Author: Martin Young, CoinTelegraph; Compiler: Tao Zhu, Golden Finance

The initial token sale of World Liberty Financial, the Trump family's cryptocurrency project, has so far performed poorly, with the number of tokens sold reaching just over 3.4% of its $300 million target due to a website crash.

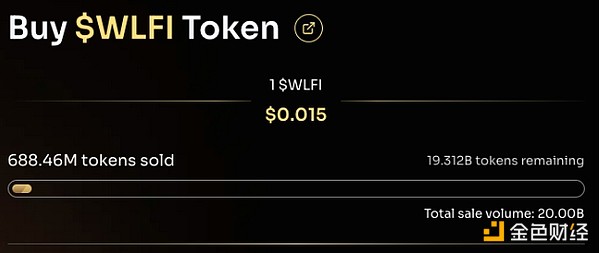

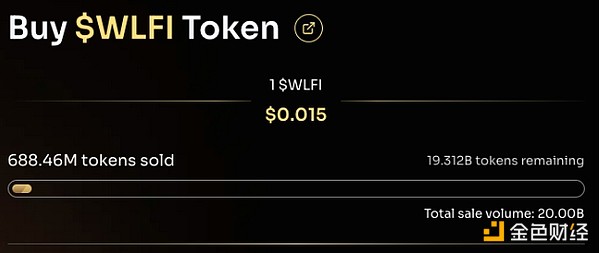

The sale of the platform's token WLFI began on October 12. On the 15th, 20 billion tokens were sold to the public at a price of 1.5 cents each, but 14 hours later, only 687 million tokens, worth about $10.3 million, were sold.

Etherscan data shows that only 6,832 unique wallet addresses hold WLFI, far lower than the more than 100,000 registered people claimed by the project team the day before the token was launched.

World Liberty Financial's website shows that its WLFI tokens are far below the $300 million target it set for its public sale. Source: World Liberty Financial

Soon after the token sale, World Liberty Financial’s website crashed and was inaccessible for several hours, apparently due to excessive traffic. Some observers encountered a “website under maintenance” notification when trying to access the site.

According to the project’s white paper released in October. 15, the total supply of WLFI will be 100 billion tokens, of which 35% will be allocated to eligible participants in the form of token sales.

Former President Donald Trump’s sons, Barron, Eric and Donald Trump Jr. are listed as the platform’s “Web3 Ambassadors.”

Current Republican presidential candidate Trump, who is referred to in the white paper as the platform’s “chief crypto advocate,” traveled to X on Oct. 15 to promote the token sale.

“Crypto is the future, let’s embrace this incredible technology and lead the world’s digital economy,” he said in the video.

Today is that day! The @WorldLibertyFi token sale is now underway. Get your $WLFI tokens today. Buy $WLFI here: https://t.co/jg1tOaHHBy pic.twitter.com/j8ewxa13wp

— Donald J. Trump (@realDonaldTrump) October 15, 2024

In the U.S., these tokens and platforms are only available to accredited investors, meaning those approved by the SEC to invest in unregistered securities because they typically have an annual income of more than $200,000 and have more than $1 million in assets.

The WLFI token will not be tradable but will serve as a governance token for an upcoming Ethereum-based decentralized finance (DeFi) platform.

World Liberty Financial plans to run as an instance of popular DeFi protocol Aave, according to a governance proposal submitted to the protocol earlier this month.

Of the remaining WLFI tokens not reserved for the public, 32.5% will be allocated to community development and incentives, 30% will be used for the “initial supporter allocation,” and 2.5% will be allocated to the team and advisors.

During the X Spaces event on October 14, the platform’s head of operations, Zak Folkman, reiterated information about the project, confirming that the platform will allow users to borrow and lend cryptocurrencies, create and interact with liquidity pools, and trade with stablecoins.

Weiliang

Weiliang