Author: Yohan Yun, CoinTelegraph; Compiler: Deng Tong, Golden Finance

Bitcoin hits a record high as President-elect Donald Trump wins the 2024 U.S. presidential election.

Trump is returning to the White House, and now he appears to be bringing a pro-crypto stance. His campaign has repeatedly promised to support the cryptocurrency industry, a departure from the previous administration.

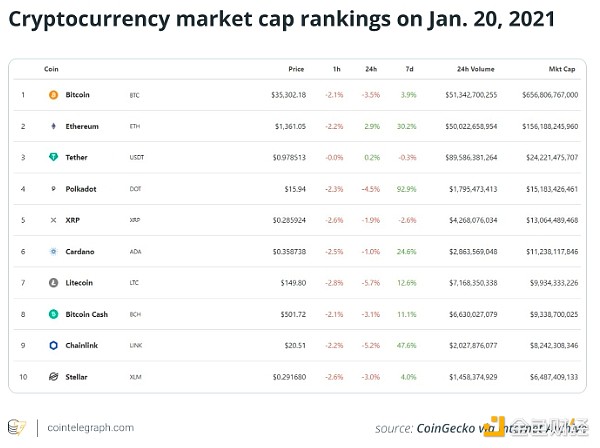

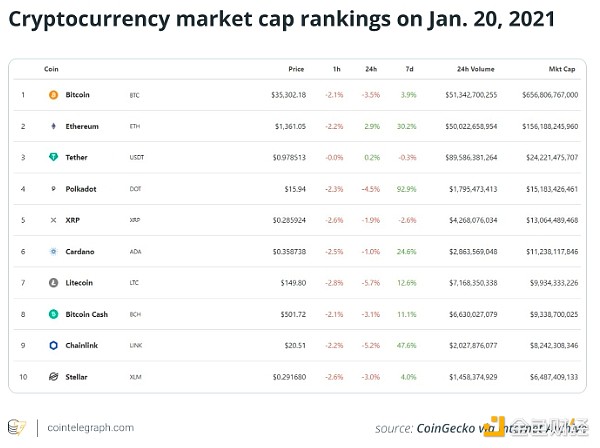

As Trump prepares to resume office, this article reviews the cryptocurrency landscape during his last term. The industry has since undergone a major transformation—half of the top 10 tokens during his last term have fallen out of the rankings.

Let’s take a look at the current status of the top ten cryptocurrencies during Trump’s last presidency.

Bitcoin remains king

Bitcoin price on January 20, 2021: $35,302.18

Bitcoin price on November 11, 2024: $82,379.60

Since Trump’s last White House, Bitcoin has experienced more twists and turns than the president-elect’s campaign. First, it hit an all-time high of about $67,000 in November 2021. Then there was FTX — the November 2022 crash that dropped Bitcoin to $17,000 left everyone wondering if the ride was over.

Both Bitcoin and the global economy experienced a bear market, and BTC struggled for much of it.

Like any good comeback story, though, Bitcoin bounced back in 2024 as it became available to institutions on the U.S. stock market via those shiny new spot exchange-traded funds (ETFs).

With Trump’s victory marking the beginning of the end for crypto supervillain Gary Gensler of the Securities and Exchange Commission (SEC), analysts’ eyes were on the $100,000 mark, with the asset having already broken through the $82,000 mark.

In addition, Bitcoin now hosts digital trinkets like Ordinals (an iteration of non-fungible tokens) and some of the internet’s most popular memecoins via Runes. So while Bitcoin remains the gold standard cryptocurrency in the age of Trump 2.0, it’s also found some new ways to keep itself interesting.

From Undisputed King to Layer 2 Lab Rat

Ethereum Price on January 20, 2021: $1,361.05

Ethereum Price on November 11, 2024: $3,175.47

ETH is the undisputed monarch of the smart contract world, ruling over a kingdom of decentralized applications. Now, that crown isn’t so secure anymore, and the network is facing some stiff competition.

Solana, a fast, flashy upstart currently ranked fourth by market cap, is taking the lead among the “Ethereum killer” blockchains.

However, Ethereum has chosen a different route to stay relevant. Instead of competing for raw speed, it has chosen to scale via Layer 2 solutions. This has helped ease notorious congestion and high fees, but it comes at a cost.

These layer 2 networks have drained liquidity and fragmented Ethereum’s ecosystem, turning its once-unified realm into a sprawling collection of mini-kingdoms.

As it continues to evolve, Ethereum is also going green with The Merge in September 2022, replacing proof-of-work with the more environmentally friendly proof-of-stake consensus mechanism.

The upgrade slashed Ethereum’s energy consumption by 99% and laid the foundation for future scalability tweaks like sharding. The crypto world praised the move as a big step forward for Ethereum’s sustainability, though it didn’t lead to the explosive price surge that some investors had expected.

While Bitcoin has been busy breaking records, Ethereum has been left behind despite listing its own spot ETF. For now, Ethereum retains its second spot, but being a legacy name alone may not be enough to keep the crown.

USDT defies skeptics

After the Terra-Luna debacle — which shook confidence in algorithmic stablecoins everywhere — Tether’s USDT has not only weathered the storm, but emerged stronger than ever. USDT is now the third-largest cryptocurrency by market cap, and its valuation has soared to around $120 billion.

Despite the company making $2.5 billion in net profit in the third quarter, bringing its total profit for 2024 to $7.7 billion, the company has yet to undergo a full, comprehensive audit. Instead, Tether regularly provides attestations.

So what’s driving it? Mainly U.S. Treasuries. That makes Uncle Sam’s debt a cash cow for Tether.

But with big profits come big problems. In the absence of a formal audit, many are skeptical that Tether’s vaults are as solid as they claim. Tether may be a giant, but trust is still the most important currency.

From Contender to Reconstructor

Polkadot Price on January 20, 2021: $15.94

Polkadot Price on November 11, 2024: $5.13

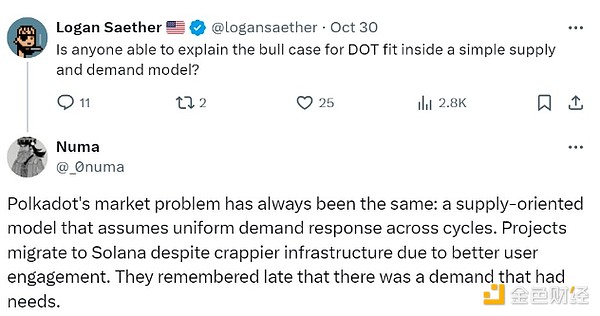

Polkadot gained momentum during Trump's last term. With a market cap of $17 per coin and fourth place in the cryptocurrency rankings, it seemed poised to become a bridge across blockchain ecosystems and a future of seamless cross-chain communication. However, in 2024, Polkadot's sheen has faded - with a price of $4.10 and a market cap that has fallen to 21st place.

Polkadot is no longer a top 10 cryptocurrency. Source: Logan Saether

Despite this, Polkadot is not raising the white flag. This year, it launched Agile Coretime, a new system that allows developers to buy processing time directly on its core layer. This is part of the Polkadot 2.0 upgrade and is a major shift from the old auction model.

With the introduction of “Inscriptions” – a playful nod to Bitcoin’s ordinals – Polkadot broke records in December 2023 with over 17 million transactions.

Polkadot’s audience is hard to impress, though. Ethereum and Solana have cemented themselves as powerhouses in the decentralized finance (DeFi) space, with other advanced blockchains not far behind.

XRP Has a Bright Future

XRP Price on January 20, 2021: $0.285924

XRP Price on November 11, 2024: $0.581592

In January 2021, XRP was fifth in the cryptocurrency rankings. It fell slightly to seventh, but growth has been mostly positive. Its price jumped from $0.2958 to $0.5355, more than doubling its market cap to $30.5 billion. Not bad for a cryptocurrency that’s endured enough legal battles to warrant courtroom drama.

Ripple Labs, the San Francisco-based company that develops technology around the XRP ledger and advocates for its use in cross-border transactions, scored a partial victory in court in 2023.

After years of back-and-forth, a judge ruled that while some private sales of XRP did enter the realm of unregistered securities, XRP itself was not a security. It was a half-victory for Ripple and a complete game-changer for the XRP ecosystem, which has long operated under a regulatory cloud.

Now, with legal uncertainty removed, XRP is even being discussed as a candidate for an ETF — alongside up-and-comers like Solana. An XRP ETF could open the door to a more mainstream audience, sparking new excitement among investors who’ve weathered its ups and downs. So while XRP may have slipped a few spots in the rankings, its resilience, steady growth, and newfound legal clarity signal the start of an unexpected recovery.

ADA Occasionally Falls Out of the Crypto Top Ten

ADA Price on January 20, 2021: $0.358738

ADA Price on November 11, 2024: $0.592937

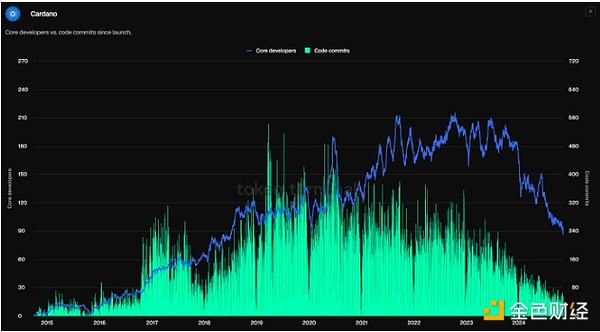

In the last round, Cardano was firmly in the top ten, dubbed the “Ethereum Killer” with roots that can be traced back to one of Ethereum’s co-founders. Today, Cardano is a bit like that band from the 90s that still lingers on the charts, occasionally falling out of the top ten.

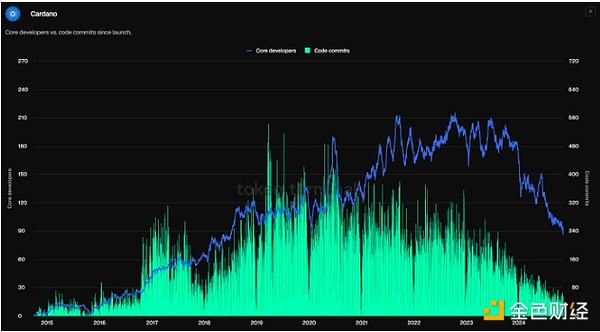

Critics like to call it a “ghost chain,” claiming there’s not much construction and even fewer users showing up. The numbers are indeed eye-popping: Cardano has seen a decline in core developers and active users.

Cardano's code commits and core developer count are down. Source: Token Terminal

However, Cardano did not sit back and let the skeptics have their say. The Chang hard fork, completed in September 2024, brought new features and scalability upgrades, showing that it still has some tricks up its sleeve. The network has also entered the Voltaire phase, which aims to achieve a decentralized governance model where users can directly participate in decision-making.

Litecoin and Bitcoin Cash: The Original Rebels Fighting for Relevance

Litecoin Price on January 20, 2021: $149.80

Litecoin Price on November 11, 2024: $77.38

Bitcoin Cash Price on January 20, 2021: $501.72

Bitcoin Cash Price on November 11, 2021: $438.73

In the early days of cryptocurrency, Litecoin and Bitcoin Cash were the champions of “spendable” cryptocurrency — two currencies vying to become digital cash for everyday use.

Litecoin is a “slimmed down” version of Bitcoin with faster transactions and lower fees, while Bitcoin Cash forked from Bitcoin with a bold promise: to deliver on Satoshi Nakamoto’s original vision of peer-to-peer cash by increasing block sizes and lowering fees.

Both currencies have gained loyal followers and even some merchants have joined in, but their paths have been more like nostalgia trips than the revolutions they were meant to spark.

In a world where Bitcoin has cemented itself as “digital gold” and newer cryptocurrencies offer advanced features like smart contracts and decentralized applications, Litecoin and Bitcoin Cash have struggled to stand out.

Countries banning crypto payments and regulatory red tape haven’t helped, either. While some small pockets of adoption remain — like cafes in Townsville, Ljubljana, and parts of Buenos Aires — widespread use cases for everyday transactions have yet to materialize.

Both Litecoin and Bitcoin Cash have fallen out of the top 10 cryptocurrencies by market cap, ranking 25th and 19th, respectively.

Behind the Scenes of DeFi

LINK Price on January 20, 2021: $20.51

LINK Price on November 11, 2024: $13.99

Chainlink isn’t trying to be “digital cash” or a “smart contract superstar”, it’s trying to be the backbone of the crypto world, quietly holding the DeFi world together.

While other cryptocurrencies chase headlines and retail hype, Chainlink is working to deliver price data, weather forecasts, and other real-world information to the blockchains that need them. Since Trump took office, Chainlink has solidified its role as the go-to oracle service, making it the ultimate unsung hero of decentralized finance.

The recently launched Chainlink 2.0 adds even more power to its oracle network. The upgrade introduced a decentralized oracle network, enabling dynamic non-fungible tokens, automated blockchain functionality, and all sorts of new DeFi magic.

With staking finally available, LINK holders can now secure the network and earn rewards — a long-awaited benefit that fuels this data-driven ecosystem. Chainlink is now more capable of completing complex tasks, proving that it is not only reliable but also versatile.

LINK’s price hasn’t been as steady as its reputation. The token has been hit by volatility and competition. New oracle providers have entered the market, and several DeFi projects are building their own oracles.

Not in the running for Stellar

XLM Price January 20, 2021: $0.291680

XLM Price November 11, 2024: $0.109166

Founded in 2014 by Ripple co-founder Jed McCaleb, Stellar aims to provide fast, low-cost international transactions, connecting everyone from financial institutions to the unbanked.

Since Trump took office, Stellar has made great strides in the central bank digital currency (CBDC) space, notably running a pilot program in Ukraine to test a digital version of the hryvnia.

But Stellar’s journey hasn’t been smooth sailing. Competition in the cross-border payments space has intensified. Governments exploring CBDCs often look to centralized solutions or established platforms like Ethereum.

As the market has increasingly favored DeFi-focused chains with high-use cases, Stellar’s XLM token has suffered. As of November 8, 2024, it has fallen from 10th to 35th place.

Catherine

Catherine