Author: jacek, co-founder of stablewatch; Translation: Jinse Finance xiaozou

Interest-bearing stablecoins are booming. This can be seen from the various indicators tracked by stablewatch: the total market value of interest-bearing stablecoins, the number of such products launched in the past few months, and the total revenue paid to users.

Let's analyze this data in depth.

1. Interest-bearing stablecoin market value

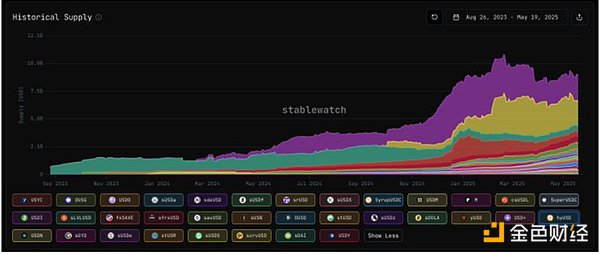

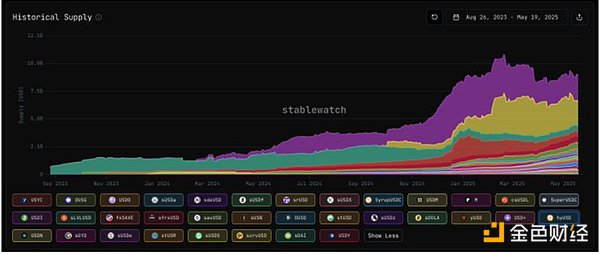

In less than two years, the total supply of interest-bearing stablecoins has increased 13 times, from US$666 million in August 2023 to US$8.98 billion in May 2025. It reached a historical peak of $10.8 billion in February this year and has since stabilized:

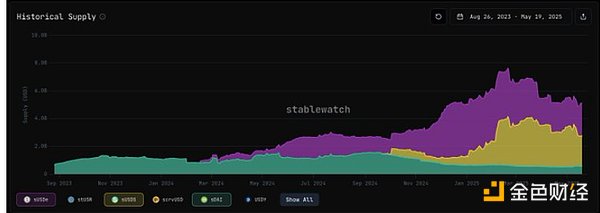

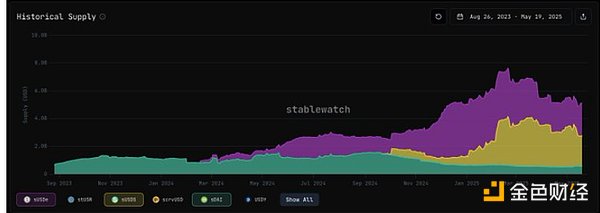

Compared with payment-first stablecoins, yield-first stablecoins still only account for a small part (3.7%) of the entire stablecoin market (as of now, the market value of yield-first stablecoins is $8.98 billion out of a total market value of $242.47 billion):

2. How many interest-bearing stablecoins are there?

Currently we track more than 30 interest-bearing stablecoins on stablewatch, but there are actually more than 100 on the list, and the continuous addition of new varieties makes us overwhelmed. It should be noted that there is no widely accepted definition of interest-bearing stablecoins, so the statistical results depend on the classification standard (see below for details). The figure below shows the market capitalization distribution of various interest-bearing stablecoins:

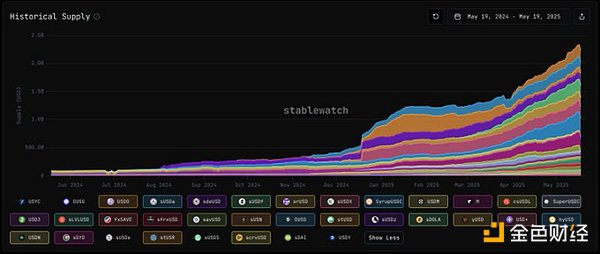

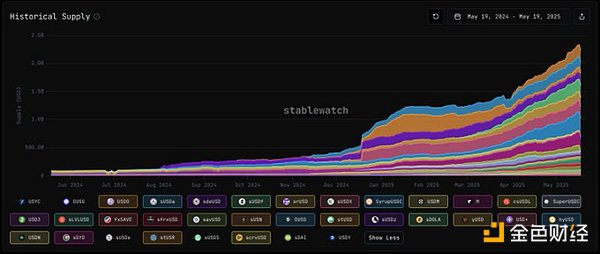

It is clear that the number of interest-bearing stablecoins is growing rapidly, and many newly launched interest-bearing stablecoins are currently gaining market attention. Let’s look at the same chart again (excluding the top six interest-bearing stablecoins by market cap and focusing on the last 12 months):

As expected, sUSDE issued by Ethena and pioneers in the field Sky (sUSDS and sDAI) dominate the market, accounting for 57% of the total market value of interest-bearing stablecoins ($5.13 billion):

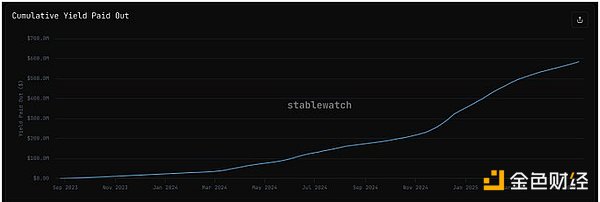

3. Yield Payments (YPO)

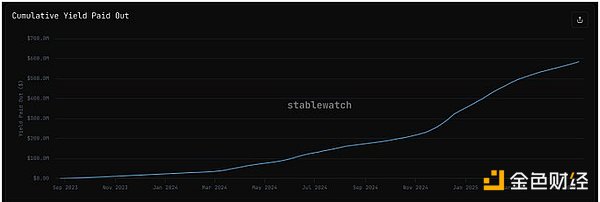

Since mid-2023, interest-bearing stablecoins have paid nearly $600 million in income:

It should be noted that the YPO indicator pioneered by stablewatch is still in its infancy and has not yet tracked the multiple correlations between interest-bearing stablecoins. Nonetheless, the metric provides a valuable overview for assessing the importance of interest-bearing stablecoins as an asset class. 4. What exactly are interest-bearing stablecoins? There is currently no unified definition of interest-bearing stablecoins in the industry. As I have previously stated in other related articles, this is an extremely broad and diverse category that covers tokenized income strategies, hedge fund-like structures, simple asset (such as treasury bonds) packaging tools, interest-bearing loan certificates, multi-strategy income aggregators, etc. Possible classification dimensions include:

Source of income

Income distribution mechanism

Anchor maintenance mechanism

Reserve asset type

Custody arrangement

Regulatory status

Liquidity characteristics and redemption channels and frequency

Governance model

Risk concentration

Target user group

left;">Underlying infrastructure (blockchain) support, etc.

This emerging phenomenon still needs more research to clarify. Even if interest-bearing stablecoins may be deconstructed into multiple clearer subcategories in the future, in-depth analysis of their economic models, technical architectures, and applicable rules will help users make more informed decisions and maintain market integrity.

Alex

Alex