Compared to the separatism of the vassal states of Ethereum, Solana's ecosystem is smaller in scale but more dynamic. After the collapse of FTX, Solana relied on high performance, strong marketing and various hardware products to successfully regain popularity again.

Specifically, high performance refers to the upgrade of Firedancer, strong marketing is the Meme season, and hardware is various Web3 mobile phones, but these are not enough. PayFi proposed by Lily Liu, chairman of the Solana Foundation, has also become a hot topic. Although the hot topics in July are a bit outdated in October, in the long run, the entire Web3 industry has shifted to off-chain and real consumption scenarios.

“Once upon a time, you owned me and I owned you.”

This article is not a song for Solana, but a song for exploring a way out for Web3.

The frustration of crypto wallets: the forerunner of PayFi

Before giving Lily Liu’s definition of PayFi, let’s talk about Web3 wallets. From 2022 to 2023, with the traffic anxiety of smart contract wallets, account abstraction (AA) and exchanges, a number of Web3 wallets ushered in the second peak after the 2017-2021 Tugou era.

From the perspective of the exchange, the wallet is the main entrance for people to interact with the chain. The subsequent traffic will flow in and out from there, and it may even replace CEX. Secondly, with the increasingly fierce competition in Ethereum L2, wallets in the multi-chain era must be the main battlefield for aggregating liquidity.

However, the wallet ecosystem in 2024 is not eye-catching. OKX's built-in Web3 wallet is already a leader, but in most cases it has not become an independent product. One of the important reasons is that the Web3 wallet has only traffic but no closed-loop transaction mechanism, that is, the wallet cannot solve the profit problem. If a handling fee is charged, users will directly open the desktop product. Why not pay one less handling fee?

From a more "path-dependent" perspective, the problem with crypto wallets is the excessive pursuit of transaction features. Please note that this does not conflict with the above-mentioned profit problem. The core product feature of crypto wallets is to provide users with richer on-chain transaction feature support, from access to more chains to dApp recommendation mechanisms with more competitive ranking features.

And the user's funds are not placed in the crypto wallet like Alipay. The non-custodial mechanism can buy peace of mind, but it cannot exchange for the user's sincerity. In a word, crypto wallets and Web2 wallets have nothing to do with each other. They neither manage money nor finance.

All these factors make it even more difficult for crypto wallets to establish their own closed-loop payment systems like PayPal, WeChat, and Alipay. From a broader business perspective, Web3 wallets only have users, but no support from merchants. If dApps are considered merchants, then there are only a small number of merchants on the chain.

However, wallets do have a lot of traffic, and DeFi's gains or losses on the chain can indeed be converted into off-chain consumption, but losses are also possible, because it depends on whether it is ETH-based, stablecoin-based, or fiat-based.

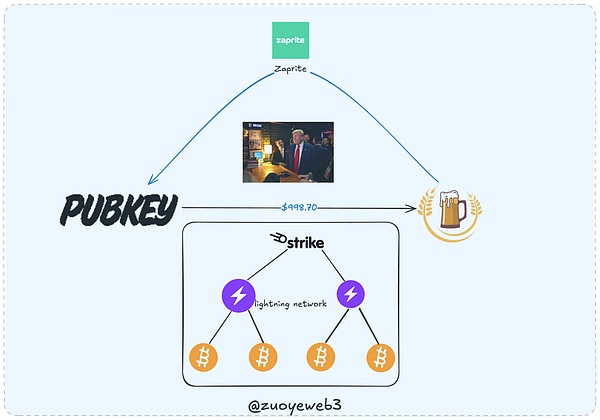

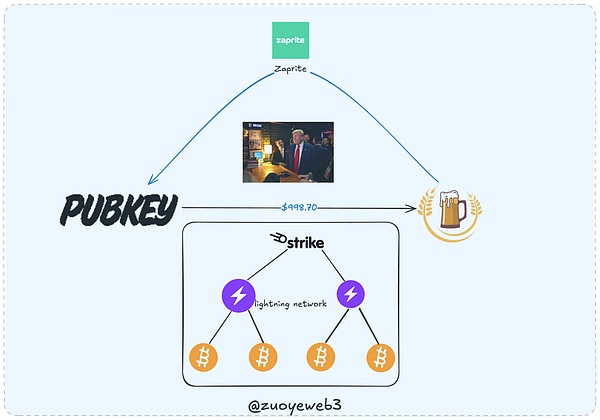

A normal Payment requires support from both the merchant and user sides, but this is precisely the current shortcoming of the industry. Let us take the top male entrepreneur Chuan Bao to illustrate this problem. On September 19, 2024, Chuan Bao visited the PubKey bar in New York and bought beer for only 998 to entertain his supporters. Chuan Bao used Strike to initiate payment, and the merchant used Zaprite to collect payment.

In this case, the merchant and Chuanbao did not use the same payment system, which was hard to imagine in the Web2 era. It is equivalent to Chuanbao paying with Alipay and the merchant receiving payment with WeChat. But in Web3, it makes sense because both parties use the Bitcoin network as the settlement layer. Let's sort out the workflow:

Chuanbao uses Strike to initiate a payment request, Strike calls the Lightning Network to start the payment process, and the Lightning Network initiates the transaction after confirmation by the Bitcoin network;

Merchant PubKey uses Zaprite to collect payment, Zaprite uses Lightning Network to confirm payment status, and Lightning Network ends the transaction after confirmation by Bitcoin Network.

In this process, Zaprite only has a subscription fee of $25. In addition, merchants only need to deduct the miner processing fee, and the rest is their own income. We can compare it. Visa/MasterCard/AE etc. require a handling fee of about 1.95%-2%, while the Bitcoin miner processing fee has an average price of about $1.46 recently, and accepting Bitcoin does not require any handling fee at all.

We continue to extend this, Web2 Payments is generally similar in logic to Chuanbao buying beer, but there are quite a few intermediate links, which is also the drawback of Web2, and opportunities for Web3 Payments and PayFi are also hidden in it.

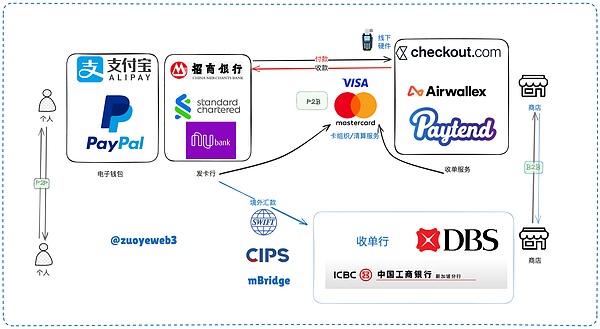

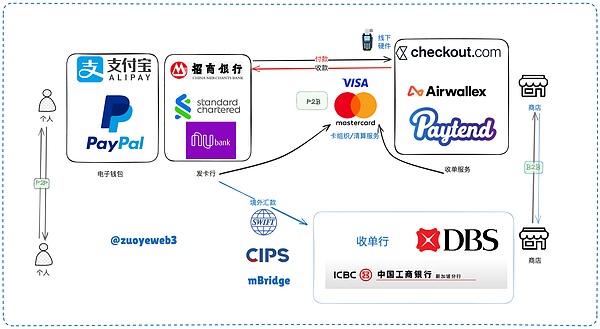

Conduct a concept and product replacement, the products we usually use, such as Alipay, WeChat Pay and Paypal, are electronic wallets, facing the C-end, and the corresponding is the acquiring system of B-end enterprises/merchants. As long as a fund clearing network similar to the Lightning Network is built, the simplest P2B (individual and enterprise) interaction system can be built. Generally speaking, the intermediate clearing network requires the card organization and the payment protocol to jointly constitute it.

Taking the above picture as an example, the Web2 payment system can be divided into P2P between individuals, P2B and B2B between individuals and enterprises, and between merchants. Banks can also conduct interbank transaction systems such as SWIFT or CIPS, or cross-border CBDC transaction systems such as mBridge.

However, it should be noted that payment strictly occurs between individuals and enterprises, and between enterprises. We include P2P and interbank payment here to facilitate comparison with Web3 payment behavior, because in Web3, the main scenario of payment behavior is between individuals. For example, Bitcoin is a peer-to-peer electronic cash payment system.

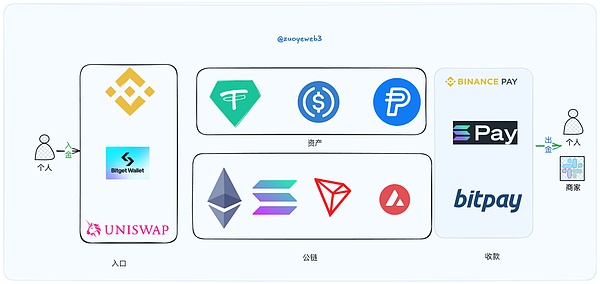

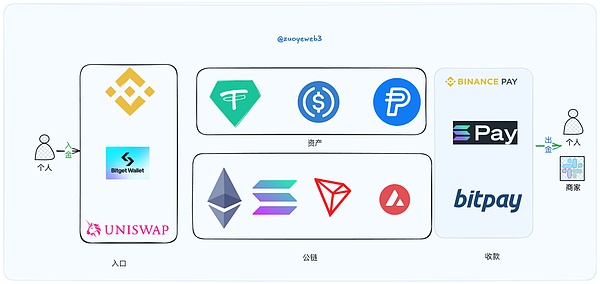

If we refer to the payment system of Web2, the payment system of Web3 is very simple. Of course, the theoretical simplicity cannot cover up the fragmentation of the ecosystem. One obvious feature is that the traditional payment system has many banks and few card organizations, so it has a strong network effect. Web3 goes the other way. There are many public chains/L2s, but the main assets are only US dollar stablecoins and only a few products such as USDT/USDC.

Even with the most optimistic estimates, there are only about 30,000 merchants worldwide that support Bitcoin. Although some regions include big brands such as Starbucks, they are still not comparable to traditional card organizations or e-wallets in terms of acceptance.

Merchants that accept Binance Pay / Solana Pay are mostly online merchants, such as travel OTA platforms such as Travala. The number of merchants that can be expanded into card organizations with hundreds of millions of merchants is still a little far away.

We will elaborate on the content of the payment system below. Next, it is time to introduce the concept of PayFi.

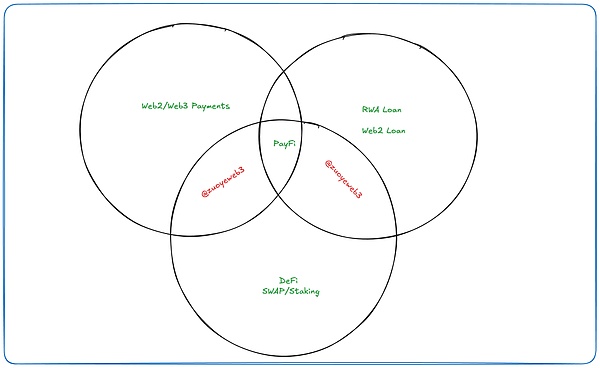

PayFi Stack: The Intersection of DeFi, RWA and Payments

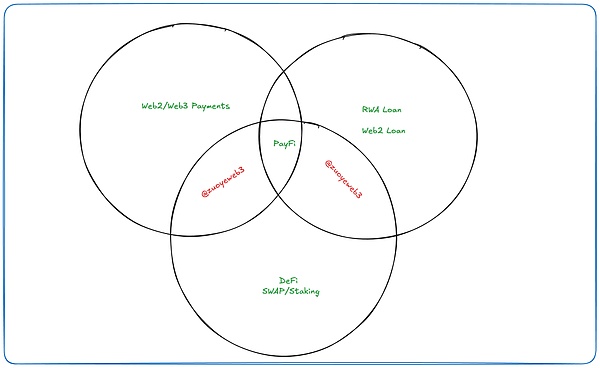

The reason why the narrative structure of talking about Payments first and then introducing PayFi is adopted is because the differences between the two are very large. On the whole, PayFi is more like DeFi + stablecoin + payment system, and it is not closely related to Web2 Payments. As mentioned earlier, everyone can feel it.

First, let's have a look at Lily Liu's explanation. PayFi uses the time value of money (TVM). For example, making a profit from funds in DeFi is the use of TVM, but the problem is that this may take time. For example, staking tokens to obtain rewards usually requires a lock-up period. However, as long as there are tokens, there is the possibility of appreciation. In previous operations, after obtaining profits, they can be invested in DeFi again, and the cycle continues to look for the possibility of profit.

Now, this part of the income can be turned to other directions, such as using the expected income for current consumption. For example:

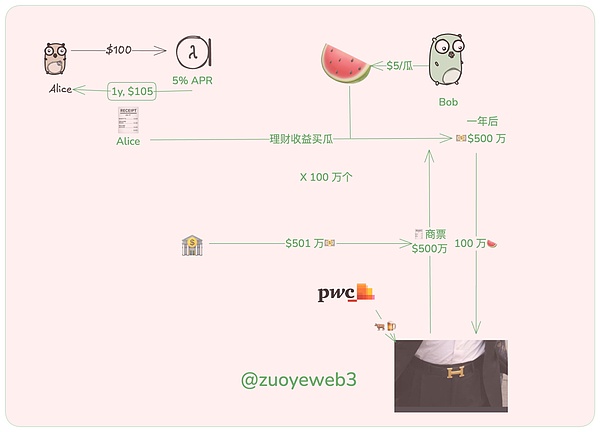

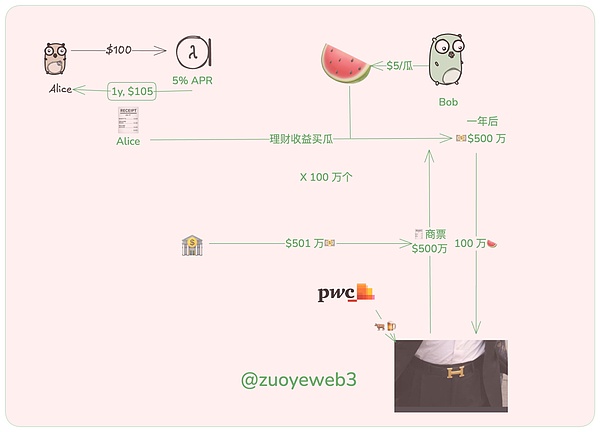

1. Alice invests 100 USDC in a financial product with an annual interest rate (APR) of 5%. After one year, she can get $105 in principal and interest income;

2. Bob runs a watermelon stall. In order to sell more watermelons, he now allows Alice to come here with her financial management certificate to eat $5

This example is very simple, so simple that it cannot withstand scrutiny. For example, how can Alice and Bob ensure the smooth execution of the contract, and what should Alice do if her financial management income decreases? However, without considering these, Alice can eat melons without paying any cost, and Bob gets 5 US dollars in accounts receivable.

A year later, the bull market came, and Bob received a lot of 5 US dollars. He was ready to enter the large-scale enterprise supplier. After choosing and choosing, he saw Evergrande looking for a watermelon seller. The order was 5 million US dollars. Bob was very happy, but Evergrande gave him a commercial bill. With the experience of cooperation with Alice, Bob happily accepted the commercial bill. The two parties agreed to pay cash with the bill after one year, and if not, he would use the house to pay off the debt.

However, half a year later, Bob was ready to enter the stock market. At this time, he needed to cash in the commercial bills. After the rating by PricewaterhouseCoopers, Evergrande's commercial bills were AAA-level high-quality assets. Banks, non-financial institutions, and even individuals in the market wanted them. Everyone rushed to buy them because Evergrande's real estate had quality assurance and great potential for appreciation.

Bob successfully sold the commercial bills at an excess price of 5.01 million. The bank got the commercial bills, Evergrande got something for free, and Bob got the dividends of the stock market. Everyone had a bright future. (Generally, commercial bills need discounts and handling fees to be cashed out. Here we are just explaining the workflow. Before the collapse of Evergrande's commercial bills, they were only about 70% to 80% of their face value.)

Another meaning of TVM is the monetization of non-circulating assets. Even non-circulating assets themselves can be currencies or their equivalents, which is similar to the logic of re-pledge.

In the context of Web3, the monetization of non-circulating assets can only be DeFi, so PayFi is a natural extension of DeFi, except that it extracts some of the liquidity of the previous on-chain Lego and invests it off-chain to improve life.

The relationship between PayFi and Payments is that payment is the simplest and most convenient way to satisfy the need for funds to go off-chain, while PayFi and RWA overlap with each other, except that traditional RWA emphasizes "going on-chain". For example, the so-called tokenization process requires securities, gold or real estate to be tokenized first to satisfy the possibility of on-chain circulation. Many alliance chains that are more familiar in China do this, such as blockchain electronic invoices or Gongxinbao.

PayFi can hardly be said to be a subset of RWA. A considerable part of PayFi's behavior is "off-chain". As for whether there is a link on the chain, it is not the focus of the PayFi concept, but its behavior needs to involve interaction with off-chain links.

However, there is no need to worry about it. Many concepts of Web3 lack large-scale products and user groups. They are more about speculating on concepts and selling coins. Roughly speaking, products involving PayFi/Payments and RWA can be divided in the following chronological order:

Old era: Ripple, BTC (Lightning Network, BTCFi, WBTC), Stellar

2022 RWA concept three musketeers: Ondo/Centrifuge/Goldfinch

New era-2024 PayFi: Huma (established long ago, became popular in 2024), Arf

It can even be said that the lending in RWA, similar to Ripple's cross-border settlement, plus the off-chain consumption of stablecoins, constitute several aspects of the current PayFi. In essence, there are only these contents.

It can be said that Web3 software and hardware are built on the material and ideological foundation of Web2, and so is Web3 PayFi. Its similarities with Payments are actually greater than its differences, and lending products are actually more from the perspective of capital flow. If off-chain products can have more benefits, then these benefits can also be used for payment.

Being misunderstood is the fate of the expresser. I don’t know whether Lily Liu agrees with this interpretation, but I think that only in this way can the logic be smooth. As long as the on-chain income is used for off-chain consumption scenarios, it conforms to the concept of PayFi. Therefore, the next focus of the market will be Web3 Payments, RWA Loan and stablecoins. In fact, the three can often be included in a cyclical process.

For example, RWA corporate lending is priced in U. Individuals enter the lending pool on the RWA chain through the DeFi protocol. The RWA lending protocol lends to physical enterprises after evaluation. After recovering the accounts receivable, LP obtains the profit of the agreement and withdraws funds through the Mastercard U card. It just happens that the merchant supports Binance Pay, which is a perfect closed loop.

History belongs to the pioneers, not the summarizers. It doesn’t matter how PayFi is defined. The most urgent task is to explore the real benefits beyond the internal circulation of the DeFi chain. The demand from billions of people off the chain will bring more abundant liquidity and higher leverage valuation support to the chain. Whoever can run it through can define the market.

Anais

Anais