Author: Luke, Mars Finance

On March 20, 2025, the Uniswap community passed two governance proposals through on-chain voting, allocating a total of $165.5 million worth of UNI tokens to the Uniswap Foundation (UF) to incentivize ecosystem development. The funds will be divided into two parts: $95.4 million for developer grants and $25.1 million for a two-year budget for operations, and $45 million to support liquidity incentives for Uniswap v4 and Unichain. This decision not only marks the largest community funding in Uniswap's history, but also reveals its ambition to seek transformation and breakthroughs in the highly competitive decentralized finance (DeFi) market. This article will deeply analyze the background, strategic goals, potential impacts and challenges faced by the proposal, and look forward to the future development of the Uniswap ecosystem.

Background: Opportunities and Challenges Faced by Uniswap

As a pioneer in the DeFi field, Uniswap's automated market maker (AMM) model has changed the landscape of digital asset trading since its launch in 2018. However, with the release of Uniswap v4 and Layer 2 network Unichain in 2025, the project did not quickly achieve the expected success. Data shows that the total locked value (TVL) of Uniswap v4 is only US$85 million, while Unichain is even lower, at only US$8.2 million. At the same time, competitors invest up to US$50 million in native tokens per month to incentivize liquidity and grab market share. Against this background, Uniswap urgently needs to revitalize the ecosystem through large-scale investment.

In addition, the community's call for a "fee switch" has never stopped. This mechanism aims to distribute part of the protocol revenue from liquidity providers (LPs) to UNI token holders to enhance the value capture ability of the token. However, due to the complexity of technology and governance, the function has been delayed and has become a focus of community controversy. The grant is seen as a key step in paving the way for the "fee switch".

The core of the proposal: four strategic priorities

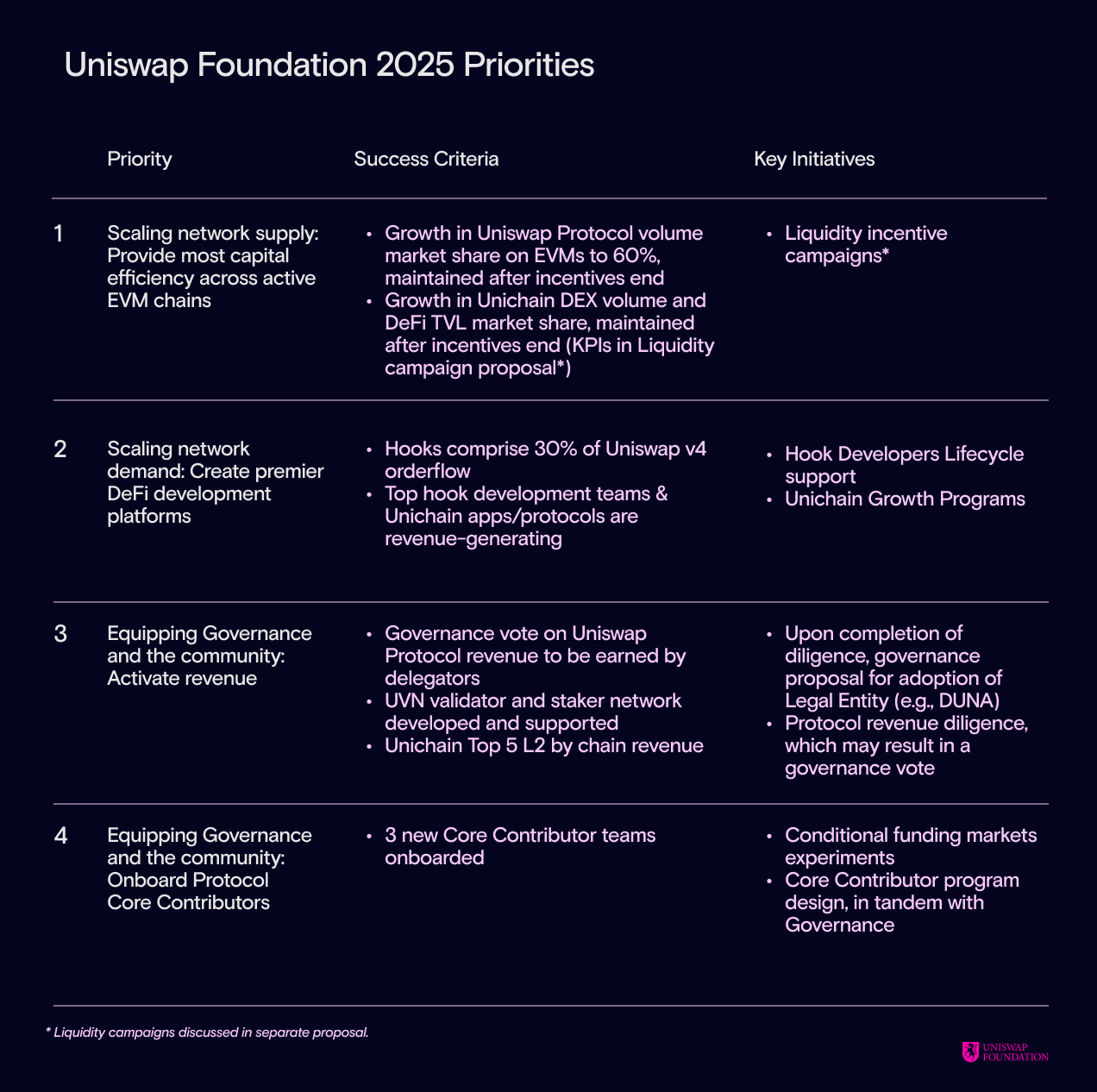

The Uniswap Foundation has identified four major strategic directions for the next two years in the proposal, and the $165.5 million in funds will revolve around these goals:

1. Expand network supply: improve capital efficiency

The goal is to provide the highest capital efficiency on all active EVM-compatible chains. To this end, Uniswap will use v4's innovative AMM features and Unichain's infrastructure to attract liquidity. The $45 million liquidity incentive program will be implemented in cooperation with Gauntlet, aiming to increase TVL and market share in the short term. However, the foundation emphasized that the long-term goal is not to rely on continuous subsidies, but to maintain liquidity through organic demand.

2. Expanding network demand: Building a top developer platform

Uniswap v4 lowers the threshold for developers to build new market structures through "hooks", while Unichain optimizes the design of the Layer 2 environment for DeFi. The $95.4 million grant budget will support the developer ecosystem, including educational programs (such as the Infinite Hackathon), infrastructure construction, and global developer ambassador programs. Currently, more than 1,000 developers have participated in v4 hook development and created more than 150 prototypes. The key to success lies in increasing the proportion of hook transactions and the number of developers on Unichain.

3. Activate income: unlock value for governance

Unichain has committed to distributing 65% of its on-chain net income to validators and stakers, and the Foundation is exploring the establishment of legal entities (such as DUNA) so that governance bodies can contract with external entities and possibly introduce protocol income distribution. This creates conditions for the implementation of the "handling fee switch". If successful, UNI token holders will benefit directly and the token economic model will usher in major changes.

4. Introducing core contributors: ensuring long-term innovation

To achieve long-term sustainable development, the Foundation plans to launch a "core contributor" program to fund development teams to advance Uniswap infrastructure (such as non-EVM versions or new hook protocols). These teams will work directly with governance bodies and receive compensation in the form of UNI tokens. This move aims to reduce dependence on a single entity (such as Uniswap Labs) and promote governance autonomy.

Fund Allocation and Transparency Commitment

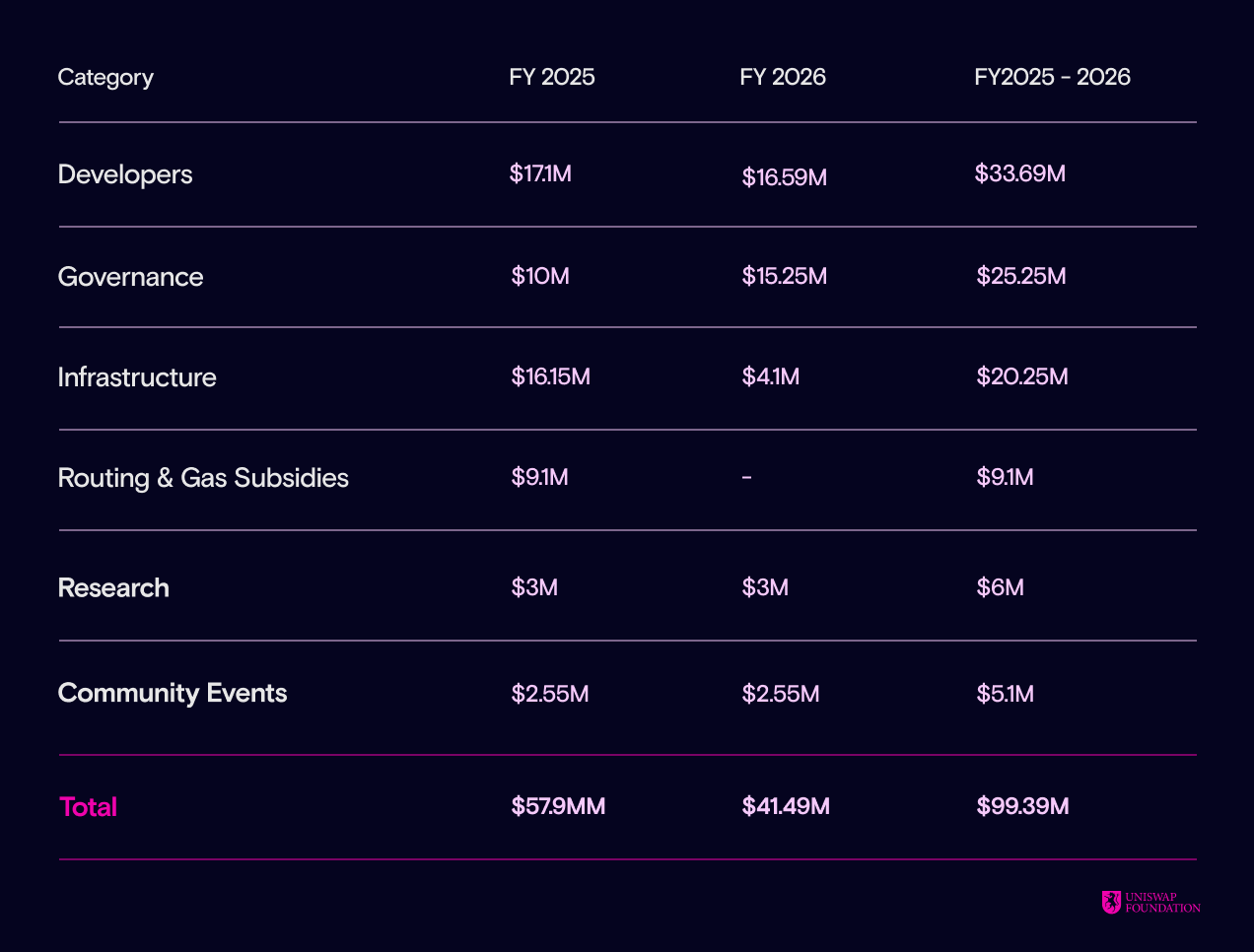

The proposal details the use of funds:

Grant budget: $57.9 million and $41.5 million in 2025 and 2026, respectively, for a total of $99.4 million (net of $95.4 million). The funds will support developer projects and the Unichain ecosystem, and set clear performance targets (such as TVL, market share, etc.).

Operational Budget: The two-year cash budget is $24.8 million, plus 1.5 million UNI (about $13.8 million) for employee compensation. The Foundation plans to add 12 new employees to cover areas such as governance and developer support.

Transparency Measures: The Foundation is committed to improving transparency through regular reports and community meetings, and will work with the Uniswap Accountability Committee (UAC) by May 8, 2025 to establish a board of representative delegates to oversee strategic execution.

Potential Impact: Opportunities and Risks

Opportunities

Ecosystem Growth: If the $165.5 million grant is properly executed, it may significantly enhance the competitiveness of Uniswap v4 and Unichain, especially in terms of developer ecology and liquidity.

Token value enhancement: The potential implementation of the "fee switch" will give UNI actual income attributes and attract more investors.

Governance upgrade: The introduction of core contributors and legal entities will push Uniswap towards a more decentralized governance model.

Risks

Fund size controversy: Some community members questioned the necessity of $165.5 million, pointing out that Uniswap Labs earned $171 million in front-end fees in two years without sharing the profits with UNI holders. This centralized model may undermine trust.

Liquidity migration: The $45 million incentive may draw funds away from Ethereum or other Layer 2s, creating opportunities for competitors.

Governance efficiency: There is still uncertainty in the implementation of the core contributor plan and the conditional funding market, and whether the governance body can effectively manage it remains to be seen.

Market reaction and future prospects

After the proposal was passed, the price of UNI tokens rose to $7.52 on March 19, a daily increase of 5.62%, showing the market's optimism about its growth plan. However, whether the price can continue to rise depends on the implementation effect. In the short term, liquidity incentives and developer support may bring visible results; in the long term, the implementation of the "handling fee switch" and governance upgrades will determine whether Uniswap can consolidate its leadership in DeFi.

The Uniswap community is at a crossroads. This $165.5 million investment is not only an increase in technology and ecology, but also an attempt to profoundly change its governance model. For investors and observers, the next execution details, market feedback, and community consensus will be the key to judging the future trend of Uniswap. Whether the pioneer of DeFi can continue to lead the trend, 2025 will be a decisive year.

Alex

Alex

Alex

Alex Kikyo

Kikyo Alex

Alex Kikyo

Kikyo Brian

Brian Hui Xin

Hui Xin Alex

Alex Kikyo

Kikyo Alex

Alex Brian

Brian