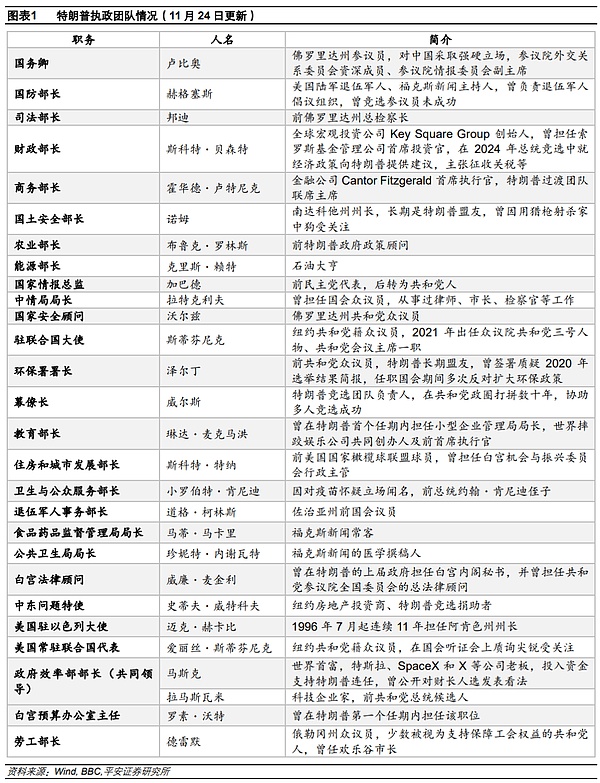

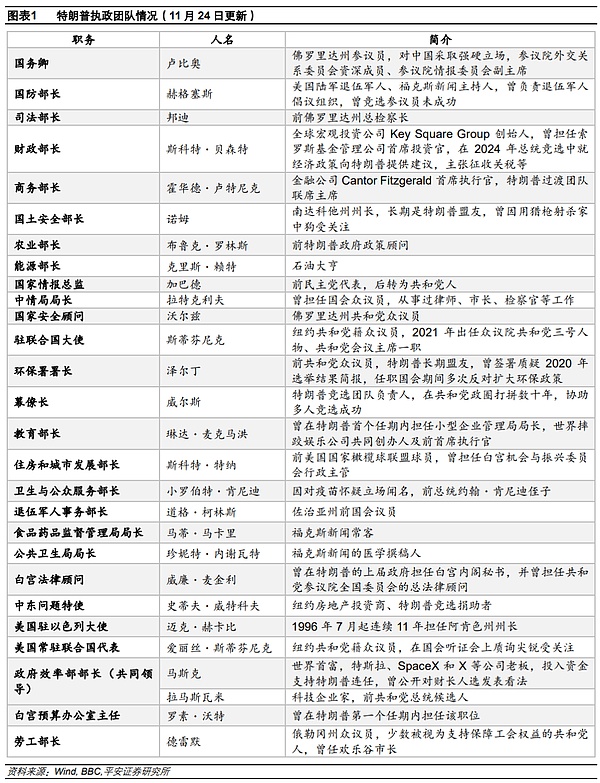

Core Views

The twists and turns and impacts of Trump's selection of Treasury Secretary. Trump has gone through a lot of speculation and weighing in on the selection of Treasury Secretary. On November 19, Trump nominated Howard Lutnick as Secretary of Commerce. On November 22, Trump nominated Scott Bessant as Secretary of the Treasury. Trump's appointments of Treasury Secretary and Commerce Secretary correspond to the policy combination of "aggressive trade + moderate finance". In terms of trade, Lutnick, as a trade hawk, may promote a tougher trade protectionist stance. In terms of finance, although Bessant supports Trump's "de-regulation and tax cuts" policy, he also attaches importance to controlling inflation and balancing the deficit. Bessant proposed an economic policy proposition known as the "333 Plan", which is to reduce the budget deficit to 3% of GDP by 2028, achieve 3% GDP growth through deregulation, and increase daily production by 3 million barrels of oil or equivalent energy. In the short term, investors' attention may shift from trade protection risks to a more sustainable outlook for the U.S. economy and debt, and both U.S. stocks and U.S. bonds are expected to be boosted.

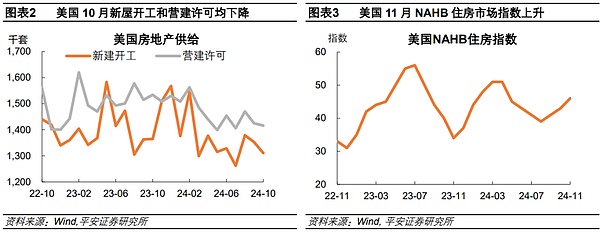

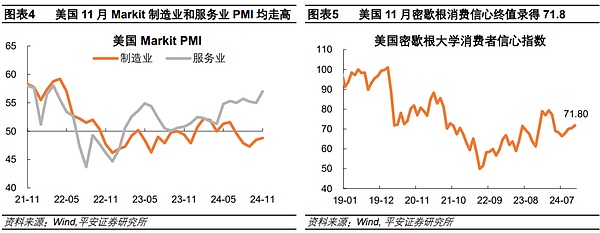

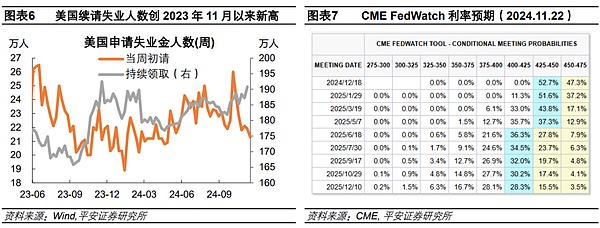

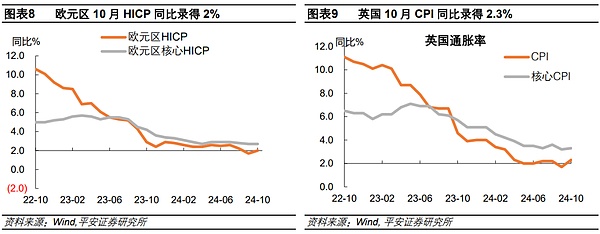

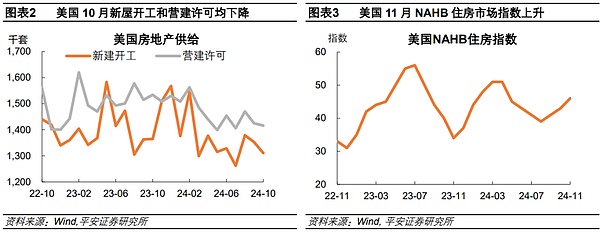

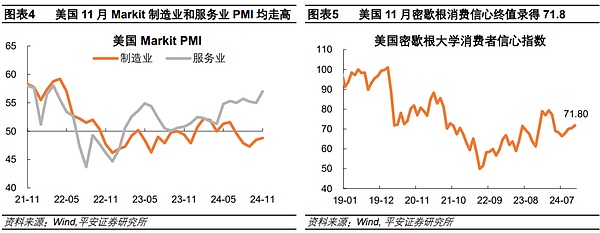

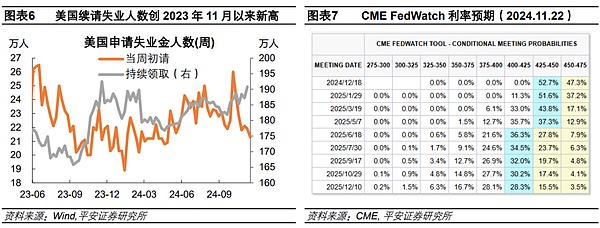

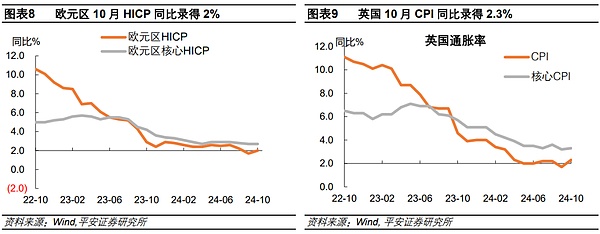

Overseas economic policies. 1) United States: U.S. housing starts and building permits in October were both lower than expected; the NAHB housing market index rose in November. The U.S. Markit manufacturing and service PMIs both rose in November. The final value of Michigan consumer confidence in November was unexpectedly revised down. The latest number of initial jobless claims in the United States fell, but the number of continuing unemployment claims hit a nearly one-year high. Market expectations for interest rate cuts were frustrated again. CME data showed that as of November 22, the market expected a 25BP rate cut in December with a probability of 52.7%, down from 61.9% the previous week. 2) Europe: ECB officials said that they will almost certainly cut interest rates by 25 basis points in December; the final value of the eurozone's HICP in October rose 2% year-on-year, while the manufacturing and service industries in November were weaker than expected and in the contraction range. The UK's October CPI was higher than expected, while the manufacturing and service PMIs were weaker than expected. 3) Japan: Japanese Prime Minister Shigeru Ishiba launched a 21.9 trillion yen economic stimulus plan, which is expected to boost GDP growth by 1.2 percentage points; Bank of Japan Governor Kazuo Ueda's speech was hawkish, and Japan's core CPI was 2.3% year-on-year, higher than expected. Pay attention to the possibility of Japan's interest rate hike in December.

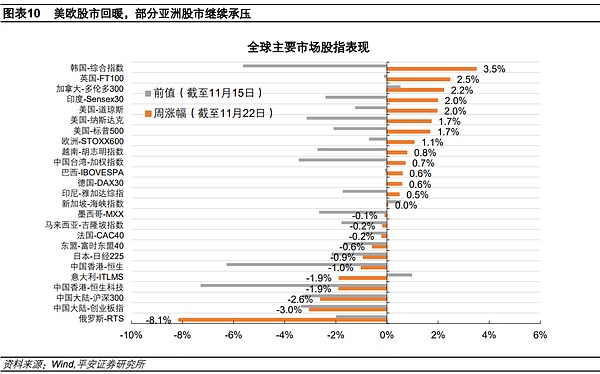

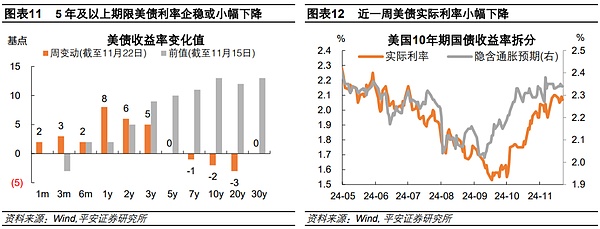

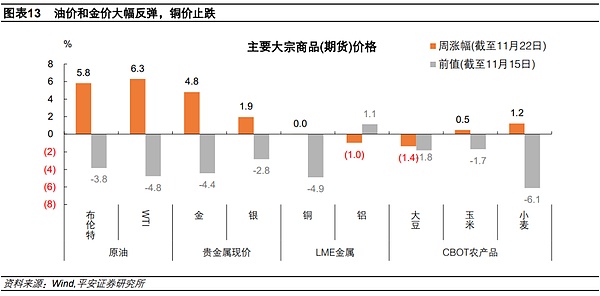

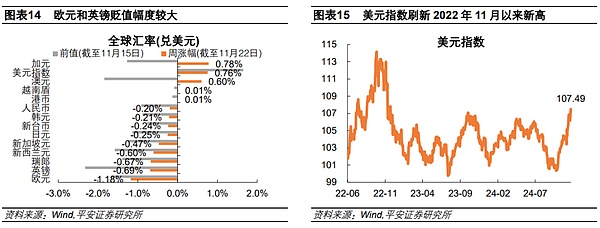

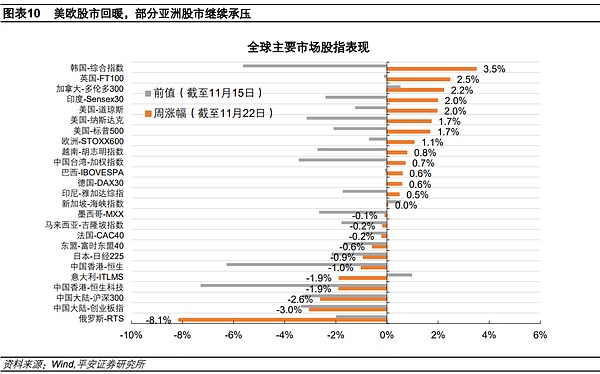

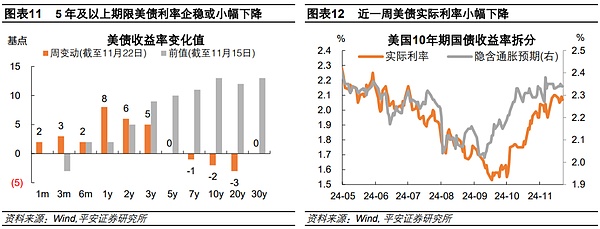

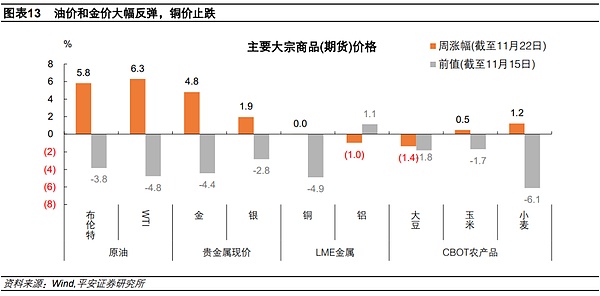

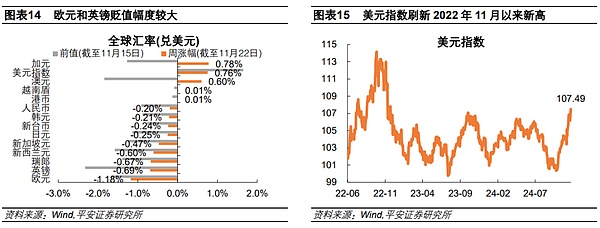

Global major assets.1) Stock market: US and European stock markets rebounded, while some Asian stock markets continued to be under pressure. The S&P 500, Dow Jones Industrial Average and Nasdaq Composite Index rose 1.7%, 2.0% and 1.7% respectively for the whole week. The Philadelphia Semiconductor Index rose 2.5% for the week; the Russell 2000 Index rose 4.5%. The European STOXX600 Index rose 1.1% for the week, and the Nikkei 225 Index fell 0.9%. 2) Bond market: The interest rates of US Treasury bonds with a term of 3 years or less rose, and the interest rates of US Treasury bonds with a term of 5 years or more stabilized or fell slightly. The yield of 10-year US Treasury bonds fell 2BP to 4.42% for the week. The total amount of US Treasury bonds held by foreigners rose for the fifth consecutive month. 3) Commodities: Oil prices and gold prices rebounded sharply, and copper prices stopped falling. Brent and WTI crude oil rose 5.8% and 6.3% for the week, closing at US$75.2 and US$71.2 per barrel, respectively. The spot price of gold rose 4.8% for the week, returning to around the US$2,700 per ounce mark. The escalation of the conflict between Russia and Ukraine, coupled with Trump's appointment of hawkish official Lutnik as Secretary of Commerce, has led to an increase in safe-haven demand; the slight decline in the real interest rate of 10-year US Treasury bonds has also helped release the upward momentum of gold prices. 4) Foreign exchange: The US dollar index rose 0.76% for the whole week, closing at 107.49, and exceeded the high point in October 2023, setting a new high since November 2022. The euro and the pound depreciated significantly, and the yen showed a certain resilience.

Risk warning: US inflation rose beyond expectations, global financial market volatility exceeded expectations, and the international geopolitical situation exceeded expectations, etc.

01 The twists and turns and impact of Trump's selection of Treasury Secretary

In the past week, the market has paid close attention to the appointment of the US Treasury Secretary and Commerce Secretary. Trump has experienced many speculations and trade-offs in the selection of Treasury Secretary.Initially, Howard Lutnick, CEO of Cantor Fitzgerald, Scott Bessant, founder of global macro investment company Key Square Group, and Lighthizer, Trump's first-term trade representative, were all on the list of candidates for Treasury Secretary. On November 16, Musk publicly expressed his support for Howard Lutnick as Treasury Secretary, which was interpreted as "publicly pressuring Trump", causing dissatisfaction among Trump's transition team. According to a report by The New York Times on November 17, Trump is reconsidering the candidates for the US Treasury Secretary after he takes office, including former Federal Reserve Board member Kevin Warsh and Wall Street billionaire Mark Rowan. On November 19, Trump announced the nomination of Lutnick as US Secretary of Commerce. On November 21, the Wall Street Journal quoted people familiar with the matter as saying that Trump has proposed to choose Kevin Warsh as Treasury Secretary, and revealed that Warsh may be nominated to succeed the Fed Chairman after the current Fed Chairman Powell ends his term in 2026. Finally, on November 22, Trump nominated Scott Bessant as Treasury Secretary.

On November 19, Trump nominated Howard Lutnick as Secretary of Commerce. Lutnick is a long-time friend of Trump and clearly supports Trump's tariff policy, which is in line with Trump's idea of using tariffs as an important economic tool. He has worked for the financial services company Jianda since 1983 and rose to CEO. He has strong control and operational experience in the business field. Trump stated in the statement that Lutnick will "lead our tariff and trade agenda and be directly responsible for the Office of the United States Trade Representative." It is worth mentioning that Lighthizer, the top official of the US foreign trade policy that was previously hotly discussed by the outside world, was not appointed. The possible reason is that in addition to being consistent with Trump on tariff policy, Lutnick also served as a co-director in Trump's transition team, participated in the selection and review of cabinet candidates, and was deeply integrated into the Trump camp in terms of politics and personnel operations. In contrast, Lighthizer may not be as good as Trump in terms of the degree of fit between the comprehensive role and Trump's expectations.

On November 22, Trump nominated Scott Bessant as Secretary of the Treasury. Bessant, 62, is the founder of the global macro investment company Key Square Group and has served as the chief investment officer of Soros Fund Management. He provided advice to Trump on economic policies during the presidential campaign. Trump said that Bessant has long been a staunch advocate of "America First" and will help him usher in a new golden age for the United States. Bessant's appointment may be because his economic philosophy is highly consistent with Trump's. His experience in the investment field can provide a unique perspective for the formulation of US economic policies. He has shown his loyalty and support for Trump during the campaign. Although he supports tariff policies, he advocates a gradual and relatively balanced approach. In addition, Bessant has long been a strong critic of the Federal Reserve. He has advocated the appointment of a "shadow Federal Reserve chairman" and recently suggested that the new government should "nominate the next Federal Reserve chairman as soon as possible." Trump's appointment of the Treasury Secretary and Commerce Secretary corresponds to the policy combination of "aggressive trade + moderate fiscal policy." In terms of trade, Lutnick, as a trade hawk, may naturally help the Trump administration take a tougher protectionist stance. Lutnick holds a radical tariff policy concept. He believes that tariffs are an effective tool to protect the interests of American workers. He even advocates that the United States "should go back to 125 years ago", that is, the era of only tariffs and no income tax. In terms of finance, although Bessant supports Trump's "reduced regulation and tax cuts" policy, he also attaches importance to controlling inflation and balancing deficits. Bessant proposed an economic policy proposition known as the "333 Plan", that is, by 2028, the budget deficit will be reduced to 3% of GDP, 3% GDP growth will be achieved through deregulation, and 3 million barrels of oil or equivalent energy will be produced per day. He believes that the federal budget deficit during Trump's first term averaged 4% of GDP, and there is room for further reduction.

In the short term, investors' attention may shift from trade protection risks to a more sustainable outlook for the US economy and debt, and both US stocks and US bonds are expected to be boosted. After Lutnick was elected as the Minister of Commerce on November 19, European stock markets fell collectively, the Nasdaq China Golden Dragon Index plunged during the session, and the prices of gold and Bitcoin rose, reflecting the market's fear of the risks of US trade policies and the rise of risk aversion. On the other hand, Bessant was called "one of the smartest people on Wall Street" by Trump and was also regarded by the market as a "safe plan" and "the adult in the room". After his nomination as the Secretary of the Treasury, the market may expect that the US economic policy and debt outlook will be more stable and predictable, which may boost the performance of US stocks and US bonds in the short term.

02 Overseas Economic Policy

2.1 United States: Expectations of interest rate cuts are frustrated again

Both U.S. housing starts and building permits in October were lower than expected; the NAHB Housing Market Index rose in November. The annualized total number of U.S. housing starts in October was 1.311 million, expected to be 1.33 million, and the previous value was revised from 1.354 million to 1.353 million. The initial value of the annualized total number of building permits in October was 1.416 million, expected to be 1.43 million, and the final value in September was 1.425 million. The US NAHB Housing Market Index rose 3 points to 46 in November, reaching its highest point since April this year, thanks to rising sales expectations and optimism that the Trump administration will reduce regulatory burdens.

The US Markit Manufacturing and Services PMIs both rose in November. The initial value of the US S&P Global (Markit) Manufacturing PMI in November was 48.8, a 4-month high, in line with expectations, and the previous value was 48.5; the initial value of the Services PMI was 57, a 32-month high, expected to be 55.2, and the previous value was 55; the initial value of the Composite PMI was 55.3, a 31-month high, expected to be 54.3, and the previous value was 54.1.

The final value of Michigan Consumer Confidence in November was unexpectedly revised down. The final value of the University of Michigan Consumer Confidence Index in November was 71.8, expected to be 73.7, the initial value was 73, and the final value in October was 70.5. The final value of the one-year inflation rate was expected to be 2.6%, expected to be 2.7%, the initial value was 2.6%, and the final value in October was 2.7%.

The latest number of initial jobless claims in the United States fell, but the number of people continuing to apply for unemployment benefits hit a nearly one-year high. As of the week ending November 16, the number of initial jobless claims in the United States fell by 6,000 to 213,000, the lowest level since April, and the market expected an increase to 220,000. As of the week ending November 9, the number of people continuing to apply for unemployment benefits increased by 36,000 to 1.908 million, exceeding the high point in February this year and setting a new high since November 2023.

Market expectations for interest rate cuts were frustrated again. CME data showed that as of November 22, the market expected a 25BP rate cut in December with a probability of 52.7%, lower than 61.9% in the previous week; the weighted average expectation of the policy interest rate at the end of 2025 was 3.84%, higher than 3.75% in the previous week.

2.2 Europe: ECB rate cuts are unimpeded

ECB officials said that they will almost certainly cut interest rates by 25 basis points in December; the final value of HICP in the euro zone in October rose by 2% year-on-year, while both manufacturing and service industries in November were weaker than expected and were in the contraction range. ECB Governing Council member Stournaras believes that the ECB will almost certainly cut interest rates by 25 basis points in December. He stressed that tariffs could have an adverse impact on Europe and could trigger an economic recession in the medium term. ECB Vice President Guindos said that inflation will fall back to the target level next year; the risks to the economic outlook have increased and are biased to the downside; it is "very clear" that interest rates will be further lowered, but officials should not act hastily due to uncertainties such as intensified trade tensions and global conflicts. The ECB released the Financial Stability Report, pointing out that although the debt-to-GDP ratio of most eurozone countries has declined, the sovereign debt burden of some countries is still heavy and there is a high risk of sustainability. ECB President Lagarde said that the ECB needs to pay more attention to financial stability and long-term growth of the European economy. The final value of the eurozone's HICP in October rose by 2% year-on-year, in line with market expectations, returning to the ECB's target level, paving the way for a rate cut in December. The eurozone's manufacturing PMI in November was 45.2, expected to be 46, and the final value in October was 46; the initial value of the service industry PMI was 49.2, expected to be 51.6, and the final value in October was 51.6; the initial value of the composite PMI was 48.1, a new low in ten months, expected to be 50, and the final value in October was 50.

UK CPI in October was higher than expected, while both manufacturing and service PMIs were weaker than expected. UK CPI rose 2.3% year-on-year in October, a significant increase from the previous value of 1.7%, higher than the market expectation of 2.2%. In October, the core CPI rose to 3.3% year-on-year from 3.2% in September, and the service CPI rose to 5% year-on-year from 4.9%. The unexpected rise in inflation weighed on traders' bets on a rate cut by the Bank of England in the coming months. The UK's manufacturing PMI preliminary value in November was 48.6, expected to be 50, and the final value in October was 49.9; the service PMI preliminary value in November was 50, expected to be 52, and the final value in October was 52; the composite PMI preliminary value in November was 49.9, expected to be 51.8, and the final value in October was 51.8.

2.3 Japan: Shigeru Ishiba announces economic stimulus plan

Japanese Prime Minister Shigeru Ishiba launched a 21.9 trillion yen economic stimulus plan, which is expected to boost GDP growth by 1.2 percentage points; Bank of Japan Governor Kazuo Ueda's speech was hawkish, Japan's core CPI was 2.3% year-on-year, higher than expected, and attention was paid to the possibility of Japan raising interest rates in December.Japanese Prime Minister Shigeru Ishiba launched a 21.9 trillion yen (about 140 billion US dollars) economic stimulus plan, which includes subsidies for low-income families, stimulating investment in semiconductors and artificial intelligence, and restarting subsidies for electricity and gas fees to address a series of challenges such as inflation and wage growth. Including private funds, the total amount of the economic stimulus package is 39 trillion yen. The Cabinet Office estimates that these measures will boost GDP growth by 1.2 percentage points. Bank of Japan Governor Kazuo Ueda said Japan's economy is heading for sustained wage-driven inflation and warned against keeping borrowing costs too low; the central bank will carefully review various data before next month's interest rate review and will "carefully" consider the impact of yen exchange rate fluctuations on the outlook for the economy and prices. Japan's core CPI rose 2.3% year-on-year in October, in line with expectations of a 2.2% increase and a 2.4% increase from the previous value; CPI rose 2.3% year-on-year in October, in line with expectations of a 2.3% increase and a 2.5% increase from the previous value; it rose 0.6% month-on-month and fell 0.3% from the previous value. Japan's preliminary service PMI for November was 50.2, up from 49.7 in the previous value; the preliminary manufacturing PMI was 49, up from 49.2 in the previous value; the preliminary composite PMI was 49.8, up from 49.6 in the previous value.

03 Global major asset classes

3.1 Stock market: US and European stock markets rebound

In the past week (as of November 22), US and European stock markets rebounded, while some Asian stock markets continued to be under pressure. In the United States, the S&P 500, Dow Jones Industrial Average and Nasdaq Composite Index rose 1.7%, 2.0% and 1.7% respectively for the whole week. At the macro level, the disturbance caused by the appointment of Trump's new team has weakened, the medium and long-term US bond interest rates have stabilized, and the market risk appetite has been restored. At the industry level, among the 11 industries of the S&P 500 index, daily consumption, materials, real estate and utilities performed well, while communication services, information technology, optional consumption and healthcare performed poorly. The Philadelphia Semiconductor Index rose 2.5% for the week; the Nasdaq Golden Dragon Index was flat; and the Russell 2000 Index rose 4.5%. In Europe, the European STOXX600 Index rose 1.1% for the week, while the German DAX, French CAC40 and British FT100 indices rose 0.6%, fell 0.2% and rose 2.5% for the week, respectively. In Asia, the Nikkei 225 Index fell 0.9%, while the South Korean Composite Index rose 3.5%, and Hong Kong stocks and A shares continued to be under pressure.

3.2 Bond Market: Mid- and Long-Term US Treasury Interest Rates Stabilize

In the past week (as of November 22), US Treasury interest rates of 3 years and below rose, while US Treasury interest rates of 5 years and above stabilized or fell slightly.The market further assessed the prospect of a rate cut in December, which led to an increase in short-term US Treasury interest rates, but the uncertain economic outlook did not continue to drive the mid- and long-term US Treasury interest rates upward. The 2-year US Treasury interest rate rose 6BP to 4.37% for the whole week. The 10-year US Treasury yield fell 2BP to 4.42% for the whole week, breaking away from the highest level since July; the 10-year TIPS rate (real interest rate) fell 3BP to 2.07% for the whole week, and the implied inflation expectations rose 1BP to 2.34% for the whole week. The latest data released by the U.S. Treasury Department showed that the total amount of U.S. Treasury bonds held by foreigners rose from $8.5034 trillion in August to $8.6729 trillion in September, the highest level on record and the fifth consecutive month of increase. However, China and Japan continued to reduce their holdings of U.S. debt. In non-U.S. regions, the 10-year German government bond yield fell 1BP to 2.32% for the whole week.

3.3 Commodities: Oil and gold rose sharply

In the past week (as of November 22), oil prices and gold prices rebounded sharply, and copper prices stopped falling. In terms of crude oil, Brent and WTI crude oil rose 5.8% and 6.3% respectively for the whole week, closing at $75.2 and $71.2 per barrel respectively. At the macro level, tensions between Russia and Ukraine have rapidly escalated, with the two countries launching missiles against each other. The market is worried that the expansion of the conflict may affect crude oil supply, triggering an increase in oil prices. In terms of inventory, as of the week ending November 15, the U.S. EIA crude oil inventory increased by 545,000 barrels, with an expected increase of 138,000 barrels and a previous value of 2.089 million barrels. In terms of precious metals, the spot price of gold rose 4.8% for the whole week, rebounding to around the $2,700/ounce mark. The spot price of silver rose 1.9% for the whole week. The escalation of the conflict between Russia and Ukraine, coupled with Trump's appointment of hawkish official Lutnik as Secretary of Commerce, triggered an increase in safe-haven demand; the slight decline in the real interest rate of 10-year U.S. Treasury bonds also helped release the potential for gold prices to rise. In terms of metals, LME copper and aluminum were flat and down 1.0% for the whole week, respectively. In terms of agricultural products, CBOT soybeans, corn and wheat fell 1.4%, up 0.5% and up 1.2%, respectively.

3.4 Foreign exchange: The US dollar index rose above 107

In the past week (as of November 22), the US dollar index rose 0.76% for the whole week, closing at 107.49, and exceeded the high point in October 2023, setting a new high since November 2022. The euro and the pound depreciated significantly, and the yen showed a certain resilience.In the United States, the appointment of hawkish officials in the United States further raised expectations for US interest rates, while the prospect of interest rate cuts in Europe was more certain, further boosting the US dollar.In the eurozone, the latest inflation data in the eurozone was in line with expectations, while the PMI was weak, and a rate cut in December was more certain. The euro fell 1.18% against the dollar for the whole week, the largest depreciation among major currencies. In the UK, the UK inflation and PMI data were stronger than those in the eurozone, and the pound fell less. The pound fell 0.69% against the dollar for the whole week. In Japan, the Bank of Japan's statement was hawkish, inflation data was strong, and investors were concerned about the possibility of a rate hike in December, limiting the decline of the yen. The yen fell 0.25% against the dollar for the whole week, and the dollar closed at 154.77 against the yen. In China, the renminbi fell 0.20% against the dollar for the whole week, and the dollar closed at 7.2452 against the renminbi.

Risk warning: US inflation exceeded expectations, global financial market volatility exceeded expectations, and international geopolitical situation exceeded expectations.

Catherine

Catherine