This article will explore:

The origin of Meme Coins: Meme blockchain based on proof of work

How Meme Coins evolve over the cycle

The impact of NFT on the Meme Coins ecosystem

Recent developments and emerging trends

Potential risks and investment opportunities

With its accessibility, viral spread, and attractive high-yield potential, Meme Coins, the intersection of encrypted digital assets and Internet culture, has always attracted many participants in previous encryption cycles.

Since May 2024, the Meme Coins market has soared in popularity, and some asset traders are focusing on Meme Coins that have been strong in recent times, such as SHIB, FLOKI, PEPE and APORK.

Since January 2024, institutional investors have also increased their attention to Meme Coins. According to statistics from the Bybit trading platform, as of April 2024, the value of Meme Coines held by institutional investors on Bybit has increased from US$63 million in January 2024 to US$300 million. The most popular Meme Coins by institutions are Doge Coin (DOGE) and SHIB, which have strong liquidity.

What is Meme?

Meme, as a communication unit that carries cultural concepts and symbols, is transmitted and evolved between people like genes. Among them, the meme trend with strong resonance can be spread for a long time, while those with weak influence quickly fade out of people's sight.

The rise of the Internet has given birth to the unique phenomenon of "Internet memes", which has greatly accelerated the spread of memes and various cultural concepts. Common carriers include images, videos, animated pictures and humorous paragraphs. Some studies have even vividly compared the spread of Internet memes to the spread of diseases: they follow a viral spread path similar to the SIR model, "infecting" a large number of Internet users.

Meme Coins is a cryptographic asset that generates value based on related memes. It gives financial attributes to the concept of memes that was originally only circulated at the social level.

With the birth of Meme Coins, memes and their dissemination process, which contain cultural connotations and symbolic meanings, have trading and investment value for the first time. The core value of Meme Coins lies in the current popularity of Memes and their power to attract public attention, which has given rise to a new market form: here, cultural resonance can not only be accurately measured, but also given real economic value.

A Brief History of Meme Coins

Here is a quick review of the crypto asset cycle and the Meme Coins born during it:

Proof-of-Work Meme Coins are designed to attract miners to turn their computing power to new assets for mining and sales. Most of these assets were born in the Altcoin section of the BitcoinTalk forum, and not all of them can be listed on trading platforms.

However, the few assets that were lucky enough to enter the market were active on now-defunct centralized trading platforms such as Cryptsy and BTC-E. Each Meme Coin has its own recognizable narrative theme with its unique name, brand image, hash algorithm, time to exit the zone, and supply.

The first batch of assets that appeared after BTC are in a sense Meme Coins because of their relatively limited actual value outside of innovative concepts. Here are a few typical examples:

Except for Litecoin, these crypto assets have all fallen into silence, with trading volume and market value almost zero, no trading platform support, and are vulnerable to 51% attacks. The reasons for this result include: the lack of cultural influence as Meme Coins, and the large obstacles for users to acquire and use such Meme Coins (because each Meme Coin is developed based on an independent blockchain network).

The main reason why Litecoin has been able to stand out from its peers and survive to this day is that it closely follows the narrative of Bitcoin's "digital gold", entered the market earlier to seize the opportunity, and continued to receive strong support from mainstream exchanges.

Doge Coin: The First Meme Coin

The meme trend that Doge Coin relies on has emerged since the summer of 2013 and has become popular on social platforms such as 4chan and Reddit.

△ Doge Meme spread on 4chan

Taking advantage of this cultural craze, Jackson Palmer and Billy Markus launched Doge Coin on the Bitcointalk forum on December 8, 2013, making it the world's first encrypted asset based on the Internet Meme trend.

The rise of Doge Coin has given rise to a new class of asset species, which are characterized by cynicism, humor, celebrity leverage (such as American rapper Kanye West, American TV host Max Keiser), animal images (such as Panda Coin) or precise targeting of a certain community. These are all proof-of-work crypto assets, born in the Altcoin section of the Bitcointalk forum. At that time, compared with technical specifications, the meme trend elements contained in them became increasingly important.

The Rise of Ethereum

The rise of Ethereum is like a catalyst-driven innovation revolution, which has not only created many emerging application fields, deeply optimized user experience, but also successfully leveraged a large and diverse user base. Its innovations are reflected in:

1. Simplifying the asset development process (ERC20 standard)

2. Expanding the user base (attracting non-Miner users)

3. Improving the profit margins of the project party

4. Achieving interoperability/single ecology/one wallet through ERC20

During this period of prosperity, a group of more "pragmatic" projects have emerged, such as The DAO, Filecoin, Tezos, EOS, Cardano, Tron and Bancor. In addition to pursuing the value of the Meme trend, they are more committed to realizing certain practical functions or achieving specific goals.

At the same time, a small number of Meme Coins that have not received widespread attention but have a certain degree of popularity have appeared in the market, such as:

Useless Ethereum Token, launched in June 2017.

Dentacoin was launched in February 2017 and was originally intended to serve the dental industry. Its market value once reached $2 billion in January 2018.

HAYCOIN was launched in 2018 and is the first ERC20 asset deployed to Uniswap V1. This asset was created by Uniswap founder Hayden Adams with the original intention of testing the Uniswap protocol. Although the response was mediocre and the trading volume was negligible at the time, it was revived in 2023 due to its unique position in history.

Collectible Memes and Early NFTs

Outside the field of crypto assets, some Pepe frog emojis are called Rare Pepes. They are not released publicly. If they are released, they will be watermarked with RARE PEPE DO NOT SAVE.

Between 2016 and 2018, a group of Counterparty (a smart contract protocol based on Bitcoin) developers and Pepe emoji enthusiasts created Rare Pepe wallets and carefully selected a batch of Meme Coins based on rare Pepe emojis for trading on the Counterparty protocol. As a recognized second-generation NFT collectible, Rare Pepe still retains its value very well, and some single items have been sold for more than $500,000.

Following CryptoPunks, MoonCats, and CryptoKitties, NFTs (non-homogeneous digital assets pointing to pictures and other media) began to emerge in the Ethereum ecosystem. EtherRocks debuted on the Reddit platform in 2017 as a joke, consisting of 100 clipart rock images of different colors.

At that time, only 30 stones were cast in the series, and the response was mediocre, but they were later re-excavated, triggering a buying frenzy. By August 2021, its floor price had soared to 305 ETH.

Another example of a collectible Meme Coin is Unisocks (SOCKS), launched by Hayden Adams on May 9, 2019. A limited number of 500 pairs of physical socks were produced, and each SOCKS (ERC20 asset) can be exchanged for one pair of socks. And based on the current market value of SOCKS, this may be the most expensive physical socks in the world.

Summer of DeFi

In June 2020, Compound Finance pioneered a new way of asset development and distribution: liquidity Mning or yield farming. Users earn asset rewards by locking up their assets to provide liquidity.

This innovation kicked off the summer of DeFi and spawned a variety of yield farms that promised investors to lock their assets in contracts called "Yam" or "Pickle" and earn returns.

Meme stocks and Doge Coin trends

In 2021, market risk appetite increased significantly due to the combined effects of fiscal stimulus, interest rate cuts, ample liquidity and COVID-19 lockdowns.

At the beginning of 2021, retail investors on Reddit launched a heated discussion around the topic of "Gamestock", and by posting related graphic information, the stock price soared sharply in a short period of time. The convenience of Robinhood (mobile app, no transaction fees) has enabled many ordinary investors to join the carnival. The "GME" (GameStop stock code) craze has further stimulated people's enthusiasm for speculation in other assets, especially those that can also be traded on Robinhood. Doge Coin has been available on Robinhood since 2018. At the end of January 2021, its price was only 0.008 cents, which is very tempting for retail investors. In early February 2021, Tesla CEO Elon Musk frequently posted tweets related to Doge Coin on Twitter, which further increased the popularity of Doge Coin. By May 2021, the market value of Doge Coin once reached 90 billion US dollars.

The popularity of Doge Coin has spawned the emergence of more Meme Coins, such as Shiba Inu, Floki, and Safemoon, all of which have reached extremely high valuations within a few months.

NFT Boom: Picture Version Meme Coins

With the popularity of the ERC721 standard and the rise of markets such as OpenSea, NFT has created a new category of crypto assets: unique, visual assets that are the core embodiment of a certain "culture" or "Meme".

The most well-known NFTs include: CryptoPunks, Bored Apes, Squiggles and Pudgy Penguins. These NFTs are used as personal avatars on platforms such as Twitter and Discord, and those who wear them use them as personal identification, which accelerates the viral spread of NFTs.

These avatars (PFP) symbolize noble status and membership in cultural clubs. Many NFT series have made holders rich, but if holders sell NFTs, they will be regarded as "out of the community."

In order to give back to loyal holders, some NFT projects have issued Meme Coins (ERC20) to the community as a supplement to liquidity, an extension of practical functions, and cultural "currency."

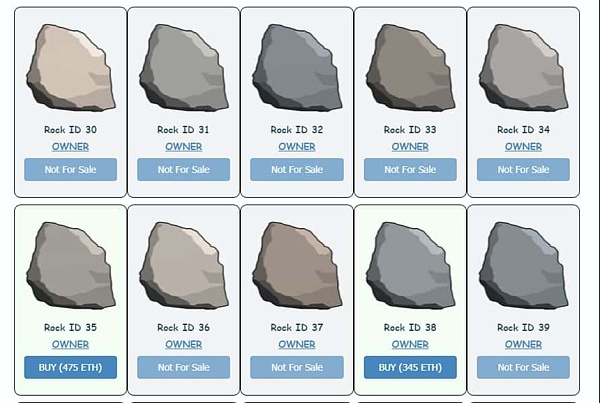

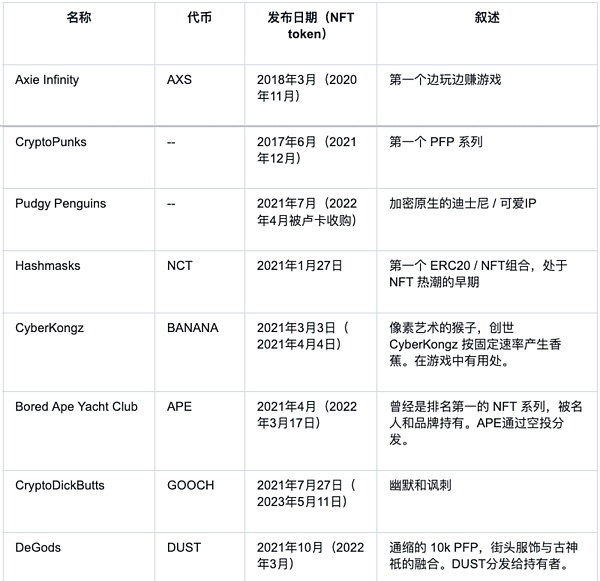

The NFT projects at this stage and their (if any) associated Meme Coins are listed below:

Recently (2023 to present)

As the crypto market emerges from the trough, various emerging Memes, cultures, ideas and ecosystems are emerging. Meme Coins, as one of the few segments that have always maintained activity (trading volume, market value appreciation, and social attention), has recently shown a significant warming trend.

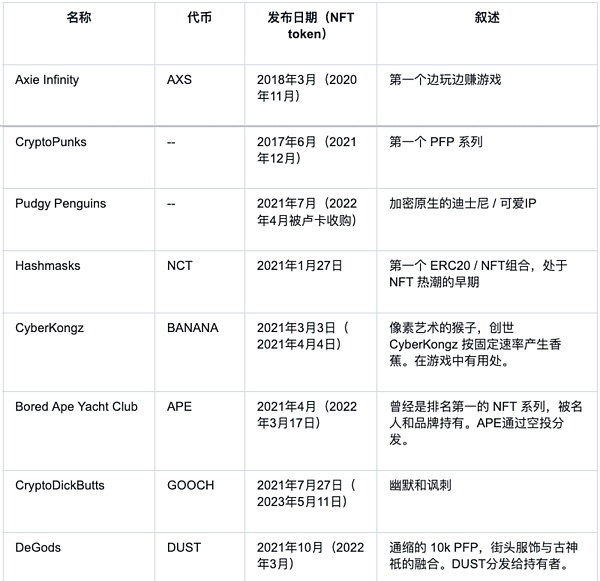

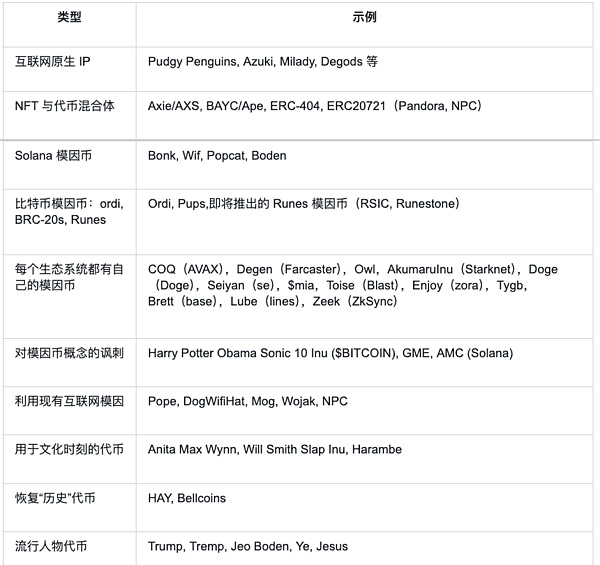

Several narratives worth paying attention to recently include:

Universal rules of Meme Coins

In each cycle, Meme Coins emerge in different forms: they present diverse performances based on the underlying technology (such as PoW assets, ERC20 assets or NFTs), and are often the first practitioners of new technologies or new forms.

Although Meme Coins rely on different media, their value accumulation paths have something in common: They all rely on the power of attention, narrative and hype to survive and spread.

While new media always generate a lot of attention in the early stages, long-term retention of value requires sustained attention. NFT or Ordinal status alone is not enough to support value, there must be a deeper driver of attention. Attention is clearly cyclical, and once a medium has experienced an initial round of hype, a more fundamental driver of attention is needed to maintain the heat.

First there is a meme trend, then there is an asset: For the most successful meme coins such as Doge Coin, Pepe Frog, and dogwifhat, the Internet meme took the lead, and the meme coins took advantage of the momentum and realized value through existing popularity and communication.

The Meme trend originating from the crypto field is gradually emerging:Crypto native users are beginning to create Meme trends that can break through the limitations of the Web3 circle and spread widely. Among them, the crypto native intellectual property NFT project represented by Pudgy Penguins is a vivid example of this trend.

Low price phenomenon:Since the early days of altcoins, users have been keen to speculate on digital assets that seem to be cheap (usually due to large supply). The psychological appeal is that if a digital asset with an insignificant price can climb to $1, the holder may become a millionaire overnight. The price itself constitutes a unique Meme trend phenomenon.

Strong community and marketing strategy:The success of Meme Coins is inseparable from the support of a strong community, founders or spokespersons, who inject vitality into crypto digital assets by creating content, promoting brands, and spreading Meme trends.

From spontaneous launch to professional team operation: Early Meme Coins were mostly spontaneous and fair launches, with no insider or team share. Although this model has many advantages, it also faces risks such as pumping and running away and theft of funds. To address these problems, Meme Coins projects with professional teams have emerged, such as the PFP project, which is committed to attracting attention and expanding the influence of Meme Coins.

Distinctive visual elements, derivative images and slogans accelerate the spread of Meme trends:In social networks, images have become the key carrier for the spread of Meme trends. Usually, a Meme trend usually starts with a core visual symbol, and then derives a rich and diverse form of expression.

Criticism and risks

Although Meme Coins contain opportunities, its risks cannot be ignored. Many Meme Coins are prone to attracting users who seek to get rich quickly and regard investment as buying lottery tickets or participating in gambling.

At the same time, the Meme Coins market frequently sees pump-and-dump and market manipulation. According to a recent report released by blockchain analysis agency CipherTrace, in 2023, pump-and-dump scams accounted for 99% of all crypto asset fraud incidents, resulting in a cumulative loss of US$2.1 billion. Therefore, for Meme Coins, investors should carefully examine their characteristics, such as the status of LP assets (whether they have been destroyed or held in a centralized manner), team allocation ratios, transaction taxes, and whether smart contracts have given up management rights.

In addition, the regulatory regulations for Meme Coins are still unclear. In June 2021, the Securities and Exchange Commission of Thailand banned a group of digital assets that lacked clear goals or substance and whose prices were easily manipulated by social media trends and influencers.

Another major concern is that Meme Coins could die out from a simple lack of interest, attention, and awareness, rather than from malicious attacks. Such investment losses could cause the community of holders to become hostile or indifferent.

Huang Bo

Huang Bo