Source: Renshen Gongfen

Are US Treasuries still safe?

Last week, many investors in global fixed-income products were shocked. How could they lose two months' worth of earnings in just one week? You should know that this type of product has always been very stable, but it is not easy to make money. It really fits the old saying about fixed-income products - "making money slowly, losing money quickly".

And this time the culprit is the US Treasury, which has always been considered a safe-haven asset.

Even more frightening, there are many rumors -

King Trump is the enemy of the whole world, no one wants U.S. debt anymore

We are going to fight a financial war with the U.S., and the ultimate weapon is the U.S. debt in our hands

King Trump wants to collect interest tax from governments of countries around the world that invest in government bonds, and now everyone is selling...

It looks like that,

Last week, the U.S. saw a "triple kill of stocks, bonds and currencies"

Question 2: Why don’t we worry about the safety of financial products centered on U.S. debt for the time being?

First of all, we should know that long-term U.S. debt with a maturity of more than 10 years has actually fallen sharply in every financial crisis.

Safe-haven assets in crises

Bond investment seems simple, but in fact, it not only has a high threshold, but the deeper you go, the more you need to have a foundation in economics research. However, for ordinary investors, they only need to understand a pair of counterintuitive concepts at the beginning: Bond prices rise, yields to maturity fall, and investors make money. Bond prices fall, yields to maturity rise, and investors lose money. This is mainly because the bond maturity price is fixed, and an increase means a decrease in yield to maturity. In articles analyzing bonds, some places use "yield to maturity" and some places use "bond price". The directions of the two are completely opposite. If you really can't figure it out, remember this answer first, and you will slowly understand it later. After understanding this "counterintuitive" relationship of bonds, you can return to the topic.

Generally speaking, government bonds are safe-haven assets. After all, they are guaranteed by the state's credit. Therefore, when risks come, the first phenomenon that "bond yields fall and bond prices rise" will appear. There are two main reasons for this:

On the one hand, macro risks often lead to economic recessions, and the market's capital demand decreases, interest rates fall, and the central bank will lower the policy interest rate to stimulate the economy;

On the other hand, bonds have less risk than stocks. When stocks fall sharply, there will be funds transferred from the stock market to the bond market. leaf="">, pushing up bond prices and lowering yields to maturity.

In the past two years, my country's 10-year treasury bond yields have fallen from more than 3% to a minimum of 1.59%, which reflects the first logic.

The same is true for sudden crises in the short and medium term. At the beginning of the outbreak in early 2020, global treasury bond yields suddenly fell sharply. China's 10-year treasury bonds fell from 3.2% to 2.4%, and the United States fell to 0.5%.

But the above are mainly recessions and ordinary crises. When the crisis reaches a certain level, it will be different later.

For example, during the outbreak of the epidemic in 2020, from the outbreak of the crisis in late February to the sharp deterioration of the crisis in early March, driven by the economic recession and market risk aversion, investors bought a large number of U.S. bonds, causing the yield to fall rapidly, falling below 0.5% for the first time, setting a new historical low - all of this is in line with traditional investment logic.

However, in the second week of March, as some investors took profits and the market's expectations for policy stimulus increased, the 10-year U.S. Treasury yield rebounded strongly, rising by about 40 basis points during the week, exacerbating the losses of investors who had avoided it - the same situation as last week.

In fact, most safe-haven assets have this feature.

The most typical safe-haven asset is gold. At the beginning of the 2020 crisis, it also rose all the way like this time, but it fell for 10 consecutive days from March 9, from $1,680 to $1,473. Many people avoided the decline of US stocks and fell into the hands of seemingly safe gold.

The Japanese yen is also a traditional safe-haven asset. At the beginning of the 2020 crisis, investors sought safe-haven assets, which pushed the yen to appreciate. The USD/JPY exchange rate appreciated sharply from 111.83 on February 21 to 103.08. However, since then, the tight liquidity of the US dollar has led to a "dollar shortage", and the yen has depreciated rapidly to 111.71.

The US dollar itself could not escape the fate of big ups and downs. The US dollar index fell from 99.9 to 94.63 on March 9, and then rose to 103 on March 20. However, on the 23rd, after the Federal Reserve provided sufficient US dollar liquidity with unlimited QE, it fell again for four days to 98.34.

Safe-haven assets are not absolutely safe in a crisis. The main reason is liquidity shock. For example, the direct cause of the decline of US bonds last week was the forced liquidation of "basis trading", which has occurred in all previous crises.

Basis Trading and Liquidity Crisis

The so-called "basis trading" is to hold long US bonds while selling Treasury futures with premiums to earn this part of risk-free income.

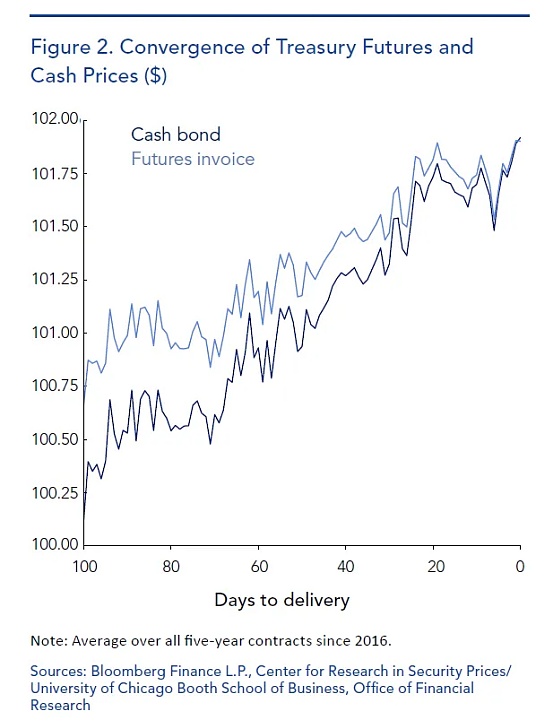

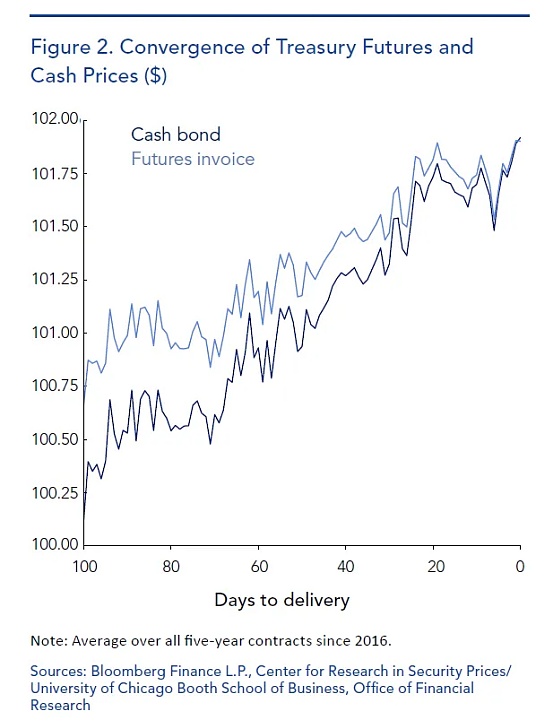

For example, at 7:00 on April 14, the yield of the US 10-year Treasury bond was 4.44% (spot price), but the trading yield of the 2505 futures contract was 4.406% (futures price). Because of the holding time cost, the general futures yield is always lower than the spot yield (that is, the futures price is higher than the spot price). This higher part is called "basis".

But on the delivery date, the prices of futures and spot will converge. In this process, either the spot yield will decrease or the futures yield will increase. No matter which way it goes, as long as the basis returns to zero, "basis trading" is a sure win.

Specifically, basis trading is divided into three steps: first, buy treasury bonds (equivalent to shorting the spot yield of treasury bonds), and at the same time mortgage these treasury bonds to financial institutions, use financing to short futures prices (i.e., go long on treasury bond futures yields), and earn the risk-free income of the intermediate price difference.

However, the basis is very small, and high leverage is required to have sufficient income. In addition, it is basically risk-free income, so treasury bond basis trading generally has a leverage of more than 50 times.

Basis trading is a sure win in the normal market, but it is not necessarily the case when the financial crisis comes.

In a financial crisis, stocks usually start to fall first. Many funds are leveraged. When the stocks fall to a certain level, the margin must be recovered, and investors need to sell other investment products. Since government bonds generally rise at this time and are profitable, they often become the first products to be sold.

If the crisis develops and more people sell government bonds, the price of government bonds will fall rapidly, and the basis will be lower than the repurchase rate, turning a stable profit into a stable loss. The selling force will be further increased, and there may be a divergence between futures prices and spot prices. At this time, both the futures and repurchase markets will require more collateral. If the hedge fund cannot meet the requirements, the lender will confiscate the collateralized government bonds and sell them to the market, triggering a further increase in bond yields, forming a feedback amplification.

The reason why basis trading can usually make a "stable profit" is that financial institutions bear the cost of liquidity in order to pay financing interest. Once a crisis breaks out, this cost is sharply magnified, and naturally the transaction will not be established.

Therefore, the size of the liquidity shock can be judged by the difference between the implied repurchase rate and the federal funds rate. Last Thursday, after Trump announced a 90-day suspension of reciprocal tariffs, the CTD implied repurchase rate was only 20-30 basis points higher than OIS, which is far lower than the extreme level of more than 200 basis points in 2020 and is still within a controllable level.

In addition, it can also be judged from the spread between 2-year and 10-year Treasury bonds, because 2-year Treasury bonds are equivalent to cash, basically have no leverage, and are mainly held by foreign governments. Last week, the 2-year bond remained basically unchanged, and the term spread widened, which also shows that the main reason for the decline in long-term bonds is the liquidity shock caused by ordinary trading institutions.

If it is just a liquidity shock, the Federal Reserve has too many tools. It can completely ease the overall liquidity pressure by relaxing bank leverage restrictions. The Federal Reserve will not make the same mistake twice. In 2020, the Federal Reserve even personally purchased high-grade U.S. Treasury ETFs for liquidity.

However, the market's concerns are not without reason. The real crisis is not the decline of long-term bonds, but the "stock, bond and foreign exchange" triple kill - has this "triple kill" appeared before?

Take the 2020 stock market crash as an example. The crisis began on March 21. In the first two weeks, U.S. stocks and the U.S. dollar fell together, but U.S. bonds rose; in the third and fourth weeks, 10-year Treasury bonds and the S&P 500 fell together, but the U.S. dollar index rose; in the last week, the U.S. dollar and U.S. bonds fell together, but U.S. stocks began to rebound.

One of the three always rose, reflecting the liquidity shock. Funds hid in the crisis, but did not leave the U.S. dollar system.

In particular, the two safe-haven funds, the U.S. dollar and U.S. bonds, fell together. There have only been four times in history, for a total of seven days. Usually, after the liquidity crisis has been greatly alleviated, safe-haven assets flock to risky assets, but this time it is completely inconsistent.

The triple kill of "stocks, bonds and currencies" only means one thing - Funds are leaving the US dollar system, such as the surge in gold, euro and yen last week. Therefore, former Treasury Secretary Yellen used "crazy self-mutilation" to describe the tariff policy this time.

Many self-media began to associate whether countries around the world will leave US dollar assets from this time, and the US dollar empire will collapse?

But again, the proportion of foreign funds selling is not high. The latest Federal Reserve custody data shows that foreign holdings of US debts only decreased by US$3.6 billion from April 2 to 9, and the average duration of official holdings is only 5 years, so the selling pressure may be limited.

In fact, the "triple kill" only occurred on April 10th. U.S. bonds began to fall on the 7th, and the U.S. stock market had stopped falling on the same day. From a weekly perspective, the U.S. stock market actually rose by 5.7% last week, and there was no "triple kill". It reflected more of the characteristics of a liquidity crisis.

So my answer is still very clear. Maybe one day in the future, but the conditions are not ripe now. The reason is still the reason for this tariff war and trade imbalance.

Can the RMB replace the U.S. dollar?

Many netizens like to use "war thinking" to think about financial issues, but in the financial market, everyone faces a common enemy - risk.

China holds more than 700 billion US dollars of US debt. Last year, when the financial market was booming, it sold more than 50 billion in a year, less than 7%. If China launches an "attack" on US debt, such as selling a large number of US debt in a short period of time, it will inevitably trigger a sell-off by global investors, which will indeed cause the collapse of US debt. But in fact, not much can be sold, and all of them are smashing their own goods. These are the wealth accumulated by foreign trade companies through years of hard work.

Moreover, China holds less than 2% of US debt, and a large amount of US debt is in the hands of global investors. The collapse of US debt is equivalent to the collapse of the global financial market and the global economy will regress 20 years. For every 1% decline in global economic growth, the number of poor people will increase by 100 million and the number of deaths will increase by 1 million. This is no different from launching a war.

The actual situation is more complicated than imagined. If China's economy does not undergo major structural changes in the future, it will be difficult to reduce the proportion of US debt held.

This is mainly because, in international trade, the currency used for settlement is usually determined by the buyer. If China's position as a global manufacturing center does not change, the surplus will definitely bring in a large amount of US dollars. After enterprises sell foreign exchange to the central bank, the central bank cannot keep it in its hands. Because the US dollar has been depreciating, there is still an interest rate of more than 4% for buying US debt, and the yield for buying Japanese bonds is only 1 point. The issuance volume of bonds in other countries is not enough.

Of course, you can also buy gold, but if everyone buys gold, the price of gold will go up. It is still an interest-free asset. US debt has a high interest rate to hedge against fluctuations, and the fluctuation of gold is a pure loss.

Also, where do you put the gold you bought? If you want to ship it back, the deficit country may not have that much. If you can't ship it back, it means that your wealth is in the hands of other countries.

So the fundamental reason lies in the surplus of US dollars in international trade. The United States is the largest global demand, and everyone has to buy US debt. China has held as little US debt as possible.

This is the same as debt in reality. A huge debt is often the result of the creditor wanting to go bankrupt, and the creditor does not want it to collapse. We are born to be the defenders of the international order. This is not an image issue, but an interest issue.

Is it possible to unite with other countries and use other currencies in international trade?

Of course it is possible, and our country has been working hard, but the root of the problem is that we are a producer, and our production capacity is prepared for the world, so there must be a surplus. If we use RMB for settlement, the RMB we spend must be less than the RMB we receive. But only we can issue RMB. The country now uses "currency swaps" to solve this problem, but the amount is far from enough, and the currencies of the countries we like may not be willing to exchange, and the currencies of the countries we are willing to exchange are not what we like. This is a paradox.

The problem lies in consumption. Only when you become a consumer and buy things from other countries, and the trade is balanced, can the RMB go abroad.

In the past, people often said that Americans issued some money and brought all the real goods back home, making a lot of money. In fact, if there were such a good thing, this tariff war would not happen. Everything has a price to pay. The government's fiscal deficit, excessive debt consumption by the people, the widening gap between the rich and the poor, and the decline of the manufacturing industry are all the costs of the dollar's international reserve status.

So the status of an international reserve currency is a result, not a wish or a goal to strive for. This time, the euro appreciated the most, but are Europeans happy? No, because the EU has a large trade surplus with the United States, and its export competitiveness has declined. If the renminbi begins to appreciate, our GDP will soon surpass that of the United States. The spectators will be happy, but the export companies will cry. Only when the dollar appreciates, the American people will not feel too bad, because they are importers and consumers, and prices are cheaper.

If the renminbi wants to become a global reserve currency, we must become a consumer country. Once we become a consumer country, it is equivalent to copying the current path of the United States.

, are we willing?

The problem is now clear. The United States does not want to be just a consumer, so we also need to increase the domestic demand market and change accordingly. One day they find that the manufacturing industry cannot return and prices cannot be controlled, and they turn back to reduce tariffs, and we can do business well again. We need to increase the adaptability of the economic structure. The idea of financial warfare is just a fantasy and is not a solution to the problem.

Four suggestions for recent configuration

Finally, let me talk about some practical financial investment views:

First, the crisis of long-term bonds has not passed. Since the market has seen that bonds are the "weakness" of Trump, this may be attacked repeatedly in the future, causing bonds, mainly long-term bonds, to increase in volatility, but they will not break through the upper limit, and the crisis will not get out of control, because the Fed has too much in its toolbox.

. Since the market has seen that bonds are the "weakness" of Trump, this may be attacked repeatedly in the future, causing bonds, mainly long-term bonds, to increase in volatility, but they will not break through the upper limit, and the crisis will not get out of control, because the Fed has too much in its toolbox.

. Since the market has seen that bonds are the "weakness" of Trump, this may be attacked repeatedly in the future, causing bonds, mainly long-term bonds, to increase in volatility, but they will not break through the upper limit, and the crisis will not get out of control, because the Fed has too much in its toolbox.

Secondly, looking at the credit of the US dollar, mainly looking at short-term bonds. The volatility of long-term bonds is caused by their speculative nature. Short-term bonds are more affected by the "gravity" of reality, have less investment, less leveraged funds, and are relatively stable. In the stock market crash in March 2020, only the volatility of short-term bonds was relatively stable among all "safe-haven funds".

Third, gold is not absolutely safe. Gold is the only safe-haven asset now (US short-term bonds count as half), and funds are pouring into this direction, resulting in a large-scale influx of speculative funds. But safe assets are all about safety, and rising too fast is itself a kind of insecurity. During the Chongqing bombing during the Anti-Japanese War, not many people who stayed on the streets were killed, but tens of thousands of people who hid in air-raid shelters suffocated to death due to lack of oxygen. Being "suffocated" by safe assets is a typical phenomenon of liquidity crisis.

Finally, the center of the storm is temporarily safe. This time, the support for the market is part of the political mobilization. The national team made no secret of it. It is just for the market to see, similar to when a bank runs, the money is placed on the counter for withdrawal to build the confidence of global investors.

Of course, not all A shares, but only a small part of the index stocks.

Anais

Anais