Author: CQ Research Source: CryptoQuant

Key Takeaways

Next week, November 6th will mark the two-year anniversary of the collapse of the FTX exchange. FTX’s collapse became one of the worst failures in the history of cryptocurrency due to the exchange’s inability to maintain sufficient reserves to cover user funds.

As a result, exchanges are required to provide “Proof-of-Reserves” (PoR) to the public so that stakeholders can verify that the user funds are actually held by the exchange.

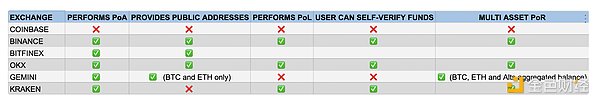

Of the top exchanges ranked by total Bitcoin reserves, Coinbase is the only exchange that does not provide a public Proof of Reserves (PoR) report. Other major exchanges provide PoR reports regularly, with varying degrees of transparency.

For example, Binance provides a detailed PoR report, which includes:

Public on-chain addresses, allowing anyone to verify the cryptocurrency they hold (i.e. Proof of Asset, PoA).

Each user can verify whether their account balance is included in the calculation of the exchange's overall liabilities (i.e. user deposits).

The report also covers assets other than Bitcoin and Ethereum, which are the earliest reserves disclosed by exchanges. Public on-chain addresses are particularly important for market stakeholders, helping to track asset flows and improve industry trust and transparency.

In addition, even in the face of US regulatory pressure in 2023, Binance's Bitcoin reserves still increased by 28,000 (about 5%) to 611,000 Bitcoins.

Among major exchanges, Binance has always had the lowest reserve consumption rate, never exceeding 16%.

Since the FTX crash in November 2022, only two major exchanges, Bitfinex and Binance, have increased their Bitcoin reserves.

The importance of monitoring foreign exchange reserves and exchange rate transparency

The importance of cryptocurrency exchange reserves has become increasingly apparent after the FTX crash in November 2022, which was a clear reminder of the risks users face when exchanges fail to hold sufficient reserves.

When an exchange is unable to meet withdrawal requests due to insufficient reserves, it undermines user trust and puts individuals at risk of losing their funds. Adequate reserves are critical to maintaining liquidity and meeting user requests, especially during times of market turmoil or increased demand.

On-chain data allows users and researchers to verify the status of an exchange’s reserves, providing transparency that is critical to assessing an exchange’s solvency and overall health. This verification is not only critical for personal safety, but also for the stability and integrity of the broader cryptocurrency ecosystem.

In addition, exchanges are required to provide proof of reserves to the public so that stakeholders can verify that they are indeed holding users’ funds.

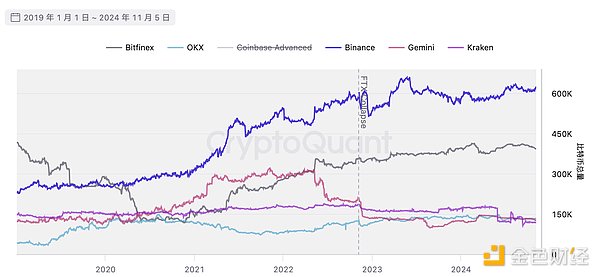

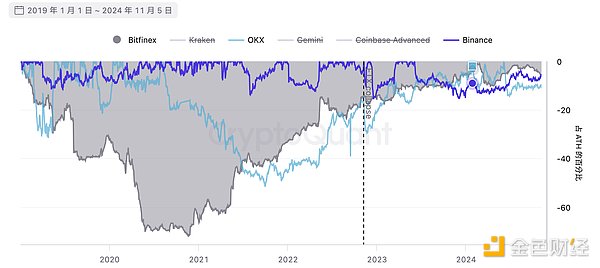

Evolution of Exchange Reserves

Since the collapse of the FTX exchange in November 2022, only Bitfinex and Binance have seen an increase in their Bitcoin reserves.

Binance's Bitcoin reserves (purple line in the right chart) have grown by 28,000 Bitcoin, or 5%, since then, even after the exchange came under regulatory pressure from U.S. authorities in 2023.

In contrast, Coinbase, Gemini, and Kraken saw their Bitcoin holdings fall by more than 10%.

Among these top exchanges, only Binance and Bitfinex appear to be showing a clear upward trend in their Bitcoin reserves.

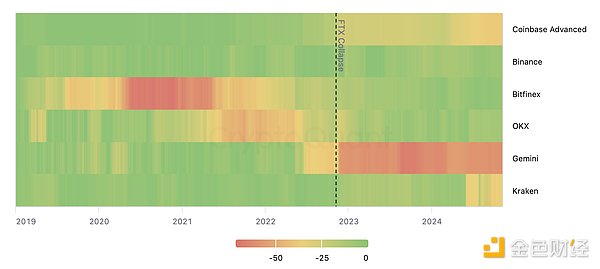

Foreign exchange reserves decline

The following chart shows the historical reduction of Bitcoin reserves of top exchanges. Green indicates a small reduction, while red indicates a large reduction.

We can see that Binance, Bitfinex and OKX are currently experiencing a small decline.

In addition, Binance seems to be the only exchange that has not experienced a large decline in history.

Measuring the health of an exchange by tracking changes in withdrawals from its reserves can provide insight into an exchange’s ability to sustain user demand over time. Large withdrawals may indicate that users are withdrawing funds at a higher rate than usual, which could indicate a decline in user confidence or financial health.

In fact, the largest drop experienced by Binance was 15%. This drop occurred in December 2022, a few weeks after the FTX crash. During this period, Binance experienced a lot of FUD regarding its proof of reserves report.

Binance’s Bitcoin reserves have all been recovered and are now down just 7%.

Other major exchanges with smaller declines are Bitfinex (-5%) and OKX (-11%).

Current Status of Proof of Reserves (PoR)

Proof of Reserves (PoR) Definition

Proof of Reserves (PoR) is a mechanism used by cryptocurrency exchanges to publicly prove that their reserve assets are sufficient to cover all user balances. This process typically involves the use of cryptographic methods or on-chain data to verify the actual holdings of the exchange without compromising user privacy.

By publishing transparent, independently auditable snapshots of reserves, exchanges can assure users that their funds are safe and accessible, reducing the risk of insolvency.

PoR promotes trust and transparency because it allows users to confirm that an exchange is not over-leveraged or mismanaging its assets, which has become particularly important in the wake of high-profile exchange collapses in the industry.

PoRR of Major Exchanges

Of the top exchanges by total reserves, Coinbase is the only one that does not provide PoR reporting. All other major exchanges provide regular PoR reporting with varying degrees of transparency.

For example, Binance provides a comprehensive PoR, including: 1. Public on-chain addresses for anyone to verify cryptocurrency holdings (Proof of Assets, PoA); 2. Each user can verify that their account balance is included in the overall calculation of the exchange's liabilities (user deposits); 3. The report includes assets other than Bitcoin and Ethereum, which are the first assets initially reported by the exchange.

Public addresses are particularly important for market stakeholders to track asset flows and improve industry trust and transparency.

Hui Xin

Hui Xin

Hui Xin

Hui Xin Brian

Brian Kikyo

Kikyo BlockX

BlockX Hui Xin

Hui Xin Joy

Joy Brian

Brian Alex

Alex Hui Xin

Hui Xin Edmund

Edmund