Author: Tonstakers; Compiler: Vernacular Blockchain

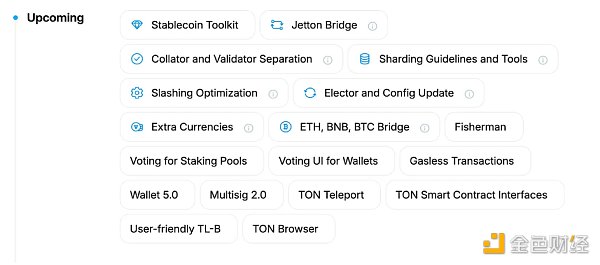

TON's development roadmap has many interesting plans, such as a stablecoin toolkit, sharding tools, and native bridges for BTC, ETH, and BNB. Although there is no release date, we hope that they will be online in 2024. In this article, we will explain the upcoming features, how they will affect the network, and whether they will change TON's staking rewards.

We have divided the most interesting points into three categories to better understand their combined impact. Let's dive in!

1. Fee-free transactions

This is the most eye-catching milestone in TON's 2024 roadmap. No other major chain offers fee-free transactions, so TON has the potential to revolutionize the blockchain space and attract more users from other ecosystems.

In every blockchain, users must pay gas fees for their transactions. Blockchain protocols cannot eliminate gas fees because they prevent spammers from sending thousands of transactions per second and clogging the network.

It is possible that TON will subsidize gas fees in certain cases, such as Telegram wallets or USDT transfers, to attract more users to use TON for their daily needs. Imagine that you can send $5 to your friend in Telegram without asking for his credit card number or wallet address, and more importantly, it's free.

2. Changes in staking rewards

1) Separation of validators and consensus

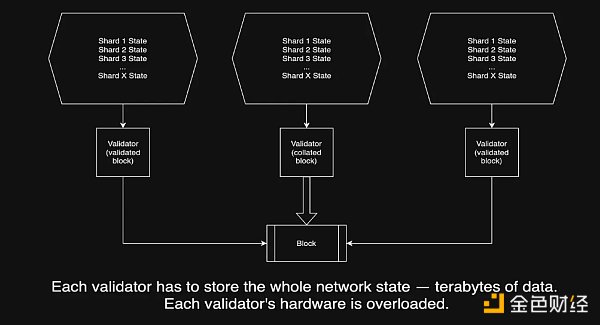

This is a major upgrade to TON's scalability. Consensus refers to the process of collecting transactions, verifying transactions, and combining them into a block. To do this, nodes store and constantly monitor all balances of all addresses in the TON blockchain.

TON plans to introduce 500 million Telegram users by 2028 and use sharding technology to provide sufficient transaction execution time and low transaction fees. Through sharding, the blockchain is divided into several shard chains. 2 shard chains provide 2 times the throughput, 4 shard chains provide 4 times the throughput, and so on.

Each shard chain will have its own subset of validators to collect and verify blocks. To ensure security, these validators must be randomly rotated between subsets frequently. Here comes the problem: with random rotation, validators will have to store the state of every shard, not just their own. Storing the state of 1 million accounts requires powerful servers, and storing the state of 5 million accounts in one place is impossible.

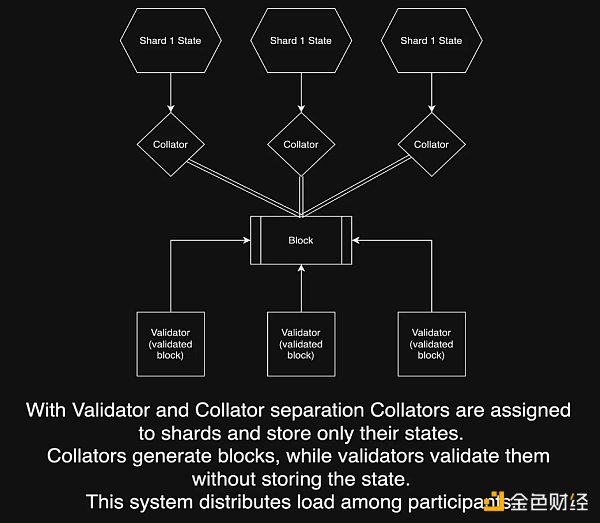

To solve this problem, the TON team proposed to split verification and collection into two roles: Collators may only store the state of their shard chain and collect blocks, while Validators are only assigned to that shard chain for a period of time to verify and sign blocks. The load and risk will be evenly shared, and TON will be able to scale to meet the needs of billions of users.

In the official documentation, there is no mention of staking rewards. Although only validators take risks in block verification, collectors should also be rewarded for storing states and generating blocks.

Although the verification process becomes more complicated, TON's annualized staking rate of return will not change, and Tonstakers' liquid staking will remain as profitable as it is now.

2) Sharding Guides and Tools

Thanks to the outstanding developers responsible, TON will become one of the first blockchains to effectively utilize sharding. Centralized exchanges, payment systems, and even TON’s services and applications require special tool sets and documentation to implement sharding support, as this is a technology they are not familiar with. That’s why TON developers hope to release such a tool in the near future.

3) Penalty Optimization

A penalty is a way to punish validators who perform poorly: missing blocks, being offline frequently, or even trying to put fraudulent transactions into blocks.

Currently, TON uses a complaint mechanism to punish misbehaving validators. Any network participant can provide evidence and hold bad validators accountable.

Penalty optimization should lead to a better system for detecting and punishing misbehaving validators, enhancing the robustness of TON. This will be implemented in several steps: First, the Liquid Staking Protocol will not be affected by validator penalties, and users’ rewards will be guaranteed. Then, the penalties will be distributed across TON provided by the Liquid Staking Protocol, slightly reducing the average annualized rate of return.

4) Voter and Configuration Contract Updates

TON's staking, liquid staking, and on-chain governance are all implemented through smart contracts. Tonstakers also use these contracts to pool TON, provide TON to validators, and distribute rewards among our users.

Updates to the Voter and Configuration Contracts will allow our users to vote on network proposals, making the network more open and increasing the value of each user.

3. Decentralized Finance

We put these changes together because if combined, they will have a positive impact on the DeFi ecosystem.

1) TON Stablecoin Toolkit

In addition to the name, there is no explanation of its specific content in the document. We can guess that the Stablecoin Toolkit will allow anyone to issue algorithmic stablecoins pegged to local fiat currencies such as GBP, EUR, NZD, etc.

Considering TON’s integration with Telegram, its built-in wallet, and its recent decision to share TON’s advertising revenue with channel owners, we can assume that Telegram may add the ability to pay for built-in services with local stablecoins.

2) Jetton Bridge

TON already has bridges with Ethereum and BNB chains for bridging $TON and popular currencies such as ETH, BNB, and USDC.

The Jetton Bridge will allow users to send TONTokens like tsTON to other chains. Why not add tsTON on Uniswap?

3) Ethereum, BNB and Bitcoin Bridges

Although we have third-party bridges, it would be logical to launch official bridges in terms of issuing additional currencies.

4) Additional Currencies

$TON is the native token: used for staking and paying gas fees. For example, the function code for trading $TON is built into the TON protocol, and the balance is held in the account.

Jettons (regular tokens such as USDT and tsTON) operate through third-party smart contracts and are not a substitute for gas fees and staked $TON. The user's balance is stored in these contracts.

Additional currencies will allow TON users to create tokens similar to the native token, which will also be stored in the account. The most significant difference between Extra Currency and Jettons is that transactions in Extra Currency should be 2-3 times cheaper than in Jettons, as they will occur without contract calls.

Issuing major tokens like bridged Bitcoin and Ethereum or native USDT as Extra Currency will make working with TON more advantageous and will attract more new users to TON. Want to buy Bitcoin, Ethereum and BNB? TON will offer them on one platform.

4. Conclusion

TON's roadmap looks promising and brings many new tools to make TON more popular among the masses.

We think the most impactful updates are the native currency, bridge and stablecoin toolkit, which together will expand the application scenarios of TON in daily payments and allow more people to start building their own crypto asset portfolios.

At the same time, we Tonstakers are interested in the separation of validators and collectors, penalty optimization, and pledge contract updates. Separation and sharding will not affect the annualized yield of pledges, and contract updates will bring more value to liquid pledge users as they will get voting rights on TON update proposals.

Can't wait to look forward to the future that TON will bring us in 2024!

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance WenJun

WenJun JinseFinance

JinseFinance Others

Others Beincrypto

Beincrypto Bitcoinist

Bitcoinist 链向资讯

链向资讯 Ftftx

Ftftx 链向资讯

链向资讯