Author: Jack Inabinet, Bankless; Translator: Baishui, Golden Finance

Michael Saylor's MicroStrategy (MSTR) began accumulating BTC in 2020 and has been unstoppable, in the process transforming the software company into the best performing equity investment company in the past two bull market cycles.

Despite huge losses in each quarter of 2024, MSTR has still easily outperformed BTC, with prices parabolicly doubling since September and up another 200% so far this year!

At MicroStrategy's most recent earnings conference on October 30, company executives unveiled their "21/21 Plan", a strategic move to raise $42B in capital (equivalent to 80% of MSTR's market value at the time of analysis) in a 50/50 ratio. The planned combination of stock sales and bond issuances makes it the largest secondary stock offering in the history of the US stock market.

Today, we will decrypt Michael Saylor's infinite money-making machine and explore how MicroStrategy intends to become a trillion-dollar company.

What is Saylor creating?

MicroStrategy announced in August 2020 that it spent $250 million to purchase 21,454 BTC, becoming the first public company to implement a BTC funding strategy, and this initial investment returned nearly 500% over a 4-year life cycle.

As of September 2024, MicroStrategy holds 252,220 Bitcoins.

While MicroStrategy maintains its position as a BTC giant among direct corporate holders, the launch of a spot BTC ETF in January 2024 reshaped the landscape of the largest holders, with BlackRock replacing MicroStrategy as the fourth largest entity holding BTC, behind Binance, Sabase, and Coinbase.

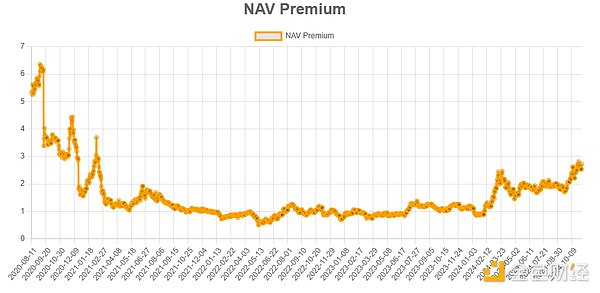

While the market initially valued Microstrategy at five times the value of its BTC assets, this premium began to disappear as holders gradually realized that they would be forever diluted to fund additional BTC purchases, and by the end of 2021, as the bear market took its toll, MSTR found itself trading below its net asset value (NAV).

Unlike in 2020 when MicroStrategy first began accumulating BTC, investors no longer need to exit traditional markets to gain crypto exposure, but even in the ETF era, MSTR stock has continued to trade at a persistent premium since February 2024.

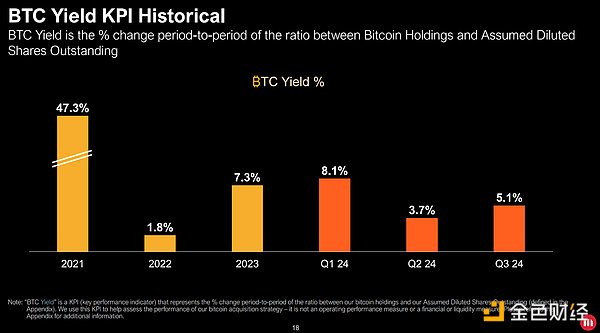

Compared to spot ETFs that simply track BTC performance (minus management fees), MicroStrategy provides its shareholders with a BTC accumulation strategy tool that can increase the number of tokens per share.

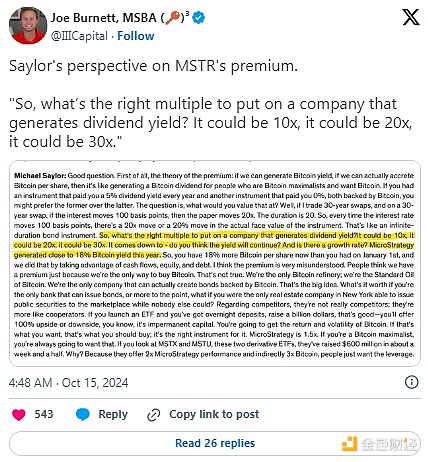

When MSTR shares trade at a premium to its BTC holdings, MicroStrategy can conveniently raise capital through two avenues: par equity offerings and convertible bond sales. The par equity offering authorization enables MicroStrategy to issue and sell new MSTR shares to the market to raise cash, while convertible bond sales enable MicroStrategy to borrow money on extremely desirable terms in exchange for debt obligations redeemable in cash or a certain number of MSTR shares in the future.

In its second quarter 2024 earnings report, Microstrategy introduced "BTC Yield" as a key investor performance metric for the first time to highlight the quarter-over-quarter growth in BTC holdings per share.

Although MicroStrategy unorthodoxly obtained a $205 million BTC-collateralized term loan from Silvergate in March 2022 as the bear market persisted, crypto industry experts often compare the company to a money printing machine because its executives seemingly raise unlimited amounts of cash to buy BTC through stock dilution during market booms.

In a recent interview with analysts at sell-side research firm Bernstein, Michael Saylor revealed his company's ultimate goal: to transform into a full-fledged Bitcoin financial services provider.

When shareholders buy MSTR, they are not only buying BTC, they are buying management's ability to effectively use the capital markets and balance sheet to efficiently generate more returns.

Investment Considerations

MSTR will undoubtedly outperform BTC in 2024, but historically it has also exhibited higher volatility, experiencing sharper downside swings while rallied sharply to the upside. Speculators seeking leveraged BTC exposure would be better off tapping the underlying asset directly.

While savvy use of public capital markets has enabled MSTR shareholders to accumulate more BTC, Microstrategy's ability to do so depends on investors' continued willingness to purchase shares at a premium.

As 2022 has shown, MSTR stock could trade at a discount to NAV for an extended period of time. If the convertible bonds mature at a persistent discount to NAV, Microstrategy would be forced to sell an unexpectedly large amount of stock to dilute investors, or sell BTC holdings to redeem the outstanding bonds.

Upcoming FASB rule changes set to go into effect this December will allow digital assets to be reported at their fair market value. While Microstrategy has posted three consecutive quarters of net losses through 2024, the adoption of these new accounting standards will have a positive impact on the company's financials, making MSTR a potential candidate for inclusion in the S&P 500. Adding it to that index, or an index like the Nasdaq 100, would unlock passive price-indiscriminate flows that could be sold to accumulate more BTC!

Compared to an investment in unproductive spot BTC, Microstrategy stock has the ability to accumulate additional tokens, and unlike companies in the extremely competitive cryptocurrency mining space, Microstrategy has a significant differentiation advantage due to its large BTC moat. As long as the desire to speculate in Bitcoin exists, investors can rest assured knowing that someone may be willing to buy shares at a premium or lend cash on ideal terms.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Hui Xin

Hui Xin Medium

Medium Others

Others Coindesk

Coindesk Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph