Author: Chris Powers, Crypto Analyst; Translation: Golden Finance xiaozou

A historic Senate vote will push Crypto from the monetary era to the financial era

This Monday, the Senate passed the GENIUS Act with a procedural vote of 66 to 32 to end the debate. The bill aims to regulate the issuance and circulation of stablecoins in the United States. Although the bill still needs to be passed by the House of Representatives and signed by President Trump, it is the most difficult to overcome the Senate (because it needs Democratic support to reach the 60-vote threshold). With the obstacles cleared, the GENIUS Act is about to become the first cryptocurrency legislation passed by Congress.

Ironically, this first crypto legislation actually embeds fiat currency into the fabric of the blockchain. This is a far cry from the early crypto world's vision of viewing fiat currency as an enemy and pursuing the separation of currency and the state. What American politicians are discussing now is how blockchain can consolidate the hegemony of the US dollar.

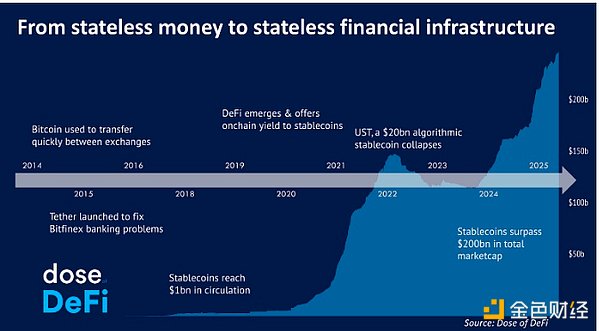

How did we get here? Where will we go? With stablecoins about to be written into law, cryptocurrencies are moving from the fantasy of anarchist currencies to their true destination: borderless financial infrastructure.

1. Blockchain, not Bitcoin

At the beginning of the rise of Bitcoin and crypto technology, Wall Street elites generally held an attitude: they were more interested in Bitcoin's underlying technology (blockchain) than Bitcoin itself. Some people started so-called "enterprise-level blockchains", while others completely abandoned the blockchain label and claimed to be building "distributed ledger technology".

None of these attempts succeeded in attracting users, and they were generally ridiculed by the crypto industry (not just Bitcoin believers) because they were neither permissionless nor decentralized. Wall Street elites believed that volatile currencies could not become the cornerstone of the new financial system - and eventually we in the crypto community also realized this. As we pointed out in our (my favorite) February 2020 issue of Dose of DeFi:

The classic scenario is a Bitcoin believer (usually an American male) preaching to an inflation-ravaged country, preaching the gospel of Bitcoin’s fixed supply. He speaks from the comfort of his Twitter account, claiming that Bitcoin is the solution to the woes of the developing world—if only people would appreciate hard money and Austrian economics.

To date, Bitcoin has never been the savior of any economy. Its censorship-resistant P2P payments have indeed provided a lifeline for individuals in repressive regimes, but inflation-ridden countries such as Venezuela and Zimbabwe have not adopted it on a large scale.

We thought they needed Bitcoin, but maybe what they really wanted was just dollars?

In the end, ideological battles gave way to market demand. The practical value of a dollar stablecoin on the blockchain has proven to be the pragmatic path to universal adoption.

2. The Growth of Crypto

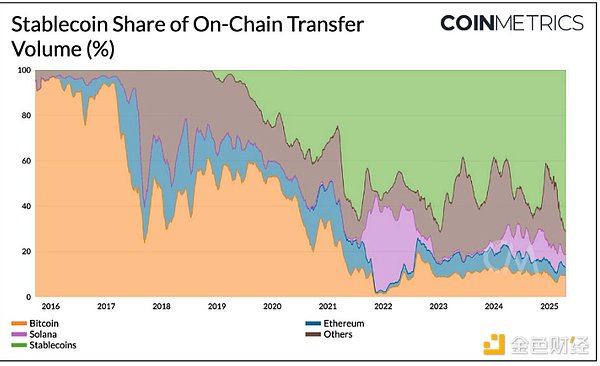

At this point, the youthful fantasy of cryptocurrency overthrowing the monetary order seems to have faded (temporarily), replaced by a clear understanding of its nature as financial infrastructure. Early Bitcoin believers were obsessed with creating monetary attributes, but in the end no one bought it (except El Salvador). It turns out that people have little interest in new currencies and are more interested in using these new blockchains to transfer dollars efficiently and quickly.

This was particularly evident in the process of Bitcoin professionalization after the 2013 bubble. Initially, Bitcoin itself assumed this function: users could transfer money between exchanges that supported BTC, bypassing the cumbersome bank wire transfer system. Then Tether (USDT) appeared, eliminating the exchange rate risk of using Bitcoin as a bridge asset - when you just want to transfer value, why bear the price fluctuations of Bitcoin?

After the ICO bubble in 2017 gave rise to a large number of on-chain assets and ERC-20 tokens, emerging DeFi trading and lending protocols added a new layer of legitimacy to the blockchain (as a truly useful financial pipeline). People soon discovered that the most popular product in the crypto world - leveraged positions - can only be achieved through stablecoin lending. These DeFi lending platforms created on-chain returns for stablecoins for the first time, expanding their audience from traders to all people who want to save in US dollars, especially those outside the traditional US financial system.

3. The epiphany of stablecoins

It must be emphasized that this is by no means a grand plan of the US government. No one instructed Bitfinex to use US dollar stablecoins to solve banking problems; when Justin Sun used US dollar stablecoins in emerging market gambling applications, he was not following a State Department memorandum; and no one from the Treasury Department asked Uniswap to upgrade to version v2 to allow all assets to be paired with stablecoins (not just ETH). This is pure market demand. Blockchain has proven to be an efficient financial track, and letting the US dollar, the world's reserve currency, circulate on it has doubled its utility.

This market-driven attraction to the dollar stablecoin finally alarmed lawmakers. Although discussions of crypto regulation often swing between over-intervention and laissez-faire, the stablecoin bill was able to pass the test successfully, thanks to the unexpected support of traditional crypto advocates such as Senator Mark Warner (D-Virginia):

"The stablecoin market is nearly $250 billion, and the United States can no longer sit idly by. We need clear rules to protect consumers, defend national security, and support responsible innovation. The GENIUS Act is an important step forward."

To sum up: The grand experiment of cryptocurrency as a new type of currency has basically failed. But what about as financial infrastructure? It has found a foothold - ironically, by tying it to the dollar it once wanted to replace. The explosive growth of stablecoins has forced legislation, but this bill is not intended to kill stablecoins. Instead, it is to give them a new name, bringing this product that once roamed in hidden corners into the brightly lit compliance square of Wall Street and the carefully manicured walled garden of Silicon Valley.

4. US Stablecoins: A New Artery of Financial Infrastructure

Back to the GENIUS Act, this is not only about regulating a niche crypto asset, but also a foundation project for rebuilding the US financial infrastructure with stablecoins as the core. Although existing stablecoins face short-term competitive pressure, their long-term impact will penetrate into all aspects of payment methods and even banking business structure.

(1) Payment Revolution and Stripe Testing Field

The most direct impact will be reflected in the payment field. Online payment giant Stripe has launched a stablecoin financial account supporting USDC for global corporate users; its acquisition of stablecoin infrastructure company Bridge can achieve a smooth DeFi access experience. Visa and MasterCard have also entered the market, allowing consumers to consume stablecoin balances through existing card networks by cooperating with card issuers and wallet service providers.

(2) Bank disintermediation and the rise of "narrow banks"

This is the really interesting (and disturbing for traditional banks) part. If businesses and digital native users prefer to hold and transfer US dollars with stablecoins, where will bank deposits go? The model of traditional banks relying on deposits for lending will be challenged - when a large amount of deposits flow into digital wallets on platforms such as Coinbase, the intermediary role of banks will be undermined.

In fact, banks have begun to be marginalized in the lending field. Although they still dominate small and medium-sized enterprise loans and mortgages, professional mortgage institutions are often responsible for lending, and then large banks provide funds. In the future, these lenders may work with investment funds that specialize in evaluating mortgages to form a "loan origination + investment" separation model - essentially the same as the current hot corporate bond and private credit markets. Stablecoins are accelerating what economists call the "narrow banking" trend: financial institutions absorb deposits and invest mainly in safe assets such as government bonds instead of issuing loans.

However, this future may still take some time, as bank lobbying groups successfully included a clause in the GENIUS Act that prohibits interest-bearing stablecoins. Although aimed at controlling risks, the pursuit of returns is unstoppable. Interest may still "leak" to less regulated non-US platforms through phenomena such as Aave's interest rate soaring due to Ethena USDe's recycling strategy, such as innovative products such as Sky Savings Rate. If these external platforms reach scale, they may bring new systemic risks to the US financial system, forcing regulators to catch up with the development of stablecoins again.

(3) New opportunities in DeFi

If banks are no longer the main source of credit, where will mortgages and small business loans come from? The answer may be DeFi. We expect DeFi to make this evolving credit system more transparent and efficient - in the future, your mortgage may not be issued by a bank, but by a DeFi protocol supported by a global stablecoin liquidity pool. Interest-bearing stablecoins such as BlackRock's BUIDL Fund and Ondo Finance's OUSG have already taken shape, providing institutional investors with compliant channels for traditional asset returns. Can a similar model be adapted to mass credit? This may create a more active (but riskier) credit ecosystem. A new order that reduces bank credit intermediation may be better, but it needs to be implemented with caution.

5. Stablecoins outside the United States: the new hegemony of the US dollar

Although the direct impact of the bill is limited to the United States, it has sown the seeds for the transformation of the global role of the US dollar. Ironically, the largest dollar stablecoin Tether is not registered in the United States. Although Tether complies with U.S. anti-money laundering regulations, its founding team has always been wary of the U.S. market.

While U.S. politicians focus on their own citizens, the GENIUS Act has a greater impact on the rest of the world. For the United States, the legalization of stablecoins will change the structure of the credit market; for other countries, this will directly challenge the monopoly of their own currencies - this is not only a financial issue, but also a matter of monetary sovereignty.

(1) Fiat currency: a repeat of the fate of local newspapers?

This trend of the collapse of local monopolies reminds us of Ben Thompson's media aggregation theory, except that this time the protagonist has been replaced by currency. When the Internet destroyed the cost of news distribution, most local newspapers died, while giants such as The New York Times went global - the Internet rewards the largest and most trusted brands.

The same plot is about to be played out in the fiat currency field. People in countries with unstable economies or financial controls will prefer USD stablecoins because of their stability and global liquidity. Although governments will instinctively impose restrictions to maintain monetary sovereignty, they may not be able to do so in the face of network effects.

(2) Trump variable

The key premise of the successful narrative of USD stablecoins is that the United States wants to maintain its status as a global reserve currency and that dollarization is beneficial to the American people. However, the Trump administration is promoting global de-dollarization through the "Mar-a-Lago Agreement", and its true intentions are still unclear.

Look at the recent surge in U.S. Treasury yields - the Trump administration's remarks have scared off foreign investors. The decline in global demand for dollars and Treasury bonds has not only increased the fiscal pressure on the U.S. government, but has also directly pushed up the mortgage and car loan interest rates of ordinary people. As the crypto world is busy building a global channel for USD stablecoins, we have to ask: Is this really what the United States wants? The GENIUS Act is ostensibly about stablecoin regulation, but it has unexpectedly sparked a major domestic discussion about the future role of the U.S. dollar.

6. Borderless Currency vs. Borderless Financial Facilities

Although Crypto is turning to stablecoins and borderless financial facilities, the dream of monetary sovereignty will never die.

Bitcoin has realized the vision of borderless currency, setting a new high this week, and it still has a long way to go as digital gold (even if it fails to overthrow the dictatorship). Other forms of borderless currency may emerge - Ethereum has also reached this level to some extent because it is the infrastructure for many stablecoins and real-world assets (RWA). Solana may follow, but all crypto assets that achieve borderless currency status need to obtain currency premiums through fee income (fashionably called REV) and the collective belief of currency holders in the future of the network - see, this is very similar to the essence of Powell's call for the U.S. dollar.

However, after the passage of the GENIUS Act, we can see more clearly that borderless currencies must compete with "national currencies" running on blockchains in the future. The latter will rely on existing network effects to compete for hegemony in the era of borderless financial infrastructure.

Alex

Alex

Alex

Alex Catherine

Catherine Anais

Anais Weatherly

Weatherly Alex

Alex Catherine

Catherine Miyuki

Miyuki Kikyo

Kikyo Weiliang

Weiliang Weatherly

Weatherly