The Bitcoin ETF decision is imminent, the Ethereum Cancun upgrade will be activated, and Bitcoin’s quadrennial block reward halving is approaching. The Web3 industry in 2024 will be dominated by these three major events A new curtain opens.

The approval of Bitcoin ETF will provide new guarantees for the liquidity and investment convenience of Bitcoin, thus attracting more investors to enter the Bitcoin market. The Ethereum Cancun upgrade will greatly improve Ethereum's scalability, thereby providing a more powerful underlying infrastructure for the development of Web3 applications. The Bitcoin halving will cause the supply of Bitcoin to decrease, theoretically pushing its price higher.

The industry predicts that these three things will be the key nodes for the crypto asset market to turn from bear to bull.

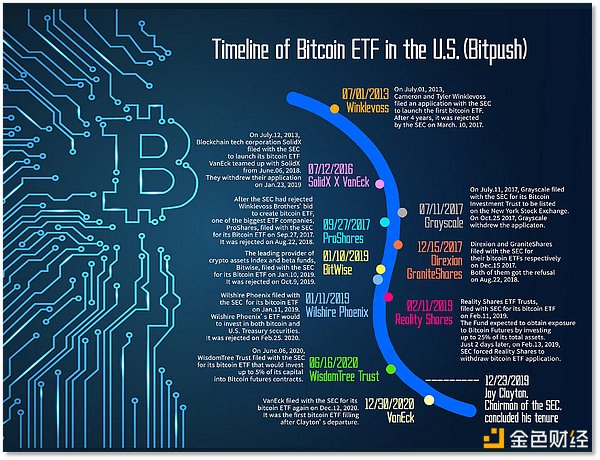

Bitcoin ETF

On December 29, 2023, Reuters released blockbuster news According to the report, the U.S. Securities and Exchange Commission (SEC) may inform applicants on January 2 or January 3 (U.S. time) whether they are allowed to launch spot Bitcoin ETFs (Bitcoin exchange-traded funds), which will allow applicants to There is time to prepare for the launch on January 10th.

As of now, 13 issuers have submitted applications for Bitcoin spot ETFs to the SEC, including Grayscale, BlackRock, Fidelity, VanEck, and ARK Companies such as +21Shares and Bitwise intend to offer spot Bitcoin ETFs on exchanges such as Nasdaq, Cboe BZX and NYSE Arca.

Image source BitPush

On December 29, many companies submitted amendments; On March 21, several applicants participated in a rare joint conference call with the SEC.

At most, on January 10, the SEC will have to respond to the application for a spot Bitcoin ETF. The industry generally believes that the likelihood of the ETF passing is very high.

Investment research firm Fundstrat predicts that once the Bitcoin spot ETF is approved, the price of Bitcoin will jump more than five times from current levels to exceed $150,000 and even reach $180,000. It is expected that more than $2.4 billion will flow into the newly approved U.S. Bitcoin spot ETF market in the first quarter of 2024.

Ethereum Cancun Upgrade

For a long time, in the fierce competition with other blockchains In the competition, Ethereum does not occupy a dominant position. Its design is relatively complicated, and the upgrade process requires a long preparation period. Compared with Bitcoin, Ethereum lacks asset advantages, and compared with rival chains, the Ethereum network is prone to congestion due to sudden hot applications, resulting in transaction delays and high fees, and its scalability is also limited.

However, the Cancun upgrade predicted for the first quarter of this year will bring huge performance improvements to the Ethereum network. By introducing sharding technology, the Cancun upgrade will enable the Ethereum network to handle multiple shards simultaneously, thereby significantly increasing transaction throughput. This will allow the Ethereum network to meet growing user demand while supporting more decentralized applications and transactions. Additionally, the Cancun upgrade will also reduce transaction fees on the Ethereum network.

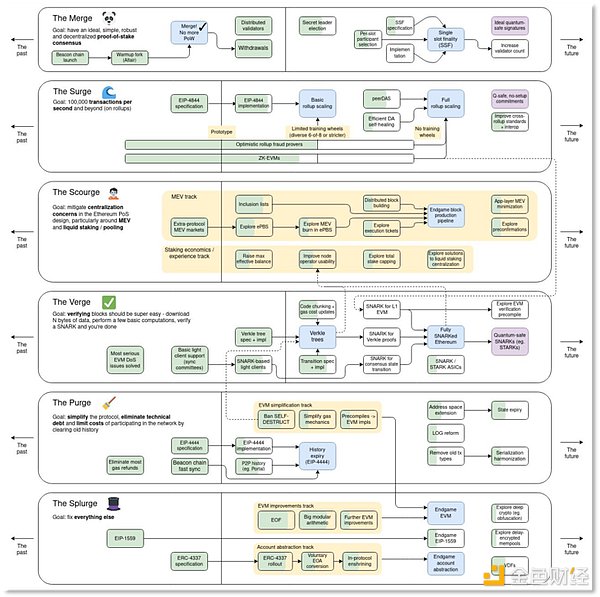

Ethereum co-founder Vitalik Buterin recently shared an updated roadmap, demonstrating a commitment to continuous improvement and innovation.

One of the key updates includes the implementation of Single Slot Finality (SSF) in post-merger Proof of Stake (PoS) improvements. SSF is expected to address many of Ethereum’s current flaws in PoS design, allowing for faster and more secure transactions.

Developers have also made significant progress in other areas such as Surge, including advancements in EIP-4844 and rollups. These improvements enhance Ethereum’s scalability and efficiency, which are critical to its long-term success.

Buterin’s roadmap also addresses the challenge of economic centralization in PoS through initiatives such as Scourge. The redesign is focused on addressing Maximum Extractable Value (MEV) and general stake pool issues, which are critical to maintaining the integrity and decentralization of the network.

Analysts are optimistic about the future of Ethereum. Some predict that after the Cancun upgrade, the price of Ethereum is expected to reach more than $5,000, and Layer 2 will dominate In the Ethereum ecosystem, decentralized applications on various chains are ushering in major underlying progress.

Bitcoin block reward halving

Bitcoin is expected to usher in April 2024 The block reward halving cycle will further reduce the supply of Bitcoin, theoretically driving its price upward.

Bitcoin halving is an established event, that is, the block reward for mining new Bitcoins is halved. The original reward (in 2012) was 50 BTC, which was reduced to 25 BTC in 2016 and reduced to 12.5 BTC in 2020. The next halving is expected to occur in April 2024, when the mining reward per block will be reduced to 6.25 Bitcoins.

This year, protocols represented by Ordinals have led a new trend in the Bitcoin ecosystem, which has gradually changed the face of Bitcoin. In particular, the new Bitcoin inscription experiment based on the Ordinals protocol has begun to introduce some new variables to Bitcoin, which has been developing towards the "payment currency" attribute for more than ten years, and has even begun to reveal the preliminary prototype of an ecosystem similar to Ethereum.

The Bitcoin network not only has NFTs, it can also issue homogeneous token assets with the help of protocols. But at the same time, controversies over "innovations" such as BRC20 continue to trigger heated debates. After Inscription, the emergence and development of the Bitcoin Layer 2 network may relieve the pressure of new asset issuance on the Bitcoin main network.

JinseFinance

JinseFinance