Dubai Court Validates Crypto as Legal Salary Payment

Dubai Court has ruled that cryptocurrency can be legally recognized as a valid form of salary payment.

Bernice

Bernice

Author: Joey Shin, IOSG Ventures

Let’s imagine a world where every financial action is more than just a simple transaction.

This is a complex world composed of information, value and timing, all controlled by the "invisible hand" of the blockchain oracle. guided by. In the vibrant world of DeFi, there is something that deserves special attention, called Oracle Extractable Value (OEV). This is a special kind of value that is captured because of the way blockchain oracles update prices – or sometimes don’t. This article will take you deep into OEV, exploring its origins, how it works, and how people are clever enough to extract value from the tiny gap between real-world prices and their updates on the underlying chain/protocol.

But there is more to the OEV narrative than that, and we should also be paying attention to innovative platforms like Uma Oval. They are looking at how the search for OEV can benefit everyone in DeFi (rather than just a few). I present this with some thoughts and feelings about the OEV space by diving into the complexities of OEV and emerging solutions like Uma Oval.

OEV Definition: OEV occurs when there is a gap between real-world asset prices and their (lagging) updates on the blockchain, providing profitability for searchers who take advantage of such oracle updates to act on them Chance.

Uma Oval Overview: Uma’s Oval takes a novel approach to management OEV, by wrapping Chainlink oracle updates, lets searchers bid on price feeds. It is then sent to MEV-Share to facilitate a private order auction process and ultimately return value to the protocol.

Key issues facing Oval: Oval builds on the differences involved in the typical MEV category On a complex and delicate balance of incentives between entities. However, Oval will need to be field-tested and improved on a number of factors, including potential price delays, specific trust assumptions related to centralization, and other low-level parameter settings.

The theory to solve OEV: My analysis shows that although the existence of OEV presents problem, but innovative solutions like Uma Oval can mitigate its negative impacts, providing a blueprint for a fairer and more sustainable DeFi future.

Personal insights on the future of DeFi: I advocate the development and implementation of a combination of protocol layers and Mechanisms for infrastructure layer solutions to promote a healthier ecosystem and a more rational MEV game theory model.

What exactly is OEV?

Oracle Extractable Value (OEV) refers to the maximum extractable value resulting from an oracle price feed update or lack of update. Oracles can provide external data such as asset prices to blockchain contracts. However, such updates are discrete rather than continuous. This in turn creates information asymmetries and MEV opportunities, also known as OEV. This allows search bots to realize profits by exploiting temporary differences between on-chain prices and real-world spot prices across venues before oracle updates occur.

Note that this can not only be generalized by the operations initiated by the oracle. For example, there may also be an "internal oracle update" if a large transaction occurs on a DEX like Uniswap and changes the price significantly.

Common OEV strategies, such as front-running, where searchers monitor pending transactions and insert higher-fee transactions before scheduled transactions, exploit Profit from price differences during the delayed period; arbitrage, where arbitrageurs trade across assets based on lagged oracle prices before updating and then sell for guaranteed profits; the most common type is liquidation, where searchers can identify insolvent investors based on price changes positions and then quickly liquidate them to receive bonuses.

OEV represents the profit captured by exploiting the temporary differences caused by the discrete nature of the oracle price feed. Search bots are able to extract value without contributing value to the protocol. This value is attributed to searchers who realize profits, builders who are incentivized to include large transactions in blocks, and validators who subsequently propose blocks. However, this comes at the expense of protocol users due to large liquidation fines, loss of arbitrage opportunities, etc.

What are the negative impacts of OEV and why should we be concerned?

OEV can have a negative impact on Dapps and cause harm to end users. The overuse of bots to exploit oracle arbitrage and liquidation increases overall transaction costs because these bots consistently outbid legitimate transactions for a first chance of being included in a block. This directly increases gas fees for actual users.

Additionally, external arbitrage trades triggered by temporary oracle price differences reduce the profits of liquidity providers in these DeFi ecosystems. Even if the current spot price may offer a significant spread, they are forced to accept low-margin prices on the side. Over time, continued trading losses on one side's assets lead to increased permanent losses for liquidity pools/liquidity providers. Users trying to exchange assets also need to deal with a degraded user experience, such as delayed trade execution, significantly increased slippage, and greater losses on forced liquidations.

A few common examples briefly illustrate how OEV activities create these problems:

Liquidation: MEV bots actively monitor decentralized lending platforms and leverage price oracle differences to quickly liquidate any insolvent loan positions to remove any insolvency from this activity Bonuses are paid in the catch. This relies on liquidating loans before oracle updates resolve data inconsistencies that expose favorable liquidated transactions.

Arbitrage: Bots constantly targeting lagging oracle prices on a DeFi platform Make a trade and immediately sell the acquired asset on another platform that may already reflect current actual spot pricing. This repetitive arbitrage extracts value without providing meaningful trading volume or liquidity to the affected applications.

Front-start: To maximize the gains from predictable oracle events Profitable, MEV bot inserts high transaction fee orders, timed before expected user trades trigger. By confirming their withdrawal transactions within a short delay window before major pricing updates, bots can take advantage of the discrepancy before competing transactions from actual users.

What is even more disturbing, however, is that the robot did not engage in any reciprocity Mutually beneficial interactions, or support for the underlying DeFi protocol, extract value. They exploit temporary oracle inaccuracies without actually trading or providing liquidity within these platforms, while further incentivizing the dominant builder ecosystem. Bots are tipped solely to prioritize their transactions, which increases competition for block space and promotes infrastructure centralization without benefiting end users or applications.

Overall, a lot of value is accruing to oracle data hunters and major blockchain validators, rather than being pumped back to feed the ecosystem's growth or availability. Persistent. Draining the revenue lifeline to external actors seeking unilateral profits has severely impacted the growth trajectory of decentralized finance. Shifting the capture of value extractable by oracles to the applications that generate the value provides a path to transforming the core economic sustainability of DeFi.

What is an order flow auction?

Order flow auctions (OFAs) aggregate swap intentions and transactions and rank them according to fair ranking criteria. This model aims to minimize the negative effects of the MEV strategy.

OFAs allow traders to easily publish their desired swap intent, which is then filled by competing external parties. This provides traders with the best prices across various decentralized and centralized liquidity venues without having to manually search for the best rates.

In an OFA structure, swappers simply publish their trading intentions, while dedicated order fillers optimize and actually execute the trades through various liquidity sources. These liquidity sources include automated market makers, private liquidity pools, etc., which order fillers can leverage to meet their exchange needs.

Shoppers actively compete to provide the most favorable trading rates to initial swappers. Their profit comes from the difference between the actual execution price and the exchange rate offered to the trader posting the intention.

The main benefits of trading with OFA include: reducing negative externalities of MEV by attempting fair trade ordering, better prices for initial traders, and overall efficiency , simplify decentralized trading across liquidity sources, and batch trades to improve execution efficiency.

By outsourcing order execution to competitive order fillers, the OFA structure simplifies the process of swapping in complex liquidity landscapes while providing traders with Consistently favorable pricing.

Example of protocol to solve OEV

API3

API3 is groundbreaking in addressing issues surrounding OEV by implementing an oracle-specific OFA mechanism called OEV-Share. It allows searchers to bid for the exclusive right to perform updates to API3 data sources derived from off-chain first-party oracles, owned and operated by the API provider themselves, and capture the OEV profits associated with these transactions. Meta-transactions cryptographically signed by API3 oracles enable data source updates to the winning bidder.

API3 introduces competition-based OEV auctions into existing oracle infrastructure, bringing several key benefits

Auctions maximize the efficiency of value extraction by linking oracle events to incentives.

Secondly, by returning returns to the affected Dapp rather than accumulating externally, This model prevents value from leaking from the network

Third, competition in the auction Pressure naturally reduces costs and increases the timeliness of updates. This enables API3 to provide cheap, accurate, low-latency data sources at scale - a cornerstone for further adoption of DeFi.

Taking a step back, API3’s OEV architecture creates a mutually beneficial Sustainable closed-loop model: search bots gain access to extract OEV profits. Dapps receive new revenue streams and pay lower rates for critical oracle services. API3 itself benefits from a profit model that sustainably funds the development and operation of oracle infrastructure.

This is currently "balanced" (it's not exactly balanced because It introduces negative externalities, but the interaction of different entities in the MEV architecture is fixed to some extent) How is this achieved under the MEV incentive mechanism?

Searcher gains an organized path to capture overlooked OEV opportunities that extend beyond transaction-level MEV. While adopting a structured bidding process may introduce slight procedural friction, increased efficiency and reduced competition will ultimately increase revenue. Since updates will be assigned to specific searchers for execution, it will be compatible with any block generation and verification scheme - for example, it does not require a private mempool. The auction proceeds will then be distributed back to the protocol, meaning they will realize proceeds that might otherwise have been leaked.

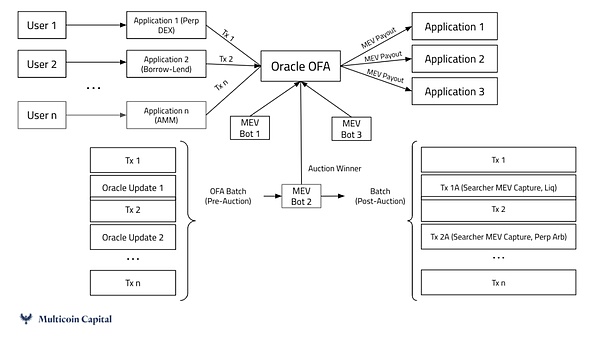

Source: Multicoin Capital

Pyth Network is developing a solution to OEV A new approach that builds on its existing market leadership in providing first-party financial data. Pyth recognizes that proprietary data sourced directly from market makers, liquidity providers, exchanges, and other direct ecosystem participants is more accurate and up-to-date than third-party aggregated pricing.

By accessing these high-quality data streams, Pyth's oracle design provides significantly higher fidelity and lower latency for contracts requiring real-world value. Pricing information. Pyth also implements a demand-pull model that allows contracts to get price updates accurately on demand, rather than relying on intermittent push-style provisioning. This increases flexibility while reducing network overhead costs.

Situated at the intersection of critical blockchain pricing data and contract execution logic, Pyth looks ideally suited to mediate the precious space available around price information. By aggregating access opportunities to embedded applications that leverage its oracle feeds, Pyth intends to facilitate global order flow auctions, allocating transaction access to specialized bots. Instead of value being accumulated strictly externally, Pyth can return contract interaction profits to the dApps that utilize it.

For Pyth's neutral oracle network, benefits include generating new revenue streams without compromising independent status in the ecosystem. By consolidating traffic access across networks at scale, fragmented application-specific auctions can be avoided. More competitive pricing captures value more fully in OEV events.

Interactions within the MEV ecosystem allow the protocol to have better mechanical trade-offs than the current OEV lifecycle process. What is unique at the core of the Pyth Network is the explicit recognition of the role of oracles by establishing proprietary data sharing incentives between first parties and contract platforms. By fetching on-chain prices directly from market-making participants, Pyth enforces reliability by minimizing latency while aligning ecosystem incentives between applications that consume data and platforms that produce it. Searchers achieve efficiency by organizing access to valuable instances in the block space connected to oracles. Builders exchange unlimited profitability for the reputational privilege of overseeing key market events. Crucially, Pyth's vantage point facilitates the redistribution of extracted profits to integrated applications through auctions of aggregated data streams, nourishing the ecosystem through recycled revenue growth rather than wasteful leakage.

Source:https://medium. com/uma-project/announcing-oval-earn-protocol-revenue-by-capturing-oracle-mev-877192c51fe2

Work Principle

UMA Oval integrates with Chainlink’s existing price feed infrastructure and leverages Flashbots’ MEV-Share architecture to facilitate oracle updates. Order flow auction.

When Chainlink’s price updates are submitted to the blockchain, Oval essentially wraps access to the latest data. This allows search bots to take advantage of the OEV opportunity by bidding and competing for the right to unlock and "pre-run" these price stream transactions.

Trusted intermediary nodes called Oval nodes are responsible for validating searcher bids and configuring refund rules for value distribution. They submit unlocking transactions to release held updates and associated pre-run bids, submitted as a bundle via MEV-Share.

MEV-Share runs a standardized private order flow auction coordinated across a wider network of Builders and Validators. Winning bidders in the auction include their bundled pre-run trades along with price feed unlocks to take advantage of arbitrage or liquidation events.

Then, according to the refund rules set by the Oval node, part of the profit is redirected back to the lending platform and other protocols integrated with Oval, while the normal amount is also allocated to Builder and Validator (this is achieved through liquidation bonus rate improvements inherent in the Oval mechanism). This way, value returns to the application, rather than allowing all profits to accrue to search bots and external validators.

One thing to note is that no one in the current MEV process is affected except Builder and the protocol itself. Searcher uses existing technology, which makes integration seamless, while fees are reallocated back to the protocol from Builder’s profits – this is controlled via the metadata of the bundled transaction. Validators still get paid for proposing blocks, which is also derived from Builder profits, which may increase some block inclusion latency during periods of high congestion (this will be discussed further in the report). However, Builders are able to have a steady flow of private orders through MEV-Share, which incentivizes them to produce blocks, especially when MEV value is high, which will result in higher fees allocated to Builders for inclusion. It also inhibits bad behavior, as MEV-Share can blacklist bad actors from the protocol.

In summary, Oval leverages existing oracles and MEV architecture to access valuable data stream updates. By controlling the release time, search auctions can be conducted and a portion of the generated profits returned to the affected applications.

Oval’s trust assumptions

There are three in the Oval mechanism Core components - the protocol that integrates the system, the Oval node that controls the auction, and the builder/miner that participates in transaction ordering and confirmation. This introduces potential trust issues:

The protocol relies on Oval nodes to set accurate refund rules to return value, without delaying or censoring price update releases. However, this will not harm the operation of most protocols using Chainlink, but in the worst case, the protocol may lose revenue that would otherwise be attributed to the builder and cause delays in price updates.

Oval relies on MEV-Share/Builders not to leak updated latest values, not to change searchers' preferences, and to send the correct pre-run payload. However, in the worst-case scenario, this does not harm the core operation of the protocol, but the protocol may lose revenue that would otherwise go to the builder and may cause delays in price updates.

Both Oval and MEV-Share trust Builders to abide by the packaging rules in submitted bundles and not to separate out transactions to steal profits. Oval selects Builders that the user can select. From a Builders perspective, the incentive to profit from OEV is less than the incentive to be prohibited from receiving this private auction stream. Flashbots thoroughly explores and field-tests this balancing mechanism, where incentives prevent bad-behaving Builders from stealing MEV profits:

(Github: https:// github.com/flashbots/dowg/blob/main/fair-market-principles.md)

The worst case scenario here is that a specific liquidation is like today What happens is unfolding - a Builder stealing OEV by unpacking is equivalent to a Builder capturing the MEV they do today.

While reputation and financial incentives often enforce good behavior, reliance on intermediaries creates risks. If an Oval node fails to post an update or redirect earnings, revenue capture will cease, but core pricing functionality will continue via Chainlink’s underlying feed.

In summary, Oval leverages existing oracles and MEV architecture to access valuable data stream updates. By controlling the release time, search auctions can be conducted and a portion of the generated profits returned to the affected applications.

Possible risks and counterarguments

A key The question is why UMA chose to adopt an intermediary auction model through Oval instead of directly implementing an on-chain Dutch auction method for liquidation events in the lending protocol. Compared to automated liquidation incentives, Dutch auctions may generate lower and slower returns for the platform. For high-risk scenarios like under-collateralization, maximizing speed and reliability is critical. Oval leverages existing MEV architecture to help ensure liquidity in these situations.

Another concern is whether users might try to censor price update releases by bribing validators not to propose certain blocks that unlock new data. However, this attack can be costly to sustain over multiple blocks. Users must bid significantly more than the existing tips that builders and validators have already received in order to prioritize their deal packages. Barring extreme circumstances, revenue-maximizing incentives still favor inclusion over censorship.

Another risky question is what's to stop Chainlink itself from building an alternative proprietary MEV capture system around its own feeds, rather than working with one like Oval Intermediary solution integration. One mitigating factor is that redirecting MEV revenue back to oracle providers could serve as a useful funding mechanism for Chainlink’s continued development. Oval provides a verification path to achieve this through protocol-level integration.

Furthermore, the trust assumption is mostly mitigated by the possibility of small price delays - as mentioned, up to 3 blocks in the most likely analysis. In the normal operation of the lending protocol, price delays of up to 3 blocks are not expected to have any measurable impact. This is very different from how price delays affect market transactions or more rapidly evolving product types. When liquidation is required, the next block (without delay) has a 90% inclusion rate and 2 blocks has a 99% inclusion rate. Experts at Uma do not believe that this delay will result in a large enough price movement to consume the existing liquidation buffer.

Finally, a potential vulnerability is whether the builder responsible for order and transaction confirmation could steal OEV profits by backrunning rather than respecting the auction mechanism. However, Incentive Alignment still supports Oval-compliant systems for private order flow from Flashbots. Reputation impact and the risk of being cut off from the entire ecosystem provide strong defenses against individual theft, and potential one-time gains pale in comparison to the ongoing revenue streams gained from following the rules.

OEV-General Thoughts

Although many solutions exist to solve OEV (especially to invest value back into the protocol/ecosystem), users are still negatively affected to a certain extent . Solutions such as Broadcaster Extract Value (BEV) are trying to alleviate the pressure of MEV on the user side, which may be an interesting direction to consider in the protocol design of other OFA models. To further mitigate some of the trust assumptions brought by the OFA model, we are excited to see that the new OFA mechanism can also be implemented at the protocol level.

For example, generalizing OEV to even internal price changes (as introduced in the introduction section) allows the protocol to further reduce negative externalities. Taking Oval as an example, just as wrappers can mediate access to external data oracle events to redistribute value, the protocol can treat these impactful transactions as internal data updates.

For example, Uniswap can set a threshold so that any transaction flow greater than $X must be routed through an Oval-like encapsulation system. This will allow Uniswap auction access, allowing bots to backrun or arbitrage these specific large trades.

Then, just as Oval returns value from liquidation to the lending platform, this Uniswap implementation can return part of the profits affected by huge transactions to the Uniswap protocol, liquidity Pools, liquidity providers, and even protocol users.

Opinions on Uma Oval

Although UMA Oval is clever While leveraging existing architecture to capture and redirect OEV, the system relies on fragile incentive alignment and trusted intermediaries, introducing security risks.

Oval nodes and order flow mechanisms provide optimizations but open attack vectors. In a worst-case breakdown of intermediary trust or incentive models, delays in critical data flows could still occur and enable more arbitrage-related value extraction.

However, this approach does mitigate some of the negative externalities in the current paradigm. As an interim solution to improve sustainability, Oval may generate meaningful revenue for affected applications. Still, concerns about increased centralization, transparency, and latency remain, all of which could become future attack vectors if not thoroughly field-tested.

Overall, UMA Oval represents an innovative attempt to recover value leakage, but it may not fundamentally solve all opportunities for extraction the central motivating question that makes it possible. Like any novel cryptoeconomic system, these mechanisms need to undergo extensive review, auditing, and real-world testing under varying operating conditions before their true robustness and ability to resist mining can be assessed.

I am very excited to see Oval transform the discussion and inspire continued research, as they address some of the outstanding questions in the OEV field that have not yet been directly addressed. But as adoption considerations unfold, a full understanding of the risks and benefits will be key.

Related links

API3

https://hackernoon.com/what-is-oracle-extractable-value-oev

https: //medium.com/api3/defi-oracles-are-broken-3c83144a7756

OEV

https://banklesspublishing.com/understanding-mev-and-the-opportunity-for-oracle-extractable-value/

Pyth

https://multicoin.capital/2023/12/14/oracles-and-the-new-frontier-for-application-owned-orderflow- auctions/

UMA

https://medium.com/uma -project/announcing-oval-earn-protocol-revenue-by-capturing-oracle-mev-877192c51fe2

https://www.theblock.co/ post/273925/uma-rolls-out-oval-to-capture-oracle-extractable-value-in-defi-protocols

https://twitter .com/uriklarman/status/1750214133411127328

Part.2 IOSG post-investment project progress

EigenLayer completed US$100 million in financing, with a16z participating

* Restaking

EigenLayer, a provider of portfolio crypto re-pledge services from IOSG Ventures, announced the completion of a $100 million financing with participation from a16z. Founded by Sreeram Kannan, EigenLayer allows tokens to be deposited or "remortgaged" into the network to support verification of transactions on the blockchain, helping new projects built on Ethereum to use the security of the blockchain to protect their own network.

DefiLlama data shows that the total lock-in value (TVL) of EigenLayer currently exceeds 8 billion US dollars.

Coinbase will launch Starknet (STRK)

* Layer2

On February 22, Coinbase Assets tweeted that Coinbase will add support for Starknet (STRK) on the Ethereum network (ERC-20 token) support, and the platform marks the asset as "experimental". Do not send this asset over other networks or you may risk losing your funds. Trading will begin later today if liquidity conditions are met. Trading on the STRK-USD trading pair will begin in phases once the asset is in sufficient supply.

Starknet: Cross-chain bridge StarkGate 2.0 mainnet has been launched

* Infra

On February 22, Starknet announced on the X platform that the cross-chain bridge StarkGate 2.0 mainnet has been launched and now supports one-click withdrawals , withdrawal limits, and fast withdrawals, as well as permission-free bridging and smart deposit services.

OKX Web3 wallet has fully supported the Starknet ecosystem

* Infra

On February 21, according to official news, OKX Web3 wallet has fully supported the Starknet ecosystem. Among them, the wallet section has supported the addition of Starknet network and on-chain asset management, and can check and receive STRK airdrops through Giveaway. The DEX section has supported asset exchange on the Starknet chain and cross-chain exchange with 12 mainstream EVM public chains. The discovery section has been established The Starknet DeFi Spring zone helps users explore popular DApps in the ecosystem anytime and anywhere and win rewards. An exclusive ecosystem-specific airdrop event will be launched soon. In the future, OKX Web3 Wallet will continue to support the development of Starknet and optimize product functions to provide users with the best experience of playing with the Starknet ecosystem in one stop.

Part.3 Investment and Financing Events

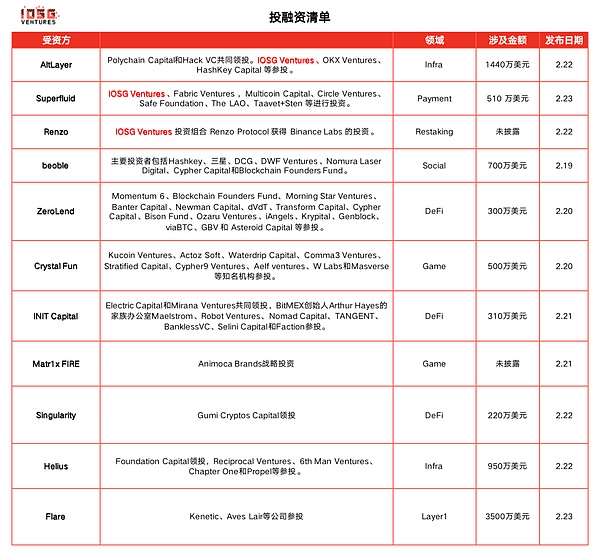

Rollup-as-a-service protocol AltLayer completes US$14.4 million in strategic round of financing

* Infra

Rollup-as-a-service protocol AltLayer completed a strategic round of financing of US$14.4 million, with Polychain Capital and Hack VC co-leading the investment. IOSG Ventures, OKX Ventures, HashKey Capital, etc. participated in the investment. This round of financing will end in September 2023.

It is reported that AltLayer is a platform designed to launch native and re-pledge Rollups, supporting Optimistic and ZK Rollup stacks. This project is also the 45th phase of Binance Launchpool.

Ethereum capital flow protocol Superfluid completed a strategic round of financing of US$5.1 million

* Payment

Ethereum capital flow protocol Superfluid announced the completion of a US$5.1 million strategy round of financing, investment from IOSG Ventures, Fabric Ventures, Multicoin Capital, Circle Ventures, Safe Foundation, The LAO, Taavet+Sten, etc. The Superfluid protocol, which allows crypto projects such as decentralized autonomous organizations to pay recurring salaries and rewards in single-chain transactions through its "super tokens," closed a $9 million seed round in 2021.

IOSG Ventures portfolio Renzo Protocol receives investment from Binance Labs

* Restaking

IOSG Ventures portfolio Renzo Protocol acquires Binance Labs Investments. This project is a liquid re-pledge token (LRT) and strategy management infrastructure built around EigenLayer. It is committed to in-depth development of shared security performance on EigenLayer and setting standards for risk management in re-pledge.

Renzo Protocol TVL has exceeded $370 million. Users can deposit LST tokens such as ETH, stETH and wBETH to Renzo and receive the corresponding amount of ezETH. Additionally, Renzo is working with cross-chain protocols to bring more on-chain native ETH to EigenLayer through Renzo.

Web3 social protocol beoble has raised $7 million in two rounds of financing

* Social

Web3 social protocol beoble has completed a seed round of financing 3 months since its pre-seed announcement, with the total amount raised reaching 7 million USD, with major investors including Hashkey, Samsung, DCG, DWF Ventures, Nomura Laser Digital, Cypher Capital and Blockchain Founders Fund. The funds raised will be used to launch beoble V2 next month to improve Web3 social media interaction and provide advanced features such as multi-chain integration, in-app social trading and OTC capabilities.

According to reports, the Web3 social platform beoble aims to provide enhanced decentralized wallet-to-wallet communication. With a range of innovative features such as Earn, Follow, Discover and a rewards-based model tailored specifically for the Web3 community, beoble prioritizes user privacy, security and contribution.

Singularity, an institutional-level privacy DeFi access layer, completed the latest round of US$2.2 million in financing

* DeFi

It was reported on February 22 that Singularity, which focuses on the institutional-level privacy DeFi access layer, was led by Gumi Cryptos Capital in Silicon Valley. invested and successfully completed its second round of financing. These funds will be used to support the development of the protocol, with the aim of promoting compliant access to DeFi and ensuring commercial confidentiality of on-chain activities. This round of financing highlights the strong confidence in Singularity’s future development from top institutions such as Nomura Securities’ Laser Digital, Eureka Partners, and previous investors Apollo Crypto, Digital Asset Capital Management, and Gandel Invest. To date, Singularity has raised nearly $4 million in total funding.

Layer1 blockchain Flare completes US$35 million in private financing

* Layer1

On February 23, according to CoinDesk reports, Layer1 blockchain Flare completed a $35 million private placement financing, with companies such as Kenetic and Aves Lair participating. cast. Early investors in the project voluntarily agreed to extend the token distribution from 2024 to the first quarter of 2026. To reduce selling pressure in the market, a selling limit of 0.5% of daily trading volume was also imposed.

It is reported that Flare is known as the Layer1 network of data, supports the creation of smart contract protocols, and focuses on pricing oracles, which are used in various decentralized Transfer asset prices between DeFi applications.

Chain game studio Crystal Fun completed a US$5 million seed round of financing

* Game

On February 20, the decentralized chain game ecological platform and studio Crystal Fun announced the completion of a US$5 million seed round of financing. This round of investment was participated by well-known institutions such as Kucoin Ventures, Actoz Soft, Waterdrip Capital, Comma3 Ventures, Stratified Capital, Cypher9 Ventures, Aelf ventures, W Labs and Masverse. The funds raised this time will be mainly used for the development and operation of its games. Currently, Crystal Fun has announced that it will launch four games: "OUTER", "Endless War", "StarFall" and "Survivor". In addition, Crystal Fun also announced that it will launch the second closed beta test of the "OUTER" game today, which will mainly test the balance values and pressure load in the game to ensure that players can enjoy the best gaming experience.

Lending protocol ZeroLend completed a $3 million seed round of financing at a valuation of $25 million

* DeFi

On February 20, the lending protocol ZeroLend announced that it had successfully closed its seed round of financing, raising US$3 million with a valuation of 2,500 Ten thousand US dollars, Momentum 6, Blockchain Founders Fund, Morning Star Ventures, Banter Capital, Newman Capital, dVdT, Transform Capital, Cypher Capital, Bison Fund, Ozaru Ventures, iAngels, Krypital, Genblock, viaBTC, GBV and Asteroid Capital participated in the investment.

As the largest protocol on zkSync and the third largest protocol on Manta (by TVL), ZeroLend plans to launch its native governance token in the first quarter of 2024 ZERO.

DeFi project INIT Capital completed a seed round of financing of US$3.1 million, led by Electric Capital and others

* DeFi

On February 21, according to official news, Mantle ecological DeFi project INIT Capital announced the completion of a US$3.1 million seed round. The financing was co-led by Electric Capital and Mirana Ventures, with participation from Maelstrom, Robot Ventures, Nomad Capital, TANGENT, BanklessVC, Selini Capital and Faction, the family office of BitMEX founder Arthur Hayes. Pendle Lianchuang (@tn_pendle), Ethena Labs founder Leptokurtic, Aevo Lianchuang Julian, Dragonfly’s Ashwin, MetaStreet founder David Choi, SCB 10X CEO Tai Panich and other investors also participated.

This seed round investment will enhance INIT’s technical capabilities, market strategy and overall position as a major DeFi liquidity layer. INIT also partners with DEXs and DApps to create a one-stop shop for users to access and manage yield strategies. Looping Hook will launch on February 28th.

It is reported that INIT is committed to transforming DeFi liquidity infrastructure through Liquidity Hook to provide users and builders with seamless liquidity access and management as well as asset composability. .

Modular blockchain developer Inco completed a US$4.5 million seed round of financing, led by 1kx

* Infra

News on February 21, according to The Block, a modular blockchain focused on confidentiality Developer Inco completed a US$4.5 million seed round of financing, led by 1kx, with participation from Circle Ventures, GSR, Polygon Ventures, Robot Ventures, Alliance DAO, zkSync developer Matter Labs, and others.

Inco founder Remi Gai said that the company started a seed round of financing in September and closed around November. The structure of this round of financing is a Simple Future Equity (SAFE) agreement plus token warrants but declined to comment on valuation.

It is reported that Inco was established in August last year and today launched its first test network called Gentry. Its second testnet, Paillier, is scheduled to be released between the second and third quarters of this year, and the mainnet is scheduled to be released in the fourth quarter. Inco is a modular, interoperable Layer 1 blockchain network dedicated to bringing confidentiality to decentralized applications. It can be compared to modular blockchain projects such as Celestia and Lava, which focus on data availability and data access respectively, while Inco focuses on confidentiality.

The metaverse shooting mobile game Matr1x FIRE received strategic investment from Animoca Brands

* Game

On February 21, according to official news, the metaverse shooting mobile game Matr1x FIRE announced that it has received strategic investment from Animoca Brands. The specific amount has not been disclosed. .

It is reported that Matr1x Fire is the flagship product of Web3 entertainment platform Matr1x. It is a first-person shooting game for mobile devices. Players can choose from the list of playable characters. Choose from and compete as a team of five to destroy your enemies.

Previously, Matr1x announced the completion of a US$10 million Series A financing in February last year, with participation from Hashkey Capital and others; in November last year, Matr1x completed a US$10 million A-2 round of financing, ABCDE Capital and others participated in the investment.

Solana infrastructure company Helius completed a $9.5 million Series A round of financing, led by Foundation Capital

* Infra

On February 22, according to Fortune Magazine, Solana infrastructure company Helius announced the completion of a US$9.5 million Series A round. The financing was led by Foundation Capital, with participation from Reciprocal Ventures, 6th Man Ventures, Chapter One and Propel.

It is reported that Helius is a vertically integrated developer platform that helps build encryption applications on Solana. The company was founded in 2022 by former software engineers from Coinbase and Amazon Web Services. The platform provides a set of tools that enable developers to quickly and easily build applications on Solana. In addition, in October 2022, Helius completed a seed round of financing of US$3.1 million.

Part.4 Industry Pulse

Vitalik: Verkle trees will enable stateless validator clients

* Infra

< p style="text-align: left;">On February 19th, Vitalik Buterin expressed his expectations for the Verkle tree on his X account (vitalik.eth) today. He believes that Verkle trees will make stateless validator clients possible, which will allow staking nodes to use almost no hard disk space and be able to synchronize almost instantly, greatly improving the user experience of individual staking. This technology is also beneficial for user-facing light clients.He is also excited about the application of AI in formal verification of code and finding vulnerabilities. He believes that the biggest technical risk currently facing Ethereum may be vulnerabilities in the code, and any technology that can bring significant changes in this regard will be amazing.

Paradex, a decentralized sustainable derivatives L2 application chain based on Starknet, has been launched on the main network

* Layer2

On February 20, according to the official announcement, the Layer2 application of decentralized sustainable derivatives based on Starknet Chain Paradex has been officially launched on the mainnet. Paradex is incubated by the cryptocurrency institutional liquidity platform Paradigm (noted, not a venture capital company of the same name). It aims to combine the liquidity advantages provided by Paradigm with the transparency and self-custody features of decentralized finance (DeFi) to create an independent operating chain.

Vitalik: The sophisticated Layer2 is not the optimal solution, and Layer1 should not be oversimplified

* Infra

News on February 22, Ethereum Lianchuang Vitalik Buterin just tweeted that for "simplification at all costs Regarding the concept of "Layer 1", his confidence has dropped three times compared to 5 years ago. After an in-depth analysis of the risks and trade-offs, Buterin concluded that Layer 2 was not the most effective solution. He pointed out that if there is a consensus failure in Layer 1, although the core developers may need to work all night to fix it, the system can eventually return to normal. In contrast, when Layer 2 fails, users may face permanent large financial losses. Based on this consideration, Vitalik proposed adding some complex functions to Layer 1 to reduce the pressure on Layer 2, believing that this is a more preferable strategy.

Ethereum liquidity staking project ether.fi will join the Manta Network ecosystem

* Staking

On February 22, the liquidity staking project ether.fi announced that its products will be launched on the Manta Pacific platform. This means that users of Manta Pacific can stake ETH into the ether.fi protocol to receive LSD tokens eETH and other related rewards.

Previously, ether.fi has allowed users to obtain ETH staking rewards, etherfi points and EigenLayer points by minting eETH. In February last year, ether.fi completed US$5.3 million in financing.

Web3 map company Hivemapper will launch a new driving recorder Hivemapper Bee

* DePIN

According to TechCrunch reports on February 22, Web3 mapping company Hivemapper will launch a new driving recorder, Hivemapper Bee, later this year. Aims to accelerate market share capture from Google by leveraging the crowdsourcing community. The Bee camera is equipped with a larger GPS antenna and supports 4K 30fps shooting, aiming to provide a more attractive option for the company's fleet customers. It also has more on-device processing power and the ability to upload data without connecting to a smartphone app. Pre-orders are now available, with the LTE chip priced at $549 and the WiFi-only version priced at $449. Shipping to Rapid Rush pre-orderers will begin in the third quarter of 2024. In addition, Hivemapper encourages the creation of high-quality map data by providing Honey tokens as rewards to contributors.

L1 Blockchain Injective cooperates with DEX DojoSwap to launch the "CW-404" standard

* ERC

On February 23, according to CoinDesk reports, Layer 1 blockchain Injective launched the CW-404 standard to facilitate Benefit from the popularity of the ERC-404 standard and move to its own network. Injective has partnered with decentralized exchange DojoSwap to offer the CW-404 standard, a ported version of the ERC-404 standard that combines the CW-20 and CW-721 standards.

ERC-404, as an unofficial Ethereum standard, allows multiple wallets to directly own a single non-fungible token (NFT) and make it hold One can create a specific use case where that specific exposure can be tokenized for borrowing or staking.

Mind Network introduced FHE technology into its data storage expansion project and received support from Zama

* Infra

On February 22, Mind Network announced that it will introduce fully homomorphic encryption technology (FHE) into its data storage expansion plan MindLake, and is backed by leading FHE research company ZAMA. This marks a substantial step forward in a new era of end-to-end encryption for Web3. MindLake is a groundbreaking data storage expansion technology designed to enhance the computing power of encrypted data on decentralized platforms to serve application scenarios such as AI, DePIN, and blockchain games.

ZAMA is an open source cryptography company dedicated to building state-of-the-art FHE solutions to protect privacy in blockchain and artificial intelligence, developed for developers Advanced encryption tools and solutions. FHE can perform computations on encrypted data without decryption. This groundbreaking approach ensures data privacy and security, opening up new possibilities for secure data analysis, cloud computing and more, without compromising user confidentiality. This cooperation with ZAMA will elevate the security standards of on-chain data computing to a new level.

Y Combinator: Stablecoins will become an important part of the future of currency

* Stablecoin

News on February 19, the latest request for startups (RFS) from the famous American startup incubator Y Combinator (YC) emphasized their hope See innovative areas where more people are engaged. These areas include applying machine learning to robotics, using machine learning to simulate the physical world, new defense technologies, bringing manufacturing back to the United States, new space companies, climate tech, commercial open source companies, spatial computing, new enterprise resource planning software , developer tools inspired by existing internal tools, explainable AI, large language models (LLMs) for traditional enterprise back-end manual processes, building enterprise software with AI, stablecoin finance, ways to end cancer, biology Foundational models of systems, managed services organization models for healthcare, elimination of middlemen in healthcare, better "glue" for enterprise software, and small fine-tuned models as replacements for giant generic models.

As for the financial part of stablecoins, YC said that there is a lot of debate about the practicality of blockchain technology, but stablecoins will obviously become an important part of the future of currency. . There are currently US$136 billion worth of stablecoins issued on the market, but the opportunity seems to be far from being fully exploited. To date, only about seven million people have traded stablecoins, while more than half a billion people live in countries with annual inflation exceeding 30%. U.S. banks hold $17 trillion in total customer deposits, which are potential conversion targets. However, there are only a handful of major stablecoin issuers, and even fewer major liquidity providers. Y Combinator hopes to fund outstanding teams building B2B and consumer products, tools and platforms on top of stablecoins, as well as more on the stablecoin protocols themselves.

Kelp DAO launches EigenLayer point token KEP

* Restaking

On February 21, Kelp DAO officially announced that it has launched Kelp’s point-earning token KEP, aiming to provide liquidity for EigenLayer points/rewards. . Users can now transfer and trade their KEP and participate in DeFi. All EigenLayer points earned by Kelp DAO will be distributed proportionally to rsETH holders in the form of KEP tokens at a 1:1 ratio.

Curve: The lending contract has been deployed and users can borrow money

* DeFi

On February 24, Curve tweeted that the lending contract has been deployed, and arbitrage traders can use it to obtain huge profits. There may be some liquidity coming in before the UI is officially launched. Curve said that the lending platform has not yet been officially launched, but users can already borrow through contracts.

As of February 24, Uniswap front-end transaction fees exceeded US$8 million

* DeFi

As of February 24, Uniswap front-end transaction fees (income) reached US$8.1 million. According to previous news, Snapshot voting for the "Activating Uniswap Protocol Governance" proposal will be released on March 1, 2024, and on-chain voting will begin on March 8, 2024. The proposal recommends upgrading the protocol so that its fee mechanism rewards UNI token holders who delegate and pledge their tokens. The proposed changes include: 1. Upgrading Uniswap protocol governance to achieve license-free and programmatic charging of protocol fees; 2. Transfer any Protocol fees are distributed proportionally to UNI token holders who have pledged and delegated their voting rights; 3. Allow governance to continue to control core parameters: which pools need to pay, and the size of the fees.

Eigenpie: LST pre-deposit has been reopened

* Staking

In news on February 25, Eigenpie stated that LST pre-deposits have been reopened. Users can deposit ETH LST to obtain Eigenpie points and earn from LST. Get potential profits. Eigenpie Points holders will receive a 60% share of the EGP token IDO and a 10% airdrop of the total EGP token supply.

Web3 social media platform Farcaster powers Solana addresses

* Social< /em>

On February 23, according to The Block, the Web3 social media platform Farcaster has provided support for Solana and combined it with the blockchain address to authenticate the user. It allows Farcaster’s client Warpcast to link users’ Solana addresses through wallets compatible with the platform. Farcaster founder Dan Romero said the new feature is live now. This Solana integration not only allows user access, but also introduces Frames, which can interact directly with users who have signed up for a Solana wallet.

ETHGlobal announces the 7 hackathon finalists

* ETH

em>On February 22, ETHGlobal announced the list of 7 finalists for the hackathon on the X platform, including:

1.priv.cast: Anti-counterfeiting and private voting application built using Noir's Farcaster framework;

2 .VeriBot: Use zkML to prove the absence of vulnerabilities in (closed) source code;

3.zkDL: An identity proof project that uses zero-knowledge proofs to protect users Privacy;

4.0xShadows: multi-signature wallet, the owner can submit/approve/reject transactions anonymously;

5.ZK open banking: a fully private open banking protocol powered by aztec network;

6.EVMTrace: designed to reveal the on-chain The use of encryption technology. Collect data using techniques such as tracking, tracking pre-compilation, pattern recognition and manual work;

7. Myriad: A new way to have real fun with DAOs, allowing The platform for users to create and participate in DAO can also be introduced into the Farcaster framework.

Dubai Court has ruled that cryptocurrency can be legally recognized as a valid form of salary payment.

Bernice

BerniceGolden Finance launches Golden Web3.0 Daily to provide you with the latest and fastest news on games, DeFi, DAO, NFT and Metaverse industries.

JinseFinance

JinseFinanceDubai’s court recognises cryptocurrency as a valid form of salary payment, reflecting a progressive stance on digital currencies in employment contracts and reinforcing the UAE's commitment to financial innovation.

Xu Lin

Xu Lin3AC Says That FTX and Alameda Hunted Their Positions During LUNA Collapse.

Others

OthersMessi and Neymar's PSG contract details revealed: How much do they earn?

Others

OthersBrazilian UFC fighter Luana Pinheiro becomes the first female sportswoman in Latin America to receive her entire salary in BTC.

Cointelegraph

CointelegraphTether USDT stablecoin cannot be used for salary payments, a Chinese court ruled, citing the country’s blanket ban on all types of crypto transactions.

Cointelegraph

CointelegraphThe total salary of the Green Bay Packers player will be worth approximately 368.8 BTC.

Cointelegraph

CointelegraphIguodala said he will also give out $1 million worth of BTC to fans in an effort to increase Bitcoin adoption.

Cointelegraph

CointelegraphThe Belgian lawmaker will convert his monthly salary of 5,500 euros into bitcoin through Bit4You, the country’s popular cryptocurrency trading platform.

Cointelegraph

Cointelegraph