Around Christmas, the crypto market seems to have entered a rest period with the arrival of the holiday.

Since Powell's words last week caused the crypto market to collapse, the overall market fell and then ushered in consolidation. Bitcoin fluctuated at $95,000, ETH held at $3,300, and the altcoin sector generally performed poorly, with most currencies falling.

From the core reasons, in addition to the change in expectations for interest rate cuts, the Christmas holiday of European and American funds has had a great impact, the market has a clear risk aversion sentiment, and ETFs have turned from inflows to outflows. Data shows that the U.S. spot BTC ETF market has set a record high for capital outflows for two consecutive days. After an outflow of $671.9 million on December 19, another $277 million outflow the next day.

The sudden decline and adjustment caused many investors to suffer a Waterloo, and among them, there was a special person. President-elect Trump also had a brief "Christmas robbery" after buying a large amount of his crypto project WLFI.

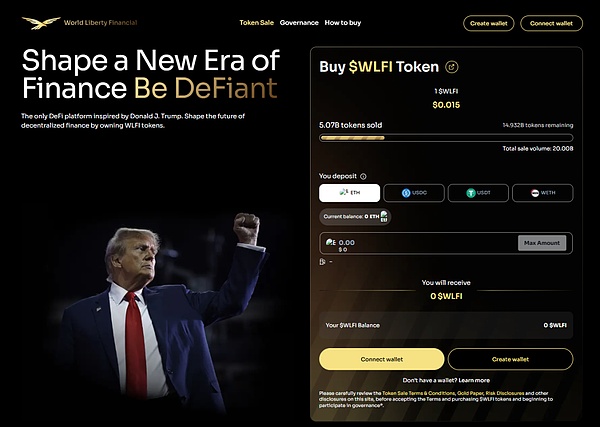

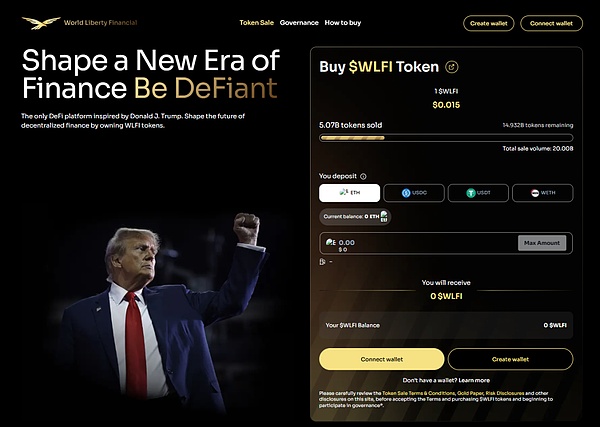

WLFI is the abbreviation of the Trump family's DeFi project World Liberty Financial. Its token WLFI was launched on October 15. On the first day of the token sale, the project raised about 10 million US dollars. At the time, this move was considered by the market as another example of Trump's support for the crypto field, and Trump successfully re-expressed his position with this project and obtained dual support of funds and votes.

Two months later, Trump has entered the White House, and World Liberty Financial has finally made new moves. On December 31, the community officially passed the first proposal to deploy a lending instance based on Aave v3 on the Ethereum mainnet. This is consistent with its project roadmap. The project white paper mentioned that a crypto bank would be built based on Aave in the first phase. The Aave community was opposed to the proposal until WLFI proposed to allocate 7% of its WLFI tokens and 20% of the fees generated by WLF in the future to Aave DAO, and successfully used the profit-sharing model to deeply bind partners.

On the other hand, from the most direct token sales, according to official website data, as of the date of publication, WLFI has sold 507 million tokens. Calculated at a price of 0.015, the total sales amount has reached 76.05 million US dollars, but it is still far from the ambitious goal of 20 billion tokens. From the perspective of disclosed investors, Justin Sun is the most well-known one among them. He invested 30 million US dollars in WLFI and is also one of the largest investors. Considering that tokens cannot be transferred and can only be used for governance, it is hard not to suspect that Justin Sun is trying to show goodwill to Trump.

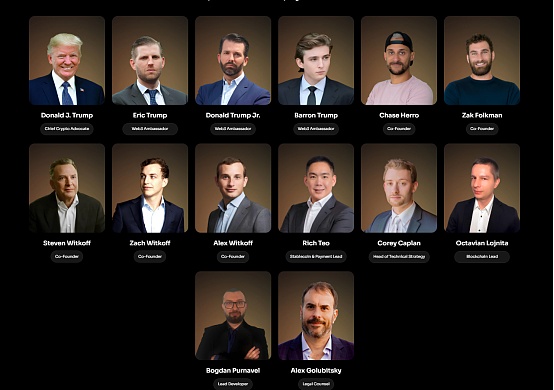

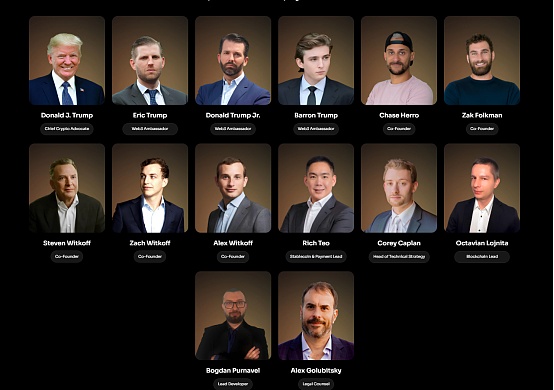

The official website disclosed the composition of Trump's team. In the team, Trump is still the chief cryptocurrency advocate, and his three sons have become Web3 ambassadors. It is worth noting that the official website clearly states the relationship between Trump and the project, clearly stating that the Trump family has no relationship with the project, but the Trump family and affiliated companies have the right to collect 75% of the net agreement income under a service agreement, and even emphasizes that the project and tokens are not political. It can be seen that this is a project with a strong Trump endorsement, and the money earned belongs to Trump, but it is actually legally unrelated to the Trump family.

Five co-founders also surfaced. In addition to Zak Folkman, who had a criminal record and Chase Herro, who sold diet pills and founded the crypto project Dough Finance, Trump's friend and real estate developer Steven Witkoff also brought his family to join the battle, and his two sons Alex and Zach also became co-founders.

It is obvious that the founders are relatively limited in their expertise, so someone naturally needs to lead the technical side. In the core stablecoin and payment business of the project, Rich Teo, a crypto veteran, served as the person in charge. He was the founder of the exchange itBit and is the current CEO of Paxos Asia. Corey Caplan, head of technical strategy, is also quite experienced and is the co-founder of another DeFi platform Dolomite.

In addition, perhaps to make up for the lack of professionalism, WLFI has also formed a team of crypto consultants. Sandy Peng, co-founder of Scroll, Ryan of Toma Wallet, Luke Pearson of Polychain Capital, etc. are all official consultants who can provide project support from a strategic perspective.

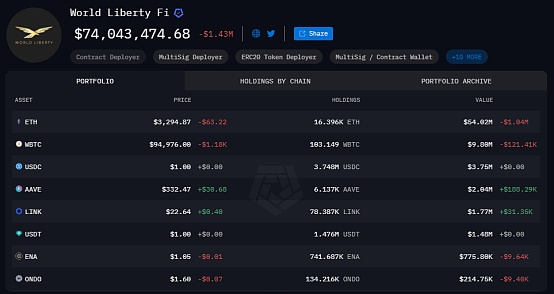

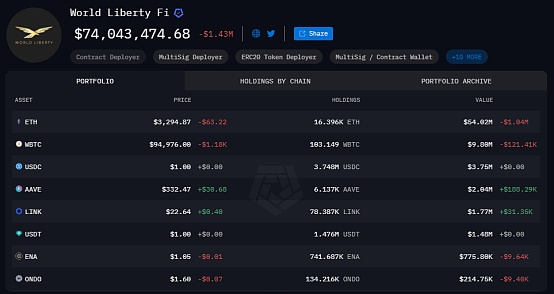

Since the income belongs to Trump, Trump will naturally pay attention to the project's income. From this perspective, WLFI's layout in cryptocurrencies can also be seen as a supplement to Trump's holdings. In the past month, WLFI has started the buying mode. According to Lookonchain data, since November 30, World Liberty Financial has spent about $45 million through a wallet to purchase a large number of crypto assets, including $30 million in ETH, $10 million in cbBTC, $2 million in LINK, $1.91 million in AAVE, $750,000 in ENA, and $250,000 in ONDO.

This huge investment, which has been in a state of continuous floating profit, was successfully washed away in the market crash. On December 20, the project's maximum loss reached $6.15 million. Although the loss has decreased to this day, the floating loss still reached $1.43 million. And President Trump has also briefly and passively become a small leek in the market, truly practicing the slogan of equality for all in the currency circle. But in the long run, the WLFI team's bullish sentiment is prominent. A typical example is that during the sharp drop on December 20, the team also spent 2.5 million USDC to increase its holdings by 759 ETH, which continued to lower the average price.

Of course, the increase in holdings may not be unreasonable. In terms of the macro direction, the policy bull market of encryption is far from over, and in the near future, the arrival of Christmas is also likely to reappear the "Christmas market".

The so-called Christmas market refers to the phenomenon that the total market value of encryption will rise around Christmas. From a theoretical analysis, the reason for this phenomenon is the regular changes in capital inflows and outflows. On the one hand, when the New Year's Day comes, most investors will realize profits or a few profit-taking clearing, and the selling is relatively obvious; on the other hand, due to the risk aversion sentiment during the holidays, funds will also be out of the market for rest, and buying will also shrink, waiting for the expectations of the next year. Combining the two aspects, before Christmas, the crypto market usually has a slight correction, and after the holiday, funds will flow back to push up prices.

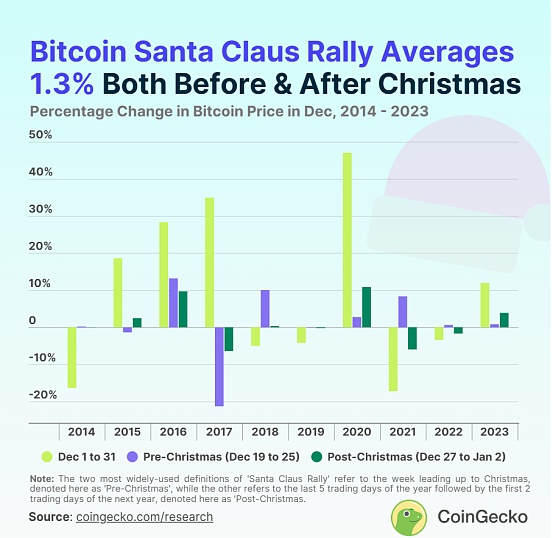

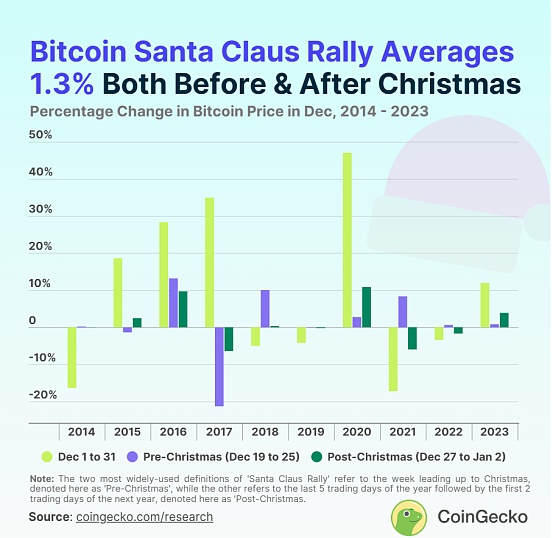

According to Coingecko data, there have been 8 Christmas rallies in the decade from 2014 to 2023, and the total crypto market value rose by 0.69% to 11.87% in the week from December 27 to January 2 of the following year. Only 2021 and 2022 did not achieve growth. In 2021, the Christmas rally occurred before the holiday, with an increase of 6.9%. In 2022, the overall market performance was mediocre, with both falling by 5.30% and 1.90% respectively after Christmas.

As the core of market value composition, Bitcoin is also related to the Christmas rally. In the past 10 years, Bitcoin has experienced 7 Christmas rallies in the week before Christmas and 5 in the period after Christmas. Specifically, Bitcoin rose by 0.20% to 13.19% before Christmas, and by 0.33% to 10.86% after Christmas. The most prominent year of the rise was 2016, when Bitcoin rose by 13.19% a week before Christmas.

Overall, due to the sharp fluctuations in funds around Christmas, it is a good time to buy on dips. Of course, based on previous predictions, it is just a matter of looking at the charts, and the market conditions are not consistent every year. Since the current bull market, there has not been a significant correction in the market. At the time of tight funds on Christmas, in addition to sideways adjustments, the probability of violent wash-outs is also increasing, but considering the relatively bright prospects in the future, the long-term bullish sentiment has not changed.

Adam, a macro analyst at Greeks.live, said that nearly $12 billion of options have expired in the options market, accounting for more than 40% of the current total positions. Large investors and market makers are actively adjusting their positions. Paying more attention to the market can occasionally get a good opportunity to pick up a bargain. The market is more betting on the market before and after Trump takes office at the end of January. It is still a good opportunity to buy options in the near future.

Christmas is approaching, the market is not volatile, and investors are celebrating the holidays. The only thing they can pay attention to is government affairs, and Politifi has therefore become a key link. Trump lost money on this side, and his ally Musk on the other side has also come to the forefront. The new Minister of Government Efficiency ignited the first fire when he took office - making a scene on Capitol Hill.

As we all know, the US government has been suffering from money for a long time, and from time to time it will face the "shutdown" crisis of having no money to pay. Therefore, the debt ceiling and financial budget have become key issues in the game between the two parties. At the end of September this year, in order to avoid the budget dispute from escalating, Congress voted to pass a temporary bill to provide funding for Biden's current government until December 20.

As the date approaches, House Speaker Mike Johnson once again announced a 1,547-page spending bill on December 17. The purpose of the bill is very clear, providing funding for the government until March 2025. In order to pass this major bill, Johnson also negotiated with the Democratic Party and attached a number of bipartisan-supported bills. In the end, members of the two parties added dozens of additional clauses to the bill.

Not only money, but more money, Minister Ma, who exists to cut government spending, is dissatisfied. At 4:15 a.m. on December 18, Musk posted on social media X: "This bill should not be passed." In the following day, he posted more than 150 posts in a row to show his opposition, and even publicly threatened the voting members that "any member of the House of Representatives or the Senate who voted for this outrageous spending bill should be voted out within two years." Compared with Musk, who was cheering, Trump, the real person in charge, was slightly silent. It was not until 4:28 p.m. on Wednesday that Trump expressed his support for Musk, saying that the bill was a betrayal of the people and demanded that the core condition of raising the debt ceiling be included in the proposal. The Democrats were naturally unwilling, and the two sides fell into a new round of game. As expected, the bill was stillborn, and the Republicans subsequently made major revisions to the bill, reducing the number of pages to more than 110 pages. Finally, at 0:38 a.m. local time on the 21st, the temporary appropriations bill, which had been revised several times, was passed, allowing the U.S. federal government to maintain its current spending level until March 2025, including $100 billion in disaster relief funds and $10 billion in aid for farmers, but not including debt ceiling clauses.

After this move, Democratic lawmakers were very dissatisfied with Musk, and even publicly ridiculed Musk as the real shadow president. Wisconsin Democratic Congressman Gwen Moore said that "Republicans have once again pushed the United States to the brink of a government shutdown at the behest of Trump and his billionaire club." The Republicans were more direct, saying that Musk should replace Johnson as Speaker of the House of Representatives. The market also joked that the U.S. president is in a three-way confrontation, with Biden, who has not yet stepped down, Trump, who is about to take the stage, and shadow president Musk filling the White House.

Trump actually responded, saying Musk would not become president, "No, I can tell you, he will not be president," he said. "I am safe, you know why? He can't, he was not born in this country."

After the bill incident, Musk was also excited, and once again released the logo of the Ministry of Government Efficiency, which also made DOGE gain fame and honor.From the current point of view, although the effect is not as obvious as before, the price of the currency has rebounded. After falling to $0.26 on December 20, DOGE rebounded to $0.35, and now fluctuates at $0.31.

Overall, this congressional event is most likely a demonstration of the Trump 2.0 government, except that Musk was the first to be sent out to play the red face. However, from the end of the event, the effectiveness of the Trump administration's muscle-flexing is beginning to show, and the power concentration of this government is vividly demonstrated, which is also an obvious benefit for the subsequent promotion of Trump's political propositions, and the encryption field may also be able to take advantage of the policy to fly again.

Alex

Alex