Author: Xiaoxiang

Many industry insiders said that the reason why the dollar plummeted on Monday was that US President Trump considered replacing the chairman of the Federal Reserve last week, which questioned the independence of the Federal Reserve and hit investors' confidence in the US economy again.

On the global market during the Asian session on Monday (April 21), gold, which hit a record high, and the dollar, which continued to fall, suddenly became the two most eye-catching market "scenery lines"...

Market data showed that the ICE US Dollar Index (DXY) plummeted by about 100 points in the morning and has now refreshed its lowest level in three years at 98.22. The sharp rise of gold in today's Asian market can be largely attributed to the rare selling of the US dollar. As of press time, the spot gold price has hit a record high of $3,385 per ounce.

Many industry insiders said that the reason why the dollar plummeted on Monday was that US President Trump considered replacing the chairman of the Federal Reserve last week, which questioned the independence of the Federal Reserve and hit investors' confidence in the US economy again. In addition, on Monday, markets in Australia, Hong Kong, China and Europe were closed for Easter, and the relatively quiet holiday liquidity in the foreign exchange market also amplified the decline of the US dollar.

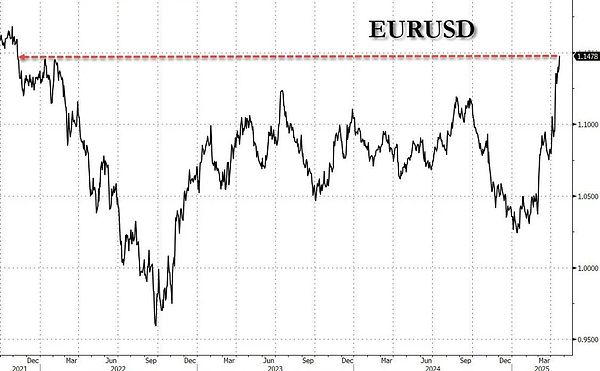

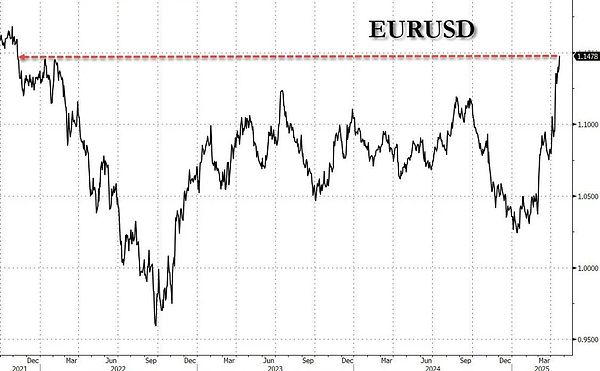

Among non-US currencies, the USD/CHF exchange rate further fell to a decade-low of 0.8069, while the EUR/USD exchange rate broke through the 1.15 mark, and the New Zealand dollar exchange rate rebounded to 0.6000 for the first time in more than five months.

The USD/JPY exchange rate also fell to a seven-month low of 140.61. Data from the U.S. Commodity Futures Trading Commission (CFTC) showed that net long positions in the yen hit a record high in the week ending April 15.

White House economic adviser Kevin Hassett said last Friday that the president and his team are continuing to study whether Federal Reserve Chairman Powell can be fired. Just one day before Hassett made the above remarks, Trump had just threatened to fire Powell and called on the Federal Reserve to cut interest rates.

OCBC Bank strategist Christopher Wong said: "Frankly, the discussion of firing Powell is incredible. If the credibility of the Fed is questioned, it may seriously undermine people's confidence in the dollar."

At present, many industry insiders have begun to worry that if Powell is fired, it may greatly undermine investor confidence, because the independence of the Federal Reserve has long been regarded as a key guarantee for investing in US assets. And if Powell really steps down early, Trump is also likely to choose a successor to Powell with an "extremely dovish" monetary policy stance to cater to the White House's call for interest rate cuts.

In fact, from the perspective of the foreign exchange market, Trump may also support the weakening of the US dollar to a certain extent, because just as he has stated before and the goal of the potential "Mar-a-Lago Agreement", the current White House team may welcome the depreciation of the US dollar because it will enhance the competitiveness of US products.

Has Trump scared the US dollar out of its wits before he fired Powell? Vishnu Varathan, head of macro research at Mizuho in Asia (ex-Japan), said, "Powell does not report directly to Trump, so Trump may not actually be able to fire him in a formal process - Powell can only be removed under a specific procedure, which people would think has a higher hurdle...But can the president promote a process that could undermine the independence of the Fed? Of course!" "I don't think they even need to fire Powell immediately. You just need to make people feel that you can fundamentally change the view on the independence of the Fed. And this will be a feast for anyone who is bearish on the dollar..... From the heightened uncertainty around the self-inflicted tariffs to the loss of confidence even before the news of Powell's firing," Varathan pointed out. Win Thin, global head of market strategy at Brown Brothers Harriman, wrote in a report, "We believe that the dollar's weakness will continue. Attacks on the Fed's independence are intensifying."

According to CFTC data, hedge funds' current bearish sentiment on the dollar has reached its highest level since October last year.

"Central bank independence is valuable - it cannot be taken for granted and once lost, it is difficult to regain," said Will Compernolle, macro strategist at FHN Financial in Chicago. "Trump's threat to Powell certainly does nothing to boost foreign investors' confidence in U.S. assets."

Kathy Jones, chief fixed income strategist at Schwab Center for Financial Research, said Trump may try to make good on his threat to fire Powell, and investors should not rule out the possibility -

this move could exacerbate the sell-off in U.S. Treasuries and the dollar, which usually only occurs in emerging market economies or when confidence in a country's governance is shaken.

Indeed, there were concerns that foreign investors might be dumping U.S. assets when Treasuries and the dollar index fell in tandem earlier this month.

"This is something that would never have happened in a major developed country," Jones said of Trump's comments seeking to remove Powell. "The more pressure Trump puts on it, the worse it gets." She said that even if investors approve of any potential Powell replacement, the damage will have been done by then. "Bond yields will go up and the dollar will go down because then the U.S. will lose any credibility."

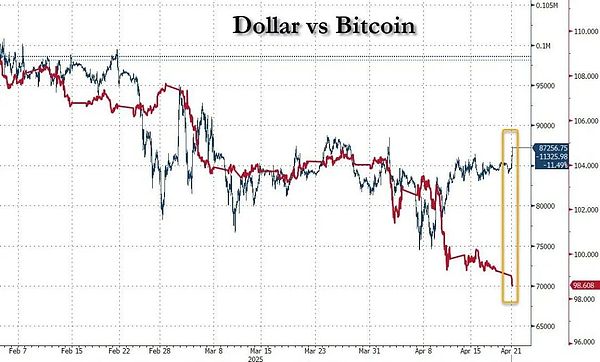

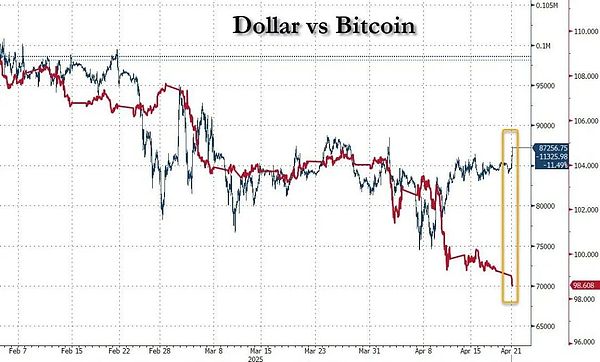

Interestingly, there was one notable anomaly across assets in today's dollar sell-off: Bitcoin.

Previously, any plunge in the dollar (and the resulting surge in the yen) would hit carry trades hard and to some extent hit technology stocks and cryptocurrencies, but today people are finally seeing a change in the pattern. After initially trading flat, a wave of buying pushed Bitcoin up by nearly $2,000, breaking through $87,000, marking its biggest one-day gain since Trump’s “Liberation Day” on April 2…

Some industry insiders said that the breakdown in the correlation between the two suggests that as gold prices approach absurdly high levels, some industry insiders also see Bitcoin as the next “safe haven” to escape the collapse of the US dollar”-After all, once all central banks launch a “printing money” frenzy, further devaluation of fiat currencies may only be a matter of time.

Weatherly

Weatherly