Author: Revc, Jinse Finance

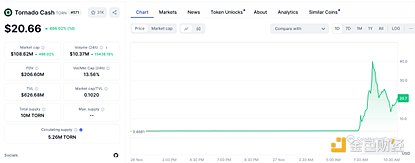

On November 26, the U.S. Fifth Circuit Court of Appeals overturned the sanctions against Tornado Cash. Affected by this news, the price of Tornado Cash token TORN soared 486.02% in the past 24 hours, with a trading volume of nearly 10 million US dollars, a 24-hour increase of 15438.18%.

In recent years, with the rapid development of blockchain technology and cryptocurrency, the contradiction between privacy and regulation has become increasingly prominent. In this game, the cryptocurrency mixer Tornado Cash has become one of the important targets of the U.S. government to combat illegal activities. However, the controversy over the sanctions against Tornado Cash is not only about privacy protection, but also about the boundaries of administrative power and legal interpretation.

Crypto mixers and privacy challenges

Cryptocurrencies are known for their open and transparent trading characteristics, and anyone with technical knowledge can track the flow of funds through the blockchain. However, this openness also brings privacy risks. Violent crimes, hacker attacks, and malicious acts against sensitive transactions are common, making users' demand for privacy more urgent. For this reason, cryptocurrency mixers have emerged.

Tornado Cash is a mixing service based on the Ethereum blockchain that anonymizes transactions through smart contract technology. However, this privacy protection tool has not only attracted legitimate users, but also become a tool for criminals and hackers to launder funds. According to the allegations of the U.S. Treasury Department's Office of Foreign Assets Control (OFAC), since Tornado Cash was founded in 2019, about $7 billion in cryptocurrency has circulated through the platform, some of which is related to criminal activities.

Legal Controversy over OFAC Sanctions

In 2022, OFAC announced sanctions against Tornado Cash, prohibiting U.S. citizens from participating in its transactions.The sanctions sparked an important legal dispute over whether executive power overstepped its bounds. Under the International Emergency Economic Powers Act (IEEPA), the president and agencies authorized by him can freeze the property and interests in property of foreign entities. However, whether the nature of Tornado Cash meets this definition became the core of the case.

In multiple lawsuits, plaintiffs have argued that Tornado Cash’s core technology—immutable smart contracts—is open source software code, not an entity or person, and therefore does not constitute “property” that can be sanctioned. In addition, the lawsuits argue thatOFAC’s expansive interpretation could lead to an unlimited expansion of executive power, posing a threat to personal privacy, open source development, and lawful transactions.

Milestone of the Court's Decision

The Fifth Circuit Court of Appeals ruled that Tornado Cash's smart contracts are not "property of foreign nationals or entities" and that their immutable nature makes them exempt from IEEPA. This ruling marks that the boundaries of government power in dealing with new technologies have been clarified by the judicial system.

The court pointed out that while smart contract technology may have adverse consequences, legislation should be led by Congress rather than solving technical problems through expansive interpretations by administrative agencies. After the ruling, Tornado Cash's native token TORN soared in the market, showing the crypto community's positive response to the ruling.

The future balance of regulation and privacy

Although the court ruling temporarily won a victory for Tornado Cash, the case is not over. The government may still hold the platform accountable through other legal channels, and its developers still face legal challenges. Recently, Tornado Cash developer Alexey Pertsev was convicted of money laundering and faces up to 5 years in prison, which further highlights the tension between regulators and open source developers.

The importance of this ruling lies not only in its direct impact on Tornado Cash, but also in its far-reaching significance for the entire crypto industry, the open source technology community, and privacy protection. As a landmark case in the field of DeFi (decentralized finance), the Tornado Cash case will become an important reference in the future development of regulation and privacy technology.

Summary

The Tornado Cash case reveals the complexity of regulators in dealing with emerging technologies. The balance between privacy protection and national security requires a more detailed and clear legal framework, rather than relying on the expansion of executive power. Congress should play a more active role in formulating regulations that adapt to technological changes and avoid excessive law enforcement or privacy infringement caused by a regulatory vacuum.

For the crypto industry, this ruling reinforces the importance of privacy protection, and also reminds practitioners to pay attention to the integration of technology and law. However,Tornado Cashstill faces legal challenges such as money laundering and financial stability, and investors should pay attention to related risks.

Privacy is a right, not a crime. In an era of constant technological innovation, the challenge of balancing privacy and regulation has just begun.

Kikyo

Kikyo

Kikyo

Kikyo Alex

Alex Brian

Brian Brian

Brian Kikyo

Kikyo Brian

Brian Alex

Alex Brian

Brian Kikyo

Kikyo Brian

Brian