"The United States will become the world's Bitcoin superpower. America's golden age has begun."

Crypto Market Summary

1. Trump signed an executive order to establish the United States' strategic Bitcoin reserve, which is very beneficial to the development of crypto from a long-term perspective.

2. The data level in the first half of this month is beneficial to the short-term trend of crypto, but due to the influence of tariffs and turbulent situation, the market is still in a volatile range.

3. In the next few months, there will be more favorable regulatory releases, including: ETH pledge ETFs, more crypto ETFs, clarification of DeFi financial regulatory bills, and tax rate legislation for Bitcoin and crypto tracks.

I Market Overview

1.1 Analysis of FMG RWA and AI Index

In the first half of March 2025, among the many indexes monitored by FMG, the RWA Index still performed well, with monthly returns rising from about 16% in late February to about 19% at present. This is due to the fact that the alt season is delayed, Web 3 investment opportunities are relatively few and over-concentrated on BTC and stablecoins. OTC funds are turning their attention back to DeFi, asset management and strategy sectors. However, DeFi in a single Web 3 market is also highly risky, so products with real-world asset anchoring and DeFi attributes are currently gaining favor.

1.2 Cryptocurrency market data

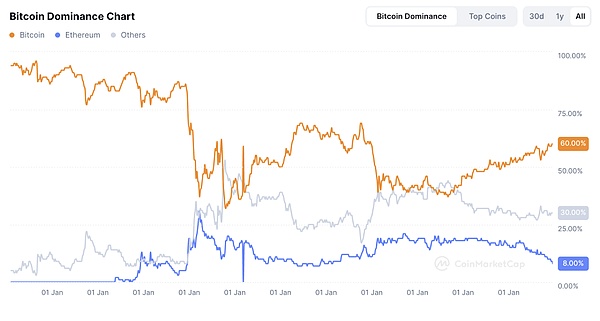

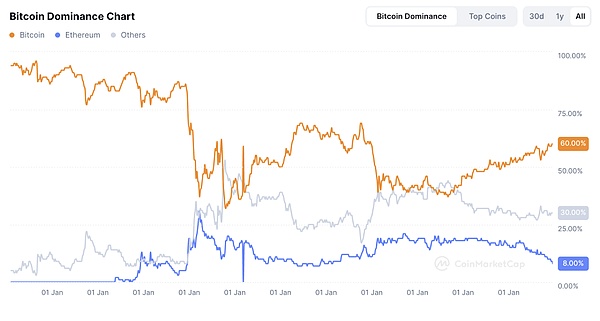

As of March 14, 2024, the total market value of cryptocurrency was 2.68 trillion, down 6.2% from 2.86 trillion US dollars in the second half of February. BTC Dominance Index: As of March 2, the current BTC dominance index is 60.1%, which is the same as in the first half of February.

Altcoin Season Arrival Index: As of March 15, the current Altcoin Season Arrival Index is 14. Compared with 22 in late February, the index has further declined, which means that there are fewer opportunities for altcoins at present, and funds are mainly concentrated in BTC and other stablecoins, but it also means that altcoins have bottomed out.

ETF and Contract Index

BTC ETF: In the past 15 days, BTC ETF had a net outflow of US$2.678 billion.

ETH ETF: In the past 15 days, ETH ETF had a net outflow of US$221 million.

1.3 CPI and other data and market reactions to market judgment

At 8:30 a.m. (EST), the U.S. CPI data was released, showing a significant decline in the inflation rate. The CPI report showed that the monthly decline rate in February 2025 was 0.2%, the lowest level since April 2021 (Source: U.S. Bureau of Labor Statistics, March 12, 2025). This positive inflation data immediately caused reactions from various asset markets, including the cryptocurrency market.

After the release of the US CPI data, crypto assets rose overall, once again confirming the huge and direct impact of the US macro environment on the crypto market: Although, after the data was released, the market further raised expectations for the #Fed to cut interest rates in September and November, and began to discuss whether the price of #Bitcoin in June and July would break through previous highs.

However, the Fed has remained on hold on interest rate actions for six consecutive times, especially considering the stubbornness of inflation. The Fed's overall position is "Wait And See"; before the inflation problem is effectively controlled, the Fed will not clearly release a signal of interest rate cuts, and the trend of the crypto market is likely to continue to maintain a volatile trend.

2. Hot Market News

2.1 White House Cryptocurrency Director: Trump Signs Executive Order to Establish Strategic Bitcoin Reserve

David Sacks, Director of AI and Cryptocurrency at the White House, said, "Just a few minutes ago, President Trump signed an executive order to establish a strategic Bitcoin reserve. The reserve will be capitalized with Bitcoin owned by the federal government that is part of criminal or civil asset forfeiture proceedings. This means it will not cost taxpayers a penny. It is estimated that the US government owns about 200,000 Bitcoins; however, a complete audit has never been conducted. The executive order requires a comprehensive accounting of the federal government's digital asset holdings.

The United States will not sell any of the Bitcoin deposited in the reserve. It will be retained as a means of storing value. For the cryptocurrency often referred to as "digital gold", the reserve is like a digital Fort Knox. The premature sale of Bitcoin has caused more than $17 billion in losses to American taxpayers. Now the federal government will develop a strategy to maximize the value of its Bitcoin holdings.

Coinbase co-founder and CEO Brian Armstrong commented on social media that "Trump is advancing the cryptocurrency reserve plan" and said that in terms of asset allocation for strategic reserves, BTC may be the best choice. As the successor to gold, BTC has the simplest and clearest narrative. If people want more variety, they can index crypto assets by market capitalization to keep it fair. But it may be easiest to just choose BTC.

2.2 French crypto market maker Flowdesk completes $52 million B

French crypto market making and liquidity provider Flowdesk has completed a $52 million Series B financing, of which 80% is equity financing and about 20% ($10.2 million) is debt financing. The equity financing round was led by European investment institution HV Capital, with participation from Eurazeo, Cathay Innovation and ISAI VC, and the debt financing was provided by funds managed by BlackRock. HV Capital also obtained a seat on Flowdesk's board of directors.

Flowdesk plans to use this round of funds to expand its business, including launching a dedicated crypto credit business and setting up an office in the UAE. Guilhem Chaumont, the company's co-founder and global CEO, said that debt financing is a strategic choice for the company to optimize its balance sheet while maintaining sustainable growth and avoid equity dilution. Flowdesk previously completed a $50 million Series B financing in January 2024, with a valuation of more than $250 million at the time.

2.3 Metaplanet completes approximately $87 million in financing to increase its holdings of Bitcoin

According to Metaplanet's announcement, the company completed the large-scale exercise of the 13th and 14th series of stock subscription rights through a third-party private placement, with a total financing of approximately 12.97 billion yen (approximately $87 million). This financing is supported by EVO FUND, and part of the funds have been used to redeem the previously issued 7th ordinary bonds in advance. Metaplanet plans to use the funds to continue to increase its holdings of Bitcoin to strengthen its digital asset investment strategy.

Third, regulatory environment

Trump: The Treasury Department and the Commerce Department will explore new ways to accumulate more Bitcoin

U.S. President Trump spoke at the White House Crypto Summit and said that the Treasury Department and the Commerce Department will explore new ways to accumulate more Bitcoin for reserves. They do not want taxpayers to pay any price. They will order federal agencies to take inventory of the digital assets currently held by the U.S. government and determine how to transfer them to the Treasury Department. The digital assets will be kept in a new U.S. digital asset reserve.

Fourth, Summary

The long-term trend is still positive:

1. Regulatory complianceThis year's legislation on crypto is gradually benefiting the entire crypto track, especially after Trump signed the US Bitcoin Strategic Reserve, the moat is more solid and the general direction is more certain. In the next few months, there will be more favorable releases in the direction of regulation, including: ETH pledge ETF, more crypto ETF, clarification of DeFi financial regulatory bills, and tax rate legislation for Bitcoin and crypto tracks.

2. Interest rate cut cycle: We are currently in an interest rate cut cycle, and it is obvious that this interest rate cut cycle will be particularly long-lasting, because the Federal Reserve will cut or not cut interest rates according to specific economic conditions, affecting the capital market. The United States is still in a period of high interest rates, and there is still a long way to go before low interest rates or even zero interest rates. It may last for 2-3 years. If there is QE, it may also be opened at the time when it is needed. From the perspective of the economic cycle, this bull market has just begun.

3. Favourable tracks: The three main core tracks in the long term: DEFI, stablecoins and US stock tokenization will lead crypto to a new height in line with the globalization of US finance. Hype track: The combination of AI, depin and crypto is also a hype track point worthy of attention in this cycle.

Weatherly

Weatherly