Author: Ping An First Economic Team; Source: Zhong Zhengsheng Economic Analysis

Core Views

On March 19, 2025, the US Federal Reserve released the FOMC meeting statement and economic forecasts, and Powell delivered a speech. Since then,The market trading style is similar to "loose trading":The 10-year US Treasury yield fell 8BP to 4.24%, the three major US stock indexes rose, the US dollar index fell, and gold rose above $3,050/ounce during the session.

Meeting Statement and Economic Forecast: If the interest rate is not cut as scheduled, it is still expected to cut interest rates twice this year. The Fed maintained the policy rate in the range of 4.25-4.50% at its March 2025 meeting, and plans to further slow down the balance sheet reduction starting in April, reducing the rate of reduction of Treasury bonds from $25 billion to $5 billion per month. Compared with the January 2025 statement, the description of the economic outlook this time changed from "uncertainty exists" to "increased uncertainty", and the statement "(two-way) risks are roughly balanced" was deleted. Fed Governor Waller voted against slowing down the balance sheet reduction. In terms of economic forecasts, the median forecast for economic growth in 2025 was significantly lowered from 2.1% to 1.7%, the unemployment rate was revised up from 4.3% to 4.4%, and the median forecasts for PCE and core PCE inflation rates were revised up by 0.2 and 0.3 percentage points to 2.7% and 2.8% respectively; the policy rate in 2025 remained at 3.9% (two rate cuts), and the dot plot showed that the expectation of rate cuts in 2025 has weakened.

Powell's speech: "unchanged" response. Powell's core idea is that policies such as tariffs have brought huge uncertainties to inflation and economic prospects, and the Federal Reserve has intentionally or reluctantly chosen to respond with "unchanged" response and maintain a high degree of flexibility in monetary policy. The key messages it conveys include: 1) It is difficult to assess the specific contribution of tariffs to inflation, but it is believed that (long-term) inflation expectations remain stable. 2) The US economy is still sound because "hard data" such as employment and consumption are not weak, but some survey data related to expectations are weak; the probability of a US recession has increased but is still not high. 3) The Fed does not need to curb inflation at the cost of recession as it did in the 1970s. 4) Financial markets, including the stock market, are important, but financial market fluctuations must be sustained enough to be focused on. These remarks have alleviated market concerns about "stagflation" to a certain extent.

Policy thinking: The outlook for the economy and interest rate cuts still needs to be re-evaluated; slowing down the balance sheet reduction may be a stopgap measure. Is the Fed willing to protect the economy and the stock market and cut interest rates in a timely manner against the backdrop of rising inflation risks? It is difficult for us to judge from this meeting. The Fed may have intentionally expressed optimism about the US economy. However, we have reservations about Powell's view that the "hard data" of the US economy is still resilient. Regarding inflation, we also have reason to worry that the Fed's judgment is too optimistic: the Fed may not fully take into account the impact of tariffs; the risk of upward inflation expectations has not been taken seriously. We believe that compared with the baseline expectation of a 50BP full-year interest rate cut, the more likely deviation is that the downward pressure on the US economy exceeds the Fed's current prediction, which will then lead to the risk that the Fed cuts interest rates too late in the first half of the year and "makes up for it" in the second half of the year, making the actual interest rate cut for the whole year exceed 50BP. A positive factor is that the Fed relatively decisively announced a slowdown in balance sheet reduction, reducing the supply of the Treasury market and lowering the yield of US Treasury bonds. This may also be an important consideration for the Fed to temporarily choose to "stand still" on interest rates.

Risk warning: The US economy and employment are weaker than expected, US inflation is higher than expected, and US policy uncertainty is high.

The Fed did not cut interest rates as scheduled at its March 2025 meeting, but announced that it would further slow down its balance sheet reduction starting in April. The latest economic forecasts have revised down growth and revised up inflation, but the median interest rate forecast still expects two rate cuts this year, although the dot plot shows that expectations for rate cuts in 2025 have weakened. The core idea of Powell's speech is that policies such as tariffs have brought huge uncertainties to US inflation and economic prospects. The Fed has intentionally or reluctantly chosen to respond with "unchanged" and maintain a high degree of flexibility in monetary policy. Powell's remarks have eased market concerns about "stagflation" in the United States to a certain extent. However, we believe that compared with the baseline expectation of a 50BP full-year interest rate cut, the more likely deviation is that the downward pressure on the US economy exceeds the Fed's current prediction, which will then create the risk of the Fed cutting interest rates too late in the first half of the year and "making up for the cut" in the second half of the year.

1. Meeting statement and economic forecast: If there is no interest rate cut as scheduled, it is still expected to cut interest rates twice this year

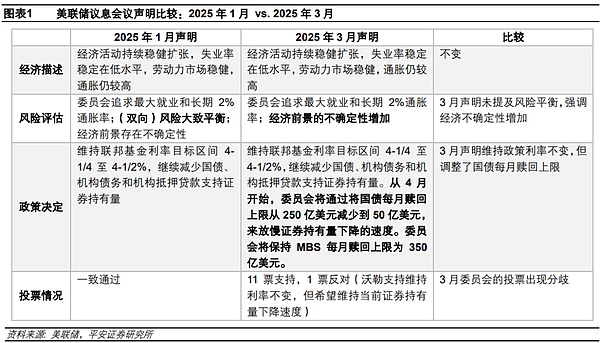

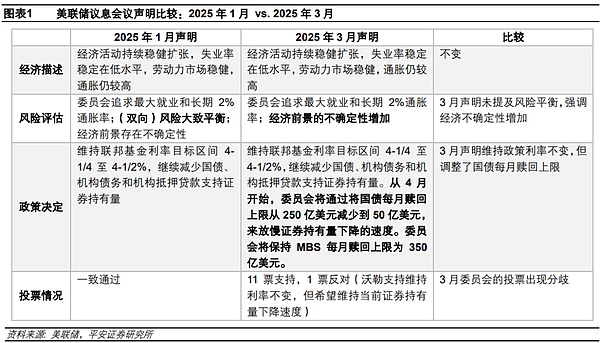

The statement of the Federal Reserve's interest rate meeting in March 2025 maintained the federal funds target rate in the range of 4.25-4.50%, which is in line with market expectations; at the same time, the Federal Reserve plans to further slow down its balance sheet reduction starting in April, reducing the pace of Treasury bond reduction from US$25 billion to US$5 billion per month, and will not change the pace of MBS reduction by US$35 billion per month.

Compared with the statement in January 2025, this statement's judgment on current economic activities, unemployment rate, labor market and inflation remains unchanged,but the description of the economic outlook has changed from "uncertainty exists" to "uncertainty increases", and the statement "(two-way) risks are roughly balanced" has also been deleted, indicating that the Fed's concerns about economic uncertainty have increased. In addition, one member (Federal Reserve Board Governor Waller) voted against the policy decision in this statement. The statement shows that he supports keeping interest rates unchanged, but opposes slowing the reduction of the balance sheet and hopes to maintain the current rate of decline in securities holdings.

The main changes in the Federal Reserve's economic forecast (SEP) released in March 2025 compared with December 2024 include:

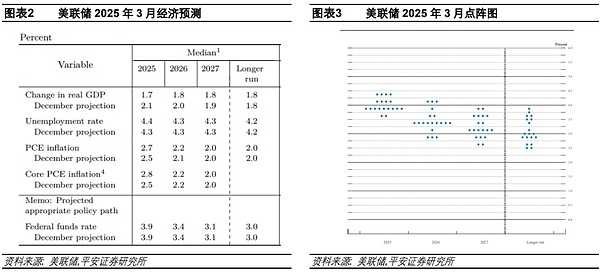

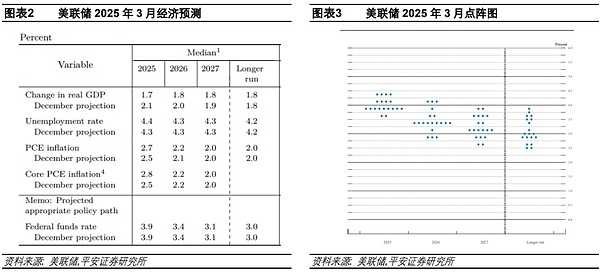

1) Economic growth: The median forecast for economic growth in 2025 was significantly revised down from 2.1% to 1.7% (slightly lower than the 1.8% long-term economic growth level believed by the Federal Reserve), and the economic growth rate in 2026-2027 was revised down from 1.9-2.0% to 1.8%.

2) Employment:The median forecast for the unemployment rate in 2025 was revised up from 4.3% to 4.4%, maintaining the forecast for the unemployment rate in 2026-2027 at 4.3% and the long-term level of 4.2%.

3) Inflation: The median forecasts for the PCE and core PCE inflation rates in 2025 were revised up by 0.2 and 0.3 percentage points, respectively, to 2.7% and 2.8%;Both indicators are 2.2% in 2026 and 2.0% in 2027, and the long-term inflation forecast is 2.0%.

4) Interest rate: The median forecast for the policy rate in 2025 remains at 3.9% (two rate cuts this year), the median forecast for the policy rate in 2026 remains at 3.4%, and the long-term policy rate forecast remains at 3.0%.

5) Dot plot: For 2025, among the 19 officials, 4 expect no rate cut (an increase of 3 from the last time), 4 expect only one rate cut (an increase of 1), 9 expect two rate cuts (a decrease of 1), and only 2 expect three or more rate cuts (a decrease of 3). It can be seen that, although the median forecast remains unchanged, the officials' expectations for rate cuts in 2025 have weakened overall.

2. Powell's speech: "unchanged" response

Overall, the main focus of this press conference is how the Fed views the inflation outlook, the pressure of economic slowdown, and the considerations of maintaining the forecast of two interest rate cuts this year. Powell's core idea is that policies such as tariffs have brought huge uncertainty to the inflation and economic prospects of the United States. The Fed has deliberately or reluctantly chosen to respond with "unchanged" response and maintain a high degree of flexibility in monetary policy. The key messages it conveys include: 1) It is difficult to assess the specific contribution of tariffs to inflation, but it is believed that (long-term) inflation expectations remain stable. 2) The US economy is still strong because "hard data" such as employment and consumption are not weak, but some survey data related to expectations are weak; the probability of a US recession has increased but is still not high. 3) The Fed does not need to curb inflation at the cost of recession as it did in the 1970s. 4) Financial markets, including the stock market, are important, but financial market fluctuations will only be the focus of attention if they are sustained enough. These remarks have alleviated market concerns about US "stagflation" to a certain extent.

After the meeting statement and Powell's speech, the market trading style was similar to "loose trading":The 10-year US Treasury yield continued to decline, down 8BP from around 4.32% to around 4.24%; the three major US stock indexes expanded their gains, with the Nasdaq, S&P 500 and Dow Jones closing up 1.41%, 1.08% and 0.92% respectively on the day; the US dollar index fell from a high of nearly 104 to around 103.5, but still closed up slightly by 0.2% for the day; the spot price of gold rose, breaking through $3,050/ounce during the session to set a new high, and closing up 1.1% for the day.

Specifically:

1) About inflation. The most frequently asked topic at this press conference was inflation. Many questions asked, How does the Fed assess the specific impact of tariffs on inflation? Powell said that at present, we can only say that part of the inflation comes from tariffs, but It is difficult to accurately assess its contribution; commodity inflation has risen significantly in the first two months of 2025, which is closely related to the implementation of tariffs, but the specific impact is difficult to quantify. Regarding inflation expectations, a reporter mentioned that various surveys currently show that short-term inflation expectations have risen. Will this change the Fed's assessment of inflation? Powell admitted that short-term inflation expectations have indeed risen, partly due to the implementation of tariffs, and businesses, households and market participants have mentioned the impact of tariffs on inflation. But he emphasized that when saying "well-anchored inflation expectations", it mainly refers to long-term inflation expectations; currently long-term inflation expectation indicators (such as the five-year or five-year forward break-even inflation rate) are flat or slightly declining. But he also emphasized that the Fed will pay close attention to all inflation expectation data and will not ignore any signs that indicate changes in long-term or medium-term inflation expectations.

2) Regarding the expectation of two interest rate cuts this year. Many reporters questioned that since the inflation forecast has been revised upward and the inflation risk is also increasing, why does the Fed still expect to cut interest rates twice this year? In summary, Powell believes that: 1) The slowdown in economic growth and the rise in inflation are balanced to a certain extent, and the overall economic situation has not shown obvious signs of recession. 2) The current economic situation is highly uncertain, "In this highly uncertain environment, people may choose to maintain the status quo". 3) The current policy stance can cope with uncertainty and choose to wait for clearer economic signals to ensure the timeliness and effectiveness of policy adjustments.

3) Regarding the balance of two-way risks. A reporter pointed out that the statement deleted "the risks of employment and inflation targets are roughly balanced". Does this change mean that the Fed is more concerned about inflation or employment? Powell said that the Fed has passed the stage where it needs to emphasize the balance of risks, so this sentence was deleted. This does not mean that the Fed is more concerned about one aspect of inflation or employment, but reflects the changes and high uncertainty of the current economic situation, especially the impact of the new government's policy changes (such as trade, immigration, fiscal policy and regulation) on the economy has not yet fully emerged. These uncertainties make the statement of risk balance no longer applicable.

4) About the economy and employment. A reporter asked whether the slowdown in economic growth will have an impact on future spending and investment. Powell emphasized that despite the slowdown in economic growth, "hard data" (such as employment and consumer spending) remain robust,especially the unemployment rate remains at a low level of 4.1%, and economic growth is still in a reasonable state. A reporter asked why the recruitment rate remains at a low level when the unemployment rate is close to 4%; whether the structure of employment growth indicates that there is weakness in private sector employment growth. Powell said that the labor market remains robust; although the unemployment rate is close to the natural unemployment rate, both the recruitment rate and the layoff rate are low, indicating that the labor market is in a state of low activity equilibrium; in the past year, job growth has indeed been concentrated in educational institutions, health care, government departments and other fields, but the private sector has also performed well; from the Fed's perspective, employment is employment, and policies do not treat different types of employment differently.

5) About the risk of recession or stagflation. A reporter asked whether the current economic slowdown would increase the possibility of a recession. Powell pointed out that the possibility of a recession has always existed, usually about one in four; looking back, there is a one in four chance of a recession within 12 months at any time; although external forecasting agencies have generally increased the possibility of a recession, the probability is still at a relatively mild level,still within the traditional range. The reporter asked whether the Fed would curb inflation at the cost of a recession, as it did in the 1970s? Powell joked that "unfortunately", the current situation is different from the 1970s. Inflation has dropped from a high level to nearly 2%, and the unemployment rate remains at 4.1%, so there is no need to copy the response strategy of the 1970s.

6) About the stock market. A reporter asked whether the stock market has fallen sharply since the last Fed meeting. Are you worried that market fluctuations will have an impact on the real economy? Powell pointed out that the financial market situation (including the stock market) is important to the Fed because it is the main channel for monetary policy to affect the real economy. However, he emphasized that the Fed will not comment on the reasonable level of any market, but will focus on changes in economic data from a macro perspective; changes in financial markets will have an impact on economic activities, but this impact needs to be substantial, continuous, and last long enough to attract the Fed's attention. He believes that market sentiment data (such as consumer confidence surveys) show concerns and downside risks, but these have not yet translated into a clear weakness in actual economic activity.

7) On slowing down the balance sheet. Reporters asked why the Fed decided to slow down the pace of the decline in the size of the balance sheet, and whether this adjustment was related to the debt ceiling issue? Powell pointed out that slowing down the pace of the decline in the size of the balance sheet was a technical decision; the reduction in funds in the Treasury General Account (TGA) account led to an increase in reserves, which led to some signs of tightening in the money market; The discussion on adjusting the pace of balance sheet reduction was indeed initially triggered by the flow of funds in the TGA account, but this adjustment was not just to deal with the debt ceiling issue. He emphasized that this adjustment has nothing to do with the monetary policy stance and will not affect the final size of the balance sheet; slowing down the pace of balance sheet reduction will help ensure that the balance sheet reduction process is smoother and closer to the expected target. Regarding the lack of adjustment in the MBS reduction speed, Powell said that there is no plan to adjust the reduction scale of MBS at present, and the Fed will continue to gradually reduce MBS; moreover, the Fed may continue to reduce MBS while maintaining the overall size of the balance sheet, but it has not yet reached that stage and has not made any relevant decisions.

3. Policy thinking: The prospects for economic and interest rate cuts still need to be re-evaluated; slowing down the reduction of the balance sheet may be a stopgap measure

For this meeting, the market is most concerned about whether the prospects for interest rate cuts will change. On the one hand, since the Fed's January interest rate meeting, the US economy has shown more signs of weakness, and the US stock market (S&P 500 Index) has adjusted by 10%. The market hopes that the Fed can consider cutting interest rates more promptly and decisively, or at least communicate this intention to the market. On the other hand, the New Fed News Agency published an article on March 18th “predicting” that Fed officials may further lower their forecast for rate cuts this year, from two cuts in December to one to two times [1], which also caused the US Treasury bond yields and the US dollar index to rise in advance before the Fed’s statement was released.

At this meeting, the dot plot did show that officials’ expectations for rate cuts were slightly lowered overall, but fortunately the median forecast remained unchanged, still predicting two rate cuts in 2025, which may not seem too “hawkish” to investors. But is the Fed willing to cut interest rates in a timely manner to protect the economy and the stock market against the backdrop of rising inflation risks? From this meeting, it is difficult for us to judge. A key reason is that the Fed may have deliberately expressed optimism about the economy, which naturally avoided talking too much about the scenario where interest rate cuts are needed due to an economic downturn.

This includes that the latest economic forecast still predicts economic growth of 1.7% in 2025 and a slight increase in unemployment to 4.4%, which is basically in a state slightly weaker than the long-term reasonable level, but it cannot be regarded as a significant economic slowdown, let alone a "recession".

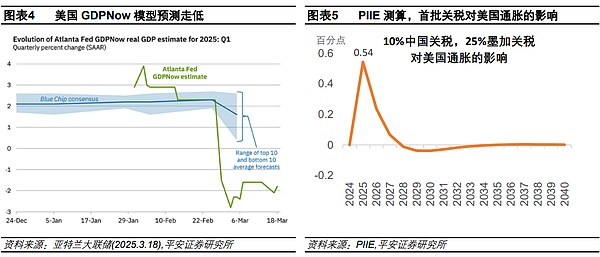

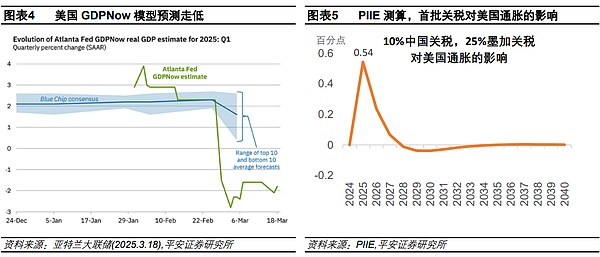

However, we have reservations about Powell's view that the "hard data" of the US economy is still resilient. The GDPNow model predicts that the US GDP in the first quarter will be -1.8% year-on-year as of March 18, with consumption growing by only 0.4%. It should be noted that most of the data based on this model are "hard data" closely related to GDP accounting (including retail sales, real estate, etc. in the near future). At least in the first quarter, the "hard data" of the United States may have cooled significantly. According to this trend, there may be room for downward revisions to the full-year economic growth forecast.

For inflation, we also have reason to worry that the Fed's judgment is too optimistic. On the one hand, the Fed may not have fully taken into account the impact of tariffs, at least not in the latest forecast. The US PCE and core PCE inflation rates in 2025 were only revised up by 0.2-0.3 percentage points. According to PIIE estimates, the combination of 10% China and 25% Canada and Mexico tariffs (excluding countermeasures) may raise US inflation by 0.54 percentage points in 2025, not to mention that the current tariff on China has been raised to 20%, and it is not ruled out that tariffs will be imposed on automobiles, medicines, chips, timber, agricultural products and other products after April, and the countermeasures of trade opponents may also increase inflation risks. On the other hand, the risk of upward inflation expectations has not been taken seriously. The latest 1-year and 5-year inflation expectations of the Michigan survey reached 4.9% and 3.9%, respectively, up 2.1 and 0.9 percentage points from December 2024, respectively. Since short-term inflation expectations will also affect the behavior of residents and enterprises, triggering the "self-fulfilling" effect of inflation, Powell's statement that "inflation expectations are stable" only looking at "long-term inflation forecasts" may not be completely scientific.

We believe that compared with the baseline expectation of a 50BP full-year interest rate cut, the more likely deviation is that the downward pressure on the US economy exceeds the Fed's current prediction, which will then create the risk that the Fed cuts interest rates too late in the first half of the year and "makes up for it" in the second half of the year. This may make the actual interest rate cut for the whole year exceed 50BP.

A positive factor is that the Fed relatively decisively announced a slowdown in balance sheet reduction and a slowdown in the pace of reducing Treasury bonds. Although Powell emphasized that from the perspective of policy objectives, this decision has nothing to do with the monetary policy orientation. However, slowing down the balance sheet reduction will have a positive effect on the economy and the stock market by reducing the supply of the Treasury market and lowering the yield of U.S. Treasury bonds, and may then objectively play a partial role in lowering interest rates. This may also be an important consideration for the Fed to temporarily choose to "stand still" on interest rates. From this perspective, the Fed may not excessively pursue inflation control in the future and ignore the needs of the economy and the market.

Risk Warning: The U.S. economy and employment have weakened beyond expectations, U.S. inflation has risen beyond expectations, and U.S. policy uncertainty is high.

Joy

Joy