Article source: Shen Jianguang and Zhu Taihui, "The integration of cryptocurrency and financial system is accelerating, and four major trends are worth paying attention to", "First Financial Daily", May 18, 2025.

Stablecoin and Crypto Asset Series Research 12

Since 2025, the market size of stablecoins has been rising steadily, the price of Bitcoin has exceeded $100,000, the decentralized financial industry has been continuously enriched, and the global cryptocurrency market has entered a period of standardized innovation and rapid development.

More importantly,cryptocurrency and the financial system have shown a trend of comprehensive integration and development, the integration and innovation of stablecoins and payment systems have been rapidly promoted, banking institutions have actively expanded cryptocurrency services, and the integration of capital markets and crypto markets has been promoted in all directions.

In this process, the United States has led major countries in the world to speed up the formulation of stablecoin and cryptocurrency regulations, increase strategic reserve investment in cryptocurrencies such as Bitcoin, etc., which has accelerated the formalization and popularization of cryptocurrencies and provided policy guarantees for the integration and innovation of cryptocurrencies and the financial system.

Looking to the future, the integration and development trend of stablecoins, cryptocurrencies and traditional financial systems is difficult to reverse. Among them, the performance of stablecoins in reshaping the global payment system, cryptocurrencies in upgrading global financial infrastructure, and tokenization in transforming the asset trading and settlement system deserves special attention.

Trend 1: "Quick and fast progress" in the integration and innovation of stablecoins and payment systems

Stablecoins have obvious advantages in payment time and cost.Stablecoins are based on blockchain peer-to-peer payments, and payment is settlement, which has significant advantages in payment efficiency and cost. Existing bank cross-border remittances usually take up to 5 working days to settle, while cross-border payments based on stablecoins, 100% of transactions will be completed in less than 1 hour. According to data from the World Bank, the average cost rate of cross-border remittances under the traditional model is about 6.35%, but the average cost of sending stablecoins through high-performance blockchains such as Solana is about US$0.00025. In addition, payment infrastructure based on blockchain technology, such as Ethereum and Tron, also achieves differentiated management of transaction priorities by introducing a mechanism similar to "Gas Fee".

Stablecoins are being widely used for real-world economic and financial transaction payments. In addition to being used for transaction payments of encrypted assets, stablecoins have also been rapidly applied to cross-border trade settlements, inter-enterprise payments, consumer payments, employee salary payments, and other financial and physical investments in recent years.

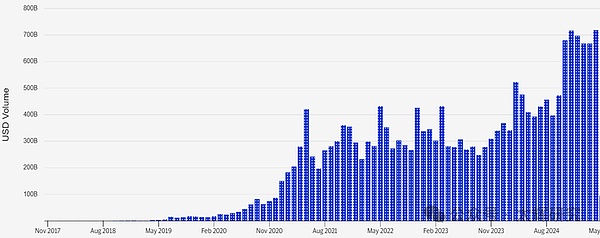

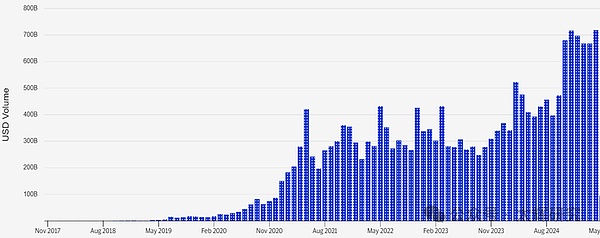

Visa's monitoring data shows that as of April 2025, the market size of stablecoins has exceeded US$220 billion, and the number of active stablecoin holding addresses in the past 12 months has exceeded 240 million. The adjusted number of stablecoin payment transactions has reached 1.4 billion times, and the transaction volume has reached US$6.7 trillion. Among them, the leading stablecoin issuers are also constantly exploring the expansion of stablecoin payment scenarios. The stablecoin issuer Tether has cooperated with the UAE real estate platform Reelly Tech to allow home buyers to use USDT and other real estate transactions. Some physical enterprises have also begun to accept stablecoin payments. Since 2025, Metro Department Store in Singapore has begun to accept stablecoins USDT, USDC, and WUSD for payment. Global chain retail giant SPAR (with more than 13,900 stores in 48 countries around the world) is testing cryptocurrency payments in Switzerland.

Chart1: Changes in the scale of global stablecoin payments

Cryptocurrency institutions cooperate with traditional payment institutions to promote domestic and overseas payment services. Tether has made a strategic investment in Fizen, a fintech company focused on digital payments, to enhance the practical application and payment infrastructure of USDT around the world; Circle, the issuer of the second largest stablecoin USDC, has cooperated with GCash, a Philippine electronic payment platform, to allow users to receive, purchase, hold or trade USDC. At the same time, cryptocurrency exchanges Kraken and OKX have cooperated with Mastercard to launch digital debit cards, allowing global cryptocurrency holders to use cryptocurrencies and stablecoins (such as USDC, USDP, etc.) for consumption at merchants around the world, thus connecting cryptocurrencies with daily consumption.

Payment institutions have actively explored the launch of stablecoin payments to improve the efficiency of payment services. In terms of payment institutions, in 2020, the US online payment company PayPal launched the stablecoin PayPal USD pegged to the US dollar, and began to support consumers to trade cryptocurrencies through PayPal accounts, etc., and recently cooperated with the cryptocurrency exchange Coinbase to expand stablecoin payment scenarios; in 2024, another US online payment company Stripe acquired the stablecoin platform Bridge to support US companies to use the stablecoin USDC for crypto payment services. In terms of credit card institutions, in 2021, Visa cooperated with the cryptocurrency exchange Crypto.com to use USDC and the Ethereum blockchain for cross-border transaction payments; in addition to cooperating with cryptocurrency exchanges to carry out stablecoin payments, Mastercard recently announced the development and launch of a "multi-token network" to integrate on-chain and off-chain assets to provide digital asset trading infrastructure for consumers, merchants and financial institutions.

Overall, cryptocurrency, especially stablecoin payment, has greatly improved payment efficiency and reduced cross-border transaction costs. The integration and innovation of stablecoin issuers, cryptocurrency exchanges, traditional payment institutions and banking institutions have been accelerated. Stablecoin has developed from a marginal payment tool to an important part of the global payment system.

Trend 2: Banking institutions cooperate with crypto institutions to issue trading services

Mainstream banks are trying to launch their own stablecoins. In 2019, JPMorgan Chase launched its own stablecoin, JP Morgan Coin. Since 2025, the pace of banking institutions exploring the issuance of stablecoins has accelerated significantly. In July 2024, Standard Chartered Bank (Hong Kong) conducted a "sandbox test" for the issuance of stablecoins. In 2025, Itau Unibanco, the largest bank in Brazil, plans to launch its own stablecoin. Sumitomo Mitsui, the second largest financial group in Japan, announced that it would cooperate with blockchain platform companies to develop stablecoins linked to legal tender. Japanese financial group SBI and stablecoin issuer Circle launched stablecoin USDC in Japan. First Abu Dhabi Bank, the largest bank in the UAE by assets, and Abu Dhabi sovereign wealth fund ADQ explored launching a stablecoin backed by dirhams.

Banking institutions explore the development of diversified stablecoin and cryptocurrency services. Since the second half of 2024, the number of banking institutions involved in stablecoin and cryptocurrency services has increased rapidly, and leading banking institutions have entered the market one after another, and the scope of business involved has also been continuously expanded. Hong Kong virtual bank ZA BANK directly provides cryptocurrency trading services to retail users, supporting users to buy and sell Bitcoin and Ethereum through Hong Kong dollars and US dollars. Emirates NBD, one of the largest banks in Dubai, launched cryptocurrency trading services through its digital banking platform Liv X. Bunq, the second largest digital bank in Europe, announced a partnership with cryptocurrency exchange Kraken to launch the cryptocurrency service platform Bunq Crypto, which supports users to buy, sell and trade cryptocurrencies on the platform. In addition, the global systemically important bank Bank of New York Mellon recently expanded its services to stablecoin issuer Circle, allowing customers to make payments to Circle through the bank for the purchase or sale of Circle's stablecoins.

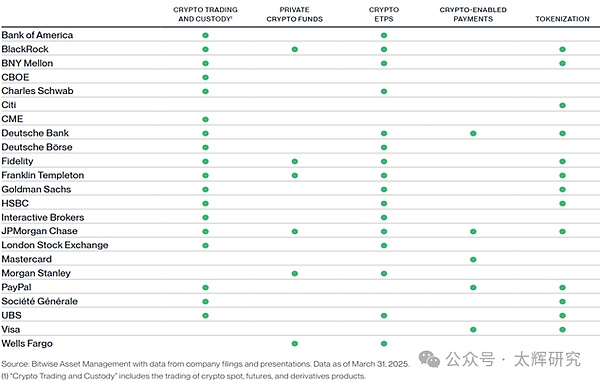

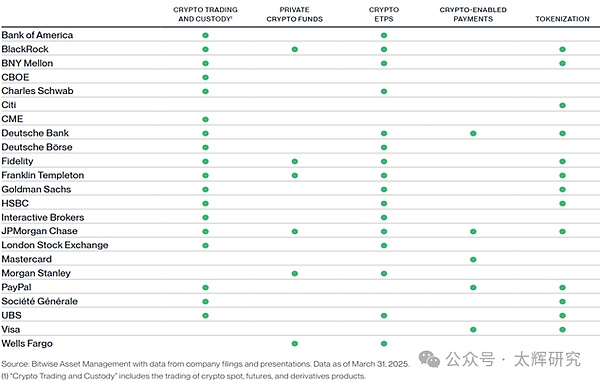

Chart2: Cryptocurrency services provided by major financial institutions around the world

Banking institutions use blockchain to transform and upgrade financial infrastructure. To improve payment efficiency and reduce payment costs, in 2023, JPMorgan Chase upgraded the Morgan Coin to the blockchain payment platform Kinexys, with an average daily trading volume of more than US$2 billion. Currently, Goldman Sachs, BlackRock, India's Axis Bank, Bahrain Bank ABC, Abu Dhabi First Bank, London Stock Exchange, etc. are using the Kinexys platform for cross-border payment and foreign exchange settlement services. Since 2025, in order to reduce counterparty risk, Swiss financial technology company and infrastructure provider Taurus announced the launch of the interbank digital asset (cryptocurrency and tokenized assets) trading platform Taurus-NETWORK, connecting global financial institutions, automatically carrying out mortgage loans, real-time settlement and operations of digital assets, without relying on third parties to process or cancel transactions; under the regulatory framework of the Dubai Virtual Asset Regulatory Authority, Standard Chartered Bank and cryptocurrency exchange OKX jointly launched the global pledged asset mirror project, accepting institutional clients to use cryptocurrencies and tokenized money market assets as over-the-counter pledged assets, of which Standard Chartered Bank is responsible for the safe storage of pledged assets, and OKX is responsible for managing pledged assets and executing transactions.

Overall, banking institutions are actively deploying cryptocurrency services by issuing stablecoins, providing intermediary services for stablecoin and cryptocurrency transactions, and using blockchain to upgrade payment, transaction and asset management infrastructure; the participation of banking institutions has greatly enhanced the liquidity of cryptocurrency transactions, provided a safe entry for institutional investors, and accelerated the globalization and disintermediation of financial services.

Trend 3: All-round advancement of the integration of capital markets and crypto markets

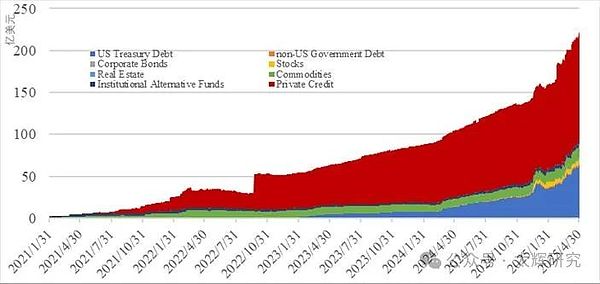

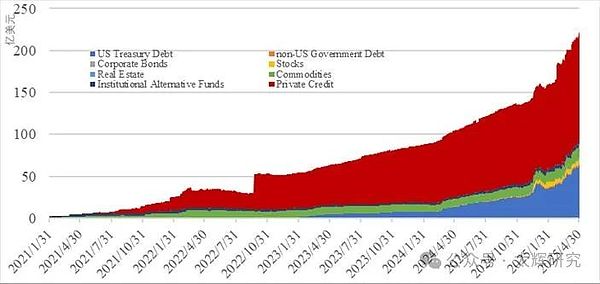

More and more institutions are launching tokenized financial products. Tokenization, with the help of blockchain, can achieve instant purchase, sale and transfer without paperwork and intermediary processing, which can greatly reduce transaction costs, improve transaction efficiency and reduce settlement risks. In terms of real-world asset tokenization, financial asset tokenization has taken the lead with the support of financial regulators and leading financial institutions. In 2022, the Monetary Authority of Singapore launched Project Guardian, a tokenization experiment. In 2023, the U.S. asset management company BlackRock launched the tokenized fund project BUIDL. In 2024, the Hong Kong Monetary Authority launched Project Ensemble, a regulatory sandbox covering asset tokenization. Financial asset tokenization has covered areas such as government bonds, corporate bonds, funds, and stocks. In the 12 months ending April 2025, the market size of real-world asset tokenization doubled (over $22 billion), with more than 100,000 holders and nearly 190 issuers. McKinsey's June 2024 report predicts that the market size of tokenized financial assets will reach $2 trillion by 2030 (excluding cryptocurrencies and stablecoins).

Chart3: Global asset tokenization (RWA) scale changes

In 2024, the securities regulators of the United States and Hong Kong successively approved the launch of crypto asset ETFs, providing a compliant channel for institutional investors to invest in cryptocurrencies, and also driving asset management companies and securities brokerage companies to invest directly in cryptocurrencies. In April 2025, BlackRock deposited 3,296 bitcoins (worth about $254 million) in the cryptocurrency exchange Coinbase Prime. Hong Kong's State Street Global Asset Management and cryptocurrency service agency Galaxy Digital Holdings have cooperated to launch the "State Street Galaxy" platform, which can carry out both crypto and traditional investment applications, and plans to increase the scale of management of crypto assets to $5 billion by 2026. Recently, Charles Schwab CEO Rick Wurster plans to launch direct spot cryptocurrency trading in the next 12 months, and Goldman Sachs also said it will expand digital asset trading activities, explore cryptocurrency lending, and make a big bet on tokenization.

The integration of crypto exchanges and stock exchanges is accelerating. With the clarification of regulatory policies and the relaxation of the regulatory environment, since 2025, crypto exchanges and brokers/dealers have actively promoted mergers and acquisitions to integrate traditional stock, derivatives and cryptocurrency trading services. In terms of cryptocurrency exchange mergers and acquisitions, cryptocurrency exchange Kraken acquired retail futures and foreign exchange trading platform NinjaTrader, and cryptocurrency exchange Coinbase is actively promoting the acquisition of cryptocurrency derivatives exchange Deribit. In terms of the integration of cryptocurrency exchanges and payment institutions, cryptocurrency trading platform Swapped.com acquired Web3 payment infrastructure company Kado Software, and crypto payment company Ripple acquired securities brokerage company Hidden Road to provide institutional investors with complete fixed income prime brokerage services. In terms of the integration of cryptocurrency exchanges and stock exchanges, British cryptocurrency exchange Archax acquired Globacap Private Markets, a broker regulated by the US Financial Industry Regulatory Authority FINRA and SEC, and securities trading platform Robinhood is integrating cryptocurrency trading platform Bitstamp. In addition, it is reported that there is a possibility of mergers and acquisitions between crypto asset exchange Coinbase and the New York Stock Exchange and Chicago Mercantile Exchange in the United States.

Overall, in 2024, cryptocurrency ETFs opened up formal investment channels for cryptocurrency investment, tokenization greatly improved the efficiency of financial asset investment transactions, and the merger of cryptocurrency exchanges and stock exchanges, and the cooperation between cryptocurrency service providers and securities brokers opened up investment transactions in financial assets and cryptocurrencies, which are comprehensively promoting the integrated development of the crypto market and the capital market.

Trend Four: Regulatory policiesShift to supporting the innovative development of cryptocurrencies

The main line of the U.S. stablecoin and cryptocurrency policy has shifted to "supporting innovative development." After Trump took office as the US President again, he signed the executive order "Strengthening the US Leadership in Digital Financial Technology", established the Presidential Digital Asset Market Working Group, and actively promoted the formulation of the US Stablecoin and Cryptocurrency Regulatory Act. The main policy line has shifted from the previous strict restrictions to "supporting innovative and standardized development". At the same time, the attitude of US financial regulators towards financial institutions participating in stablecoin and cryptocurrency activities has also undergone a major change. Since March 2025, the US Federal Deposit Insurance Corporation, the Office of the Comptroller of the Currency, and the Federal Reserve have successively revoked the previous prior regulatory filing/approval requirements for banking institutions to participate in cryptocurrency-related businesses, allowing banking institutions to independently engage in cryptocurrency activities permitted by law while doing a good job of risk management.

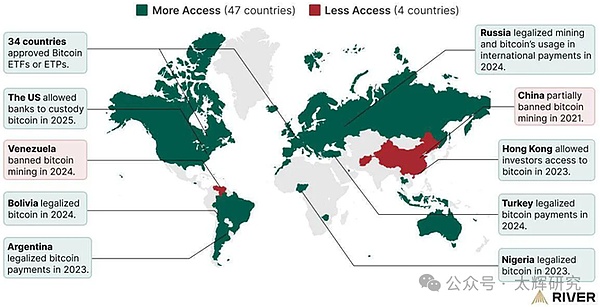

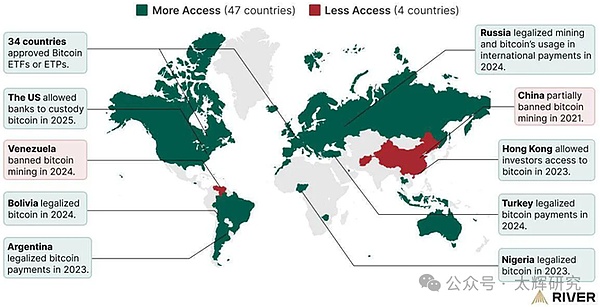

Major countries have accelerated the promotion of stablecoin and cryptocurrency regulatory legislation. Although Malta, the United Arab Emirates, Singapore, the European Union, Hong Kong, China and other countries and regions have formulated and issued regulatory laws and regulations related to stablecoins and cryptocurrencies since 2018, the policy shift of the United States on stablecoins and crypto assets since 2025 has had a great driving effect, activating the regulatory legislative intentions of other countries. Recently, countries such as the United Kingdom, Australia, Japan, South Korea, Turkey, Argentina, Nigeria, the Cayman Islands, and Panama have issued or announced bills to promote the regulation of stablecoins and cryptocurrencies. According to RIVER statistics disclosed by Cointelegraph, 47 countries in the world have relaxed or simplified the regulation of cryptocurrencies since 2020, and only 4 countries have tightened regulation or completely banned cryptocurrency transactions and mining activities. At the same time, since 2019, countries and regions such as Japan, Hong Kong, China, Dubai, the United Arab Emirates, and the United States have actively explored the issuance and trading of stablecoins and tokenization through regulatory sandboxes to better balance risk prevention and innovative development.

Chart4:2020Changes in cryptocurrency regulatory policies in major countries around the world since 2019

Among them, Australia plans to introduce cryptocurrency regulatory legislation in 2025 to regulate stablecoin issuers, cryptocurrency exchanges, custody services, and brokerage platforms, and reduce the de-banking behavior of financial institutions (i.e. restricting the provision of services to cryptocurrency companies); the UK Treasury issued a statement saying that the UK plans to cooperate with the United States to promote innovative development in the encryption industry, and will formulate new regulations for crypto asset service providers such as Bitcoin and Ethereum through the "Transformation Plan" to enhance investor confidence and promote growth; the Japanese Financial Services Agency reviewed and approved the "Report of the Working Group on Fund Settlement Systems, etc.", while strengthening user protection when exchanges go bankrupt and implementing the "Travel Rules" for stablecoin transactions, it allows the development of cryptocurrency intermediary business and broadens the scope of asset investment of stablecoin issuers to better achieve a balance between security compliance and innovative development.

The United States leads governments around the world in promoting strategic reserve investment in cryptocurrencies. In March 2025, Trump signed an executive order announcing the establishment of a "strategic bitcoin reserve" and a "digital asset inventory", which would include about 200,000 bitcoins (worth about $20 billion) confiscated by the government through judicial procedures and administrative fines into the reserve, and explore increasing holdings of bitcoin through a budget-neutral strategy. At the same time, the U.S. Congress is advancing the formulation of the "Bitcoin Strategic Reserve" bill. Driven by the United States, some countries are also considering promoting investment in bitcoin reserves. In April 2025, Binance CEO Richard Teng said in an interview that Binance has been providing advice to multiple governments on establishing strategic bitcoin reserves and formulating crypto asset regulations. In addition, sovereign wealth funds in France, Norway, Saudi Arabia, Singapore, Brunei and other countries are increasing their investment in cryptocurrencies. Recently, six digital economy industry associations in the UK jointly wrote to the Prime Minister's Office, calling on the government to appoint a cryptocurrency envoy and formulate a special development plan for digital assets, emphasizing that the UK needs to "strengthen strategic focus" to promote investment, employment and economic growth in the crypto field.

Overall, driven by the new policy of the Trump administration on stablecoins and cryptocurrencies, countries are actively promoting stablecoin and cryptocurrency regulations, which greatly reduces the policy uncertainty of the development of the stablecoin and cryptocurrency market; the United States has led governments and sovereign wealth funds to increase strategic reserve investment in cryptocurrencies such as Bitcoin, taking a big step in promoting the formalization and legalization of cryptocurrencies, alleviating the worries of the integrated development of traditional financial institutions, capital markets and stablecoins and crypto ecosystems, marking the maturity of cryptocurrencies as an asset class.

Future Outlook

Stablecoins and cryptocurrencies have been increasingly recognized in improving the efficiency of financial services, reducing the cost of financial services and promoting the development of financial inclusion. The integrated development trend of stablecoins, cryptocurrencies and traditional financial systems will be difficult to reverse. In the future, with the iteration and maturity of blockchain technology and the accelerated improvement of regulatory frameworks in various countries, this integration trend will accelerate in depth, the integrated business ecosystem will be richer, and will ultimately have a significant impact on the global financial development pattern and economic development model.

Stablecoins and cryptocurrencies will achieve complementary development with central bank digital currencies, comprehensively improve payment efficiency and reduce payment costs, reconstruct the global payment system, and drive the development of decentralized finance (DeFi). Although some countries only supported central bank digital currency experiments in previous years, and some countries focused on supporting the innovative development of stablecoins and cryptocurrencies, most of them have recently turned to a model that supports the co-development of the three. The European Union, Japan, the United Arab Emirates, Singapore, and Hong Kong, China, typical representatives of supporting integrated development, while promoting the application and testing of central bank digital currencies, have clarified or are formulating regulatory regulations for stablecoin and cryptocurrency activities to regulate the innovative development of stablecoins and cryptocurrencies.

With the support of technological improvement and regulatory norms, cryptocurrencies will transform from "alternative assets" to "popular assets" and eventually upgrade to "infrastructure", reshaping the global financial landscape.According to Triple A data, there will be 560 million cryptocurrency holders in the world in 2024, with a holding rate (penetration rate) of about 6.9%. However, research data from relevant institutions since 2025 show that the cryptocurrency holding rates in the United States, South Korea, Singapore, and the United Arab Emirates have all exceeded 20%. At the same time, Bitwise data shows that in the first quarter of 2025, listed companies purchased a total of 95,431 bitcoins, an increase of 16.11% from the previous month. The number of listed companies holding bitcoins reached 79, an increase of 17.91% from the previous month. Some companies use bitcoins as financial reserve assets. These show that with the integration and development of cryptocurrency and the financial system, cryptocurrency has in fact become a popular asset. Tokenization is a revolutionary innovation following ETFs, and is penetrating into all types of assets, including stocks, bonds, real estate, and artworks, and will eventually transform the asset trading and settlement system. The ideal goal of tokenization is to achieve "everything can be tokenized" and enable capital to flow around the world without friction. Although it will take time to achieve this goal, as the World Economic Forum pointed out in December 2024, the interest of major global financial institutions in asset tokenization continues to heat up because tokenization can reduce costs, improve efficiency, and reduce settlement risks. The attractiveness of Singapore's tokenization project Project Guardian, Hong Kong's tokenization project Project Ensemble, and BlackRock's BUIDL fund project shows that the tokenization of real assets has reached a turning point from on-chain experiments to practical applications.

Of course, in this process, countries need to promptly improve policies, regulations and regulatory frameworks, and at the same time improve the global regulatory governance mechanism in view of the natural global attributes of stablecoins and cryptocurrencies. On the one hand, the current financial regulatory system is built according to the centralized financial service model, and the decentralization of the cryptocurrency system means that it may not work in the end to regulate cryptocurrencies in full accordance with the principle of "same activities, same risks, same rules". On the other hand, current financial regulation and governance are nationalized, while cryptocurrencies and decentralized finance are global, requiring international regulatory organizations to pay more attention to and focus on solving the problem of "globalization of business and nationalization of governance" and guard against the hegemony of the United States in the global cryptocurrency governance system.

Alex

Alex