approximately 5.5%. Ethereum, through risk-free staking alone, has already approached this level, demonstrating that Ethereum Treasury companies' earnings prospects remain considerable. In the past, the Ethereum community has repeatedly suggested that the Ethereum Foundation adopt this model to generate cash flow, thereby avoiding the direct sale of Ethereum assets. However, these proposals were opposed by Vitalik Buterin, primarily arguing that the Foundation should avoid the potential conflicts of interest associated with direct participation in network validation. The entry of the Ethereum Treasury now provides validation for the feasibility of this development model. When investing in Bitmine, Wood mentioned that investing in an Ethereum Treasury offered advantages over crypto ETFs: Under Section 40 of the US Internal Revenue Code, funds gaining exposure through crypto ETFs inevitably face complex tax treatment, multiple layers of management fees, and potential tax risks associated with "bad income." Of particular note, if the gross profit of a fund's investment exceeds 10% of its total annual profits, the fund could lose its tax benefits, be forced to close, and even face significant fines. In other words, US fund managers facing fewer compliance obstacles and tax pressures when investing in an Ethereum Treasury than in a crypto ETF would. In summary, given their high returns, cost-effectiveness, and inherent compliance advantages, the market share of Ethereum treasury companies still has significant room for growth. As market awareness deepens, those Ethereum treasury companies with net asset premiums approaching zero will gradually demonstrate unique investment value.

Anais

Anais