Author: Onkar Singh Source: cointelegraph Translation: Shan Ouba, Golden Finance

The role of halving events in Bitcoin's scarcity mechanism and inflation control

A key component of Bitcoin's design is its regular halving, which ensures the scarcity of the cryptocurrency and acts as a buffer against inflationary pressures.

Bitcoin halvings are programmed into the Bitcoin code and occur approximately every four years. With each halving event, the block reward is halved, and the supply of new Bitcoins (BTC) is directly affected.

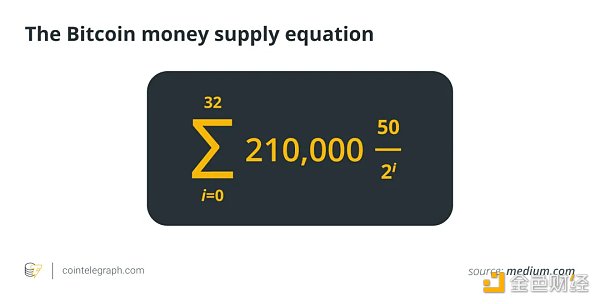

In addition, halvings steadily reduce the rate at which new Bitcoins enter the market, thereby exacerbating Bitcoin's inherent scarcity. Its predictable and finite supply, capped at 21 million, supports Bitcoin's long-term value proposition. Halving also reduces inflation by gradually reducing the supply of new Bitcoins. This predictable inflation control mechanism makes Bitcoin an ideal alternative to traditional fiat currencies, which are susceptible to unpredictable inflation. Bitcoin Money Supply Equation The Bitcoin Money Supply Equation formula provides a theoretical maximum supply. In reality, some early mined Bitcoins may be lost, causing the circulating supply to drop slightly.

The Bitcoin money supply equation is shown below:

In the above formula, Σ (Sigma) refers to the sum of Bitcoin block rewards in all halving cycles.

i: The index variable representing each halving cycle.

0: The starting point of the sum represents the first (genesis) block.

i=0^32: This defines the range of the sum.

^32: The upper limit of the sum, indicating the 32nd halving cycle. Since counting starts at 0, there are a total of 33 halving cycles included (0 to 32).

50: This is the initial block reward for the genesis block (50 BTC).

(1/2)^(i/210000)): This represents the block reward per halving cycle.

(1/2): This represents the halving factor, where each reward is divided by two at each halving event. That's why it's -1 (1/2 is equivalent to 2 to -1).

(i/210000): This exponent represents the number of halving cycles that have occurred. As "i" increases with each cycle (from 0 to 32), the exponential ensures that the reward halves at appropriate intervals (approximately every four years).

The Math Behind Bitcoin Halvings

Some core concepts such as block rewards, halving equations, and exponential decay form the mathematical basis of Bitcoin halvings.

Bitcoin halving mathematics is an interesting example of how code can enforce economic principles. The idea focuses on the block reward, which is the number of newly produced BTC that miners receive for successfully validating transactions and adding new blocks to the blockchain. In Bitcoin's design, this block reward was initially set at 50 BTC and halves approximately every four years.

A simple yet powerful equation governs this reduction:

Block Reward: 50 / 2^(blocks / 210,000), where "blocks" is the total number of blocks mined since Bitcoin's inception.

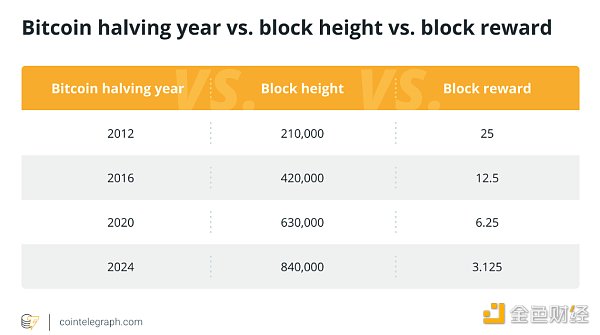

The exponential nature of this equation is what makes it magical. For every 210,000 blocks added to the blockchain, the block reward decreases exponentially. Accordingly, the reward drops to 25 BTC after the first halving, 12.5 BTC after the second halving, and so on. This procedural deterioration replicates the increasing complexity of precious metal mining, where resource extraction becomes more expensive and complex over time.

The Bitcoin halving mechanism has significant consequences. It introduces inherent scarcity by gradually reducing the rate at which new Bitcoins enter circulation. In addition, Bitcoin's potential as a store of wealth is enhanced by its limited supply and predictability.

How to Calculate the Approximate Time Between Bitcoin Halving Events

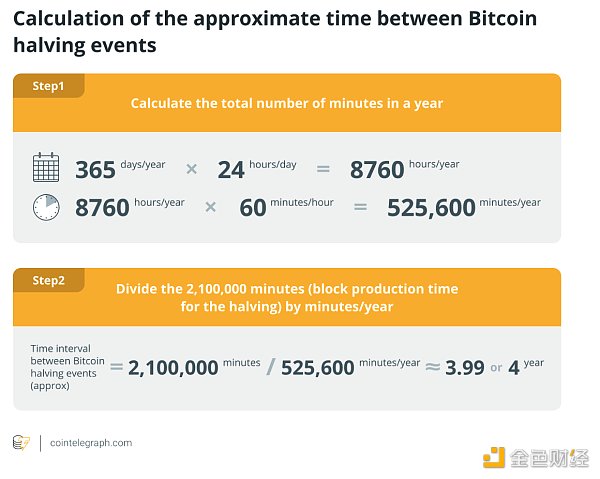

The exact timing of a Bitcoin halving cannot be predicted precisely, but it can be roughly estimated.

Bitcoin's code is designed to generate a block every 10 minutes. Since the halving occurs every 210,000 blocks (not after a specified time or date), the following basic calculation can provide a first estimate: 210,000 blocks * 10 minutes/block = 2,100,000 minutes.

Divide the total number of minutes by the number of minutes in a year to get a number in years: 2,100,000 minutes / (365 days in a year * 24 hours a day * 60 minutes an hour) = approximately four years.

In reality, the interval between halvings may vary from the four-year average because the production rate of blocks is not precisely fixed to 10 minutes. Changes in the network's overall hash rate (computing power) can also cause the process to speed up or slow down slightly.

Potential Impact of Bitcoin Halving on Cryptocurrency Adoption

Anticipation of the halving event could increase demand for Bitcoin, potentially attracting new investors and increasing its popularity.

The cryptocurrency community may feel a sense of urgency and anticipation in response to the halving. This increased attention tends to lead to increased demand for Bitcoin and possible price volatility around the halving event.

Such market activity may stimulate interest in Bitcoin and cryptocurrencies and increase public awareness of them, which may lead to increased adoption. Although the direct impact of the halving on price is speculative, Bitcoin's overall value proposition is strengthened in the evolving landscape of digital assets as it highlights its unique economic design.

In addition, the emphasis on limited supply, controlled inflation, and scarcity enhances Bitcoin's appeal as a competitive alternative to fiat currencies and other cryptocurrencies, potentially attracting a wider range of individual and institutional investors.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Huang Bo

Huang Bo JinseFinance

JinseFinance MarsBit

MarsBit Finbold

Finbold Others

Others Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph