Author: Nian Qing, ChainCatcher

Earlier yesterday, Fortune magazine reported that Yida Gao, founder of crypto venture capital Shima Capital, was suspected of misappropriating assets by creating secret offshore entities to transfer assets belonging to his venture capital company to a company registered in his own name, without the knowledge of other investors in the company. If true, the behavior has violated the Investment Advisers Act.

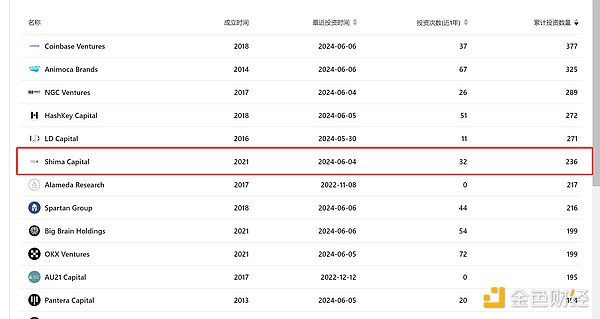

According to RootData data, Shima Capital is a crypto-native fund established in the United States in 2021 and has been registered with the U.S. Securities and Exchange Commission. Although Yida Gao has not yet been charged, his performance and behavior clearly violated the investor protection rules of the U.S. Securities and Exchange Commission (SEC).

In addition, the report also mentioned that Shima Capital has also experienced a wave of departures of senior employees in recent months, including Chief Technology Officer Carl Hua, Head of Research Alexander Lin, Chief Operating Officer and Platform Director Hazel Chen and others. Its official website shows that the team currently has a total of 13 people. Although many employees have left, Shima Capital has not yet recruited new people.

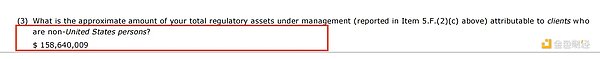

Shima Capital's investment advisory form registered with the SEC in April this year shows that its assets under management are approximately US$158 million, which is lower than the US$200 million raised in 2022.

As of press time, Shima Capital and Yida Gao himself have not responded to the relevant reports. Yida Gao's X dynamics are still in December last year, and he was active in various media and public relations platforms last year. In April 2023, Yida Gao succeeded Gary Gensler, Chairman of the U.S. Securities and Exchange Commission, to teach a crypto finance course at MIT for the second consecutive year (15.492 Crypto Finance). Last September, Yida Gao was asked in an interview with Cointelegrap how he convinced investors to participate in high-risk industries in the early days of Shima Capital. He replied that he had accumulated a good record and credit in the financial and venture capital fields for ten years, both in traditional and Web3 industries, and played a key role in winning the trust of investors. Yida Gao: From a small town in Fujian to a financial elite on Wall Street Yida Gao is a young Chinese American who immigrated to Atlanta, USA from Fujian Province with his family when he was very young. Out of nostalgia for his hometown, Yida Gao named Shima Capital after the town where he was born, Shima Town.

Yida Gao has a similar resume to many crypto star founders, graduating from a prestigious university, majoring in mathematics and computer science, and working in major Wall Street companies.

Yida Gao holds a Bachelor of Science degree in Mathematics and Computer Science from MIT, and has worked in research and programming positions under Professor Paul Asquith at MIT Sloan School of Management and McKinsey & Company in Boston. During his undergraduate years, he also had two special identities: a college pole vaulter and a member of the American University Phi Beta Kappa Honor Society.

After graduation, he started his career on Wall Street, working as an analyst in the M&A group at Morgan Stanley, providing consulting for transactions with a total value of more than $15 billion. After that, Yida Gao worked as an investment consultant at New Enterprise Associates (NEA).

In 2017, Yida Gao dropped out of Stanford University's School of Business and engaged in crypto investment full-time. According to his personal website, he co-manages venture fund Struck Capital and multi-strategy crypto fund DDC (Divergence Digital Currency) as a managing partner. During this period, he was selected as a general partner of Struck Capital and the founder of the fund, Adam B. Struck, as one of the "Forbes 30 Under 30".

In 2021, Yida Gao founded Shima Capital on his own. In August 2022, Shima Capital raised $200 million for its first venture capital fund. Shima Capital Fund I focuses on pre-seed and seed-stage investments, with participation from many well-known investors such as Dragonfly, hedge fund billionaire Bill Ackman, Animoca, OKX, Mirana Ventures, and Republic Capital.

In 2022, Yida Gao was invited to teach the graduate course on cryptocurrency and finance at MIT, and Gary Gensler, chairman of the U.S. Securities and Exchange Commission, has just vacated this position.

Shima Capital: Focus on start-up projects and invest in 200+ projects in three years

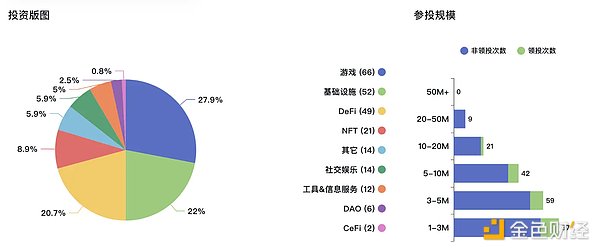

Shima Capital has invested in more than 200 projects in the three years since its establishment (the number was still 100+ in September last year). Well-known projects include Wombat Exchange, Berachain, Monad Network, Polkadot, Solv Protocol, Meson Network, Galxe, 1inch, Coin98, etc. The most recent disclosed investment was on June 4, ranking sixth on RootData's list of active investors, and it is also one of the VCs with the most investments for two consecutive years in 2022 and 2023.

Shima Capital mainly invests in pre-seed and seed-round startups. More than half of the team members are responsible for the post-investment operations and support of the invested companies, including engineering design, community management, token design, etc. According to RootData data, Shima's main investment areas are games, infrastructure and DeFi, and its investment amount is generally between US$500,000 and US$2 million.

Currently, RootData has included a total of 236 Shima Capital investment projects, of which 96 projects have issued tokens. Shima mainly invests in SAFE (Simple Agreement for Future Equity) with token warrants, and sometimes invests in pure tokens. The projects invested usually have a lock-up period of two to four years, and the average holding period is about four years.

Shima's investment philosophy is "We run through walls for our founders". Yida Gao once mentioned in an interview that Shima considers three aspects during due diligence: team, product and market. Among them, as a seed fund, the most concerned is the team, because in this fast-growing industry, products and markets are always changing. In addition, the investment team actively seeks out deals and investment opportunities through hackathons, accelerator demo days, universities, and even social media such as Twitter.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Beincrypto

Beincrypto Others

Others Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph 链向资讯

链向资讯