Hong Kong Bitcoin ETFs Poised to Draw $25 Billion via Stock Connect

Matrixport sees up to $25 billion potentially channelled into new Bitcoin ETFs in Hong Kong through the Stock Connect, pending regulatory approval.

Brian

Brian

Original author: Joel John and Siddharth

(Portfolio: DAYBREAKER, About Tomo: Illustrator of eth Foundation)

"Recommendation: Layer3 has recently been listed on exchanges intensively and will issue airdrop applications and token staking on July 30, achieving another milestone. This articleexplains the practical application of aggregation theory in the field of cryptocurrency. Taking the Layer3 platform as an example, it introduces how it attracts and retains users by encouraging users to participate in tasks (Quests) and provides users with ownership and economic incentives. Enjoy! "

March 2022,

I first wrote about Aggregation Theory in the context of crypto

https://www.decentralised.co/p/on-aggregation-theory-and-web3

Since then, I have seen it in action across multiple portfolio companies.

Hashflow has achieved over $18 billion in trading volume.

Gem has been acquired by OpenSea.

Layer3 has scaled to 4.5 million wallets.

Layer3 is particularly special because it was the last payment I checked out from LedgerPrime, just before FTX collapsed. I wish I could claim that we foresaw these results with genius foresight, but in fact they were somewhat unexpected. However, in hindsight, it is worth revisiting aggregation theory and exploring the scaling patterns that founders can exploit.

For today's sharing, we are fortunate to be working with Layer3, who generously opened up their internal datasets for VCs and their top users to access. Over the past few weeks, we have deeply studied how a business can become a focus of attention, just as Google did in the early 2000s. In today's column, I will first refute some of the arguments I made in 2022, and then explain the different strategies that aggregators must take in the process of building scale.

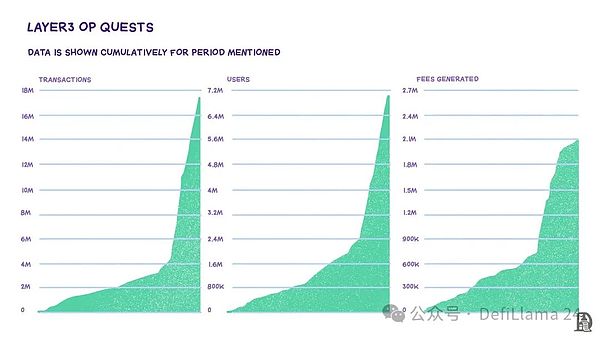

We often think that consumer applications in crypto are difficult to scale. Yet Layer3 as a product has 4.5 million wallets that have completed 100 million tasks. In the process, they have driven nearly 120 million on-chain operations. The scale is there, it’s just that these stories have not been widely disseminated or studied in depth.

This issue will take you deep into the internal mechanisms of how similar results are produced.

The Power of Aggregation

Before the Internet, the most challenging aspect of building any product or service was reaching customers. If you were to produce a consumer product, you could only sell it through physical storefronts. This naturally limited the number of consumers you could reach. The key breakthrough of the Internet was its ability to aggregate demand globally.

This aggregation has given rise to many of the giants that are now household names: Google, Netflix, Amazon, and Meta, all of which more or less follow some of the characteristics of Aggregation Theory.

There are three key elements to a supply chain: suppliers, distributors, and consumers.

Suppliers: The party in the network that seeks distribution, such as advertisers in the case of Google and Meta, retailers in the case of Amazon, and content creators in the case of Netflix

Distributors: The distribution channel through which the supply side reaches the end consumer

Consumers: The demand side of the network, the final purchaser of a product or service from the supply side.

Aggregation Theory refers to the integration of supply, distribution, and demand to optimize processes, reduce costs, and improve efficiency. Aggregators have the following three characteristics:

Direct relationship with consumers: The platform directly owns the consumer’s time and attention. For example, consumers visit Amazon to buy goods or Netflix to consume content.

Zero marginal cost to serve new users: As more users join the platform, the platform incurs no additional costs. For example, Spotify or Netflix can distribute content to 100 or 1 million users without increasing costs (other than serving infrastructure).

Network effects: Users flock to the aggregator platform, making suppliers more likely to join the platform, which attracts more users due to increased supply. For example, users go to Amazon to buy goods, which attracts manufacturers to sell through Amazon, which in turn attracts more users due to the diversification of supply.

Not all aggregators have every characteristic. For example, Amazon is an aggregator, but it incurs marginal costs for serving each additional user.

Ultimately, aggregators accrue tremendous value by improving transaction efficiency and user experience on both sides of the market.

Now, let’s turn our attention to the crypto space to understand the emerging aggregators. The supply chain is as follows:

Suppliers: The supply side of cryptocurrencies consists of first- or second-layer blockchains and decentralized applications (dApps) with native tokens. The former aims to distribute block space, while the latter provides products to consumers. These players are all pursuing efficient distribution strategies to reach and acquire users.

Distributors: Distributors are any channel that has a direct relationship with consumers. This includes wallets, exchanges, and the emerging models we will discuss further below.

Consumers: This includes developers, institutions, or retail participants who have demand for block space or on-chain applications.

The supply side of the market is increasingly fragmented, with hundreds of Layer 1 and Layer 2 blockchains and thousands of dApps emerging. Many of these projects have raised tens of millions of dollars in venture capital and hold hundreds of millions of dollars worth of treasury funds. These assets will be used for promotion as each party competes to reach their target audience.

In a 2019 panel, Chamath Palihapitiya famously pointed out that for every $1 of venture capital raised,

$0.40 goes to Google, Facebook, or Amazon.

https://www.youtube.com/watch?v=iVOFSsvThxY

We believe the same dynamic will happen in crypto, except that instead of spending cash, most teams will distribute their native tokens. Another way to think about TAM is the value of the native tokens held in the protocol team’s coffers.

As of June 2024, the top twenty blockchain ecosystems collectively hold over $25 billion in token reserves that are scheduled to be distributed to users and stakeholders. This value is expected to continue to grow as thousands of projects issue their own tokens in the coming years.

As the market value of these tokens rises, they will become the primary tool for incentive mechanisms on the Internet.

We also believe that there are a handful of applications that have the potential to become the primary distribution channel for this spending.

This issue focuses on a business at the heart of these factors. Multiple top users we spoke to in our research said Layer3 had become the “Google of crypto” for many new users. They bookmarked the page as a way to find new products or just find links they use every day. In other words, the product has crossed the chasm from needing to retain users to building habits among their user base — an achievement few startups in the industry can claim today.

Behind these behavioral patterns are some extremely solid business fundamentals. To understand what those foundations are, we need to go back to early 2022.

The industry briefly thought it had crossed the chasm before the collapse of Luna, 3AC, and eventually FTX. Buying stadium naming rights was seen as a way to break into the mainstream. However, when it comes to user acquisition, the experience is quite fragmented. Despite the public acceptance of crypto, most projects still can’t advertise directly on Twitter or Google. Product discovery still relies heavily on Twitter users discussing products.

A new dynamic of ownership through tokens is emerging in the industry. In crypto, tokens effectively act as customer acquisition costs (CAC). As the industry has evolved, these tokens have been used in a variety of ways to attract users. Initially, users were acquired through sales to the community (ICOs), then through ex post rewards to users (airdrops), and finally through rewards for capital alignment (liquidity mining). However, these methods have proven to be inefficient.

New distribution channels, such as Layer3, have emerged and seek to distribute tokens to acquire users in a more efficient and optimized way. This is where “task” platforms come into play. The value proposition is simple and clear: instead of putting money into advertising, brands directly reward users. Early adopters looking for new products simply go to the Q&A platform and invest their time. The more users engage with the product, the higher the token incentive they receive.

Layer3 was founded in 2021 by Brandon Kumar and Dariya Khojasteh. Remember, Layer3's original landing page read "Earn Crypto by Doing Chores". The core idea is to build a marketplace for protocols to coordinate user behavior using their tokens. Interestingly, the two successfully raised seed rounds of funding with websites built on two no-code platforms, Webflow and Airtable.

The platform has grown into one of the fastest growing aggregators in the industry. Supporting this growth is a technology stack that solves pain points in areas such as user identification, distribution, and ownership of user assets.

Prior to joining Layer3, Brandon was an investor at Accolade Partners, a multi-billion dollar institution and one of the largest capital allocators in the global venture capital (VC) and private equity (PE) sectors. His extensive experience as an investor positions him well to manage the supply side of the business. He ensures the supply side of the network is strong by building relationships with protocol builders and cross-selling across dozens of VC-backed portfolios. Of course, this requires a world-class product, which is where Dariya’s expertise lies.

Daria, an experienced application developer who has successfully built and scaled multiple consumer applications. He is well-positioned to design the product experience that Layer3 is now known for. The thoughtful gamification and effective UX strategies he implements result in a highly engaging and addictive consumer experience.

Essentially, Brandon focuses on the B2B side of the business, onboarding protocols, while Dariya focuses on the B2C side, engaging with consumers. This complementary way of working is a key factor in Layer3’s emergence as a leading aggregation platform.

In the early stages of Layer3, there was a classic "chicken or egg" problem. Task platforms can only have pricing power when they reach a certain scale. Just like aggregators in the traditional world, the value you can control depends on the resources you have on the demand side. Amazon is able to negotiate with suppliers for better prices precisely because it has a large user base.

But what do you do when you have no users? How do you stand out in a field where multiple existing companies compete? This was the challenge that Layer3 faced in its early days. They knew that they would find it difficult to control pricing power before they had a large number of users. Therefore, most of their initial efforts were focused on cultivating core believers.

Layer3's earliest tasks focused on protocols that had just been launched - the applications in these protocols were still in their infancy, and users explored them out of pure curiosity.

Layer3’s initial mission was to discover and surface new products before the market had discovered them. The focus was on curation rather than profit. Users quickly began to flock to the product because they knew it was a reliable source for finding cool on-chain activity. This parallels a similar paradigm that emerged in the development of the web in the early 21st century.

As users flocked online, Google gradually became the homepage for many users.

Why? Because remembering websites is a hassle.

You can just go to Google and type in a query like “Face Book” to find the social network. While researching this article, we came across multiple users whose main purpose for using Layer3 was to discover new protocols in a safe and enjoyable way.

One of the strategies that Layer3 adopted early on was to run tasks for specific protocols before approaching them for sale. Typically, this resulted in founders noticing a significant increase in user traffic from third-party products, which in turn led to a preference for working with Layer3.

Optimism chain-specific data

At the time of writing, Layer3 has become one of the most used applications on Arbitrum, Base, and Optimism.

As of June 29, 2023, they have facilitated more than 120 million on-chain operations from users in 120 countries, and nearly 4.5 million wallets have interacted with the product. Today, Layer3 drives the growth of 31 different blockchains and more than 500 protocols in the fields of gaming, AI, DeFi, and NFT.

According to the team, they receive active attention from 60 to 90 protocols per month that are interested in joining their distribution network.

As mentioned earlier, without the demand side, you cannot attract the supply side of the network. Now, let's focus on user behavior and the relationship between Layer3 and the end consumer.

Layer3's significant growth and user engagement did not happen overnight. In 2022, although the company raised much less money than its peers, its well-thought-out gamification strategy enabled it to expand rapidly.

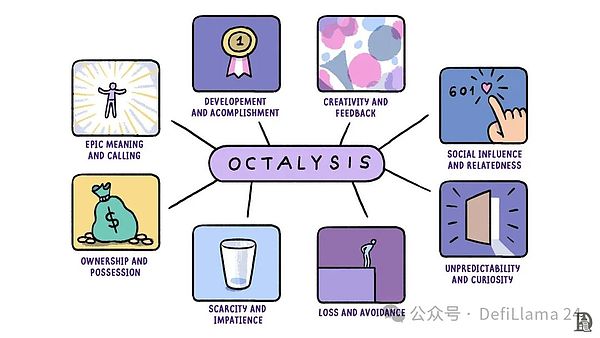

Drawing heavily from the Octalysis framework

https://yukaichou.com/gamification-examples/octalysis-complete-gamification-framework/

, Layer3’s platform has become the benchmark for building industry-leading consumer experiences.

The Octalysis framework, developed by Yukaichou, breaks down the complexity of gamification into eight core drivers that motivate human behavior. It forms the foundation for the Layer3 team to think about its product.

First, Layer3 satisfies users’ pursuit of a sense of grand meaning and mission by allowing users to take ownership in protocols and projects. This gives users a sense of contributing to a cause that transcends themselves. The platform satisfies users’ desire for growth and achievement through the XP system and reward center, and users accumulate experience points by completing activation tasks (such as tasks, competitions, and combos) to stay competitive and unlock more opportunities.

The need for creativity and feedback is met by stimulating users’ creativity and strategic planning through the strategic use of gems in the platform store. Ownership and a sense of ownership are the focus, and Layer3 ensures that users have a strong sense of ownership over their digital assets and identities through CUBEs and ERC-20 tokens. More details will be revealed later.

This sense of ownership deepens user engagement and loyalty.

Layer3’s leaderboards. In the course of writing this article, we spoke with several of the platform’s leading users to understand their perspectives on the platform.

Social influence and relevance are leveraged through the leaderboard feature, which showcases top users, creating a competitive environment where users strive to climb the rankings and gain recognition. Scarcity and urgency are created by implementing time- or participant-limited tasks, competitions, and limited seasons, incentivizing users to act quickly to reap the rewards.

Layer3 also leverages unpredictability and curiosity through the introduction of treasure chests and loot boxes, which entice users to continue to engage with the platform and explore the rewards that may be unlocked. Finally, through the daily streak feature, the user’s drive for loss and avoidance is satisfied, incentivizing them to return to the platform regularly to avoid losing progress.

Some of the platform’s most experienced users have continued to use the product for more than two and a half years because they are afraid of losing their lead.

When the web first emerged, its monetization potential was unclear. Analysts in the late 1990s speculated on the number of times a person would see a Microsoft loading page to assess the likelihood of advertising on that page. Attention was shifting to digital, but the mechanism to measure its value had not yet been established. As large numbers of users began to concentrate on a few platforms, solutions emerged.

Google, Facebook, and Amazon have built massive data silos that can predict user emotions, preferences, and curiosities.

These data sets were isolated and not open to developers to exploit and target users. Ads on the web are like taxes paid to platforms to reach users. The longer a user stays on Facebook, the more likely Facebook is to show them ads. And the more ads they see, the more likely they are to buy. Facebook has an incentive to keep users engaged for long periods of time because its revenue depends on it.

Between 2010 and 2020, the internet evolved into an attention trap that keeps us glued to our screens

Blockchain as a funding rail enables advertisers to reward users directly.

Incentive mechanisms often explain why the system works the way it does. On products like Meta’s Instagram, WhatsApp, or Facebook, we share our most intimate details. In the mid-2010s, we checked in to restaurants, shared photos, and documented our emotional states in detail.

Unbeknownst to us, the platform is encouraging us to give up our data without us fully realizing it.

As mobile devices become more powerful, networks no longer require us to log into their products. We give up our data through Google searches, GPS locations, and sometimes even through chats.

Layer3 disrupts this model in two powerful ways.

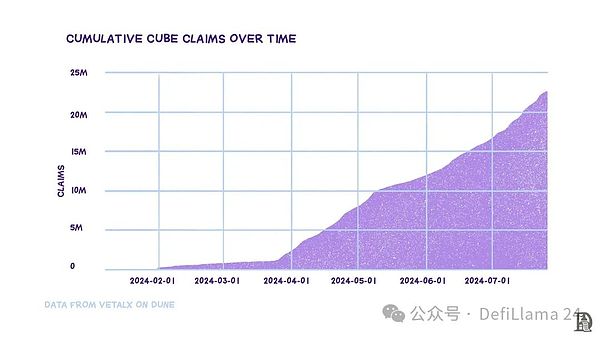

Unlike traditional advertising models, consumers on Layer3 own their data through CUBEs. These credentials are portable and held by the user forever. Once issued, Layer3 cannot take them back. CUBEs are ERC-721 tokens that users receive after completing Layer3 activation. Each token contains custom metadata that unifies the user's on-chain session data. This enables users to own their own on-chain footprint and helps protocols target users more precisely.

CUBEs have become the most popular NFT on Base, Optimism, Arbitrum, and zkSync platforms, with over 1.5 million wallets holding Cube NFTs across chains, according to Growthepie.xyz (as of June 17, 2024).

Cubes are on-chain credentials that grant users the right to perform specific actions.

In addition to owning their own data, users actually gain ownership of the protocols they use through Layer3. For example, if a consumer completes an Optimism activation on Layer3, they will receive OP tokens. If they complete an Arbitrum activation on Layer3, they are awarded ARB tokens. This process is facilitated by Layer3’s distribution protocol, which dynamically rewards users based on their on-chain footprint.

We’ll discuss this specific dynamic in the next section.

The result is a strong moat around consumer adoption and attention, allowing Layer3 to build a large audience and enabling them to plug into more protocols, thereby attracting a wider audience.

A few years ago, Jesse Walden published a blog post titled

The Ownership Economy

https://variant.fund/articles/the-ownership-economy-crypto-and-consumer-software/

The basic premise is that as individual contributions to platform value creation become more prevalent, the next evolutionary step is toward software that is built, operated, funded, and owned by users. This ownership is enabled through tokens.

We believe in this future, but acknowledge that this vision has not yet been realized due to the lack of good infrastructure for efficient ownership distribution until recently. Mechanisms such as airdrops and liquidity mining have attempted to address this problem, but have generally performed poorly.

One of the core value propositions that Layer3 provides to protocols is to provide a more efficient way to distribute tokens to acquire users. Protocols route tokens through Layer3 to reach the right users at the right time.

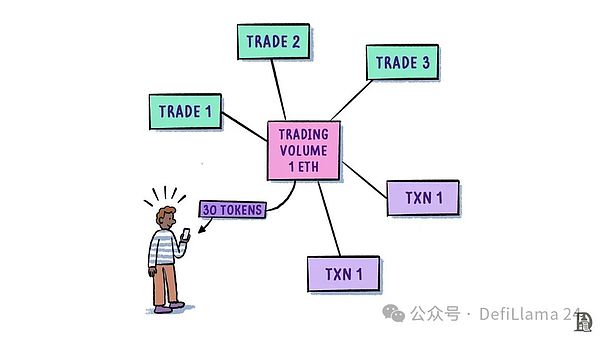

Milestone mechanisms enable developers to require users to complete a series of actions over a period of time before they can receive rewards.

Further, last month, Layer3 launched a product called Milestones. The product observes user behavior over time and rewards users not for a single transaction, but for a combination of multiple activities. For example, a user might be required to lock funds in a smart contract for 30 days, or complete five trades on Uniswap in a month.

Unlike the traditional airdrop model that focuses on a single event or cumulative transactions, Layer3's Milestone product enables developers to mix and match on-chain interactions that drive value.

To me, this highlights a key difference between scaling businesses in Web2 and businesses in crypto. Unlike Google or Meta, Layer3 has little monopoly on its user data. As mentioned before, anyone can query it. They don't even have a monopoly on how users can extract value. Anyone can query CUBE holders and send them tokens. Layer3 accrues value in two key ways:

Long-lasting relationships with users: Past transaction records cannot be forged on the blockchain. Layer3’s ability to filter out users with many years of transaction data through tasks on its platform constitutes a significant moat.

Choose the best products: Their ability to filter out the best products comes from their large user base. In the early days, they had to actively seek out products, but now products actively come to them. In many of the user interviews we conducted, users often mentioned their trust in Layer3 as a product discovery engine. As of writing, Layer3 has partnered with nearly 500 different products.

Users benefit greatly from this model.

In the Web2 advertising model, users benefit very little from the products they are pushed to them. They spend their most scarce resource — time — hoping to find relevant content. Layer3 does the exact opposite. Products compete with each other for token rewards for user attention. The more valuable the user, the more rewarded they are.

This competition for users also exists in Web2, but most of that value is captured by platforms like Google, not end users.

In contrast, Layer3 passes most of the value to end users. You might ask, “How is Layer3 different from its peers?”Remember when I mentioned earlier that aggregation theory in crypto requires community? This is the key ingredient. In products that form large communities, users keep coming back in part because of their loyalty to the community and their relative standing in it. This translates into long-term, timestamped proof of the user’s activity on-chain.

Sure, you can use a tool like Etherscan to find millions of wallets with activity records. But finding a curated list of users who can provide timestamped proof that they were early adopters of a new product, and have a single website where they can find you, requires a platform. And that’s exactly where Layer3 is today.

While researching this post, I stumbled across a blog post written by one of the founders of Layer3. Dariya published an article on his personal website titled

“All I Have Is Attention”

https://dariya.com/2024/05/13/attention-is-all-i-have/

In a paragraph near the end, he explains the reasons for Layer3’s moat.

Attention, coordination, and distribution are interrelated. Can you reach people? Can you get people to do good things for your ecosystem? A few metaphors can help: attention is oil, distribution is kerosene, and coordination is oil. On the internet, value typically accrues only to the platforms that capture your attention. But at Layer3, we aim to disrupt that. You own the network, you accrue value. Projects issue value to you directly or indirectly, as evidenced by Layer3 users capturing 20.4% of the entire Arbitrum airdrop. And over two dozen projects have issued incentives directly through the protocol in the past sixty days.

In other words, Layer3 is able to capture value while disrupting the historical relationship between ad networks and products. To me, that’s the definition of a disruptor.

In my many years of writing, I’ve known that crypto will evolve into a value network. The core function of blockchain is to facilitate the transfer of value. Its primary use case is transactions on a global scale. With 4.5 million wallets in nearly 120 countries, Layer3 is the closest thing to a fully functioning and scalable “value transfer network” I’ve ever seen.

When the web was evolving, advertising was necessary to get billions of users online. But today, we’re beyond that. The users are already there. Now, what we need is a better way to monetize and target them. Layer3 is right at the crossroads of this transition — from an attention network to a value network. We’re moving from an era where users give their time and data to an era where they own their data and receive economic value.

If users can receive value (in the form of tokens or NFT minting), then platforms will inevitably compete to offer the best rewards. This is where Layer3’s business model has a strong moat.

With the number of people using its product today, Layer3 will be able to continue to bootstrap and build user incentives. A large protocol like Uniswap may have no incentive to work with a new Q&A platform with less than 100,000 users. But what if you could target five million wallets?

In terms of scale, this is the size of the entire DeFi market in 2021. This is exactly where Layer3 is positioned. An analogy is that it’s like being on the front page of Google Play or Steam in early 2012.

This will change the way developers think about app launches. Products launched in crypto often face the cold start problem — it’s extremely difficult to find an initial group of sticky users to collect data. Traditionally, products would partner with well-known networks like Polygon or Solana to solve this problem. However, with platforms like Layer3 providing distribution services from day one, the reliance on the network is greatly reduced.

Developers can run a campaign through Layer3, find a core group of users, and reward them for being early adopters. To me, this feels like the Google Ad Manager moment in crypto — a critical point where developers realize that they can effectively invest resources on a platform that provides meaningful targeting, rather than relying solely on influencers.

Of course, this positioning also brings its advantages. The scale of Layer3's operations means they can expand into their own product line. They can integrate with exchanges and see hundreds of millions of dollars flow back and forth as users swap tokens within their products. They can even launch their own exchange or launch platform.

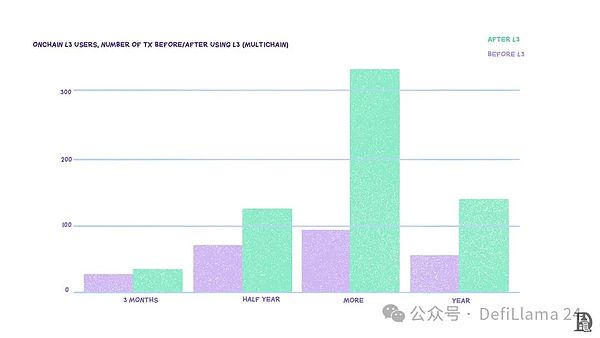

Data shared by Layer3 investors. The data shows the number of transactions between users who use Layer3 and those who do not use Layer3 in a specific time period. It is observed that Layer3 users are more active in various time periods.

Attention precedes liquidity. Layer3 has significantly aggregated the former. The more transactions users make within their ecosystem, the greater the surface area they have to increase the lifetime value of users. The natural extension is to expand into verticals where users have shown demand. For example, Jupiter charges 1% of the token supply for launching new tokens.

What stops Layer3 from doing the same? It would create a flywheel effect where users flock to the product in hopes of being early adopters of new projects, which in turn use Layer3 to help them scale.

Around 2003, Google decided to do more than just index the web. Over the next five years, they IPO’d, launched GMail, acquired YouTube, and bought Android. These moves laid the foundation for the internet as we know it today. Google made these moves because they realized that more and more attention was moving online and waiting to be monetized. Google was able to successfully identify these acquisition opportunities by identifying where demand was going. That’s the advantage of positioning.

Layer3 is also in a good position. They have an incentive to expand into new areas because they can clearly see where users are investing the most time and resources. While blockchain data is public and available to anyone, not everyone can activate the same user base because they lack the direct connection that Layer3 has with its users.

Layer3 has the distribution needed to launch new product lines and scale to value. The only thing missing is time and the compounding effect that comes with it.

When I met Brandon at TOKEN2049 in Dubai, one of the topics we discussed was which of today’s protocols will survive into the next decade. This perspective reflects the way Brandon and Dariya think about their business. Most founders worry about the price of their tokens in the next quarter; they are planning a decade-long game plan.

This doesn’t mean it’s an easy road ahead for Layer3. Building value networks requires developers to accept a model of token incentives in exchange for usage—an established but not yet widespread business model. As other consumer areas such as AI attract public attention, the on-chain user market may shrink, or the total number of protocols willing to work with Layer3 may reach saturation.

All of these are real challenges. But if the past two years of Layer3 operations are any indication, I bet Brandon and Daria will still be around for the next decade, continuing to realize their vision of tokenizing attention.

Matrixport sees up to $25 billion potentially channelled into new Bitcoin ETFs in Hong Kong through the Stock Connect, pending regulatory approval.

Brian

BrianThe MetaMask-Robinhood partnership revolutionizes web3, merging seamless crypto transactions with user-centric design for a simplified, secure digital asset experience.

Weiliang

WeiliangShiba Inu faces a 12% overnight plunge, prompting investors to shift towards Binance Coin and Everlodge amid mysterious market dynamics. While Shiba Inu struggles, Binance Coin surges past $300, and Everlodge's disruptive DeFi approach to holiday property ownership gains traction with potential high returns.

Joy

Joy JinseFinance

JinseFinance JinseFinance

JinseFinanceAI's progress opens the possibility of reconnecting with departed loved ones.

Hui Xin

Hui XinHeld on Wednesday, 16th August 2023, in the city of Kuala Lumpur, Web3 Connect Kuala Lumpur saw notable attendees, including crypto enthusiasts, representatives from the Malaysian government, and diplomats.

Samantha

Samantha Coinlive

Coinlive Bitcoin meetups have been around for years, but now there are companies helping Bitcoiners to meet and even find love “IRL.”

Cointelegraph

CointelegraphEthereum’s decentralized finance protocol MakerDAO proposed a historic vote to connect a U.S. bank to its platform, the Huntingdon Valley ...

Bitcoinist

Bitcoinist