Author: Liu Jiaolian

There was an east wind in the small building last night, and I had a clear understanding.

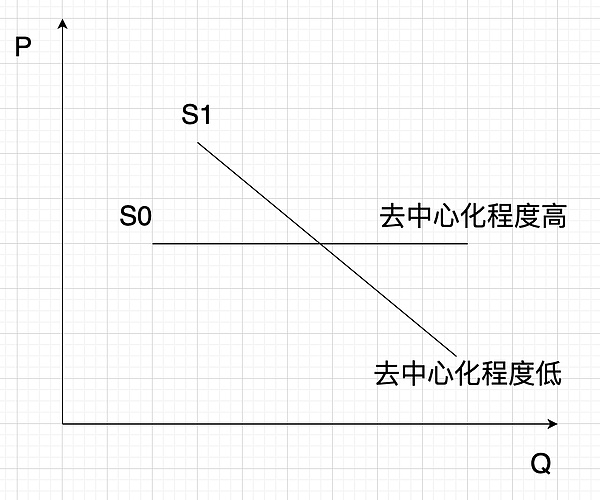

On the afternoon of the 12th, Jiaolian published a new work "Microeconomics of Public Chain Utility Tokens" on the backup account "Liu Jiaolian Pro", which creatively proposed Yes, the economic significance of "decentralization" lies in flattening the supply curve. That is:The higher the degree of decentralization of a public chain, the closer its supply curve is to the horizontal, that is, the inelastic supply curve (S0). As shown in the figure below:

< p style="text-align: left;">In the evening of the same day, the teaching chain published another article on 3.12 "Internal Reference: Will the Ethereum Cancun upgrade open up room for upside?" "", using this token microeconomics theory, the potential impact of Ethereum's expansion on the price of ETH is analyzed.

"Decentralization" is a "technology for security". Security here not only includes technical security, such as protection against cracking, but also, more importantly, includes economic security, such as being immune to corruption, immortality, perdition, deterioration, and centralization. depreciated, not confiscated, etc.

Before Bitcoin, gold and the US dollar had the greatest value and were global safe assets. (See the Jiaolian 2022.3.4 article "The Twilight of Dollar Hegemony")

Of course, they each have their shortcomings, or in other words, major security holes. Gold is unsatisfactory in terms of protecting against robbery and confiscation (Roosevelt’s confiscation of gold in 1933 is still vivid in my mind, see the article "Gold, Gold" on Jiaolian 2023.9.28). The U.S. dollar has a centralized infinite over-issuance mechanism (U.S. debt Ponzi spiral, please refer to the article "The "Four Big Lies" of the U.S. Dollar" on Jiaolian 2023.10.12).

Bitcoin just overcomes all their shortcomings.

Bitcoin is an ultra-secure asset.

As an ultra-safe asset, Bitcoin’s supply curve is closer to the inelastic level than all other known goods and monetary goods (S0)!

What we are talking about here is not the secondary trading market of BTC, or the speculative market, but the primary market of BTC, especially the demand side. That is the application side.

BTC has two primary markets, one on the production side and the other on the demand side. They are connected through the secondary market. The diagram is as follows:

M0 -> M2 -> M1

Speculative market M2 Its function is to lubricate the transaction friction between M0 on the production side and M1 on the demand side, and improve circulation efficiency.

M2 is a free market that strictly follows the elastic supply and demand balance and has the function of price discovery.

Satoshi Nakamoto made a wonderful design at M0: First, no matter how miners expand production and increase computing power, they cannot increase M0’s output of BTC. rate; second, this output rate decreases by half approximately every 4 years.

This has brought a marginal supply shock to M2, forcing the supply and demand balance of M2 to change.

Because M0 and M2 are not the objects of discussion in this article, we will stop here and will not continue to expand.

Let us focus on M1.

BTC is an ultra-safe asset. At the margin, its supply curve in M1 is horizontal.

In other words, no matter how much BTC M0 sends to M1 through M2, it will not change the marginal value of BTC in M1.

In M1, the marginal value of BTC will be completely determined by the upper limit of demand acceptance.

This is thanks to the hoarding effect: because the cost of hoarding BTC is almost 0, and the ultra-safety of BTC allows people to have the confidence to hoard forever, that is, There will be no forced sales, price suppression, or prices falling below marginal value.

Simple quantification: What is the marginal valuation of BTC that people can accept on the demand side?

Known: The main use value of BTC is as a transnational, permissionless, low-friction value transmission tool.

Subjectively estimated, on average, the price people are willing to pay for an international remittance is about US$10.

Objective benchmarking, it can be seen from the inquiry that the international wire transfer service charge standard of a certain bank is 1‰ of the remittance amount, with a minimum of 50 yuan/transaction and a maximum of 1,000 yuan/transaction. , plus telecommunications charges. Obviously, the subjective estimate of $10 is already far lower than the current charging standards in the banking industry.

Then, according to public data on the BTC blockchain, the recent average transaction fee is 0.00011 BTC (36 sats/vB), and the median fee is 0.000047 BTC (14.8 sats/vB).

Using the above data, the marginal valuation of BTC can be calculated: $10 / 0.00011 BTC = $90909/BTC, $10 / 0.000047 BTC = $212766/BTC.

That is, the marginal valuation range of BTC is 90,000-210,000 dollars.

The current price of BTC in the secondary market is more than $70,000, which means that the secondary market is subsidizing demand-side users and providing them with discounted use. fee. This creates what is called “consumer surplus” in economics for users who actually use BTC.

At the same time, we can easily find out why activities such as inscriptions that cause network congestion increase the income of miners, but also increase the handling rate. This reduces the marginal value of BTC and ultimately damages the economic value of the entire system. (See Jiaolian’s 2023.12.26 article “Inscription Kills Bitcoin”)

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Xu Lin

Xu Lin JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Finbold

Finbold