Original title: 《Jito (Re)staking is here- Who will win the Solana restaking race?》 Written by: flow, crypto researcher Translated by: zhouzhou, BlockBeats Editor's note: This article introduces Jito Labs' restaking protocol Jito (Re)staking on Solana, a technology that allows the use of staked SOL assets to obtain higher returns and potentially participate in airdrops. Users can restake SOL through three providers (Renzo, Fragmetric and Kyros), each of which differs in risk, liquidity and potential returns. The article compares their features in detail, and recommends preferring Kyros, which supports fair launch and has potential airdrop returns.

The following is the original content (the original content has been reorganized for easier reading and understanding):

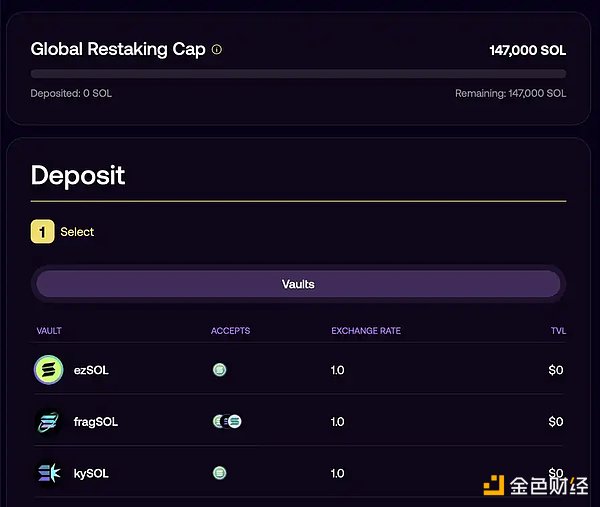

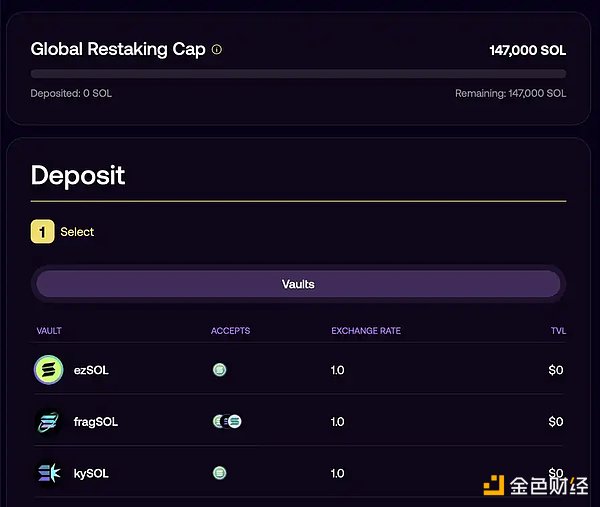

After successfully building the largest liquid staking protocol on Solana, Jito Labs has once again brought another important development: the launch of a new re-staking protocol - Jito Re-Staking. This re-staking project is live today and will soon be open for deposits, with an initial re-staking limit of approximately 25 million US dollars (147,000 SOL). For those who want to earn higher SOL annualized returns and want to participate in the airdrop opportunity first, this is a very attractive opportunity in the market right now.

Before introducing how to maximize this opportunity, let’s briefly review the basic principles of Jito Re-Staking.

What is Jito Re-staking

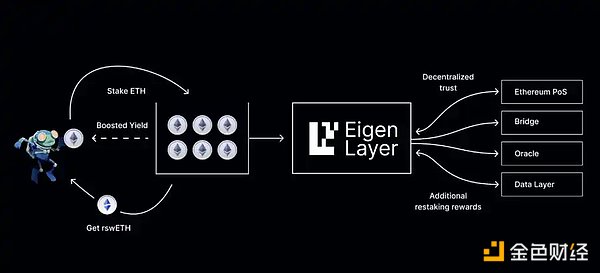

In simple terms, re-staking refers to using assets that have already been staked to provide security for a specific decentralized service again. Although it may seem unimportant, it is actually one of the most promising innovations in this cycle. The concept was pioneered by EigenLayer and first launched on the Ethereum mainnet in June 2023.

An example of re-staking in action

Today, Jito is finally bringing this new technology to Solana through its re-staking solution.

Diagram of the components of Jito re-staking

Core components of the Jito re-staking framework

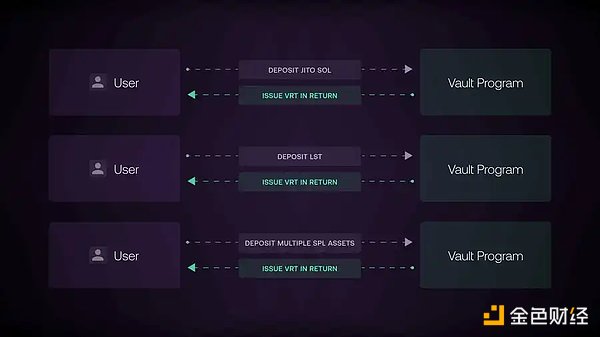

The Jito re-staking framework consists of two main components: the re-staking program and the vault program. They can be thought of as two independent entities that work together to provide a flexible and scalable infrastructure for creating and managing staked assets, vault receipt tokens (VRT), and node consensus operators (NCN). VRT is Jito's term for liquid re-staking tokens, while NCN is similar to the active verification service in EigenLayer, which is used to represent the entities that will utilize Jito's re-staking solution.

The main function of the re-staking program is to manage the creation of node consensus operators (NCN), the selection mechanism for users, and the reward distribution and penalty mechanism. This part is invisible to users and can be regarded as the core support of Jito's re-staking solution.

The Treasury program is responsible for managing liquid re-staking tokens (VRT) and customizing different re-staking strategies through DAO or automated protocols. This is the main interface for users to participate in re-staking. It can be analogized that the re-staking role of EigenLayer is played by the re-staking program on Solana, while the Treasury program is similar to EtherFi, acting as a liquidity layer between users and the core re-staking protocol.

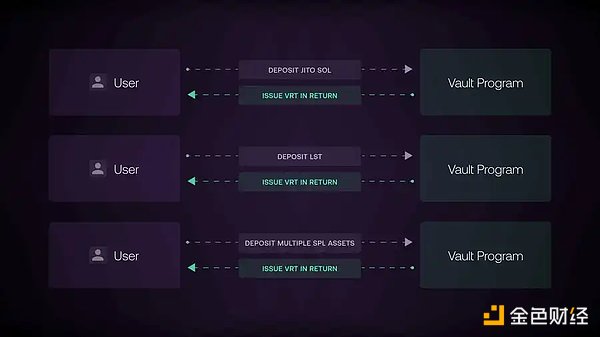

Image display of how the Vault program works

3 VRT providers

In the initial stage, Jito only cooperates with three VRT providers: RenzoProtocol ($ezSOL), fragmetric ($fragSOL) and KyrosFi ($kySOL), which will jointly allocate the initial cap of 147,000 SOL. Therefore, any user who wants to re-stake SOL through Jito needs to choose among these three VRT providers.

Image of Jito (Re)staking’s landing page

Here is a quick table of the key features of each VRT provider:

How to choose the right VRT for SOL re-staking?

When choosing which VRT, the key is to find an optimal risk-reward ratio.

The following is an analysis of each provider:

1. Risk: In terms of risk, the main focus is on protocol penalties (i.e., penalty risk) and liquidity risk. Since the current number of NCNs is small and it is in the early stages, it can be assumed that the risks of all providers are basically the same. Renzo and Kyros accept JitoSOL, which has the best liquidity, while Fragmetric accepts a wider variety of liquidity staking tokens (LST), which may increase its liquidity risk. In addition, Renzo and Kyros' VRT will have liquidity from the beginning, while Fragmetric's tokens will not be transferable in the early stages. Therefore, in terms of risk, Renzo and Kyros have the lowest risk, and Fragmetric has a slightly higher risk.

2. APY Return: The APY of each project is expected to be similar, but it can be assumed that Renzo and Kyros may have a slightly higher APY than Fragmetric because they only use JitoSOL, but the gap will not be large.

3. Airdrop potential: Given that all VRTs have similar risks and expected returns, the key factor in choosing a specific VRT is the potential for airdrop rewards. Renzo already has tokens, and although re-staking may earn some future airdrop points, the potential is relatively low. Kyros and Fragmetric currently have no tokens and have higher airdrop potential.

Further analysis of the differences between Kyros and Fragmetric:

Fragmetric features: expected to receive venture capital support, may follow a high FDV, low circulation model; biased towards technology and decentralized user groups; partnered with risk management company Gauntlet; tokens are not transferable in the early stages; accepts multiple LSTs.

Features of Kyros: Supported by SwissBorg, helping to distribute $kySOL and possibly working with major players in Solana; likely to raise funds through a fair community-driven token model; large-scale promotion has not yet begun; NCN distribution method may be based on DAO voting; support JitoSOL.

On the whole, KyrosFi is more attractive in multiple aspects. First, SwissBorg's support makes it easier to distribute $kySOL and opens the door to its major partners with Solana. Second, Kyros may take a fair launch approach. Finally, Kyros is relatively low-key at the moment, which makes its airdrop return potential more attractive.

Of course, this is a personal opinion and is for reference only. I hope this analysis can help you make a more informed decision when choosing to re-stake SOL.

Catherine

Catherine