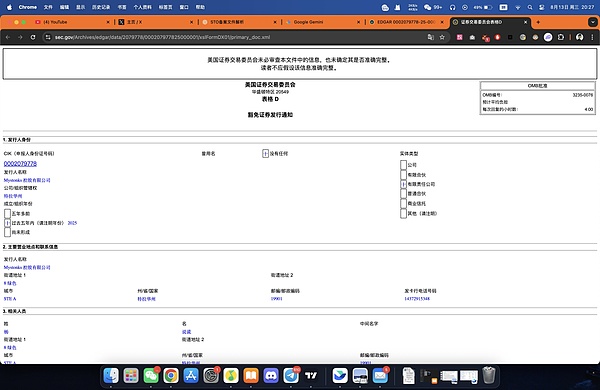

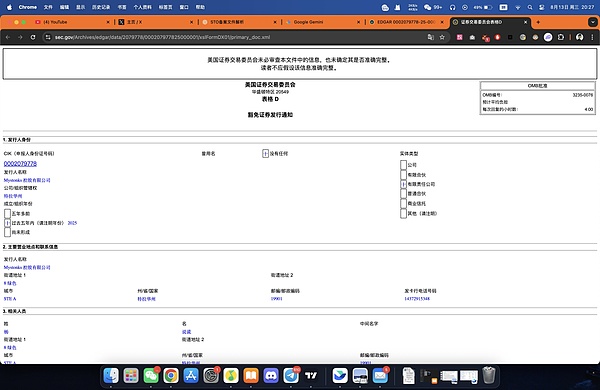

Recently, a "US stock on-chain" platform called Mystonks sparked widespread controversy by freezing user funds. It's understood that the platform withheld a significant amount of assets, citing "illegal sources of user funds." From a financial compliance perspective, this handling is highly unusual. When a regulated financial institution identifies suspicious funds, the standard practice is to refuse to accept them, return them by the original route, and submit a report to regulators. The platform's direct "withholding" of assets casts a significant doubt on its claims of "compliance." The Mystonks platform has consistently touted its US MSB license and compliant issuance of STOs as key selling points. So, what is the truth behind these so-called "compliance" credentials? I conducted some investigation. 1. The Truth About "Compliant STOs": Filing Doesn't Equal Permission, and Private Placement Doesn't Equal Publicity During my research, I discovered that Mystonks's claims were not unfounded. The filing information for Mystonks Holding LLC can indeed be found in the U.S. Securities and Exchange Commission's (SEC) public database. The key points of this Form D are as follows: ● Filing Type: Private Placement Exemption under Regulation D 506(c). ● Target: Accredited Investors Only. ● Offering Size: $575,000, with a minimum investment of $50,000. This document is precisely the crux of the matter and the most misleading aspect of the platform's promotional materials. First, Form D is a notification filing, not a business license. It merely notifies the company to the SEC of a private placement. The SEC merely keeps it a record and does not constitute any review or endorsement of the company's qualifications or the authenticity of the project. Second, and most importantly, this filing strictly limits the target audience. Regulation D is an exemption designed for private placements, targeting a small number of qualified wealthy or institutional investors (i.e., "accredited investors"). As a trading platform open to the public, the vast majority of Mystonks' users clearly do not meet this standard. Therefore, Mystonks' actions can be understood as using a filing document designed only for fundraising from a small, wealthy group of individuals to publicly engage in securities trading, a business requiring a strict license. This practice essentially exploits the unfamiliarity of ordinary investors with US securities regulations and creates confusion. To legally offer security token trading services to the public, a platform requires a high-level license such as an ATS (Alternative Trading System) or Broker-Dealer (Broker-Dealer)—a significant difference from a simple Form D filing. Second, the Abused MSB License: Anti-Money Laundering Filings Unrelated to Fund Security. Having discussed the relatively complex STOs, let's look at a more common promotional tool: the US MSB license. Regarding the MSB license, investors need to understand a core fact: its value and significance have been grossly overstated by many projects in the market. The regulator for MSBs (Money Services Businesses) is FinCEN, an agency within the U.S. Treasury Department. Its core responsibility is Anti-Money Laundering (AML). This means FinCEN only cares about whether platforms report suspicious transactions in compliance with regulations to combat financial crime, but it has no responsibility for ensuring user funds security or reviewing platforms' business models or technical capabilities. More importantly, the MSB application process is extremely low. Registration can be easily completed overseas through an intermediary, even without the need for a physical office in the United States. This makes it a popular tool for many projects to quickly and cost-effectively enhance their compliance image. When a platform primarily serving non-U.S. users repeatedly emphasizes its MSB license, investors need to understand that this is more of a marketing ploy than proof of its financial strength. Conclusion: Understanding the "Compliance" Tactics of a Certain Type of Platform from the Case of Mystonks

The Mystonks case is not an isolated one; it clearly illustrates the "compliance" tactics commonly employed by certain platforms operating in a gray area. Across the market, numerous exchanges and financial platforms are reusing similar strategies, and investors need to be aware of this.

The typical tactics employed by these platforms can be summarized as follows:

1. Step 1: Using the MSB license as a marketing "stepping stone." Leveraging its "US official" background and extremely low acquisition costs, they quickly establish a basic, seemingly reliable image.

2. Step 2: Using a "subtle substitution" approach to interpret securities filings. They package a limited, strictly restricted filing document (such as a private placement filing) as a comprehensive operating license that allows them to provide services to the public, exploiting information asymmetry to deeply mislead. 3. Step Three: Leverage regional and legal differences for "precision marketing." Knowing their business cannot be established in the US, they focus on overseas users unfamiliar with US regulations, creating a situation where "flowers bloom within the wall, but fragrance blooms abroad." As investors, we should learn lessons from these tactics. When determining whether a platform is truly compliant, remember two basic principles: ● True compliance is expensive and tangible. It involves high license application fees, security deposits, physical office rentals, and local legal team expenses. Easily acquired, intangible "compliance" is inherently cheap.

● True compliance is transparent and specific. It clearly discloses the license type, number, regulatory scope, and restrictions. Vague, generalized claims of "compliance" often fail to withstand scrutiny.

When making investment decisions, please transform "compliance" from a marketing term into a legal fact that requires rigorous scrutiny. Only by upholding this bottom line can we maximize the security of our assets.

●

●

●

1.

2.

3.

●

●

Joy

Joy