Author: arndxt, Threading on the Edge; Translation: Jinse Finance xiaozou

The Birth of Unichain

Unichain has the potential to mark the beginning of Ethereum’s decline, as mainstream protocols like Uniswap will siphon away value and activity, turning Ethereum into a pure settlement layer.

The impact of Uniswap is undeniable.

As the largest DEX, Uniswap has millions of users, and a large portion of Ethereum’s liquidity flows through the Uniswap protocol.

Finally, Uniswap announced the launch of its own blockchain, Unichain. This move may mark a strategic shift in the blockchain paradigm - from the traditional Fat Protocol Thesis to the upcoming Fat Application Thesis.

As Uniswap aims to consolidate its dominance, this move raises key questions about the future of Ethereum, the asset value of ETH, and potential DeFi liquidity reallocation and user experience.

In this article, I will give some of my thoughts and findings.

Key points of this article:

Strategic transformation to the Fat Application theory

Uniswap gained control of its own blockchain through Unichain, capturing more value from transaction fees and infrastructure.

Solving Scalability Issues with Flash Blocks and TEEs

Faster transactions (200-250 ms) and lower gas fees improve user experience and network performance.

MEV Minimization

Reduces MEV vulnerabilities through fair gas auctions, saving users up to $1 billion in potential costs per year.

Liquidity Integration

Unichain’s centralized liquidity hub alleviates fragmentation issues and improves pricing efficiency across L2s.

Impact on Ethereum's Status

Support Ethereum's rollup-centric roadmap and strengthen ETH's position as a secure settlement layer. (Controversial)

Enhanced security through the Unichain Verification ServiceVerification service

By allowing UNI token holders to participate in transaction verification, the network integrity and decentralization characteristics are improved.

New competitive landscape of DeFi

Set an example for other DeFi applications to launch their own chains, promote vertical integration and infrastructure control.

1、Uniswap’sDeFidominance

Uniswap has been a key force in the DeFi field, occupying a considerable market share.

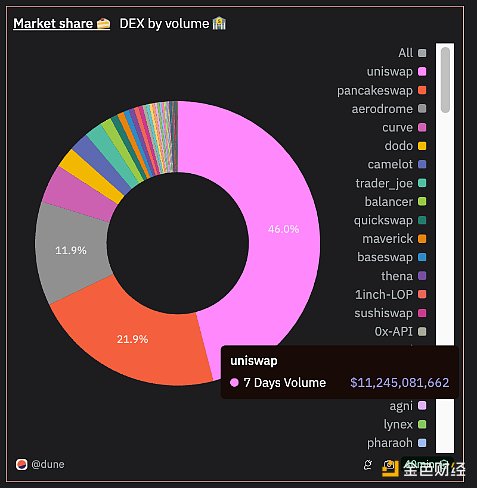

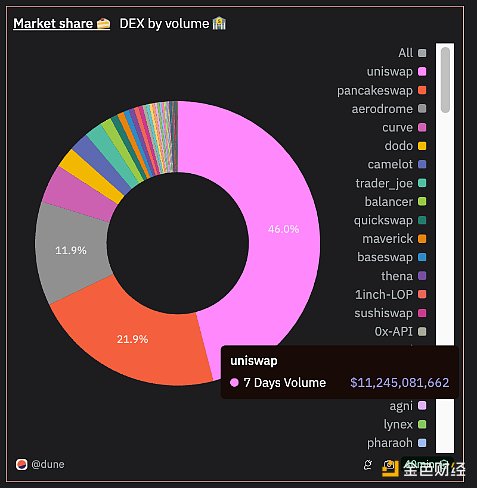

Market share: According to Dune Analytics, Uniswap accounts for about 46% of the total Ethereum DEX transaction volume.

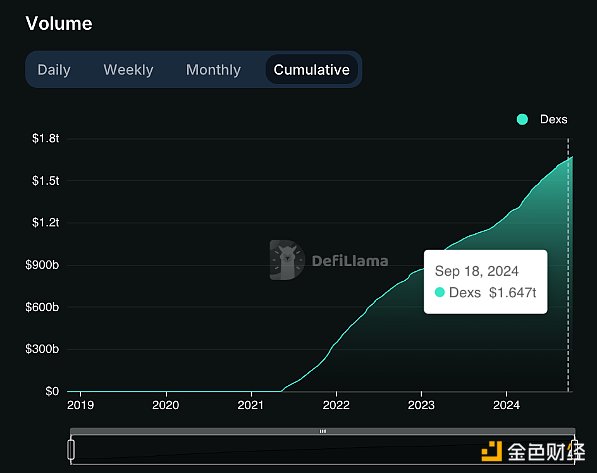

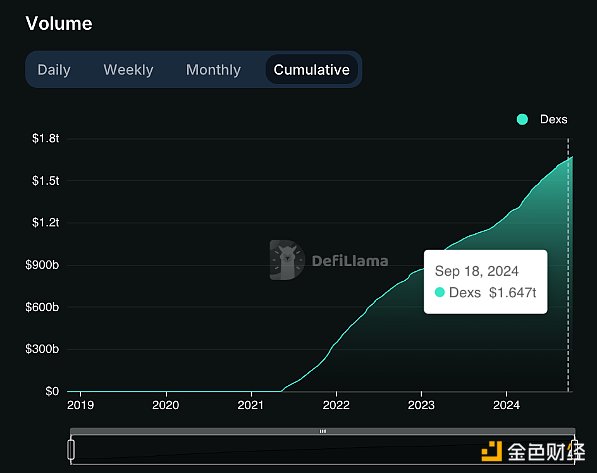

Cumulative trading volume: Since its establishment in 2018, Uniswap's cumulative trading volume has exceeded 1.7Trillion US Dollars.

User Base and Adoption

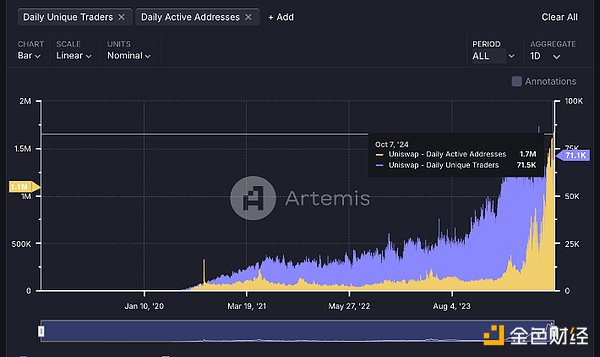

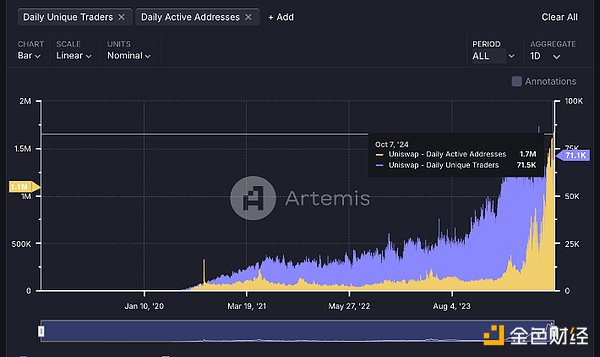

Unique Address Traders:The number of unique address traders interacting with Uniswap’s smart contracts exceeds 71,500.

Daily Active Users:Uniswap currently has 1.2 million daily active users, highlighting its widespread adoption.

TVL(Total Value Locked): Uniswap’s total locked value is approximately $6 billion, making it one of the most liquid DeFi protocols.

2、Uniswap launchesUnichainReasons

Want to solve scalability issues throughL2 solutions.

Ethereum's scalability issues are a topic that people have been talking about for a long time.

High gas fees and slow transaction times affect the user experience and limit the network's ability to cope with a growing user base.

Ethereum's rollup-centric roadmap aims to alleviate these problems by moving most transactions from the Ethereum chain L1 to L2 solutions, which can process transactions more efficiently.

Unichain is built using OP Stack, an open source framework developed by Optimism, designed to run on this Superchain (a network of interoperable blockchains that share the same standards).

By leveraging this technology, Unichain aims to solve the following problems:

(1) Scalability and performance issues

Ethereum's network congestion and high gas fees have always been difficult obstacles to overcome. Uniswap launched Unichain with the following goals:

Increase transaction speed: The target block time is 200-250 milliseconds, which is significantly faster than Ethereum's average of 12-15 seconds.

Reduce transaction costs: Lower fees make it easier for DeFi to gain a wider user base.

(2) Infrastructure control and customization issues

Running on its own blockchain allows Uniswap to:

Achieve protocol-level optimization:Customize the blockchain to suit Uniswap's specific needs, such as custom transaction sorting.

Introduce advanced features:Achieve innovations such as Flash Blocks and MEV minimization strategies.

(3)Liquidity fragmentation problem

By creating a centralized liquidity center, Uniswap users will benefit from:

Unified liquidity pool: Unichain aims to pool liquidity that is currently distributed across multiple L2 solutions and sidechains.

Optimized pricing and slippage: Deeper liquidity brings better pricing and lower slippage to traders.

3The transition from Fat Protocoltheory

Fat Protocol:Points out that in the blockchain ecosystem, the protocol layer (such as Ethereum) has gained the most value because it provides support for all applications.

Fat Application:Proposes that dominant applications can gain more value by having a wider range of technology stacks.

(1)Fat ProtocolFat Protocol Theory

This theory was first proposed by Joel Monegro in 2016. It argues that in the blockchain ecosystem, most value is accumulated at the protocol layer rather than the application layer. This is in stark contrast to the traditional Internet model, in which the application layer (e.g., Facebook, Google) captures most of the value, while the underlying protocols (e.g., TCP/IP, HTTP) are relatively "weak" in terms of value capture.

The main points of the Fat Protocol Theory are as follows:

Value-Added: Protocol tokens (such as Ethereum's ETH) increase in value because they are integral to network operations, and their scarcity, combined with network effects, drives demand.

Network Effects: As more and more applications and users are on the protocol, the protocol itself becomes more valuable, consolidating its dominance.

Composability: Applications built on these protocols benefit from their security and decentralized nature, but individual applications capture less value.

(2)Fat ApplicationFat Application Theory

Fat Application Theory challenges the Fat Protocol Theory, arguing that dominant applications can capture significant value by owning a larger technology stack, effectively "moving down" the stack. This theory is based on the idea that applications can differentiate themselves from competitors and create moats through proprietary features, user experience enhancements, and control over infrastructure.

The main content of the Fat Application Theory is as follows:

Value capture at the application layer:Applications can capture more value through vertical integration, owning not only interfaces but also part of the underlying infrastructure.

Differentiation:By controlling a larger stack, applications can provide unique features and optimizations that competitors cannot obtain.

User Experience: Focusing on a seamless, efficient, and user-friendly experience can drive adoption and loyalty, further increasing the value of the application.

(3)Uniswap’s Strategic Transformation

By launching Unichain, Uniswap:

Move Down the Stack: Control the underlying protocol to capture more value.

Enhance Value Capture: Potentially increase revenue through transaction fees and other mechanisms.

Strengthen Ecosystem Control: Guide development and innovation within the ecosystem.

4What role will the shift to fat application theory play?

(1) Increased competition among applications

As shown by Uniswap's launch of Unichain, the shift to fat application theory will greatly reshape the blockchain ecosystem. This move may lead to:

Increased competition among applications, and other successful DeFi platforms will follow Uniswap's footsteps and launch their own chains.

This vertical integration allows applications to gain control over their infrastructure, enhancing performance in addition to improving the user interface.

This may form a new competitive landscape in which applications differentiate themselves not only through functionality, but also through the scalability and efficiency of their underlying infrastructure.

(2) Ecological fragmentation and integration

However, this shift brings risks and opportunities in terms of ecological fragmentation and integration.

On the one hand, the increasing number of specific application chains may lead to fragmentation problems, making interoperability more challenging and potentially undermining the user experience that is critical to mass adoption.

On the other hand, dominant applications may attract smaller projects to build within their ecosystems, forming new centers of activity and potentially forming a consolidation of resources and user bases.

This evolution may affect the value dynamics between the protocol layer and the application layer. If applications begin to capture more value, the dominance of the underlying protocol may decline relatively, and as users and liquidity concentrate around these application ecosystems, network effects will shift to these application ecosystems.

(3)Impact on Protocol Layer Value

The shift to fat apps challenges traditional protocol layer dominance.

As applications like Uniswap launch their own blockchains, they begin to capture more value - less dependent on underlying protocols for transaction fees.

This may lead to a shift in network effects as users and liquidity are concentrated in the ecosystems of these specific applications rather than the broader protocol layer.

As a result, protocols like Ethereum may face a relative decline in value capture, while dominant applications will become new centers of activity and influence within that blockchain ecosystem.

5, Impact on Ethereum and ETH's Asset Status

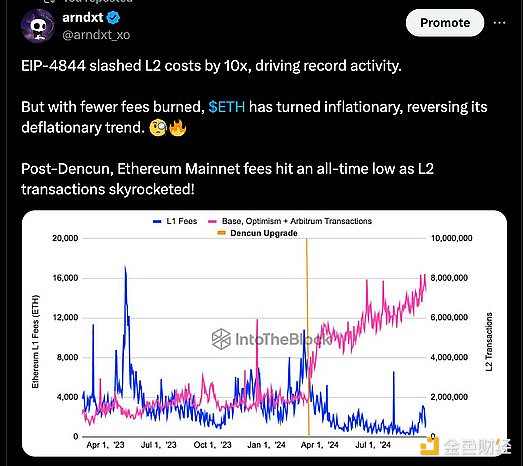

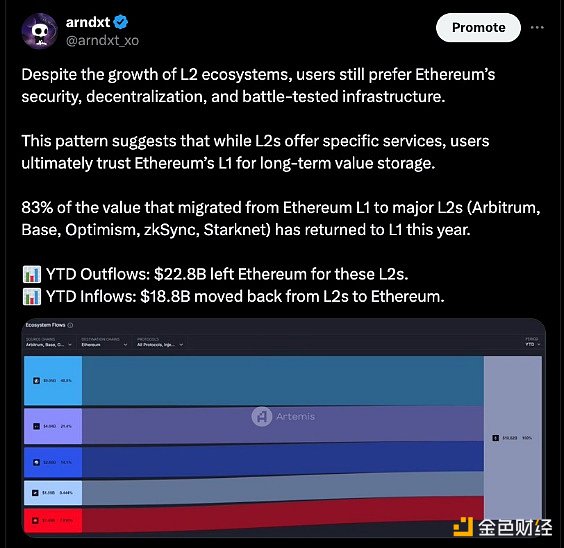

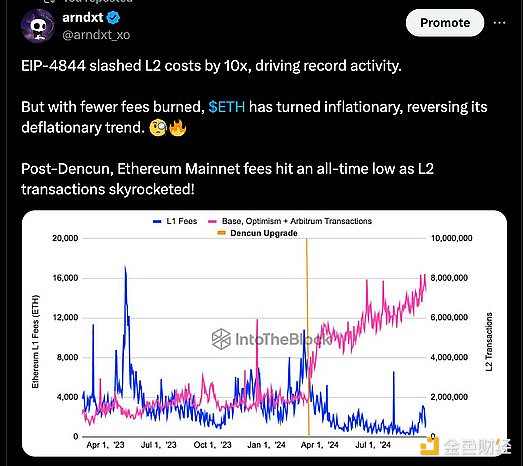

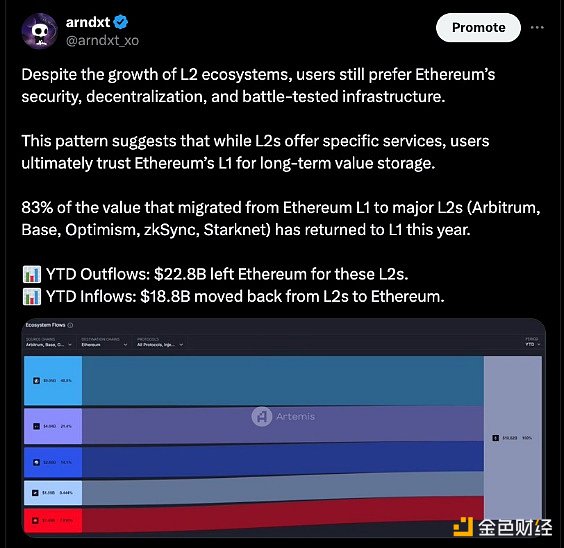

The launch of Unichain has sparked a debate about the future role of the Ethereum mainnet and the value accumulation of ETH as an asset. I can say that migrating DeFi activities to L2 solutions may reduce the importance of the mainnet and have a negative impact on the value of ETH.

Another angle to consider here is:

However, supporters believe that this evolution is in line with Ethereum's long-term vision. By serving as a secure decentralized settlement layer, the Ethereum mainnet can focus on providing data availability and finality, while L2 solutions handle scalability and user-facing applications. In fact, this symbiotic relationship can enhance the value proposition of ETH as it is the underlying asset that supports the vast L2 network.

My thoughts are:

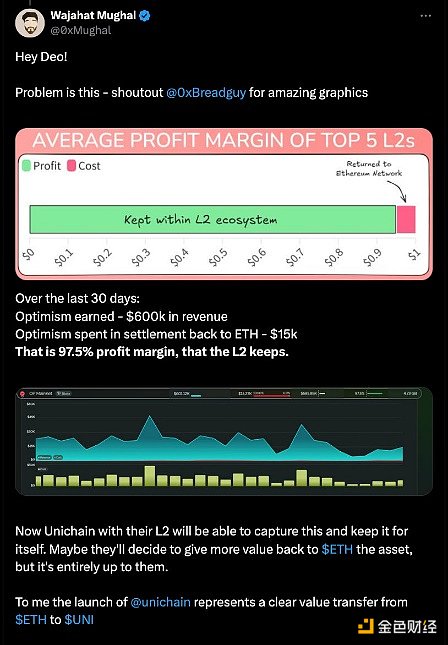

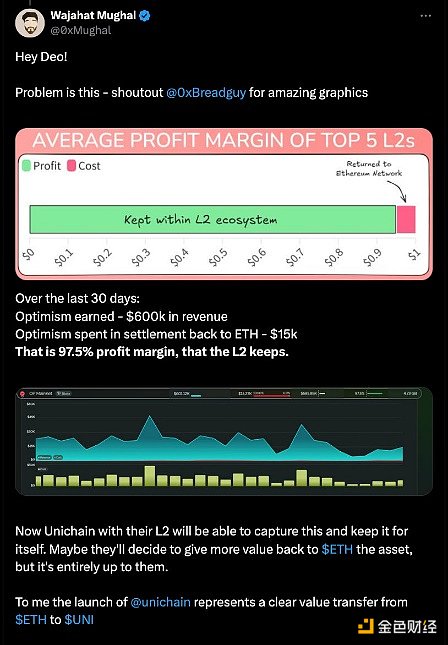

(1) Potential negative impact on ETH

ETH demand reduction: ETH demand may decrease if Unichain uses a different native token to pay gas fees.

Ethereum transaction fee reduction: Activity migration to Unichain may result in a reduction in Ethereum validator fees.

Liquidity Loss: Liquidity integration on Unichain may reduce liquidity on the Ethereum mainnet and other L2s.

Wajahat Mughal also shared his findings/thoughts:

(2) Potential Benefits for Ethereum

In line with Ethereum’s rollup-centric roadmap: Unichain still relies on Ethereum’s security and data availability.

ETHas a settlement layer: Ethereum can strengthen its position as the base settlement layer for multiple L2s.

Potential growth in Ethereum usage: Enhanced scalability may attract more users to the Ethereum ecosystem.

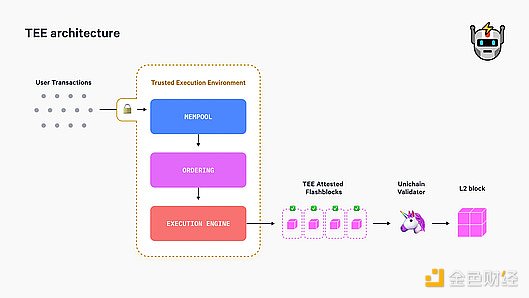

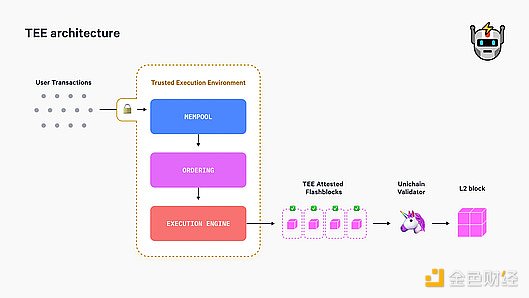

6、Unichain’s technological innovation

Unichain has launched a set of technological innovations in the hope of improving transaction speed and security for users.

These innovations are Flash Blocks and Trusted Execution Environments (TEEs: Trusted Execution Environments), which have the following functions:

Support sub-second transaction finality.

Reduce the risk of manipulation and ensure users conduct faster and more secure transactions.

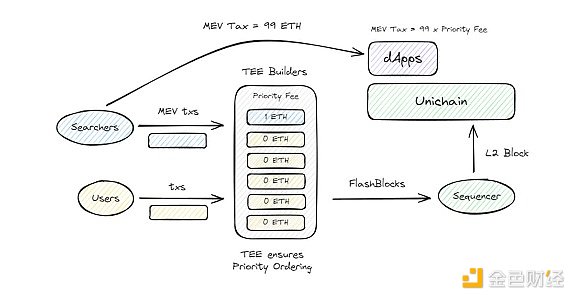

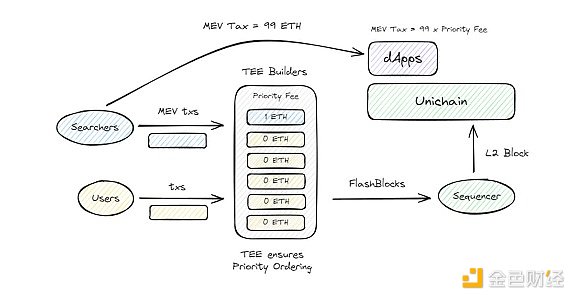

Another important innovation is Unichain’s MEV (Maximum Extractable Value) minimization approach.

Through a fair priority gas auction system, Unichain ensures a transparent and fair order of transactions, reducing harmful MEV vulnerabilities such as sandwich attacks.

The system is expected to save users up to $1 billion per year by curbing vulnerability attacks that often lead to higher transaction costs.

To further enhance security and decentralization, Unichain has integrated a Verification Service, where a network of validators continuously verifies the activities of the orderers responsible for ordering transactions.

This additional layer of security not only ensures the integrity of the network, but also invites community participation, allowing UNItoken holders to participate in network validation, creating a more decentralized and stronger ecosystem.

7Conclusion

Unichain is a bold move for Uniswap, solidifying its position as a DeFi leader and redefining how decentralized applications operate. By directly addressing scalability issues, minimizing MEV losses, and pooling liquidity, Uniswap is taking control of its future in a way few dare. This strategic shift challenges Ethereum’s traditional role, but fits seamlessly with Ethereum’s rollup-centric vision.

I see this as a pivotal moment for DeFi. Uniswap’s decision to take control of a larger technology stack feels like the shift we’ve been waiting for in the space. I hope other DeFi projects will follow suit and reimagine how value is created and captured. Unichain represents the next wave of DeFi, and we are seeing DeFi begin to sail.

Catherine

Catherine