The airdrop, which was thought to benefit people overnight, turned into a war about humanity.

On June 11, in response to the ongoing witch review of LayerZero, LayerZero co-founder Bryan Pellegrino announced on the X platform that the final list of witches would be announced before the end of June, and once again emphasized that the review would focus on real users and fair distribution.

The speech, which seemed to be in line with the identity of the project party, still caused a lot of condemnation in the community. For this mighty witch hunt, the market has different opinions, with both strong support and words of killing the donkey after it has done its job.

To clarify the joints, we must start with LayerZero.

As a star project of cross-chain protocols, it is not an exaggeration to describe LayerZero as being born with a golden key.

LayerZero was founded in November 2021, during a bull market when capital was particularly interested in infrastructure. At that time, cross-chain interoperability technology was the most popular, and the asset cross-chain ecosystem was initially established, but other areas of data transmission were relatively blank.

LayerZero just hit this point. Unlike the cross-chain bridges on the market at the time, it chose an oracle network to replace the traditional cross-chain continuous streaming transmission, outsourced the burden of verifying on-chain information transmission to a third-party oracle, and adopted a light client, which is easy to use and low-cost.

Although the founding team is Canadian, the core members have completed their education in the United States, and the team also has sufficient industry background. Against this background, Wall Street star FTX quickly got in touch with the project. In March 2022, LayerZero's development team LayerZero Labs announced the completion of a $135 million Series A+ round of financing led by FTX Ventures, Sequoia Capital and a16z, with a post-investment valuation of $1 billion. With the shining capital, less than 5 months after its establishment, LayerZero successfully became a new crypto unicorn.

In the following year, under the protection of capital and the promotion of industry KOLs, LayerZero has developed rapidly, and has been integrated and used by more than 50 projects, covering DeFi, NFT and stablecoins. Even the collapse of FTX did not have a huge impact on it. In April 2023, LayerZero completed another $120 million Series B financing, with a valuation rising to $3 billion. In addition to the original capital, traditional capital such as Christie's and Samsung also supported it.

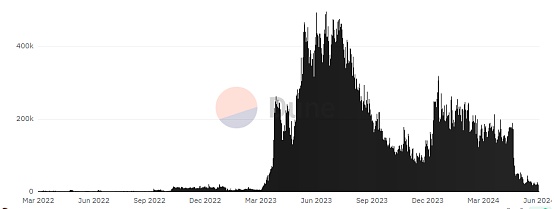

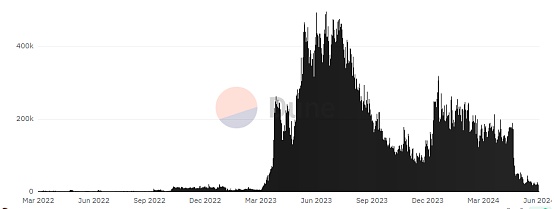

It was at that time that LayerZero announced that it would consider airdropping governance tokens. After this statement was released, the community responded strongly. Large capital + high valuation + top project, this configuration often means feedback from large airdrops. Affected by this, airdrop hunters quickly listed it as a target, and individual wool-pulling and gold-making studios flocked in. Dune data dashboard shows that since April last year, the interaction volume on the LayerZero chain has surged, with the number of transactions per day exceeding 200,000, and the highest single-day even soaring to 490,000. High-frequency interaction not only brings impressive data, but also brings a lot of income. Taking Stargate, the first cross-chain DApp launched on LayerZero, as an example, the monthly income of the protocol exceeds 1 million US dollars, and this is just a product in the ecosystem.

With this expectation, LayerZero's airdrop expectations have never stopped, and airdrop information has been frequently reported in the following year, but it has been postponed one after another. Finally, the timeline came to May 2 this year, when LayerZero officially announced on the X platform that the first snapshot had been completed. Market sentiment reached its peak, and many users said on social platforms that "the big one is coming."

This is indeed the case. According to WOO X Research, the value of LayerZero's airdrop will be between 600 million and 1 billion US dollars. Under conservative estimates, TGE is calculated at 4 times the valuation, the initial circulation is 15%, and the FDV is 12 billion US dollars. The airdrop value is expected to be 600 million US dollars, which is converted into a value of between 750 and 1,500 US dollars for each user. In the optimistic forecast, based on 20% of the circulation and 4.5 times of TGE, the FDV is $13.5 billion, and the airdrop value is expected to increase to $1.08 billion, with the average value per user ranging from $1,350 to $2,700.

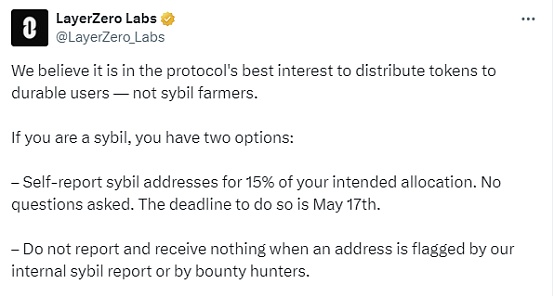

But just as users were immersed in cheers and hoped for another airdrop, Layer Zero gave users a wake-up call. On May 3, Layer Zero issued an official announcement stating that the airdrop tokens would be released soon, but to ensure the durability of the airdrop users in order to formulate a token distribution plan, it is expected to launch a Sybil review action lasting one month.

Sybil review is not uncommon, especially in airdrops. Sybils usually refer to a single entity using a large number of accounts in batches to conduct meaningless or extremely small transactions to obtain interactive data in order to obtain airdrops. Considering that Layer Zero has 6 million users, it is understandable to screen witches to ensure the interests of the project and users.

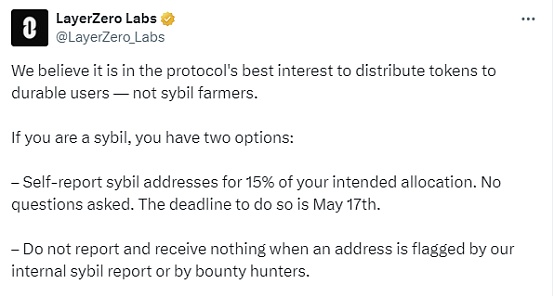

However, in this witch action, an extremely strange "bounty reporting mechanism" appeared. According to the official announcement, the witch action will be divided into three stages. The first is the 14-day self-exposure stage. During this stage, users can voluntarily expose their personal witch behavior, and the official will retain 15% of the airdrop allocation for such accounts; the second is the official review stage. LayerZero officials will screen witches according to specific rules during this stage, and the accounts found by the official review will not retain any airdrop quota. The most controversial is the third stage - bounty reporting, which will last from May 18 to May 31. Anyone can submit a report on Github. The successful report will receive 10% of the airdrop allocation of the reported person, and the remaining 90% will be allocated to the airdrop pool, while the reported person will receive nothing.

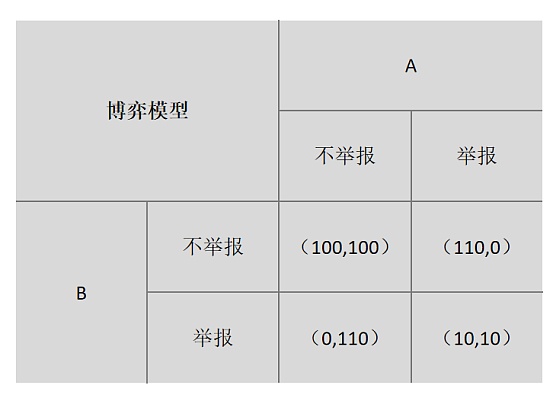

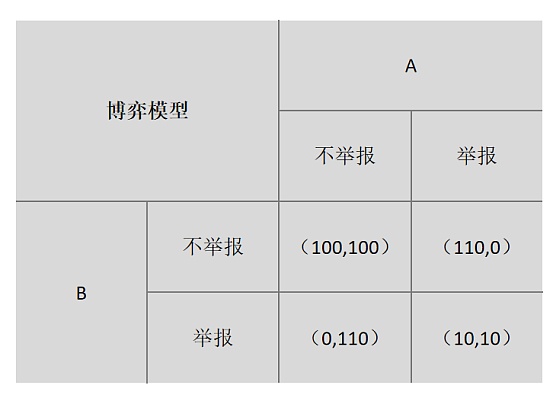

Reporting each other is undoubtedly a test of human nature. In fact, although everyone knows that reporting cannot maximize benefits, under the premise of not knowing whether others will report you, according to the prisoner's dilemma, the most appropriate choice is to report others to obtain an additional 10% share. In this case, human nature is extremely magnified, and the market has set off a wave of reporting, and various events have followed.

Lu Mao Studio became the first victim. A small studio claimed that more than 200 of its boutique accounts were judged as witches, and even some employees resigned and reported their former companies for profit. Security companies are even more active. There are market rumors that a certain organization provided 480,000 addresses to LayerZero at one time. Rumors and reports are also common. Bryan Pellegrino, co-founder of LayerZero, said that not every report is valid.

Due to the excessive number of reports submitted, many reporting accounts were once considered junk accounts by Github.

From the final result, the witch operation still achieved impressive results. In the first round of witch self-exposure, 803,000 addresses were identified as potential witches, of which more than 338,000 addresses reported themselves as witches. During the reporting process, LayerZero received 3,550 witch-hunting reports, each of which contained at least 20 addresses indicating witch operations. During the review process, Bryan Pellegrino revealed that 3 million of the 6 million initial wallets sent less than 5 transactions, and the weight of transactions below $1 and worthless NFTs was reduced by 80%.

Looking back on this massive witch-hunting operation, there is no shortage of controversy in the market, but the parties involved seem to have their own reasons.

For the project side, the demand for interaction only for airdrops is not an effective demand. After the airdrops are distributed, this type of user is likely to sell and then move on to the next target, not the actual construction holders. Large-scale selling pressure will also affect the token price and further hinder the development of the ecosystem. The fact is exactly the same. After the snapshot, LayerZero's daily transaction volume dropped sharply, falling to 27,000 on June 7, reaching a new low in nearly a year.

But for users or studios who are actively making money, they have invested real money and contributed impressive interaction data to the project, and also provided samples for project optimization. Obviously, they have the function of builders. The project side's move is undoubtedly a waste of time.

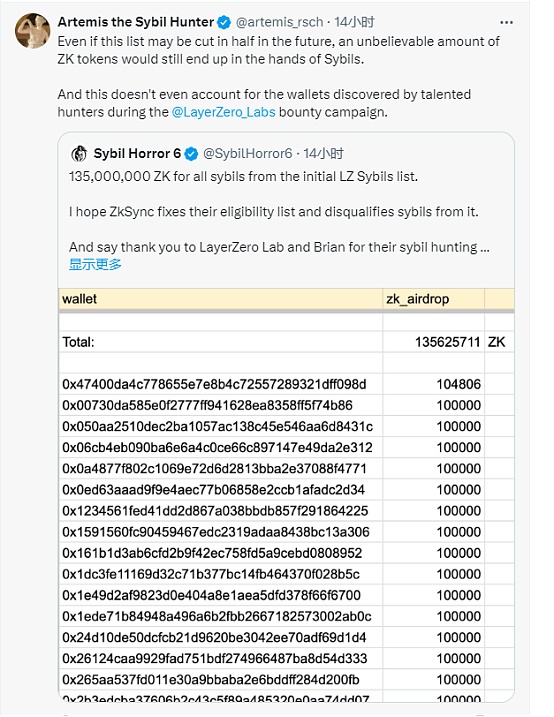

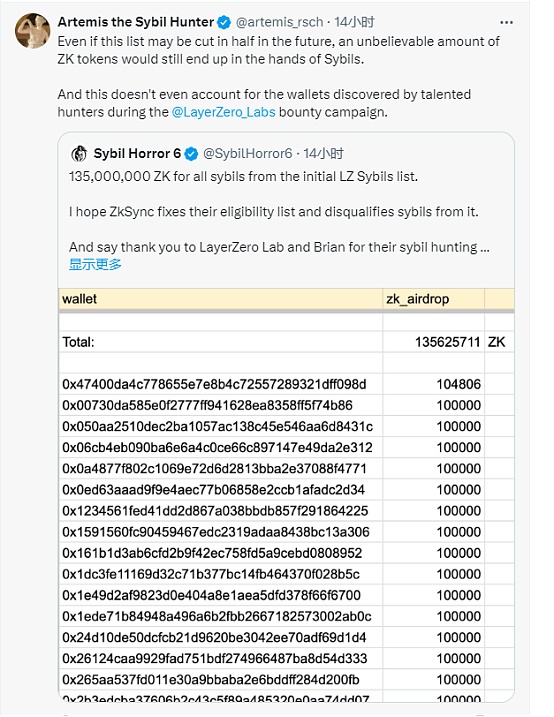

The community is more concerned about the use of the reporting mechanism. Is such a radical witch-hunting behavior worthy of praise? There are many discussions in the market about this issue. Those in favor believe that out of responsibility to early users, the project should not encourage swindling, and anti-witch is politically correct, and no user would think that they want witches to participate in the project; opponents emphasize that the rules are too strict and ugly, and if there are no swindlers to optimize the project, the project will be difficult to continue. Interestingly, Zksync also announced that it will release an airdrop next week. It did not launch a large-scale witch sniping, but it was widely criticized for this. Among the 690,000 addresses that received airdrops, not only are the airdrop details vague, but there are also multiple witch addresses that have been checked. According to witch hunter Artemis, some rat warehouses obtained more than 2 million ZK tokens by depositing the same Ethereum funds on the same day, and almost all accounts were marked on LayerZero's witch list. From this point of view, witch detection is necessary.

Back to the airdrop itself, looking at the evolution of airdrops, the abnormal dependence between the project party and the Mao party is not the first time to be discussed.

Airdrops were first used in the Auroracoin project in 2014, and then developed in the ICO boom in 2017, but it was not until the rise of DeFi in 2020 that Uniswap really detonated this activity. From the development process, airdrops have experienced a development path from easy to difficult, from being able to be issued by joining the community at the beginning, to registering to obtain, from simple interaction to deep interaction, and then to witch screening heavy users, funds mixed verification and other methods. Today, airdrops can be said to be rolled up, not only are large-scale airdrops difficult to appear, but the funding threshold is also increasing, and various odysseys allow users to describe them as PUA.

As for why the project needs PUA, the reason is that it is difficult for most Web3 applications to have effective demand, and early users are very scarce. In order to obtain user volume and interactive income, the project has to use various activities to stimulate user use, and airdrop is the most effective way. After 20 years, the benefit effect of airdrops has become prominent, and Apecoin, DYDX, Arbitrum, and ENS have also successfully made many early users realize their dreams of getting rich.

Under the influence of the benefit effect, the figure of the wool party has been following since the birth of airdrops. Since its development, the increased difficulty of airdrops has forced the wool party to develop towards professionalization, institutionalization, and scale, forming a complete wool industry chain. The studio will be equipped with professional teams such as investment research, anti-witch technology, and interaction, and some will also invest large amounts of money in the project. From a certain perspective, the wool team has even gradually become a participant in the primary market of the project.

In the meantime, the offensive and defensive battles between the project and the Mao Mao Party have been staged, and the Mao Mao Party has frequently experienced counter-money. The two maintain a tense and delicate balance. It can be said that this is the current status of airdrops for all projects and the fundamental reason why radical witch measures are controversial. However, in the long run, LayerZero's radical bounty mechanism is still expected to be widely used in large projects.

Back to another core issue, if the stimulus effect of airdrops is excluded, whether there is really effective demand for the project is still in doubt. Projects without long-term value rely on airdrops to obtain short-term users, and eventually decline is inevitable.This is also one of the reasons why many well-known projects continue to extend the timeline of issuing coins and take tough measures against witches. Comparing with the Web2 industry, airdrops are quite similar to the subsidy wars in the Internet, but airdrops are for users to invest first and then for projects to be subsidized, while the traditional Internet initially subsidizes demand, and reduces the scope of subsidies after the network advantage is formed. There are also projects that swim naked after the subsidies end. In the final analysis, the survival of projects must return to their self-sustaining ability.

In any case, the increasing cost of long-term haircuts is an inevitable trend, and the studio has foreseen this. As long as airdrops are profitable, the evolution of the studio will continue. For individual users, although the secular meaning of "free is the most expensive" is also true in encryption, airdrops are indeed one of the ways with the highest input-output ratio. Unfortunately, as the airdrop rules headed by financial points have surpassed interactions and become the main trend of airdrops, the so-called haircut interactions left for users may not be much.

JinseFinance

JinseFinance