Author: 527 Source: X, @Eth527

The currency circle is a history of currency issuance. All innovations and capital operations are essentially centered around the three eternal themes of assets, distribution, and circulation. Therefore, I still sort out the situation of Rune from these three perspectives in combination with the recent situation of Rune.

1. New assets-the historical mission of Rune

Rune is a new asset. New assets will inevitably bring about a new wave of coin minting, which is already a law of history.Therefore, it can be predicted that we will inevitably participate in a vigorous new coin issuance in the near future, and countless project parties and participants will benefit from this wave of dividends and make a lot of money. What we have to do is not to leave the market, and force ourselves to be nailed to the wind outlet like a pig, waiting to be blown to the sky.

As for why this new asset appeared, it can be understood from many angles:

1. For example, when Bitcoin is halved, miners need to prosper the Bitcoin ecosystem and promote transactions, so inscriptions and runes were born;

2. Domo realized Casey's idea, so Casey proposed runes to take back his own glory and wealth;

3. The narrative of BTCFI is grand enough, and project parties need a suitable carrier for issuing assets on the BTC chain. For details, please refer to my previous article: "Detailed Explanation of the Gameplay of Runes (Written in the Exciting Narrative Before the Halving)".

In this article, I want to discuss from a more grand proposition: the right to mint coins. On the surface, every project in the circle is issuing coins, and even retail investors can deploy a dog coin, a token, an NFT, an inscription, and a rune on the blockchain according to protocols such as ERC2, ERC721, and Ordinals. Everyone can also cast it fairly, and it is nothing more than who gives a higher or lower GAS. But do we have the right to mint coins? That is not my understanding. The assets we release do not directly generate any value, nor can they directly lead to the allocation and transfer of assets, except that we frantically fool others to take over. It is nothing more than who has a greater influence, who can operate, and who can sit in the market. However, real currency has absolute influence, such as gold and silver since the Age of Discovery. They are globally recognized circulation price standards. Whoever controls the gold mines and has the most reserves can directly plunder global materials and get rid of the value obtained through exploitation. After the Bretton Woods system was abolished by Nixon, the US dollar relied on its superpower to link the US dollar with oil and become a universal international currency. It can increase and harvest global wealth by simply issuing and reducing it. After truly obtaining the right to mint coins, the United States began to deindustrialize, globalize, and comprehensively develop the financial services industry, standing at the top of the pyramid and becoming a global trend-setter.

So, who has the right to mint coins in the currency circle?

Before ETH, it was Bitcoin, but it had no scalability and could not develop an ecosystem. Therefore, after the emergence of ETH, ETH is actually the one who truly has the right to mint coins. All project deployments and asset circulation cannot bypass it. Others also want to follow his example and build their own empires, such as various Layer1s, but they do not have the strength of ETH and can only be local emperors in their own small territory.

Now, the times have changed. After the ETF is passed, Wall Street has completely legitimate reasons and channels to enter the currency circle. They who are well versed in the principle of minting coins naturally need to get the greatest voice. Who does ETH belong to? It belongs to Russia's Vitalik Buterin, to the Ethereum Foundation, and in short, not to Wall Street. Therefore, from the perspective of conspiracy theory, a battle between ETH and BTC for the right to mint coins began on the day the Ordinals protocol was born. BTC must be scalable and establish an ecosystem that can compete with or even crush ETH. People must get used to BTC as a settlement unit for deployment and transactions. Therefore, it can be predicted that various solutions to expand BTC will emerge in an endless stream over a period of time. Even if there is no innovation in replicating an ETH ecosystem, it will receive support and funding.

Therefore, I can assert that a large amount of capital will be invested in BTC's famous protocols in the future, and they will use runes to issue coins to achieve their own growth and profitability. I can make an analogy. After World War II, the United States exported a lot of funds and technology to Japan and Germany to help them resume production and build the country. Why? The essence is to establish a community of interests that all use the US dollar. Back to today's BTC ecosystem, the same applies.

Then why is it not Inscription? Because it is a fair sale and is not suitable for project parties. The answer is so simple. Therefore, the next Rune craze will come sooner or later, and only those project parties that build the Bitcoin ecosystem can run. You can say that this violates the spirit of decentralization, but no spirit can stop the greed and madness of capital.

If you are more conspiratorial, why does Wall Street want to seize the coinage right of the currency circle? I understand that this is part of defending the hegemony of the US dollar, because cryptocurrency is also one of the global assets. Why is my country buying gold crazily this year? Think about this question carefully, I can't expand it here.

From the above perspective, I think I can explain some problems, such as why Inscription still has a market value of only 2 billion, because there is no motivation to pull the market, it does not fundamentally solve the proposition of expanding the Bitcoin ecosystem, and there is no direct interest in any project party. Runes will eventually be falsified because of the ugly faces of miners. In essence, miners are just beneficiaries. They cannot start and rewrite such a huge narrative.

2. Distribution mode - inventory and outlook

1. Inventory of existing models

Through the sorting of runes 0-9, we have seen several ways of chip distribution: PRE-RUNE, MINT, mining, and snap-up. PRE-RUNE can be further divided into snapshots and holding time.

Let's not talk about MINT. Everyone casts it fairly with GAS. It's nothing more than a question of how much the project party pre-mines. Rune 0 is unlimited, which is a sample for everyone by the founder. 99.9% of Rune 1 is pre-mined, and the remaining 0.1% is basically mined by Wolong Fengchu with high GAS. Runes 6 and 7 pre-mined 20%, and the remaining 80% was given to everyone as fair MINT, which is more like the way to play with inscriptions.

Mining is done by Rune 4, 10% is PRE-RUNE, that is, holding NFT can get 10%, and the remaining 90% must be mined by staking NFT, and the output is halved every month, and the income is released linearly. I don’t have a good impression of the No. 4 project recently, because compared with other project parties horizontally, he seems stingy and bad. I can only say that this distribution method is suitable for eating melons.

The first way of PRE-RUNE is snapshot, that is, the moment of holding the NFT snapshot, it is determined whether the rune can be allocated, such as No. 3 and No. 9, but after the snapshot, the NFT is smashed. The second way is the holding period, which is the way to play No. 8, that is, mining has been going on during the holding period, and the runes during the holding period still belong to the original address after the NFT is transferred. At the same time, it also adds some algorithms to encourage holding, such as random rewards and lottery. For details, please see my article "Carefully sorting out the money-making logic of runes 0-9 (Part 2)".

The rush purchase was created by DOTSWAP. The project party first MINTs all the runes and then everyone can rush to open the market, which is similar to the feeling of beating a dog.

The above model does not represent the distribution model of the entire rune. Except for rune No. 8, other distribution models are very common.

2. Outlook of rune distribution model

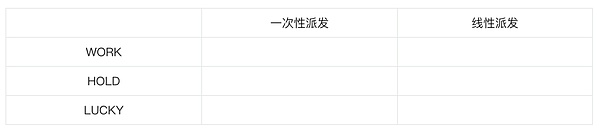

In fact, the distribution model can be divided into two categories in essence. The first is why it is given to you, and the second is when it is given to you. Why it is given to you can be divided into three modes: WORK, HOLD, and LUCKY, which are the same in all changes.

When to give it to you can be divided into: one-time distribution and linear distribution.

WORK refers to proof of contribution. Bitcoin mining and airdrops are two distribution modes. Whoever pays has the right to distribute chips. It’s just that Bitcoin mining is a linear distribution, which can be mined, withdrawn and sold, just like settling daily or monthly wages; airdrops are a one-time distribution, which is given to you in one breath after accumulating for a long time, just like year-end bonuses and equity dividends.

HOLD means holding and distribution, such as the dog airdropped on the 3rd, the wolf airdropped on the 9th, and the RSIC airdropped on the 8th. The difference is snapshot distribution and point distribution. In essence, I prefer the latter, because the former is easy to use everyone’s expectations to distribute holdings at a high position. Unless the project party is particularly awesome, there is a high probability that it will cut leeks. Why did the NFT on the 8th not fall much, and the NFTs on the 3rd and 9th plummeted after the snapshots? This is the principle.

LUCKY refers to luck, such as DOTSWAP's snap-up and IEO, which means getting more accounts to increase the numerator, but this is a quick way to attract attention and increase the market value of the platform currency.

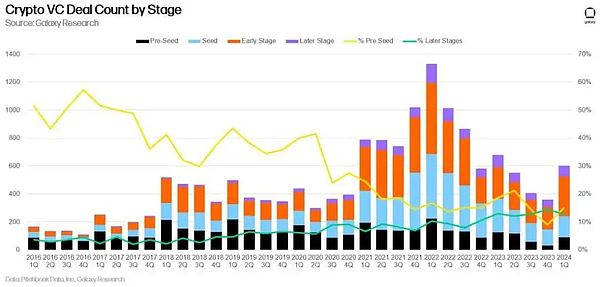

In terms of transactions, the share of pre-seed transactions in the first quarter increased slightly, indicating that newly established startups have grown.

In the future, when encountering new distribution methods, everyone will understand it in this quadrant to better think about the motivations and operation paths behind the project party. Instead of focusing on whether it is an airdrop or MINT on the surface.

To understand the distribution model in depth, you can compare it with the company's salary system, which is exactly the same. There is actually no difference between the project party distributing chips to you and the boss paying you wages. A good salary model will motivate employees to work hard, while a bad salary model will spawn countless ungrateful people. Of course, there are too many PUA bosses in life who want to make you do the biggest thing with a little money, and there are even bosses who cheat employees of their money by painting cakes in reverse.

For example, pure mining, I dare say that there is no other project that can be played like this except Bitcoin. This is a daily or even hourly settlement. Employees actually have no loyalty, especially new companies. They will think that you will collapse and take advantage of you to mine and sell. On the other hand, if a new company sets a high mining and selling price, do you really think he is stupid? He must want to cheat you of your money, just like we received some calls from black intermediaries. He does not look at your appearance, education, and ability. The part-time salary is extremely high. You think you are filling in the pie in the sky, but in fact he is deceiving you to pay the registration fee or even sell you to Myanmar.

For example, blind box airdrops. To be honest, SOL is still great. It has changed the PUA-style pattern of the ETH ecosystem. All airdrops are based on a points system, which is very good. What it feels like is that airdrops are year-end bonuses. The projects in the ETH ecosystem depend on the boss's mood. He can give them to anyone he wants, so the airdrop standards are not announced in advance. There are a lot of insider warehouses, and then you are infinitely PUA. The projects in the SOL ecosystem are to issue a scoring system in advance. Everyone scores points according to the rules, and finally distributes the year-end bonus in proportion.

For example, holding NFT to issue coins is very similar to the options that a company subscribes to employees before listing. If it is a company like Tencent, then I have nothing to say, buying is earning. If it is an ordinary company, then he will give you a dream of wealth every day, and then induce employees and others to take over, which is actually a disguised ICO.

In the final analysis, the distribution methods are tools and means, and we still have to look at the strength and purpose of the project party. Some weak project parties use some very PUA tools and means, I suggest you to participate with caution. However, if the rules of weak project parties clearly tell you the distribution standards, it is actually very good. Of course, it is best for strong project parties to follow the clear rules, which is really quite good.

I strongly suggest that you sort out the projects you want to participate in according to this process in the future: whether there is strength, whether the distribution method is in line with his strength, whether he wants to do things or cheat money. Conversely, a project party who really wants to do things should also think about whether his distribution model can motivate users, whether it is long-term or short-term, or a combination of long-term and short-term.

Three, flow method - how to find more takers

1. Circulation

Infrastructure for rune circulation, in fact, some projects respond quite quickly.

First, there are the order markets: OKX, UNISAT, MAGICEDEN. UNISAT has the best liquidity and is used by many foreigners. Although MAGICEDEN was launched later, the function of bulk purchase is great. How should I put it? I am still very optimistic about MAGICEDEN. Its points are worth brushing. We also got its airdrops in the process of trading runes. It really kills two birds with one stone. I hope that a great god will come up with a strategy to maximize the points of order runes. Even, you can be a dealer of some runes like BLUR before, making money while brushing MAGICEDEN points: that is really making money again and again.

Second, CEX: Inscriptions are so difficult to deal with, but they can be listed on CEX. It is very easy for runes to be listed on CEX. To be honest, it depends more on the resources of the project party and who will send their projects to OK and Binance first. Of course, if you have been listed on a small exchange but not on Binance, then you may need to pay attention. The purpose of listing on a small exchange is to collect chips rather than pull the market, so the probability of an infinite decline is very high.

Then there is DEX: DOTSWAP, which was the first to come up with this thing. Rune 4 also made a cross-chain, which can cross its runes to ETH for SWAP, but it seems that it cannot support other things. In my understanding, it does not solve the cross-chain problem. It just adds or subtracts the number of internal tokens. Therefore, I still want to observe DOTSWAP, and its market value is not high now.

2. Pledge/mortgage

Whether it is a rune or a shovel for pre-mining a rune, it should be able to be properly pledged and pledged as an asset in the end, such as forming an LP or something. There is less information available now, and the market value of the rune is not large, so the market demand is not high. However, relevant protocols should be noted. Once the market value is large, it will stand out.

This article only takes stock of the current situation. More tracking and observation are still needed. If the bosses have other good investment research perspectives, please feel free to communicate more.

Fourth,Thinking

It is actually meaningless to simply review the situation. Let's talk about some action guidelines

1. Pay attention to and continue to increase holdings of assets such as RSIC. At present, it seems that it is comparable to Rune Stone. Holding means point mining, which is not PUA at all. It is also an early Rune project and may receive airdrops from various project parties in the future. Moreover, you can read his official tweets. He is a ruthless and quiet big brother. He has also cooperated with MEMELAND and is very strong. Compared with @LeonidasNFT, I think he is like Ma Huateng, who is low-key and silent, but has the temperament of a big boss. @LeonidasNFT is like Jack Ma, who is flamboyant and outward-looking, attracting countless believers. Either way, it is very meaningful in the early stage of the Rune ecosystem. But in the long run, RSIC may be more powerful. Therefore, I will at least hold Rune Stone and RSIC in half.

2. Brush MAGICEDEN points, it will become the leader of Bitcoin ecological asset trading venues, Bitcoin ecological projects may fail, but exchanges are guaranteed to make money.

3. Pay attention to those projects that are really doing BTCEI, brush their interactions, participate in their Pre-Rune methods, and strive to get shovels and airdrops. At the same time, for those runes that are the first to provide liquidity for runes, it is recommended to participate in new issuance and hold appropriately, such as Dotswap.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Huang Bo

Huang Bo Joy

Joy Coindesk

Coindesk Beincrypto

Beincrypto Bitcoinist

Bitcoinist Beincrypto

Beincrypto Coindesk

Coindesk

Cointelegraph

Cointelegraph