Author: Jasper De Maere, researcher at Outlier Ventures; Greysen Cacciatore, associate researcher at Outlier Ventures; Translator: 0xjs@黄金财经

Key points of this article:

The $Trump token embodies the fusion of politics, finance and culture, confirming the mainstream significance of cryptocurrency.It emphasizes that the financialization of non-financial assets is a cultural phenomenon that reshapes social structures.

Financialization has dominated businesses through derivatives and securitization for decades, and is now spreading to individuals and culture through tokens.

We believe there are three drivers behind hyper-financialization and finance becoming a core part of culture. They are:

Technology — The digital revolution has made financial markets accessible and innovative.

Education — The younger generation is the most financially literate.

Spirit — In today’s zeitgeist, financial success defines personal and professional achievement.

Presidential President Launches TRUMP Token

While the net impact of the $Trump token on the broader ecosystem is unclear, the launch of a memecoin by the President-elect just days before his inauguration is striking to say the least. It represents a momentous moment at the intersection of politics, finance, and culture. It solidifies tokens as a new liquid asset class and a tool for engagement, fundraising, and building influence at the pinnacle of global influence.

Beyond confirming the mainstream relevance of cryptocurrencies, the move highlights that the increasing financialization of non-financial assets is a profound cultural phenomenon. By transforming intangible concepts like identity, community, and influence into tokenized assets, it demonstrates how tokens intertwine finance, technology, and culture. This marks a transformative moment that redefines the fabric of society and how we engage with value.

We call this hyper-financialization, and we explore it in detail in our recent research on the Post Web. In the post-internet, improvements in technology and financial infrastructure will allow for greater financialization of personal assets, making them more liquid and yield-producing. This will fundamentally reshape how value is stored, accessed, and utilized.

Not for the First Time

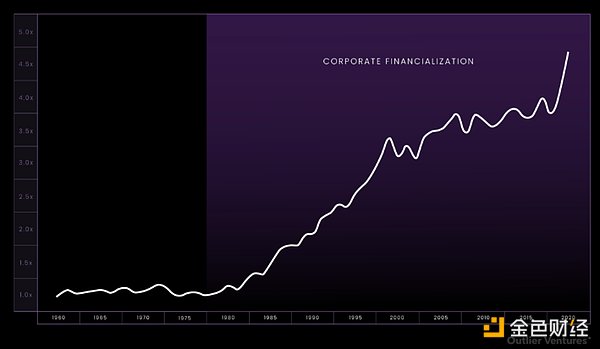

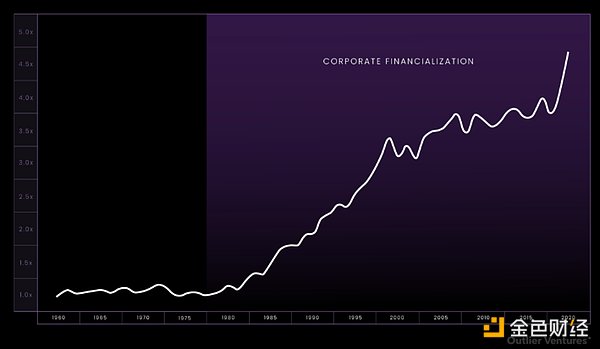

We have seen financialization happen in the business world before.Over the past 40 years, financialization has transformed the economy by transforming corporate balance sheets into engines of speculative value.In the 1980s, deregulation and tools such as derivatives, securitization, and global credit markets enabled companies to unlock value from financial engineering rather than production.As companies increasingly used financial instruments to maximize shareholder returns, non-bank financial assets surged from 40% to more than 200% of GDP (see Figure 1). This shift marks the advent of a new era in which the economy is driven less by tangible goods and services and more by the monetization of abstract financial assets.

Figure 1: Non-bank financial institution assets as a percentage of GDP in the United States

Similar to companies, individuals also have balance sheets (i.e., their assets). Tokens and cryptocurrencies are now bringing financialization to the consumer level. Like derivatives and securitization in the 80s, innovations like tokenization and DeFi are enabling individuals to extract more value from their assets. Unlike the 80s, however, cryptocurrencies go further, blending finance with culture, and like memecoin, tokens can represent identity, community, and participation. However, much like derivatives, these new instruments in the form of tokens carry inherent risks, which we are witnessing firsthand as frameworks to manage these risks continue to evolve.

Mind, Education, and Technology

The following sections in Chapter 2 of Post-Internet lay out what we believe to be the key drivers behind hyper-financialization.

The increasing financialization of everyday objects is a phenomenon we call “hyper-financialization.” This socio-cultural shift allows assets that are not traditionally viewed as financial, especially intangible assets, to be quantified in monetary terms and leveraged for maximum financial gain. This trend towards monetizing everyday assets will drive adoption of blockchain technology. These assets become more economically viable through tokenization, offering attractive returns on investment.

We believe there are three key drivers behind today’s hyper-financialization, namely (i) educational (ii) spiritual and (iii) technological (as shown below).

Figure 2: Three major drivers of the hyper-financialization of society

Source: Outlier Ventures

1. Education

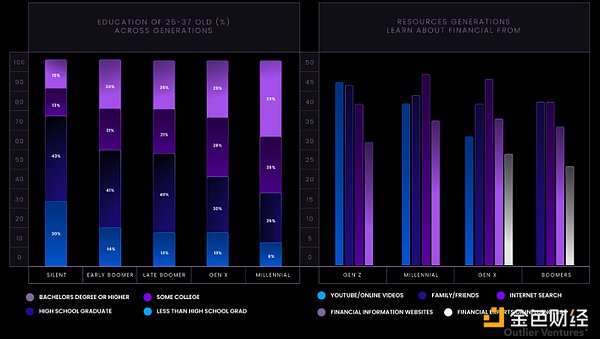

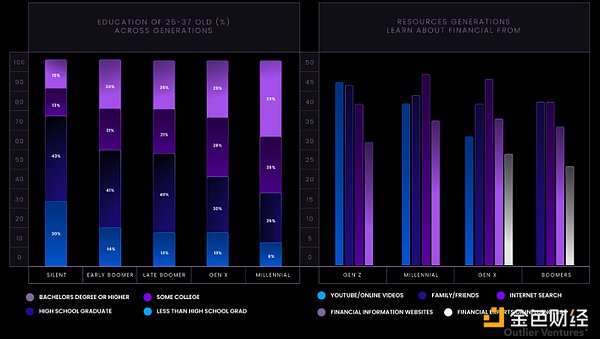

Education equips individuals with the knowledge to understand financial markets and their importance.Today’s young generations, especially Generation Z and Generation Alpha, are the most financially literate in history, thanks to their early exposure to digital technology and “DIY” online resources. LLM and agents further narrow the financial literacy gap, enabling individuals around the world in any language to be educated to make smart decisions about saving, investing, and managing debt or assets, which we believe paves the way for the rise of "100x individuals" and the improvement of the civilization level of the global population.

Figure 3: Left - Comparison of education levels of different generations. Right - Source of education of different generations.

Source: Pew Research Center, Outlier Ventures

2. Spirituality

Spirit, or the collective values of a generation, shapes the desire to participate in financial markets. In the zeitgeist of the times, financial success is closely linked to personal and professional achievement. Society's evaluation of financial success drives the desire to explore and participate in financial opportunities. The spirit of pursuing financial success encourages the financialization of owned assets and maximizes the financial potential of personal assets. We are entering an era of extreme capitalism, where financialization will penetrate more aspects of our lives than ever before.

3. Technology

Technology is critical, bridging the gap between financial knowledge, willingness to participate, and actionable financial opportunities. The digital revolution has made financial markets and assets more accessible, enabling individuals to participate freely. Financial applications have not only democratized access to financial markets, but the underlying technology is also changing the types of financial products we offer and abstracting the complexity of financial products.

Technology is changing financial markets in three interrelated ways

1. Democratized access

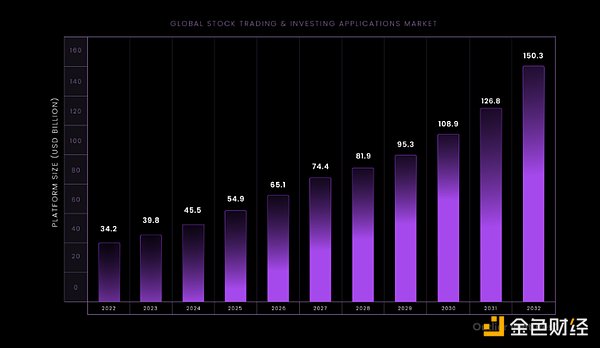

The democratization of financial services has changed the financial landscape, making financial tools and platforms widely available and lowering the threshold for individuals and non-qualified investors. This trend has promoted financial inclusion, expanded market participation, and rapidly expanded the potential market for financial products.

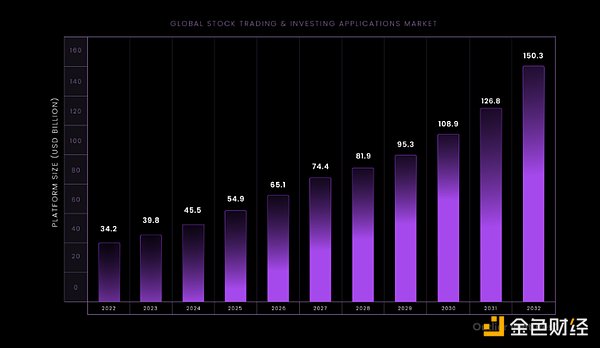

Figure 4: TAM (Total Potential Market Size) for Stock Trading and Investment. The growth of TAM means an increase in service activities and the number of users.

Source: Vision, Outlier Ventures

2. New Financial Products

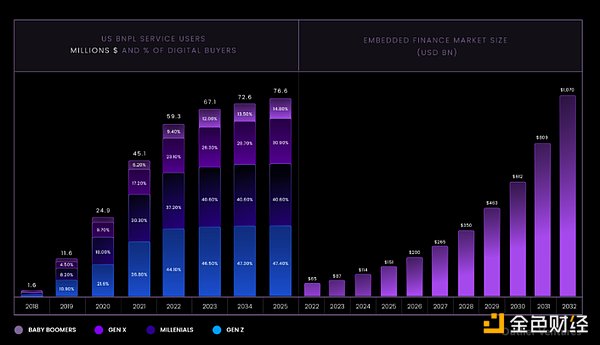

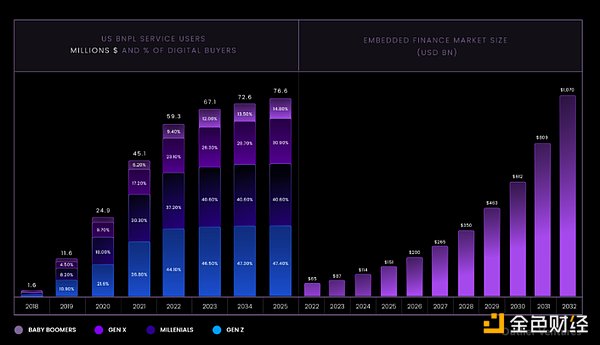

Technology enables investors to access more sophisticated services and markets. For example, blockchain-based systems unlock decentralized and tokenized finance, revolutionizing the way individuals manage their financial assets. The intersection of technology and finance has driven innovation in consumer finance and investment products. Figure 5: A timeline of the evolution of financial technology over the past 60 years, showing the exponential growth of financial services and products due to technological development. Source: SVB, Outlier Ventures 3. Abstraction of complexity Abstraction is driving the adoption of new financial products, making consumer finance and investing more intuitive for ordinary users through technologies such as complex algorithms, robot advisors, and AI-driven platforms. This simplification is driving rapid growth in the adoption of financial services and investment opportunities, as exemplified by trends such as embedded finance and buy now, pay later. Figure 6 shows that more complex products such as BNPL are being adopted primarily among the younger, tech-savvy generations.

Figure 6 : BNPL and embedded finance adoption show rapid adoption.

Source: Insider Intelligence, Outlier Ventures

As a result, transaction volumes in the modern economy are evolving rapidly. In addition to hyper-financialization, society is also becoming increasingly transactional. Digitalization allows for more granular transactions, changing the way we pay for services. For example, software is evolving from prepaid purchases to subscription models as digital platforms improve payment tracking. Distributed ledger technology is another upgrade that enables Web3 services such as DePIN to achieve a pay-as-you-go model.

Hyper-Financialization in the Post-Web Era

As the post-web era accelerates hyper-financialization, addressing gaps in financial literacy and execution becomes critical. People with both skills will participate in economic cycles, grow their wealth, and actively participate in the tokenized economy as shareholders. As assets are tokenized at scale, post-web LLMs and agents play a transformative role in leveling the playing field by enabling everyone to have basic financial literacy and participation. These tools enable individuals to manage and leverage their tangible and intangible assets, ensuring broader access to economic opportunities and alleviating gaps in wealth and knowledge.

Weatherly

Weatherly