Author: Liam

Trump, the first crypto president elected in the United States, is setting an example to show the world how MemeCoin can rewrite the rules of the world's capital markets.

On January 18, two days before taking office as president, Trump shocked the world by announcing his own "official" Memecoin TRUMP on his Truth Social and X accounts.

Trump wrote on his social media, Truth Social: "My new official Trump emoji is here! It's time to celebrate everything we stand for: victory! Join my special Trump community. Come get your Trump emoji now."

At first, the crypto community questioned the legitimacy of the token. Some warned that it might be a hacker attack or a social engineering plan. In fact, even Elon Musk was not sure whether Trump's X account was hacked. However, as Trump's posts have been online and data from Polymarket shows that there is only a 10% chance that the account has been stolen, people's doubts have begun to subside and the price of the token continues to rise.

TRUMP opened at $0.1824, but rose more than 15,000% in 12 hours, trading at around $30 as of 10 a.m. ET, 12 hours after the token was issued.

Since its launch 12 hours ago, the MemeCoin project has surged to $30 billion in market value, about three times the market value of Trump's media technology group DJT, which is about $8.7 billion. This is an exponential growth process, with its market value rising by $1 billion every few minutes.

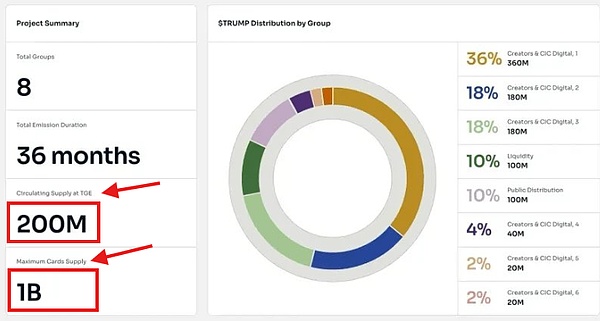

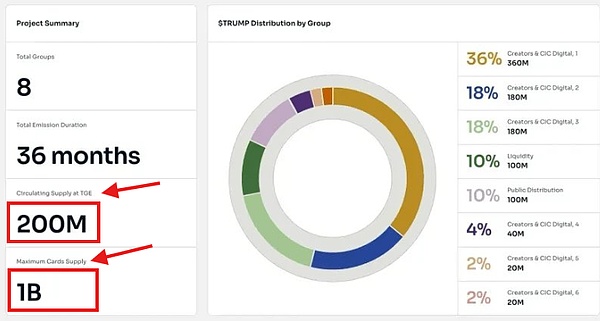

According to estimates from blockchain analysis platform Arkham Intelligence, "cryptocurrency president" Trump's net worth soared to $28 billion overnight, thanks to Trump's virtual currency "TRUMP", which increased his estimated net worth by 400%. Trump's affiliates CIC Digital LLC and Fight Fight Fight LLC control 80% of the supply, and the value of his cryptocurrency holdings alone has soared to $22.4 billion. Forbes valued Trump at $5.6 billion last November.

Some industry investors say that Trump and his family have made more money in the past 12 hours because of cryptocurrencies than they have made in the past 50 years. This may explain why he is so supportive of cryptocurrencies? Cryptocurrency prices have not yet been factored in. Under Trump's leadership, cryptocurrency prices will continue to rise.

Coinbase's head of product business operations Conor Grogan said in an article published on X: "80% of the token supply is locked in a multi-signature wallet, worth $3 billion, controlled by the creator, and he has also added $40 million in liquidity." He added that the project received millions of dollars in seed funding from Binance and Gate, two exchanges that do not provide services to US customers. Other analysts pointed out that 80% of the token's circulating supply was allocated to Fight Fight Fight LLC and CIC Digital LLC, which are associated with the Trump Organization, and only 20% of the supply was evenly distributed between public investors and liquidity.

While Trump controls the vast majority of tokens, they remain locked, meaning the U.S. president is unlikely to “scam” his millions of most loyal fans… at least for now.

Also, while the memecoin associated with Solana has pushed Solana’s market cap to a record $118 billion, the price of Ethereum, a major source of liquidity, has seen an offsetting decline, with its market cap falling 5% overnight, losing about $240 billion in value.

Trump’s comments come as the president-elect continues to support cryptocurrency initiatives. He has been outspoken about his skepticism of cryptocurrencies, but did a 180-degree turn during the campaign, promising to reshape the U.S. cryptocurrency landscape and make the United States the “crypto capital of the world.” Paul Atkins, Trump’s nominee for the SEC, is expected to lead these efforts. Atkins, a well-known cryptocurrency advocate and former SEC commissioner, will replace Gary Gensler, who has been criticized for cracking down on the industry.

Finally, while many are excited to join the biggest momentum trade of all time, which has even overshadowed social media phenomena like Gamestop and AMC, some like Bloomberg’s senior ETF analyst are skeptical, arguing that this particular attempt by Trump “seems exploitative” and is “an unforced mistake that’s happening.”

Whether he’s right or wrong depends on how long it takes for this bubble to burst.

Putting aside the bubble, we wonder what the significance of this first “presidential coin issuance” moment in world history is?

Global macro investor Raoul Pal said the signal here is the speed and simplicity of capital formation. The previous MemeCoin and ICO were just test cases, and the real capital game has not yet arrived, which will completely change the capital market.

Former Citi and current digital asset investment officer Jeff Dorman believes that the market has lost its rational understanding of $Trump and completely missed the rise process.

He said that first of all, potential token issuers and investors in the United States have been concerned about "regulatory issues" for more than three years. Now, when the president himself is both an issuer and an investor, this concern can be completely eliminated.

Now, the president's issuance of Memecoin does not mean that the world will only pay attention to memecoin. Trump verified the technology, but only introduced a single use of the technology. Potential issuers and investors can go beyond this limited application scenario

The Internet boom began with ".com companies", which exist only because of the existence of the Internet. But most have failed. The Internet grew when non-internet native companies started using it. Now, every company is a “.com company.” Walmart, Domino’s, JPMorgan Chase, etc. are now “.com companies.”

The TRUMP Token shows every company, municipality, university, and personal brand that crypto can now serve as a capital formation and customer onboarding mechanism. New York City will issue a token, Harvard will issue a token, Netflix will issue a token.

We are now officially saying goodbye to the “dot-crypto” phase of blockchain. All of the existing use cases for cryptocurrencies come from crypto native companies, but in the future, the world will come up with innovative ways to use tokens.

When this happens, many of the currently useless tokens and projects will die, but the biggest and best projects will thrive with the support of millions of new investors, issuers, and users.

In Jeff Dorman's opinion, if you are an investment banker, you have to start selling token ideas to your clients.

Now. The immediate price action on Friday night suggests that crypto is now a joke and the only winner will be the blockchain that issues the joke coin ($SOL). But this is short-sighted and the lack of liquidity over the weekend is more important than anything else.

Those who call this the "top of the cycle" have lost their minds. PTSD is real and all of you are so damaged in 2022 that you can't imagine what will happen in the crypto-friendly environment that is coming.

Jeff Dorman finally said, so, to sum up - while I personally don't care much about meme coins or TRUMP tokens, I care a lot about the future application scenarios of blockchain. And the President of the United States just gave the green light to all future possibilities.

Catherine

Catherine