Source: Vernacular Blockchain

This year is the half-year reduction of Bitcoin in the four-year cycle of the crypto market, but most people do not seem to be very happy, and some people may be in a state of loss. People who are used to "carving a boat to find a sword" find that this round of bull market is obviously "not in line with expectations". With the ups and downs of the market and even the downturn, some people began to feel a sense of frustration like "waiting for the rabbit by the tree", and they were restless about the question of "Is the bull still there?"

01 Why is this round of bull market so different

In the past 10 years, the crypto market has had a total of four bull-bear cycle rotations, including the current round of market. This round of bull market seems to be very different from the previous bull market. People who have experienced the first three rounds of bull market should not find it difficult to find clues after careful analysis:

1) Similarities and differences between the first three rounds of bull and bear cycles

a. Similarities

Bitcoin will always be the narrative and consensus of "digital gold";

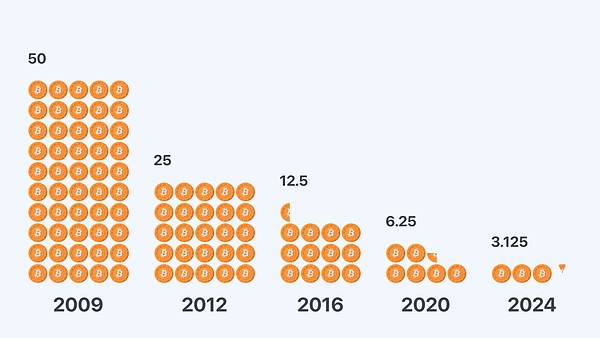

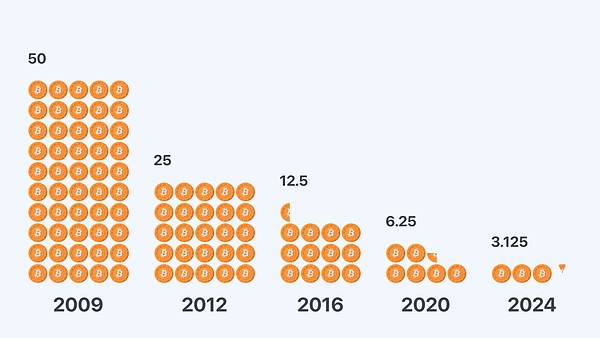

Bitcoin halving has always been the fuse and catalyst of the big market, and the bull and bear cycles are highly consistent with the Bitcoin halving cycle;

The big bull market has a balanced rotation of sectors, and almost all projects can have a good market, and many people make money.

b. Differences

The main narratives are different: decentralized applications such as digital gold, smart contracts, DeFi, and GameFi have exploded;

As time goes by, there are more new narratives, more institutions, and the infrastructure has been gradually improved;

The volume of encrypted assets is getting bigger and bigger, and the volatility of Bitcoin is gradually decreasing.

2) Obvious anomalies in this round of bull market

In addition to the expected changes that as the industry matures, there are more narratives, more institutions, and more complete infrastructure, we have found obvious anomalies such as "no mutual takeover", "almost no sector rotation", and Meme flying all the way. Even Ethereum, the protagonist of the past bull market, is "not doing well"...

In fact, the incomprehensible changes in this round include "no mutual takeover", "almost no sector rotation", and Meme flying all the way. This is because the substantial participation of institutional capital has changed the grassroots gameplay of the past encryption industry. The influence of capital is getting bigger and bigger. With the listing of Bitcoin spot ETF, capital has accelerated inflow, which makes the old leeks a little uncomfortable.At a loss for a while, it is better to play a fairer Meme by yourself than to expect the takeover institution to lead the project. In addition, institutional funds are more rational and prefer new narratives such as Bitcoin, AI, and DePIN. This has led to the fact that old narratives and old projects that no one has paid attention to have become unpopular.

Institutions have more and more say, and it is difficult for retail investors to influence the market. With so many narratives, institutions may not necessarily reach a consensus, and there are even factions between different institutions. The Chinese region is engaged in the Bitcoin ecosystem, while the Western region is developing AI and DePIN. As for Ethereum, it was definitely the most dazzling star besides Bitcoin in the first two rounds of bull markets, but now it is a bit cold. Part of the reason is the diversion of new narratives that are not Ethereum itself, and the other part is the preference of new funds for Bitcoin, which has led to Ethereum's current embarrassing situation. Of course, in this special situation, Ethereum may also be underestimated. Whether it can be valued in the future, we will wait and see. In fact, the impact of Bitcoin's halving every four years on the crypto market is declining in a step-by-step manner, and the direct cause of each round of bull market comes from external factors and new narratives, rather than simply repeating history. Whether this round of bull market is still going to last depends on the external and internal factors that will affect this round of bull market in the future...

02 The external and internal factors that will really affect this round of bull market in the future

1) External factors: Mainstream crypto assets cater to the rhythm of the external environment

In recent years, it is not difficult to find that Bitcoin and crypto assets are increasingly affected by the external environment, of which the most influential is the relevant policies of the Federal Reserve. Behind every high and low market, it is almost always because of the main external factors such as the environment.

The Fed's interest rate hike will cause a large amount of global funds to flow back to the United States, leading to an increase in the US dollar and a drop in the prices of commodities, precious metals, and foreign exchange markets denominated in US dollars. On the contrary, when the Fed cuts interest rates, the US dollar exchange rate falls, which is conducive to improving the performance of commodity prices. After the Fed's rate hike, interest rates and exchange rates fell, and the liquidity of the US dollar gradually recovered, bringing momentum for the market to rebound. Due to the international status of the US dollar, the global economy will be affected accordingly.

Bitcoin denominated in US dollars has gradually entered the mainstream asset category from the original small circle of encryption. Now Bitcoin is no longer a niche digital asset that can be promoted by a group of enthusiasts in the "grassroots" period. The increasingly mainstream Bitcoin will change more due to the rhythm of the Fed's rate hikes and rate cuts.

2) Internal factors: New narratives are the real bull market engine

In fact, the reason why each round of bull market can be accompanied by halving is that Bitcoin halving is a very good opportunity in the encryption industry. Before and after halving, the encryption community often has frequent activities due to strong expectations. Institutions and innovative developers follow the halving cycle to layout and resonate with the community to achieve twice the result with half the effort.

At the same time, the active encryption industry and the rise of the encryption asset market are constantly attracting more new builders during this period. In fact, the reason why more and more people have been able to come together to conduct "large-scale human society" experiments like Bitcoin is because of consensus, and consensus needs a main narrative to support it, such as "digital gold", just like the past few rounds of crypto bull markets have been supported by new narratives.

Behind the new narrative are the new "bright spots" of blockchain and Web3 and more and more solutions explored and discovered by KOLs, innovative entrepreneurs in the crypto community. They not only solve the problem of high cost and low efficiency of blockchain, but also solve the landing problem of crypto applications like DeFi and GameFi, bringing funds and a steady stream of new users to the entire crypto industry. Of course, innovation will not stagnate. More and more new narratives are being proposed to empower the crypto industry, bringing stronger momentum, becoming the source of the intrinsic value of the crypto industry, and driving the market higher.

03 Is the bull still there?

First of all, we still need to have a correct mindset. It doesn’t really matter whether there is a bull market or a bear market, because people lose money in both bull and bear markets. In a bull market, because of various slogans and exciting narratives, it is easier for people to rush in on impulse, and end up stuck at the top of the mountain, with even greater losses. For more people, a bull market is the beginning of losing money.

In addition, "stop predicting" is indeed a mature attitude in investment. Mature investors usually focus on fundamental analysis, asset allocation, risk management, and long-term investment planning, rather than trying to find short-term profit opportunities in every market fluctuation.They understand the uncertainty and volatility of the market and accept this uncertainty, so they are more inclined to adopt a steady, long-term investment approach.

Both the internal and external factors of this round of market conditions tell us that there is a high probability that there will be follow-up.At present, it is impossible for the printing presses of countries around the world to stop for a long time. Once the gears of the printing presses are turning, crypto assets, led by Bitcoin, will always be an important part of many asset allocation portfolios. In the future of AI, Web3, and the metaverse, crypto assets will definitely stand at the center of the stage.

04 Summary

The crypto industry is changing every day, and we must look at it from a development perspective. The future market is difficult to predict, because the macro environment has extremely high uncertainty in the short term, so there is no need to be too keen on "prediction". What we can do is to keep an eye on new things, grasp the development trend of the industry and find new dividends. Perhaps temporary fluctuations will make people feel confused and anxious, but if the timeline is extended, the future of encryption is still clearly visible.

Cheng Yuan

Cheng Yuan