Source: Taihui Research

WLFI (World Liberty Financial), a crypto institution supported by the Trump family of the United States President, launched the USD stablecoin USD1 and released a governance proposal on April 8, planning to start launching it on the Ethereum mainnet. USD1 is guaranteed by the value of short-term U.S. Treasury bonds, U.S. dollar deposits and other cash, ensuring that each USD1 can be exchanged for 1 U.S. dollar at a ratio of 1:1 at any time. USD1 directly targets the two major stablecoins, USDT issued by Tether and USDC issued by Circle, but it has a strong Trump family color, which has attracted widespread attention in the crypto asset market.

The launch of USD1 is not only a further expansion of the Trump family's crypto asset business map, but also a key step for the United States to improve its crypto asset strategic map. From the perspective of business model, USD1 has a distinct "high-profile" color. It selects mainstream public chains such as Ethereum and Binance Smart Chain as the first issuance chains, focuses on B-side users such as institutional investors and sovereign wealth funds, and attaches great importance to the audit and transparency of reserve assets. With the brand effect of the crypto-asset-friendly president, the above model will help USD1 to expand its market size and seize market share in the short term, and further strengthen the United States' dominant position in the global stablecoin market in the long term.

However, from the perspective of industry development practice, there is still uncertainty about the specific development of USD1 in the future. First,USD1's strong Trump family label has also aroused concerns about its potential conflicts of interest. In addition, the Trump family has recently made huge profits from the stock price fluctuations caused by the tariff policy adjustment. More and more members of Congress are calling for an investigation into Trump's insider trading and market manipulation surrounding the tariff policy adjustment;Second,USD1's customer positioning is institutional investors, and the scale of issuance transactions is difficult to increase as quickly as serving individual holders;Third,the leading stablecoins USDT and USDC have already created a rich business ecosystem, and it is unclear how USD1 will transform its brand advantage into business scenarios.

Article source: Shen Jianguang, Zhu Taihui, Wang Ruohan, Trump family launches digital stablecoin: model and impact, "First Financial Daily", April 20, 2025.

1. The launch of USD1 improves Trump's strategic map of crypto assets

Trump will actively promote the "new policy of crypto assets" after taking office. The "ten supporting development policies" of crypto assets he launched not only conform to the general trend of global and US crypto regulation from strict restrictions and suppression to "responsible innovation", but also imply the consideration of the national strategic level of strengthening the international status of the US dollar. The launch of the new stablecoin USD1 is not only a further expansion of the Trump family's crypto asset business map, but also a key step for the United States to actively improve its strategic map of crypto assets.

1. The launch of USD1 will comprehensively strengthen the connection between the Trump family's cryptocurrency and the traditional financial market.

WLFI is essentially Trump's family business, and the stablecoin USD1 it issues is essentially a stablecoin supported by the US President, that is, it has a strong Trump family color. WLFI was established in October 2024 and has raised $550 million in funds through the issuance of digital tokens so far. WLFI claims to be inspired by Trump to promote the large-scale adoption of stablecoins and DeFi (decentralized finance), especially US dollar stablecoins, to ensure the dominance of the US dollar. According to the official website of WLFI, DT Marks DEFI, an entity affiliated with Trump and his family members, holds a 60% stake in WLF Holdco, the parent company of World Liberty Financial, holds 22.5 billion WLFI tokens, and is entitled to 75% of the proceeds from the sale of WLFI tokens (excluding operating costs, reserves, etc.).

USD1 is an important part of the Trump family's crypto asset business, and its launch will connect the Trump family's crypto asset business with the traditional financial market. The Trump family is involved in almost every field of the crypto industry: investing in NFTs and digital collectibles; a decentralized financial project (WLFI); a Bitcoin mining plan; a pair of memecoins, one "Trump Coin" belonging to the president, and one "Melania Coin" belonging to the first lady; Trump Media & Technology Group has also launched ETFs and related products in cooperation with Crypto.com, planning to invest in digital assets and securities related to the theme of "Made in America". The launch of the stablecoin USD1 makes the Trump family's crypto business more complete. On the one hand, USD1 is a payment tool for investment and trading in the cryptocurrency market, and on the other hand, it will focus on issuing to institutional investors, which will help the Trump family fully connect its own crypto assets with the traditional financial system.

2. The launch of USD1 makes the strategic map of the United States supporting the innovative development of crypto assets more complete.

First, Trump's crypto asset development strategy includes three aspects of deployment. After taking office, Trump signed two executive orders, "Strengthening the United States' Leadership in Digital Financial Technology" and "Establishing a Strategic Bitcoin Reserve and U.S. Digital Asset Inventory", and made clear deployments in three aspects: "Promoting the development and growth of globally legal dollar-backed stablecoins through action", "Prohibiting the establishment, issuance, circulation and use of central bank digital currencies (CBDCs) within the jurisdiction of the United States", and the United States' "Strategic Bitcoin Reserve and Digital Asset Reserve". At the same time, the President's Digital Asset Market Working Group was established to coordinate the implementation of the above strategic deployments and accelerate the formulation and promulgation of U.S. stablecoin and crypto asset regulatory regulations. At present, the United States' CBDC is basically stagnant, and the United States' strategic Bitcoin reserves and digital asset reserves are promoting legislation, while exploring implementation plans for the U.S. government to increase its purchase of Bitcoin. The launch of USD1 will be a concrete measure to implement the Trump administration's strategic deployment of "taking action to promote the development and growth of legal dollar-backed stablecoins around the world".

Second, the US dollar stablecoin is an important tool to link crypto assets with the US dollar system. In the current crypto asset system, more than 95% of stablecoins are stablecoins pegged to the US dollar, and the US dollar acts as a "unit of account". Stablecoins are the settlement work of other crypto asset investment transactions, and at the same time perform the "payment settlement" function in physical transactions and cross-border trade payments. Various crypto assets such as Bitcoin and Ethereum have gradually become optional investment assets, performing the "value storage" function. At present, about 80% of the reserve assets of stablecoins have been invested in US Treasury bonds. Through the cycle of "buying stablecoins-supporting crypto asset transactions-investing in US Treasury bonds", the US dollar has returned to the US financial market and is still affected by the regulation of US monetary policy.

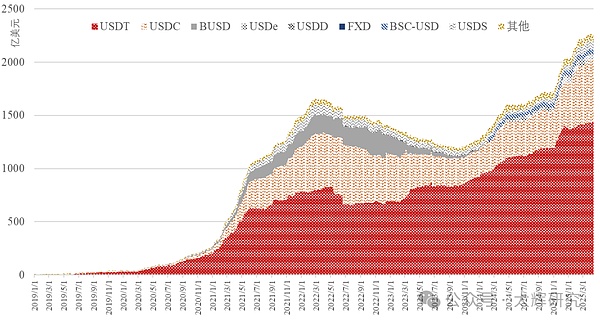

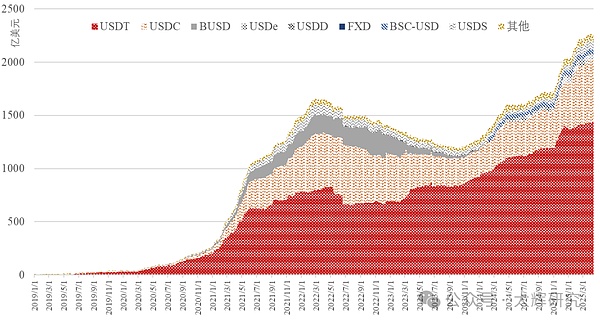

Chart1: Global stablecoin supply scale and structure

Third, the launch of the US dollar stablecoin USD1 will comprehensively strengthen the United States' dominant position in the stablecoin market.In the current global stablecoin market, the largest stablecoin is USDT issued by Tether (with an issuance scale of more than 150 billion US dollars), and its market share has remained above 60%. Although USDT is a US dollar stablecoin, Tether is not an American company, which affects the US's control over the stablecoin market. The launch of USD1, together with the world's second largest stablecoin, USDC issued by Circle (with an issuance scale of about US$56 billion), will help increase the market share of US dollar stablecoins issued by local institutions in the United States and enhance the US's influence on the stablecoin and crypto asset markets.

3. USD1's presidential family label has also triggered market concerns about conflicts of interest and unfair competition.

Currently, Trump is pushing the US Senate and House of Representatives to speed up the formulation of stablecoin regulatory regulations and federal regulatory authorities to improve the unified regulatory mechanism. At present, the "GENIUS Act", a new stablecoin regulatory bill submitted by the US Senate in February, is likely to be passed in June (the current Senate support rate is 75%). With the implementation of the stablecoin regulatory bill and regulatory mechanism, the Trump family label behind USD1 may receive priority treatment in license acquisition and market access, leading to unfair competition and conflicts of interest in the market.

First, the Trump family's layout of stablecoin and cryptocurrency business is indeed inconsistent with the requirements of US government employees. According to the United States Code, federal government employees are prohibited from participating in any government affairs that may directly or substantially affect their own financial interests (including the interests of their spouses, minor children or affiliated companies). In addition, the rules of the US Office of Government Ethics (OGE) also require that government employees avoid matters involving their financial interests. While Trump is pushing the US stablecoin and crypto asset policy to "support innovative development", his family is directly or indirectly involved in stablecoin and crypto asset projects, which is equivalent to "being both a referee and a player", which is indeed inconsistent with the above-mentioned US regulations.

Second, coupled with the impact of the recent "tariff war", criticism of the Trump family's conflicts of interest and insider trading has increased significantly. Recently, Bloomberg pointed out based on public data analysis that even considering the market volatility caused by the "tariff war" provoked by Trump, the cryptocurrency project has brought the Trump family nearly $1 billion in book profits. On April 2, U.S. Representative Waters accused Trump of using political influence to promote the family business to issue stablecoins for profit, and warned that if Congress does not resolve its conflicts of interest, it should veto the relevant bills. On April 2, Trump signed an executive order to implement a new reciprocal tariff policy, and then implemented a suspension policy to drive the stock price of Trump Media Technology Group (TMTG) up 22% in one day, further triggering criticism from many parties. Recently, many U.S. congressmen and state legislators have asked the U.S. Securities and Exchange Commission (SEC), the Government Accountability Office (GAO), etc. to thoroughly investigate Trump's manipulation of the stock market and conflicts of interest in the crypto market.

2. USD1 aims to seize market share through high-profile institutional services

1. In terms of market positioning and customer selection, USD1 is mainly aimed at institutional investors and sovereign fund investors, aiming to strengthen the connection with the traditional financial system.

Different from the existing stablecoins (such as USDC, USDT) that target retail investors, USD1 is mainly designed for institutional investors and sovereign investors.This positioning shows that the Trump family hopes to enter the ToB market and traditional financial market through USD1, challenge the application of existing stablecoins in cross-border payments and DeFi through institutional models, and reshape the existing stablecoin market structure. WLFI co-founder Witkoff also emphasized its uniqueness: "USD1 intentionally combines the credibility of the traditional financial system with the technical advantages of the DeFi protocol, which is a model that algorithmic stablecoins and anonymous DeFi protocols cannot replicate." "Sovereign investors and large institutions can confidently integrate it into their strategies for seamless and secure cross-border transactions." WLFI also plans to cooperate with DeFi projects such as Sui, Ondo Finance, Chainlink and Aave to explore how to more closely integrate blockchain finance with traditional finance.

2. In terms of issuing chains and custodians, USD1 better meets the needs of the ToB market and financial institutions by cooperating with mainstream public chains and custodians.

In terms of issuing blockchain selection, the first batch of USD1 will be issued on Ethereum and Binance Smart Chain (BSC). Among them, Ethereum is the earliest blockchain to apply smart contracts and is also the core of the current DeFi ecosystem; BSC is the blockchain network launched by Binance, the largest cryptocurrency exchange, and occupies an important position in the crypto market due to its low transaction fees and high throughput.

In terms of assets and custody, USD1's reserve assets will be held by BitGo, a California-based crypto asset solution and infrastructure provider. BitGo provides custody, wallets, pledges, transactions, financing and settlement services, providing security for about 20% of the Bitcoin transaction value on the public chain, and should be the world's largest crypto asset custodian. Mike Belshe, CEO of BitGo, said that once the project goes online, the company's 2,500 institutional clients will be able to trade USD1 stablecoins immediately.

3. In terms of regulatory compliance and asset transparency, USD1 will attach great importance to stablecoin license applications and audit disclosures to alleviate the risk concerns of institutional clients.

WLFI stated that USD1 will be "fully supported by a reserve portfolio audited regularly by a third-party accounting firm", but did not disclose the details of the audit firm. From the development practice of stablecoins in recent years: Circle, the issuer of USDC, has applied for US money service and money transmission business licenses, and publishes audited reserve asset certificates and reports every month.

From the industry perspective, Circle publishes information on the composition of assets on its website, with a higher frequency of updates. It has also recently released a breakdown of the Treasury bonds held by the reserve pool. Compliance guarantees have pushed USDC's market share from 20% in mid-2024 to the current 27.5%. The USDT issuer Tether is registered in non-US regions, has obtained relatively few regulatory authorizations and licenses, and has low transparency on the status of its reserve assets. It is currently facing increasing pressure to be delisted in regions/countries with strong stablecoin regulation such as Europe, and faces increasing regulatory compliance pressure. Its market share has also dropped from around 70% in mid-2024 to around 62.5%.

Chart 2: Comparison of the operating modes of USDT and USDC

The experience of USDC and USDT shows that improving the compliance and transparency of stablecoins is, on the one hand, a response to the need to strengthen the global supervision of stablecoins and digital assets, and on the other hand, it is also a need to gain customer trust and open up development space. ToB services need to pay more attention to compliance and transparency. It is expected that WLFI will learn from Circle's experience, actively apply for regulatory licenses for USD1 issuance transactions, improve the independent audit of reserve assets, and win the trust of institutional customers with compliance and transparency. III. Development Prospects and Impact Outlook of USD1

As global digital currency competition intensifies, USD1 has injected new impetus into the development of the US dollar stablecoin by relying on the brand effect of the presidential family, cooperation with mainstream public chains, institutional services, and high attention to compliance and transparency. It is expected to reshape the current competitive structure of the stablecoin market and further consolidate the United States' dominant position in the global stablecoin market.

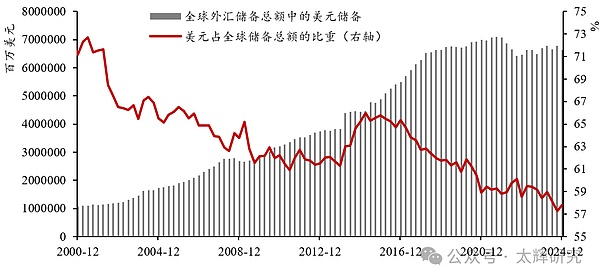

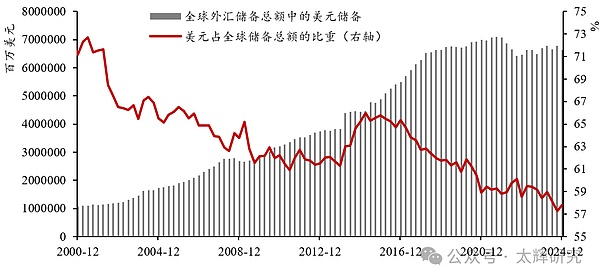

1. USD1's business model has created a differentiated competitive advantage and is expected to reshape the pattern of the stablecoin market.USD1 has obvious differentiated competitive advantages. The customer positioning for institutional investors and sovereign investors, the brand effect of the presidential family, the cooperation with mainstream public chains and head exchanges, and the integration of regulatory compliance and asset transparency have made USD1 a "new category" in the global stablecoin market. Whether compared with USDT or USDC, these competitive advantages of USD1 are very obvious, and also open up its future development potential. In order to expand the market size and increase market share, USD1 is expected to initially leverage its competitive advantages to focus on opening services for sovereign wealth funds and traditional financial institutions, and then further counterattack the ToC retail market through the support of head exchanges and DeFi ecological scenarios. 2. USD1 is in line with the US stablecoin development strategy and is expected to enhance the US's dominant position in the stablecoin market. Trump's "Cryptocurrency New Deal" appears to have a strong family business interest color, but behind it is to reverse the downward trend of the US dollar's position in the global monetary system. The latest data released by the International Monetary Fund (IMF) shows that the share of the US dollar in global official reserves fell to a historic low of 57.8% in the fourth quarter of 2024 (the share of 57.3% in the third quarter of 2024 was the lowest level in nearly 30 years since 1995). Trump wants to build the United States into the world's crypto asset capital and Bitcoin superpower, and there are greater national strategic considerations behind it - actively promoting the development of the crypto asset market, using the linking role of the US dollar stablecoin in the crypto asset market and the traditional financial system, and consolidating and enhancing the status of the US dollar in the global monetary system through the cycle of "buying stablecoins with US dollars - supporting cryptocurrency transactions - investing in US Treasury bonds". Chart 3: The scale and proportion of US dollar reserves in global foreign exchange reserves

From the perspective of development strategy, the development of the US stablecoin market must achieve both the dominance of US dollar stablecoins and the dominance of US issuers. ToC's USDC is undoubtedly an optional object for the United States to implement this strategy, and it also needs to develop ToB services' USD1 to form the linkage and market coverage of ToC and ToB stablecoin services. At the same time, USDT, the largest stablecoin, still accounts for more than 60% of the global stablecoin market, but its registered place is outside the United States and has little relevance to the United States. After the United States' stablecoin regulatory bill and unified regulatory framework are determined, it is expected that WLFI will apply for a regulatory license for USD1 as soon as possible, and expand the market size together with USDC through compliance advantages, squeezing USDT's share in the stablecoin market.

3. The development speed of USD1 and its impact on the global stablecoin market still face some uncertainties.

As Kevin Lehtiniitty, CEO of Borderless, a Web3 technology investment management company, pointed out, "It is easy to launch a stablecoin, but it is much more difficult to build a widely adopted ecosystem."

For USD1, on the one hand, USD1's customers are institutional investors and sovereign investors, and it is not easy to start issuing and trading. For example, JPMorgan Chase launched the stablecoin JPM Coin in 2019, which is also mainly used for cross-border payments of large corporate customers, securities trading payments between customers and other ToB services, but the current daily trading volume is only about 1 billion US dollars, which is significantly lower than the daily trading volume of USDT and USDC of about 36 billion and 16 billion US dollars. At the same time, many stablecoins have recently focused on expanding their services to institutional customers. For example, on April 9, the encrypted payment company Ripple acquired the institutional credit service provider Hidden Road and used the Ripple stablecoin RLUSD as collateral for the main brokerage products to enhance the competitiveness of services for institutional investors.

On the other hand, USDT and USDC have formed a rich business ecosystem. Among them, USDT has created a significant first-mover advantage by using the support of mainstream exchanges and flexible service strategies, and USDC has continuously expanded its usage scenarios and link scope by using its compliance advantages. There is also great uncertainty as to whether USD1 can transform its brand advantages into real usage scenarios and business ecosystems.

In addition, stablecoins are global in nature. Currently, USDT and USDC have accumulated a large number of users and usage scenarios outside the United States. How USD1 can quickly expand into markets outside the United States is also a practical problem.

(Shen Jianguang is the chief economist of JD Group; Zhu Taihui is the senior research director of JD Group; Wang Ruohan is a researcher of JD Group)

Catherine

Catherine