Author: Xiaobing, Deep Tide, TechFlow

In December's precious metals market, the protagonist wasn't gold; silver was the most dazzling light.

From $40, it leaped to $50, $55, and $60, traversing one historical price level after another at an almost out-of-control pace, giving the market almost no chance to breathe.

On December 12th, spot silver once touched a historical high of $64.28 per ounce, before sharply reversing and falling. Year-to-date, silver has accumulated a gain of nearly 110%, far exceeding gold's 60% increase.

This is a seemingly "extremely reasonable" rise, but it also appears exceptionally dangerous.

The Crisis Behind the Rise

Why did silver rise?

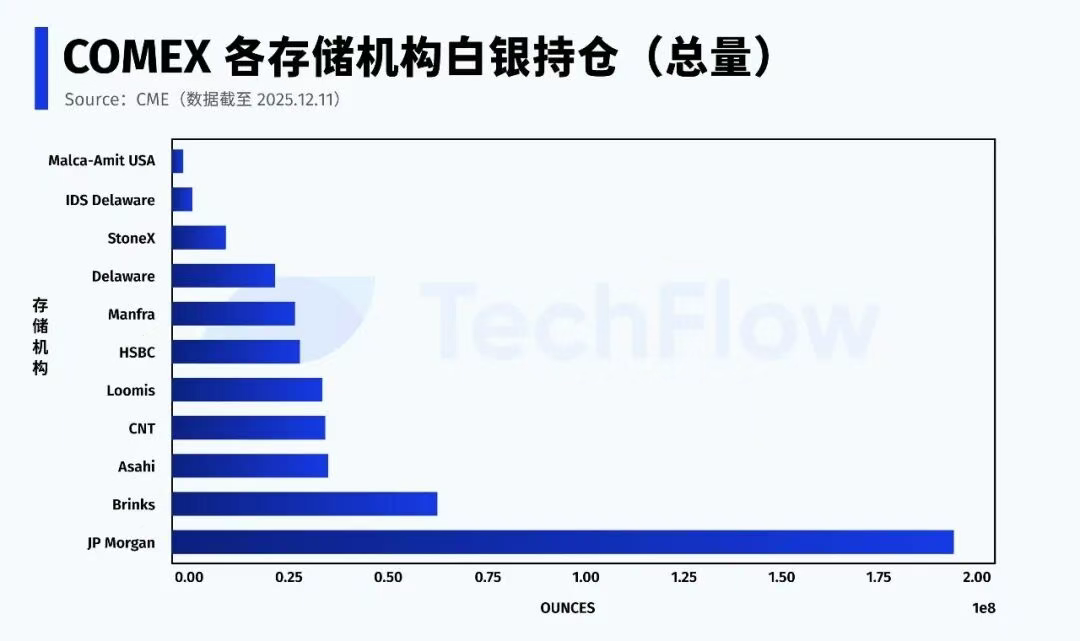

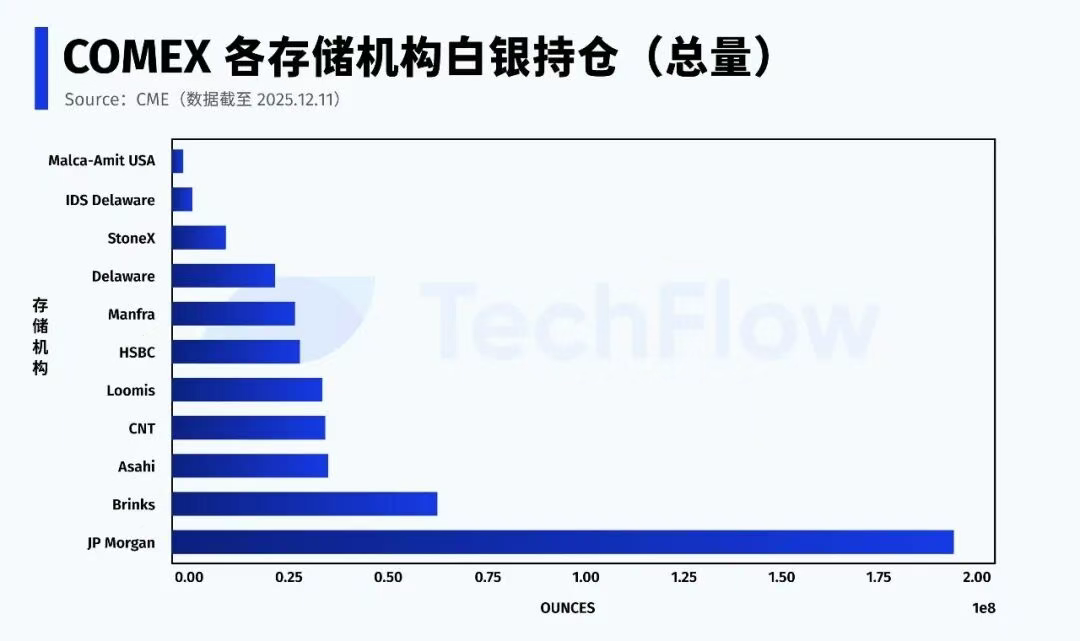

Because it looks worth the price increase. From the perspective of mainstream institutions, all of this makes sense. Expectations of a Fed rate cut have reignited the precious metals market. Recent weak employment and inflation data have led the market to bet on further rate cuts in early 2026. Silver, as a highly volatile asset, reacts more strongly than gold. Industrial demand is also contributing to the surge. The explosive growth of solar energy, electric vehicles, data centers, and AI infrastructure fully reflects silver's dual attributes (precious metal + industrial metal). The continued decline in global inventories further exacerbates the situation. Fourth-quarter production from mines in Mexico and Peru fell short of expectations, and silver ingots in major exchange warehouses are decreasing year by year. If we only consider these reasons, the rise in silver prices is a "consensus," even a belated revaluation. But the danger lies in this: The rise in silver prices, while seemingly reasonable, is unsettling. The reason is simple: silver is not gold; it lacks the same consensus and the support of "national teams." Gold's resilience stems from global central bank buying. Over the past three years, central banks worldwide have purchased over 2,300 tons of gold, which are reflected on national balance sheets as an extension of sovereign credit. Silver is different. Global central bank gold reserves exceed 36,000 tons, while official silver reserves are virtually zero. Without central bank support, silver lacks any systemic stabilizers when the market experiences extreme volatility, making it a typical "isolated asset." The difference in market depth is even more pronounced. Gold's daily trading volume is approximately $150 billion, while silver's is only $5 billion. If gold is the Pacific Ocean, silver is at best a small lake. It is small in size, has few market makers, insufficient liquidity, and limited physical reserves. Most importantly, the primary form of silver trading is not physical silver, but "paper silver," with futures, derivatives, and ETFs dominating the market. This is a dangerous structure. Shallow waters are easily capsized; the entry of large funds can quickly disrupt the entire surface. This year, precisely this situation has occurred: a sudden influx of funds rapidly propelled a already shallow market, pulling prices off the ground. The futures squeeze wasn't caused by the seemingly reasonable fundamental reasons mentioned above; the real price war occurred in the futures market. Normally, the spot price of silver should be slightly higher than the futures price. This is easy to understand: holding physical silver requires storage costs and insurance premiums, while futures are simply contracts, naturally cheaper. This price difference is generally called "spot premium." However, starting from the third quarter of this year, this logic has reversed. Futures prices are systematically higher than spot prices, and the price difference is widening. What does this mean? Someone is aggressively pushing up prices in the futures market. This "futures premium" phenomenon usually only occurs in two situations: either the market is extremely bullish on the future, or someone is engaging in a short squeeze. Considering that the improvement in silver's fundamentals is gradual, demand for photovoltaic and new energy sources won't surge exponentially within a few months, and mine production won't suddenly dry up, the aggressive behavior in the futures market is more likely the latter: funds are pushing up futures prices. An even more dangerous signal comes from anomalies in the physical delivery market. Historical data from COMEX (New York Mercantile Exchange), the world's largest precious metals trading market, shows that less than 2% of precious metals futures contracts are settled physically, with the remaining 98% settled in US dollar cash or through contract rollover. However, in the past few months, COMEX's physical silver delivery volume has surged, far exceeding historical averages. More and more investors are no longer trusting "paper silver" and are demanding physical silver ingots. A similar phenomenon has occurred with silver ETFs. While large amounts of capital are flowing in, some investors are beginning to redeem their shares, demanding physical silver rather than fund units. This "run" of redemptions has put pressure on ETF silver reserves. This year, the three major silver markets—New York COMEX, London LBMA, and Shanghai Metal Exchange—have all experienced runs. Wind data shows that in the week ending November 24, silver inventories on the Shanghai Gold Exchange fell by 58.83 tons to 715.875 tons, a new low since July 3, 2016. CMOEX silver inventories plummeted from 16,500 tons in early October to 14,100 tons, a drop of 14%. The reasons are not hard to understand: under the dollar interest rate cut cycle, investors are unwilling to settle in dollars; another hidden concern is that exchanges may not have enough silver available for settlement. The modern precious metals market is a highly financialized system. Most "silver" is merely a paper figure; actual silver ingots are repeatedly pledged, leased, and derivatived globally. One ounce of physical silver may simultaneously correspond to more than a dozen different warrants. Veteran trader Andy Schectman, using London as an example, notes that the LBMA has only 140 million ounces of floating supply, but daily trading volume reaches 600 million ounces, with over 2 billion ounces of paper claims on these 140 million ounces. This "fractional reserve system" functions well under normal circumstances, but once everyone wants physical silver, the entire system experiences a liquidity crisis. When the shadow of a crisis looms, a strange phenomenon seems to always occur in the financial markets, commonly known as "pulling the plug." On November 28th, the CME experienced a nearly 11-hour outage due to a "data center cooling issue," setting a new record for the longest outage and preventing COMEX gold and silver futures from updating normally. Notably, the outage occurred at a crucial moment when silver broke through historical highs, with spot silver surpassing $56 and silver futures even exceeding $57. Market rumors speculated that the outage was to protect commodity market makers exposed to extreme risks and potential large losses. Later, data center operator CyrusOne stated that the major interruption was due to human error, further fueling various conspiracy theories. In short, this market movement driven by a futures squeeze has inevitably led to extreme volatility in the silver market, effectively transforming silver from a traditional safe-haven asset into a high-risk commodity. Who's manipulating the market? In this dramatic squeeze, one name cannot be ignored: JPMorgan Chase. The reason is simple: it's an internationally recognized silver market manipulator. For at least eight years, from 2008 to 2016, JPMorgan Chase manipulated gold and silver market prices through traders. The method was simple and brutal: placing large orders to buy or sell silver contracts in the futures market, creating a false impression of supply and demand, inducing other traders to follow suit, and then canceling the orders at the last second to profit from price fluctuations. This practice, known as spoofing, ultimately resulted in JPMorgan Chase being fined $920 million in 2020, setting a record for a single CFTC fine. But the real textbook example of market manipulation goes beyond this. On one hand, JPMorgan Chase used massive short selling and spoofing in the futures market to drive down silver prices; on the other hand, it massively acquired physical metal at the low prices it created. Starting in 2011 when silver prices approached $50, JPMorgan Chase began accumulating silver in its COMEX warehouses, continuously increasing its holdings while other large institutions reduced their silver positions, eventually reaching a peak of 50% of total COMEX silver inventory. This strategy exploits a structural flaw in the silver market: paper silver prices dominate physical silver prices, and JPMorgan Chase, which can influence paper silver prices and is one of the largest holders of physical silver, plays a crucial role. So, what role did JPMorgan Chase play in this silver squeeze? On the surface, JPMorgan Chase seems to have "turned over a new leaf." Following the settlement agreement in 2020, it underwent systematic compliance reforms, including hiring hundreds of new compliance officers. Currently, there is no evidence to suggest that JPMorgan Chase participated in the short squeeze, but it still wields significant influence in the silver market. According to the latest CME data from December 11th, JPMorgan Chase holds approximately 196 million ounces of silver (proprietary trading + brokerage) within the COMEX system, accounting for nearly 43% of the exchange's total inventory.

In addition, JPMorgan Chase has another special role: the custodian of the Silver ETF (SLV), holding 517 million ounces of silver, worth $32.1 billion, as of November 2025.

More importantly, JPMorgan Chase controls more than half of the Eligible Silver (i.e., silver that is eligible for delivery but not yet registered as deliverable) segment.

In any round of silver short squeeze, the real game in the market boils down to two points: First, who can provide physical silver; second, whether and when this silver will be allowed into the delivery pool. Unlike its past role as a major short seller of silver, JPMorgan Chase now sits at the "silver gate." Currently, deliverable registered silver accounts for only about 30% of total inventory, while the majority of eligible silver is highly concentrated in the hands of a few institutions. Therefore, the stability of the silver futures market actually depends on the actions of a very small number of key players. The paper system is gradually failing. If we were to describe the current silver market in just one sentence, it would be: The market continues, but the rules have changed. The market has undergone an irreversible transformation, and trust in the "paper system" of silver is crumbling. Silver is not an isolated case; the same changes have occurred in the gold market. Gold inventories at the New York Mercantile Exchange have continued to decline, with registered gold repeatedly hitting lows, forcing the exchange to allocate gold bars from "eligible" gold, which is not originally intended for delivery, to complete transactions. Globally, capital is quietly migrating. For the past decade or so, mainstream asset allocation has been highly financialized; ETFs, derivatives, structured products, leveraged instruments—everything can be "securitized." Now, more and more funds are withdrawing from financial assets and seeking physical assets that do not rely on financial intermediaries or credit guarantees, typically gold and silver. Central banks are continuously and massively increasing their gold reserves, almost without exception choosing physical form. Russia has banned gold exports, and even Western countries such as Germany and the Netherlands have requested the repatriation of their overseas gold reserves. Liquidity is giving way to certainty. When the supply of gold cannot meet the huge demand for physical assets, funds begin to look for alternatives, with silver naturally becoming the first choice. The essence of this movement towards physical assets is a renewed struggle for currency pricing power in the context of a weak dollar and deglobalization. According to a Bloomberg report in October, global gold is shifting from West to East. Data from the CME Group and the London Bullion Market Association (LBMA) shows that since the end of April, more than 527 tons of gold have flowed out of vaults in New York and London, the two largest Western markets. Meanwhile, gold imports by major Asian gold-consuming countries like China have increased, with China's August gold imports reaching a four-year high. To cope with market changes, JPMorgan Chase moved its precious metals trading team from the United States to Singapore at the end of November 2025. Behind the surge in gold and silver prices is the return of the "gold standard" concept. While this may not be realistic in the short term, it is certain that whoever controls more physical gold has greater pricing power. When the music stops, only those holding real gold and silver can sit comfortably.

Miyuki

Miyuki